Russian Peak

Re: Russian Peak

So far, the peak of all liquids production was November 2018 (though I haven't seen the last few months). Conventional oil continues its steady decline.

Whenever the overall peak comes, I very much doubt the downslope will be a mirror image of the upslope. A declining supply will likely precipitate the collapse of societies, especially those who don't have their own oil and refining capabilities.

Whenever the overall peak comes, I very much doubt the downslope will be a mirror image of the upslope. A declining supply will likely precipitate the collapse of societies, especially those who don't have their own oil and refining capabilities.

-

TonyPrep - Intermediate Crude

- Posts: 2842

- Joined: Sun 25 Sep 2005, 03:00:00

- Location: Waiuku, New Zealand

Re: Russian Peak

$this->bbcode_second_pass_quote('TonyPrep', '

')Whenever the overall peak comes, I very much doubt the downslope will be a mirror image of the upslope. A declining supply will likely precipitate the collapse of societies, especially those who don't have their own oil and refining capabilities.

')Whenever the overall peak comes, I very much doubt the downslope will be a mirror image of the upslope. A declining supply will likely precipitate the collapse of societies, especially those who don't have their own oil and refining capabilities.

Perhaps the Chinese see the future they way you do, and perhaps that is why the Chinese have set up strategic partnerships with the oil producing countries of Russia, Iran, and Saudi Arabia, guaranteeing a long term oil supply for China.

Meanwhile, Joe Biden has taken the opposite tack with his plan to supposedly get the US off oil.

There are some big bets going down on the importance of oil in the future, and somebody is going to be right and somebody is going to be very very wrong.

Either China will be right to have secured themselves a supply of oil into the future, or Joe Biden will turn out to be right to have reduced US oil production and severed the US-Saudi partnership as part of his plan to transition the US into a carbon free economy.

The Chinese have a much simpler task ahead of them....they just have to continue business as usual. The US, in contrast, has to totally reinvent and reorganize the US economy to function with much much less oil, something that has never been done before.

Good luck to all.

Cheers!

-

Plantagenet - Expert

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Russian Peak

Total oil independence is impossible in this age. Even natural gas will not substitute for some oil products. Yes, things will change drastically negative for the US but for multiple reasons. No reasonable amount of "renewables" are possible in the next decades, to replace FFs. Resources in needed amounts do not exist to do so. But, dream if you want. That is free...for now.

-

Makati1 - Wood

- Posts: 7

- Joined: Wed 16 Sep 2015, 21:51:28

Re: Russian Peak

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Russian Peak

$this->bbcode_second_pass_quote('TonyPrep', 'S')o far, the peak of all liquids production was November 2018 (though I haven't seen the last few months). Conventional oil continues its steady decline.

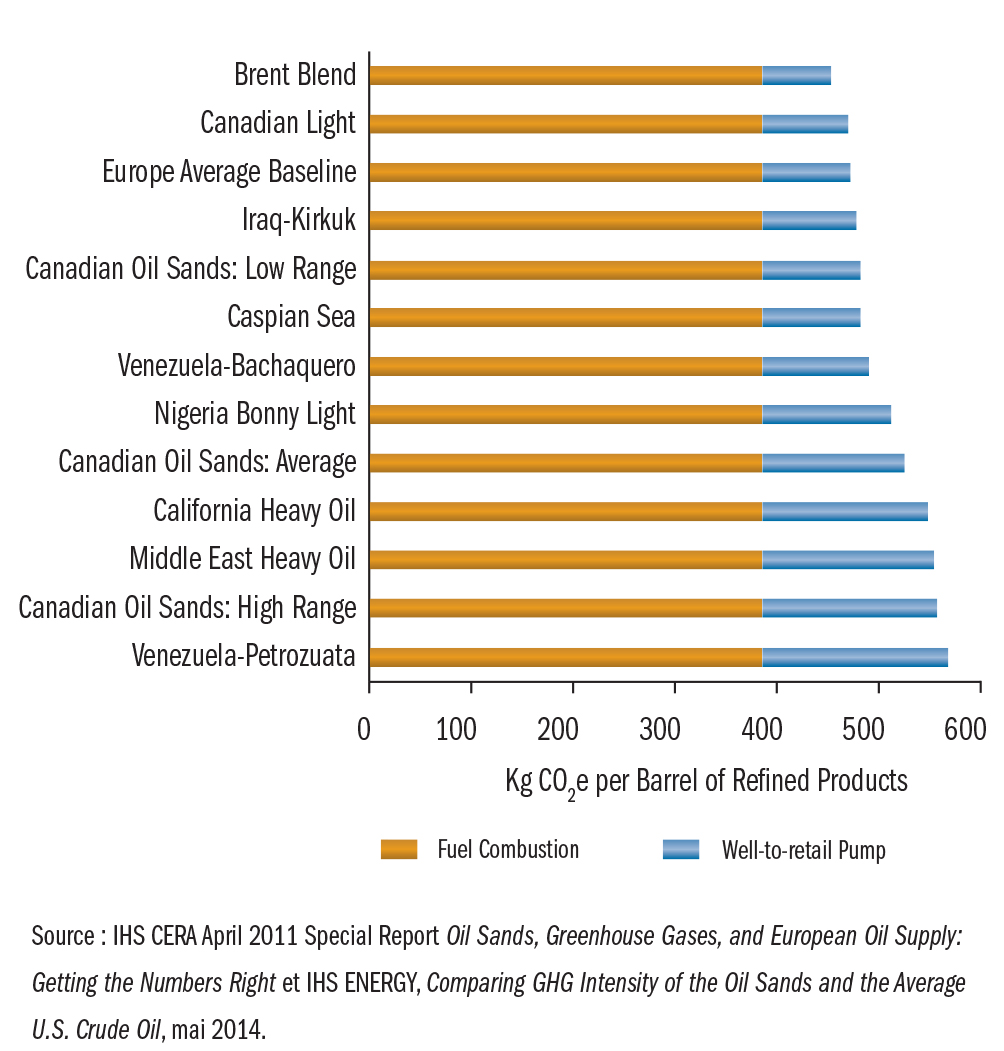

Can you please describe what you think "conventional oil" characteristics are? Does it have to do with the color, API gravity, impurities, and all the things that are used to describe oil properites and then grouped into crude benchmarks so a refinery knows the physical properties of the oil it is buying? And because of these chemical properites, these oil types cost different amounts to buy.

I ask because "conventional" oil isn't on the list of global oil benchmarks located here. Are you able to point out the ones that are?

$this->bbcode_second_pass_quote('TonyPrep', '

')Whenever the overall peak comes, I very much doubt the downslope will be a mirror image of the upslope. A declining supply will likely precipitate the collapse of societies, especially those who don't have their own oil and refining capabilities.

Well, we've had 6 occurred or claimed peak oils so far this century, and I agree with you that the natural decline profile of aggregated production from oil fields won't look anything like the build phase of the aggregate production increase. As far as a declining supply bringing about the collapse of societies, that was one of those old peak oil claims that didn't work out very well after the the 1979 global peak oil, where oil took 15 years to recover and reveal that it was not, indeed, the final peak oil, but just another in the overall sequence. And was the "go-go 80's" rather than "the decade of collapse because peak oil happened".

So if peak doesn't collapse society in 5 years, and it didn't happen in 15 years after a global peak, do you have a time frame in mind, undoubtedly needing to be measured in more than 15 years, for these collapse scenarios to play out? Back in the peak oil heyday, it was claimed that collapse evidence because of peak oil would be visible in days and weeks. By some real live energy expert no less back then who had credibility before it turned out that the early peak claimants of this century lacked exactly that.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Russian Peak

There is a definition of conventional oil in this article which seems reasonable:$this->bbcode_second_pass_quote('', 'L')ight or medium density oil occurring in discrete oil fields, usually having an oil–water contact, produced by primary (own pressure, or pumping) or secondary (natural gas or water injection) recovery techniques. Currently this class of oil supplies about 70% of global ‘all-liquids’, and has constituted the vast majority of oil produced to-date.

The same article has a graph of oil production and conventional oil has been on a slight decline (though the article calls it a plateau) since 2005.

Forecasting future production of total liquids is hard. Impossible to say exactly when different categories of liquids will peak or what new categories might be discovered or old categories revived and profitably so. I don't agree that peak oil voices lacked credibility at the time (hindsight is a wonderful thing). I'm sure human societies will take no notice anyway. It is only when any activity becomes a long term loss maker that the activity will cease.

-

TonyPrep - Intermediate Crude

- Posts: 2842

- Joined: Sun 25 Sep 2005, 03:00:00

- Location: Waiuku, New Zealand