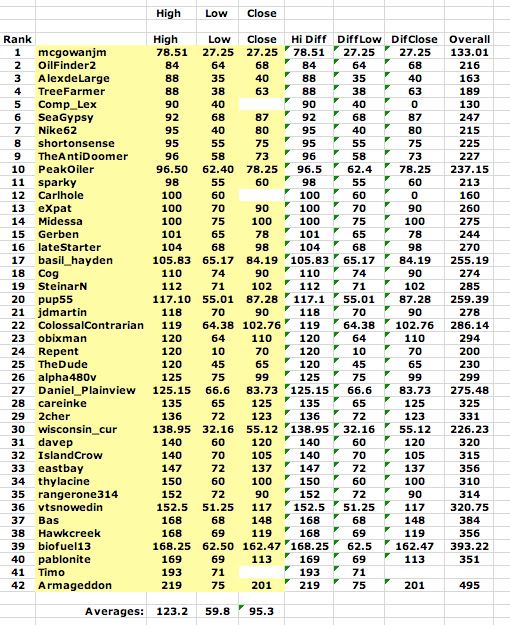

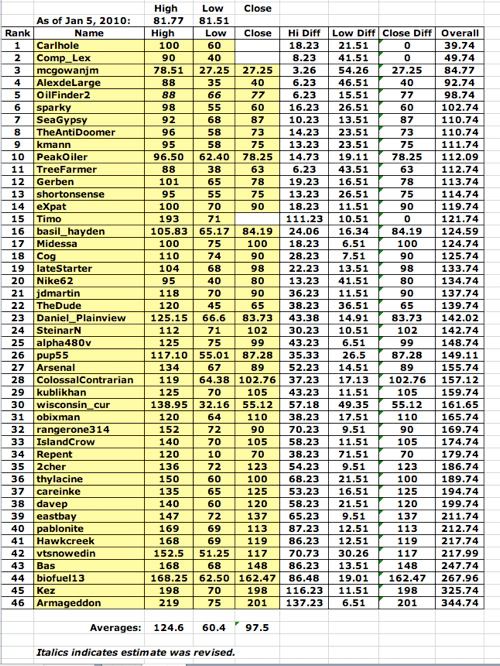

The 2010 PO.com Oil Price Challenge

Re: The 2010 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('', 'E')IA expects the price of West Texas Intermediate (WTI) crude oil will average about $76 per barrel this winter (October-March). The forecast for the monthly average WTI price dips to $75 early next year then rises to $82 per barrel by December 2010, assuming U.S. and world economic conditions continue to improve. EIA's forecast assumes that U.S. real gross domestic product (GDP) grows by 1.9 percent in 2010 and world oil-consumption-weighted real GDP grows by 2.6 percent.

EIA 82 75 82

marketwatch

$this->bbcode_second_pass_quote('', 'B')y the end of 2010, however, Patrick Kerr, a managing director at Amerifutures Commodities & Options, expects to see crude-oil prices to return to record levels and reach $150 per barrel, taking retail gasoline prices along with them -- to $5 per gallon.

Hi = Close = 150, low = end 2009 price?

(Alaska) Revenue forecast released amid Parnell reviewing oil taxes

$this->bbcode_second_pass_quote('', 'C')reated: 12/10/2009 09:47:33 PM PST

ANCHORAGE, Alaska (KTVA-CBS 11 News) - Revenue Commissioner Pat Galvin painted a very different economic outlook for Alaska's budget, after last budget year's tumultuous oil market.

"What a difference a year makes," Galvin said. "Prices began upwards of $130-$140 a barrel, and by the time we were releasing a revenue forecast five months later, they had declined into the $20s."

In stark contrast, Galvin now predicts steady budget times ahead. While the state's projection last spring said oil would remain about $58.29 per barrel this fiscal year, now officials predict an increase to about $66.93 per barrel. Next budget year, Galvin forecasts about $76.35 per barrel.

Crude Oil Predictions and Targets: Round-UpSeveral predictions here.

-

Keith_McClary - Light Sweet Crude

- Posts: 7344

- Joined: Wed 21 Jul 2004, 03:00:00

- Location: Suburban tar sands

Re: The 2010 PO.com Oil Price Challenge

')Crude Oil Predictions and Targets: Round-UpSeveral predictions here.

$this->bbcode_second_pass_code('', '

<p>Anyway, let’s take a look at some projections and commentary on the near term outlook for crude:</p>

<p><strong>Credit Suisse (moderately bullish)</strong></p>

<blockquote><p>“This is the first stage of the new cycle as the demand recovery on a global scale is underway,” said Tobias Merath, head of commodities research at Credit Suisse Group AG in Zurich. “What’s capping any break to the upside is the huge over-hang of distillates in the U.S. and low refinery margins.”</p></blockquote>

<p><strong>B of A/ Merrill Lynch (turning bullish)</strong></p>

<blockquote><p>Bank of America-Merrill Lynch raised its 2010 U.S. crude oil CLc1 price forecast on Friday to $85 a barrel, from its previous estimate of $75…its revision follows a stronger than expected rebound in world economic recovery, which led it to also revise up its GDP and oil demand forecasts.</p></blockquote>

<p><strong>Morgan Stanley (longer-term bullish)</strong></p>

<blockquote><p>Morgan Stanley has raised its forecast of U.S. crude oil price to $105 a barrel in 2012 from $95 due to tightening spare capacity. “Assuming that demand returns to growth, we see global spare capacity back to 2007/08 levels by 2012, and getting even tighter thereafter…We believe that prices will need to move higher to ration demand as the world struggles to find enough supply.”</p></blockquote>

<p><strong>Goldman Sachs (bullish short and long-term)</strong></p>

<blockquote><p>U.S. investment bank Goldman Sachs expects oil prices to rise to an average $90 a barrel next year, before increasing to $110 in 2011, as strong growth in emerging market economies boosts crude demand.</p></blockquote>

<p><strong>Deutsche Bank (bearish)</strong></p>

<blockquote><p>While many experts predict higher oil prices, Deutsche Bank analysts say they could fall to $60 a barrel next year, as the sluggish economy dampens demand. That would represent a drop of more than 20 percent from recent levels…the analysts predict an average price of $65 in 2010.</p></blockquote>

<p><strong>Mexico (nervous and hedging)</strong></p>

<blockquote><p>Mexico has hedged much of its 2010 net oil exports at $57 a barrel, the government said on Tuesday, continuing the conservative strategy that reaped huge profits in 2009 after the credit crisis crushed oil prices. Mexico paid $1.172 billion for options that guarantee a minimum price of $57 a barrel for 230 million barrels of oil exports next year.</p></blockquote>

<p>Sources:</p>

<p><strong><a href="http://www.reuters.com/article/idUSLD45057820091113" target="_blank">BofA-Merrill Lynch ups 2010 US oil forecast to $85 (Reuters)</a></strong></p>

<p><strong><a href="http://moneynews.newsmax.com/streettalk/Deutsche_Bank_Oil_Drop/2009/12/09/296325.html" target="_blank">Deutsche Bank: Oil Could Drop to $60 (Money News)</a></strong></p>

<p><strong><a href="http://news.alibaba.com/article/detail/energy/100171166-1-morgan-stanley-ups-oil-price.html">Morgan Stanley ups oil price f’cast to $105 in 2012 (Alibaba)</a></strong></p>

<p><strong><a href="http://thereformedbroker.com/Goldman%20sees%202010%20oil%20price%20at%20$90,%20higher%20in%202011" target="_blank">Goldman sees 2010 oil price at $90, higher in 2011 (Reuters)</a></strong></p>

<p><strong><a href="http://www.bloomberg.com/apps/news?pid=20601082&sid=awn1RkoWhxz0" target="_blank">Oil Advances as Dollar Falls, Report Shows Drop in Stockpiles (Bloomberg)</a></strong></p>

<p><strong><a href="http://www.reuters.com/article/idUSN0813903220091208" target="_blank">Mexico hedges bulk of 2010 oil exports at $57/bbl (Reuters)</a></strong><br />

<strong></strong></p>')

-

Keith_McClary - Light Sweet Crude

- Posts: 7344

- Joined: Wed 21 Jul 2004, 03:00:00

- Location: Suburban tar sands