The 2010 PO.com Oil Price Challenge

Re: The 2010 PO.com Oil Price Challenge

Oil:

Low: 40

High: 90

Close: unknown

US Gasoline:

Low: 1.50

High: 6.00

Close: unknown

Low: 40

High: 90

Close: unknown

US Gasoline:

Low: 1.50

High: 6.00

Close: unknown

-

Comp_Lex - Peat

- Posts: 116

- Joined: Wed 02 Nov 2005, 04:00:00

- Location: The Netherlands

Re: The 2010 PO.com Oil Price Challenge

Low: 72

High: 152

Close: 90

Modest production decline combined with speculators looking for something to chase their money with (after stocks tank again by April 2010) and higher demand from China will drive up oil.

Reality by end of year (and profit taking) will deflate oil speculation and drive it down to something more reasonable.

High: 152

Close: 90

Modest production decline combined with speculators looking for something to chase their money with (after stocks tank again by April 2010) and higher demand from China will drive up oil.

Reality by end of year (and profit taking) will deflate oil speculation and drive it down to something more reasonable.

An ideology is by definition not a search for TRUTH-but a search for PROOF that its point of view is right

Equals barter and negotiate-people with power just take

You cant defend freedom by eliminating it-unknown

Our elected reps should wear sponsor patches on their suits so we know who they represent-like Nascar-Roy

Equals barter and negotiate-people with power just take

You cant defend freedom by eliminating it-unknown

Our elected reps should wear sponsor patches on their suits so we know who they represent-like Nascar-Roy

-

rangerone314 - Light Sweet Crude

- Posts: 4105

- Joined: Wed 03 Dec 2008, 04:00:00

- Location: Maryland

Re: The 2010 PO.com Oil Price Challenge

Low: 65

High: 135

Close: 125

High: 135

Close: 125

Cliff (Start a rEVOLution, grow a garden)

-

careinke - Volunteer

- Posts: 5047

- Joined: Mon 01 Jan 2007, 04:00:00

- Location: Pacific Northwest

Re: The 2010 PO.com Oil Price Challenge

low: 62.50

high: 168.25

close: 162.47

high: 168.25

close: 162.47

"With man gone will there be hope for gorilla? With gorilla gone will there be hope for man?" --Ishmael by D. Quinn

-

biofuel13 - Tar Sands

- Posts: 606

- Joined: Wed 07 May 2008, 03:00:00

- Location: Chaska, MN

Re: The 2010 PO.com Oil Price Challenge

High $152.50

Low $ 51.25

End $ 117.00

I'm betting that the bills will start coming due on all the government bailouts and inflation will kick in in a big way.

Low $ 51.25

End $ 117.00

I'm betting that the bills will start coming due on all the government bailouts and inflation will kick in in a big way.

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: The 2010 PO.com Oil Price Challenge

Can't miss this year....

Notice this is the same high I've gone with the past couple years and been completely wrong both times...

High: $119

Low: $64.38

End: $102.76

Notice this is the same high I've gone with the past couple years and been completely wrong both times...

High: $119

Low: $64.38

End: $102.76

- ColossalContrarian

- Heavy Crude

- Posts: 1374

- Joined: Tue 20 Jun 2006, 03:00:00

Re: The 2010 PO.com Oil Price Challenge

Your high is completely realistic. Too bad there is a bubble here and there on the market.

-

Comp_Lex - Peat

- Posts: 116

- Joined: Wed 02 Nov 2005, 04:00:00

- Location: The Netherlands

Re: The 2010 PO.com Oil Price Challenge

.

High 98

Low 55

closing 60

As everybody , I'm torn between the China growth scenario and the languishing western demand

but there is a lot of Iraqi oil just waiting to be unleashed with quite a few barrels in storage now

The Saudi have said 75~ 80 and have enough clout to stop a rise but interestingly not a fall

that should be OK everybody else ( bar Iraq ) is close to their limits

any increase in production is canceled by some other depletion

my 98 is simply a one off , to account for some wild spike ( Earthquake ,piracy ,revolution ......)

As sea gypsy mention , the big unknown is on the currency side .

.

High 98

Low 55

closing 60

As everybody , I'm torn between the China growth scenario and the languishing western demand

but there is a lot of Iraqi oil just waiting to be unleashed with quite a few barrels in storage now

The Saudi have said 75~ 80 and have enough clout to stop a rise but interestingly not a fall

that should be OK everybody else ( bar Iraq ) is close to their limits

any increase in production is canceled by some other depletion

my 98 is simply a one off , to account for some wild spike ( Earthquake ,piracy ,revolution ......)

As sea gypsy mention , the big unknown is on the currency side .

.

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: The 2010 PO.com Oil Price Challenge

High: $96.50

Low: $62.40

Close: $78.25

Just another WAG.

Low: $62.40

Close: $78.25

Just another WAG.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2010 PO.com Oil Price Challenge

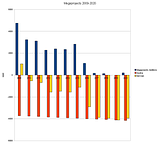

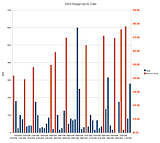

High Low Close

TreeFarmer 88 38 63

eXpat 100 70 90

alpha480v 125 75 99

jdmartin 118 70 90

SeaGypsy 92 68 87

Hawkcreek 168 69 119

Armageddon 219 75 201

OilFinder2 84 64 68

IslandCrow 140 70 105

wisconsin_cur 138.95 32.16 55.12

Cog 110 74 90

davep 140 60 120

mcgowanjm 78.51 27.25 27.25

2cher 136 72 123

TheDude 120 45 65

Gerben 101 65 78

pablonite 169 69 113

AlexdeLarge 88 35 40

Bas 168 68 148

eastbay 147 72 137

SteinarN 112 71 102

Repent 120 10 70

thylacine 150 60 100

obixman 120 64 110

Daniel_Plainview 125.15 66.6 83.73

lateStarter 104 68 98

Nike62 95 40 80

Carlhole 100 60

TheAntiDoomer 96 58 73

Comp_Lex 90 40

rangerone314 72 152 90

careinke 135 65 125

biofuel13 168.25 62.5 162.47

vtsnowedin 152.5 51.25 117

ColossalContrarian 119 64.38 102.76

sparky 98 55 60

PeakOiler 96.5 62.4 78.25

avg 121 61 95

TreeFarmer 88 38 63

eXpat 100 70 90

alpha480v 125 75 99

jdmartin 118 70 90

SeaGypsy 92 68 87

Hawkcreek 168 69 119

Armageddon 219 75 201

OilFinder2 84 64 68

IslandCrow 140 70 105

wisconsin_cur 138.95 32.16 55.12

Cog 110 74 90

davep 140 60 120

mcgowanjm 78.51 27.25 27.25

2cher 136 72 123

TheDude 120 45 65

Gerben 101 65 78

pablonite 169 69 113

AlexdeLarge 88 35 40

Bas 168 68 148

eastbay 147 72 137

SteinarN 112 71 102

Repent 120 10 70

thylacine 150 60 100

obixman 120 64 110

Daniel_Plainview 125.15 66.6 83.73

lateStarter 104 68 98

Nike62 95 40 80

Carlhole 100 60

TheAntiDoomer 96 58 73

Comp_Lex 90 40

rangerone314 72 152 90

careinke 135 65 125

biofuel13 168.25 62.5 162.47

vtsnowedin 152.5 51.25 117

ColossalContrarian 119 64.38 102.76

sparky 98 55 60

PeakOiler 96.5 62.4 78.25

avg 121 61 95

-

pup55 - Light Sweet Crude

- Posts: 5249

- Joined: Wed 26 May 2004, 03:00:00

-

pup55 - Light Sweet Crude

- Posts: 5249

- Joined: Wed 26 May 2004, 03:00:00

Re: The 2010 PO.com Oil Price Challenge

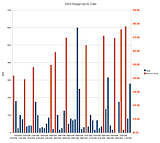

So, you can't say anything about the prices if you only look at the past prices.

-

Comp_Lex - Peat

- Posts: 116

- Joined: Wed 02 Nov 2005, 04:00:00

- Location: The Netherlands

Re: The 2010 PO.com Oil Price Challenge

Oh, I think you can say several things.

You will notice that in the 2003 to 2006 time frame the system was at least stable. After that, no longer. Well, maybe 2007 was not totally unreasonable, but that was the time during which the prices kept going up in the fall, instead of falling back like they normally do, thus screwing up the refining margins. I believe people will look back on the period of fall 2007 as a really critically important period for the entire system.

It used to be fairly common for the closing price to be pretty close to the average price for the year. I suppose the pattern was for the low to happen during February, and the high to happen in July sometime. Well, we can see what has happened to that theory. High or low can happen anytime now, can't it The seasonality is no longer the main driver of prices.

It used to be fairly common for the average price in a given year to be fairly close to the high price for the previous year. Example: The average for 2005 was pretty close to the high for 2004: Well, that is no longer the case either.

I'm going to wait for a few days before putting in my forecast, but I am asking myself several questions right now:

a. Is the system even stable right now? If it is, and it's a bit IF, maybe it will get back to something that approaches the pattern that was happening in the 2003-2006 time frame. Maybe it will even extend the trend line that was established during that time, a high of maybe 100to 110 or so, a low in the 50's and the yearly average someplace in the 705 range as predicted by the big banks.

b. Is there something that approaches a "base" for oil prices, and if so what is the likelihood that we will see it at some point. Keep in mind that historically, crude oil prices should be relaxing this time of year. In fact, in three out of those years, the year end price was pretty close to the low for the following year....The only other year that that did not happen was 2007, and we all know what happened in 2008....

c. Is the overall economy stable enough, and is OPEC still strong enough, to sustain prices at these levels? How hungry will Venezuela and Russia and Mexico get in the coming year, and will they dump oil into the market to keep their economies running? A counterargument can be made that the current price is silly, it really belongs somewhere between here and 20 in the next 12 months.... Mcgowanjm has a scenario that kind of resembles that idea, and it is not far fetched....OF2 has also a pretty plausible scenario.

I am still thinking about it. Maybe someone stuck in a boring office will go back through previous years for the high, low, average and close for previous years, including the last recession year, to give us some more information.....

Or maybe Comp_lex is right: Past results are no longer a good predictor of future events.

You will notice that in the 2003 to 2006 time frame the system was at least stable. After that, no longer. Well, maybe 2007 was not totally unreasonable, but that was the time during which the prices kept going up in the fall, instead of falling back like they normally do, thus screwing up the refining margins. I believe people will look back on the period of fall 2007 as a really critically important period for the entire system.

It used to be fairly common for the closing price to be pretty close to the average price for the year. I suppose the pattern was for the low to happen during February, and the high to happen in July sometime. Well, we can see what has happened to that theory. High or low can happen anytime now, can't it The seasonality is no longer the main driver of prices.

It used to be fairly common for the average price in a given year to be fairly close to the high price for the previous year. Example: The average for 2005 was pretty close to the high for 2004: Well, that is no longer the case either.

I'm going to wait for a few days before putting in my forecast, but I am asking myself several questions right now:

a. Is the system even stable right now? If it is, and it's a bit IF, maybe it will get back to something that approaches the pattern that was happening in the 2003-2006 time frame. Maybe it will even extend the trend line that was established during that time, a high of maybe 100to 110 or so, a low in the 50's and the yearly average someplace in the 705 range as predicted by the big banks.

b. Is there something that approaches a "base" for oil prices, and if so what is the likelihood that we will see it at some point. Keep in mind that historically, crude oil prices should be relaxing this time of year. In fact, in three out of those years, the year end price was pretty close to the low for the following year....The only other year that that did not happen was 2007, and we all know what happened in 2008....

c. Is the overall economy stable enough, and is OPEC still strong enough, to sustain prices at these levels? How hungry will Venezuela and Russia and Mexico get in the coming year, and will they dump oil into the market to keep their economies running? A counterargument can be made that the current price is silly, it really belongs somewhere between here and 20 in the next 12 months.... Mcgowanjm has a scenario that kind of resembles that idea, and it is not far fetched....OF2 has also a pretty plausible scenario.

I am still thinking about it. Maybe someone stuck in a boring office will go back through previous years for the high, low, average and close for previous years, including the last recession year, to give us some more information.....

Or maybe Comp_lex is right: Past results are no longer a good predictor of future events.

-

pup55 - Light Sweet Crude

- Posts: 5249

- Joined: Wed 26 May 2004, 03:00:00

Re: The 2010 PO.com Oil Price Challenge

$this->bbcode_second_pass_code('', 'Sort by High

$ 78.51 27.25 27.25 mcgowanjm

$ 84.00 64.00 68.00 OilFinder2

$ 88.00 35.00 40.00 AlexdeLarge

$ 88.00 38.00 63.00 TreeFarmer

$ 90.00 40.00 0.00 Comp_Lex

$ 92.00 68.00 87.00 SeaGypsy

$ 95.00 40.00 80.00 Nike62

$ 96.00 58.00 73.00 TheAntiDoomer

$ 96.50 62.40 78.25 PeakOiler

$ 98.00 55.00 60.00 sparky

$100.00 60.00 0.00 Carlhole

$100.00 70.00 90.00 eXpat

$101.00 65.00 78.00 Gerben

$104.00 68.00 98.00 lateStarter

$110.00 74.00 90.00 Cog

$112.00 71.00 102.00 SteinarN

$118.00 70.00 90.00 jdmartin

$119.00 64.38 102.76 ColossalContrarian

$120.00 64.00 110.00 obixman

$120.00 10.00 70.00 Repent

$120.00 45.00 65.00 TheDude

$125.00 75.00 99.00 alpha480v

$125.15 66.60 83.73 Daniel_Plainview

$135.00 65.00 125.00 careinke

$136.00 72.00 123.00 2cher

$138.95 32.16 55.12 wisconsin_cur

$140.00 60.00 120.00 davep

$140.00 70.00 105.00 IslandCrow

$147.00 72.00 137.00 eastbay

$150.00 60.00 100.00 thylacine

$152.00 72.00 90.00 rangerone314

$152.50 51.25 117.00 vtsnowedin

$168.00 68.00 148.00 Bas

$168.00 69.00 119.00 Hawkcreek

$168.25 62.50 162.47 biofuel13

$169.00 69.00 113.00 pablonite

$219.00 75.00 201.00 Armageddon

Sort by Low

$120.00 10.00 70.00 Repent

$ 78.51 27.25 27.25 mcgowanjm

$138.95 32.16 55.12 wisconsin_cur

$ 88.00 35.00 40.00 AlexdeLarge

$ 88.00 38.00 63.00 TreeFarmer

$ 90.00 40.00 0.00 Comp_Lex

$ 95.00 40.00 80.00 Nike62

$120.00 45.00 65.00 TheDude

$152.50 51.25 117.00 vtsnowedin

$ 98.00 55.00 60.00 sparky

$ 96.00 58.00 73.00 TheAntiDoomer

$100.00 60.00 0.00 Carlhole

$140.00 60.00 120.00 davep

$150.00 60.00 100.00 thylacine

$ 96.50 62.40 78.25 PeakOiler

$168.25 62.50 162.47 biofuel13

$120.00 64.00 110.00 obixman

$ 84.00 64.00 68.00 OilFinder2

$119.00 64.38 102.76 ColossalContrarian

$135.00 65.00 125.00 careinke

$101.00 65.00 78.00 Gerben

$125.15 66.60 83.73 Daniel_Plainview

$168.00 68.00 148.00 Bas

$104.00 68.00 98.00 lateStarter

$ 92.00 68.00 87.00 SeaGypsy

$168.00 69.00 119.00 Hawkcreek

$169.00 69.00 113.00 pablonite

$100.00 70.00 90.00 eXpat

$140.00 70.00 105.00 IslandCrow

$118.00 70.00 90.00 jdmartin

$112.00 71.00 102.00 SteinarN

$136.00 72.00 123.00 2cher

$147.00 72.00 137.00 eastbay

$152.00 72.00 90.00 rangerone314

$110.00 74.00 90.00 Cog

$125.00 75.00 99.00 alpha480v

$219.00 75.00 201.00 Armageddon

Sort by Close

$100.00 60.00 0.00 Carlhole

$ 90.00 40.00 0.00 Comp_Lex

$ 78.51 27.25 27.25 mcgowanjm

$ 88.00 35.00 40.00 AlexdeLarge

$138.95 32.16 55.12 wisconsin_cur

$ 98.00 55.00 60.00 sparky

$ 88.00 38.00 63.00 TreeFarmer

$120.00 45.00 65.00 TheDude

$ 84.00 64.00 68.00 OilFinder2

$120.00 10.00 70.00 Repent

$ 96.00 58.00 73.00 TheAntiDoomer

$101.00 65.00 78.00 Gerben

$ 96.50 62.40 78.25 PeakOiler

$ 95.00 40.00 80.00 Nike62

$125.15 66.60 83.73 Daniel_Plainview

$ 92.00 68.00 87.00 SeaGypsy

$110.00 74.00 90.00 Cog

$100.00 70.00 90.00 eXpat

$118.00 70.00 90.00 jdmartin

$152.00 72.00 90.00 rangerone314

$104.00 68.00 98.00 lateStarter

$125.00 75.00 99.00 alpha480v

$150.00 60.00 100.00 thylacine

$112.00 71.00 102.00 SteinarN

$119.00 64.38 102.76 ColossalContrarian

$140.00 70.00 105.00 IslandCrow

$120.00 64.00 110.00 obixman

$169.00 69.00 113.00 pablonite

$152.50 51.25 117.00 vtsnowedin

$168.00 69.00 119.00 Hawkcreek

$140.00 60.00 120.00 davep

$136.00 72.00 123.00 2cher

$135.00 65.00 125.00 careinke

$147.00 72.00 137.00 eastbay

$168.00 68.00 148.00 Bas

$168.25 62.50 162.47 biofuel13

$219.00 75.00 201.00 Armageddon')

$ 78.51 27.25 27.25 mcgowanjm

$ 84.00 64.00 68.00 OilFinder2

$ 88.00 35.00 40.00 AlexdeLarge

$ 88.00 38.00 63.00 TreeFarmer

$ 90.00 40.00 0.00 Comp_Lex

$ 92.00 68.00 87.00 SeaGypsy

$ 95.00 40.00 80.00 Nike62

$ 96.00 58.00 73.00 TheAntiDoomer

$ 96.50 62.40 78.25 PeakOiler

$ 98.00 55.00 60.00 sparky

$100.00 60.00 0.00 Carlhole

$100.00 70.00 90.00 eXpat

$101.00 65.00 78.00 Gerben

$104.00 68.00 98.00 lateStarter

$110.00 74.00 90.00 Cog

$112.00 71.00 102.00 SteinarN

$118.00 70.00 90.00 jdmartin

$119.00 64.38 102.76 ColossalContrarian

$120.00 64.00 110.00 obixman

$120.00 10.00 70.00 Repent

$120.00 45.00 65.00 TheDude

$125.00 75.00 99.00 alpha480v

$125.15 66.60 83.73 Daniel_Plainview

$135.00 65.00 125.00 careinke

$136.00 72.00 123.00 2cher

$138.95 32.16 55.12 wisconsin_cur

$140.00 60.00 120.00 davep

$140.00 70.00 105.00 IslandCrow

$147.00 72.00 137.00 eastbay

$150.00 60.00 100.00 thylacine

$152.00 72.00 90.00 rangerone314

$152.50 51.25 117.00 vtsnowedin

$168.00 68.00 148.00 Bas

$168.00 69.00 119.00 Hawkcreek

$168.25 62.50 162.47 biofuel13

$169.00 69.00 113.00 pablonite

$219.00 75.00 201.00 Armageddon

Sort by Low

$120.00 10.00 70.00 Repent

$ 78.51 27.25 27.25 mcgowanjm

$138.95 32.16 55.12 wisconsin_cur

$ 88.00 35.00 40.00 AlexdeLarge

$ 88.00 38.00 63.00 TreeFarmer

$ 90.00 40.00 0.00 Comp_Lex

$ 95.00 40.00 80.00 Nike62

$120.00 45.00 65.00 TheDude

$152.50 51.25 117.00 vtsnowedin

$ 98.00 55.00 60.00 sparky

$ 96.00 58.00 73.00 TheAntiDoomer

$100.00 60.00 0.00 Carlhole

$140.00 60.00 120.00 davep

$150.00 60.00 100.00 thylacine

$ 96.50 62.40 78.25 PeakOiler

$168.25 62.50 162.47 biofuel13

$120.00 64.00 110.00 obixman

$ 84.00 64.00 68.00 OilFinder2

$119.00 64.38 102.76 ColossalContrarian

$135.00 65.00 125.00 careinke

$101.00 65.00 78.00 Gerben

$125.15 66.60 83.73 Daniel_Plainview

$168.00 68.00 148.00 Bas

$104.00 68.00 98.00 lateStarter

$ 92.00 68.00 87.00 SeaGypsy

$168.00 69.00 119.00 Hawkcreek

$169.00 69.00 113.00 pablonite

$100.00 70.00 90.00 eXpat

$140.00 70.00 105.00 IslandCrow

$118.00 70.00 90.00 jdmartin

$112.00 71.00 102.00 SteinarN

$136.00 72.00 123.00 2cher

$147.00 72.00 137.00 eastbay

$152.00 72.00 90.00 rangerone314

$110.00 74.00 90.00 Cog

$125.00 75.00 99.00 alpha480v

$219.00 75.00 201.00 Armageddon

Sort by Close

$100.00 60.00 0.00 Carlhole

$ 90.00 40.00 0.00 Comp_Lex

$ 78.51 27.25 27.25 mcgowanjm

$ 88.00 35.00 40.00 AlexdeLarge

$138.95 32.16 55.12 wisconsin_cur

$ 98.00 55.00 60.00 sparky

$ 88.00 38.00 63.00 TreeFarmer

$120.00 45.00 65.00 TheDude

$ 84.00 64.00 68.00 OilFinder2

$120.00 10.00 70.00 Repent

$ 96.00 58.00 73.00 TheAntiDoomer

$101.00 65.00 78.00 Gerben

$ 96.50 62.40 78.25 PeakOiler

$ 95.00 40.00 80.00 Nike62

$125.15 66.60 83.73 Daniel_Plainview

$ 92.00 68.00 87.00 SeaGypsy

$110.00 74.00 90.00 Cog

$100.00 70.00 90.00 eXpat

$118.00 70.00 90.00 jdmartin

$152.00 72.00 90.00 rangerone314

$104.00 68.00 98.00 lateStarter

$125.00 75.00 99.00 alpha480v

$150.00 60.00 100.00 thylacine

$112.00 71.00 102.00 SteinarN

$119.00 64.38 102.76 ColossalContrarian

$140.00 70.00 105.00 IslandCrow

$120.00 64.00 110.00 obixman

$169.00 69.00 113.00 pablonite

$152.50 51.25 117.00 vtsnowedin

$168.00 69.00 119.00 Hawkcreek

$140.00 60.00 120.00 davep

$136.00 72.00 123.00 2cher

$135.00 65.00 125.00 careinke

$147.00 72.00 137.00 eastbay

$168.00 68.00 148.00 Bas

$168.25 62.50 162.47 biofuel13

$219.00 75.00 201.00 Armageddon')

Facebook knows you're a dog.

-

Keith_McClary - Light Sweet Crude

- Posts: 7344

- Joined: Wed 21 Jul 2004, 03:00:00

- Location: Suburban tar sands

Re: The 2010 PO.com Oil Price Challenge

hi $95

lo $55

close $75

lo $55

close $75

-

shortonsense - Permanently Banned

- Posts: 3124

- Joined: Sat 30 Aug 2008, 03:00:00

Re: The 2010 PO.com Oil Price Challenge

Awesome it's time for another Oil Price Challenge! I wanted to play last year but I didn't want to lose any love or respect by joining late. I am so glad I remembered to get in this year. So here are my picks:

Low 75

High 100

Close 100

Low 75

High 100

Close 100

Last edited by Midessa on Thu 31 Dec 2009, 15:50:27, edited 1 time in total.

-

Midessa - Wood

- Posts: 21

- Joined: Thu 12 Jun 2008, 03:00:00

- Location: Midland/Odessa Texas

Re: The 2010 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('pup55', '

')a. Is the system even stable right now? If it is, and it's a bit IF, maybe it will get back to something that approaches the pattern that was happening in the 2003-2006 time frame. Maybe it will even extend the trend line that was established during that time, a high of maybe 100to 110 or so, a low in the 50's and the yearly average someplace in the 705 range as predicted by the big banks.

b. Is there something that approaches a "base" for oil prices, and if so what is the likelihood that we will see it at some point. Keep in mind that historically, crude oil prices should be relaxing this time of year. In fact, in three out of those years, the year end price was pretty close to the low for the following year....The only other year that that did not happen was 2007, and we all know what happened in 2008....

c. Is the overall economy stable enough, and is OPEC still strong enough, to sustain prices at these levels? How hungry will Venezuela and Russia and Mexico get in the coming year, and will they dump oil into the market to keep their economies running? A counterargument can be made that the current price is silly, it really belongs somewhere between here and 20 in the next 12 months.... Mcgowanjm has a scenario that kind of resembles that idea, and it is not far fetched....OF2 has also a pretty plausible scenario.

')a. Is the system even stable right now? If it is, and it's a bit IF, maybe it will get back to something that approaches the pattern that was happening in the 2003-2006 time frame. Maybe it will even extend the trend line that was established during that time, a high of maybe 100to 110 or so, a low in the 50's and the yearly average someplace in the 705 range as predicted by the big banks.

b. Is there something that approaches a "base" for oil prices, and if so what is the likelihood that we will see it at some point. Keep in mind that historically, crude oil prices should be relaxing this time of year. In fact, in three out of those years, the year end price was pretty close to the low for the following year....The only other year that that did not happen was 2007, and we all know what happened in 2008....

c. Is the overall economy stable enough, and is OPEC still strong enough, to sustain prices at these levels? How hungry will Venezuela and Russia and Mexico get in the coming year, and will they dump oil into the market to keep their economies running? A counterargument can be made that the current price is silly, it really belongs somewhere between here and 20 in the next 12 months.... Mcgowanjm has a scenario that kind of resembles that idea, and it is not far fetched....OF2 has also a pretty plausible scenario.

I can give you my own answers on your questions based on my own analysis:

a) Looking at the supply and demand curves, we know that the average price will go up in the near future and extending the trend set in the 2003-2006 timeframe. This is by the way not a stable system. It will go up until the economy crashes.

b) Looking at my own analysis I've made with my software, the lower bound estimation lies around $40-$50 / barrel, which is quite a realistic price in my opinion.

c) Looking at the supply and demand curves using data from BP, ASPO, Koppelaar (Peak Oil Netherlands Foundation) and Hubbert Curves, I believe that the counterargument is quite silly. I'm not familiar with the scenario, but if those prices will be reached next year, then or the economy is failing or the economy is doing well and there will be a major correction to +$100 / barrel.

-

Comp_Lex - Peat

- Posts: 116

- Joined: Wed 02 Nov 2005, 04:00:00

- Location: The Netherlands

Re: The 2010 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('', 'I') didn't want to lose any love or respect by joining late

Yes, these commodities are also in short supply....

Welcome to the fun. We are up to about 40 participants I think we had 45 or so the last couple of years, Time will tell whether we will get any better.

-

pup55 - Light Sweet Crude

- Posts: 5249

- Joined: Wed 26 May 2004, 03:00:00

Re: The 2010 PO.com Oil Price Challenge

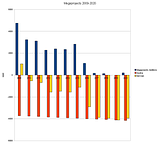

Here's punching a simple trend line through 1999-2009 and extrapolating out to 2015:

On an annual basis the price was:

$this->bbcode_second_pass_code('', '

Year WTI Diff

1999 19.34 4.92

2000 30.38 11.04

2001 25.98 -4.4

2002 26.18 0.2

2003 31.08 4.9

2004 41.51 10.43

2005 56.64 15.13

2006 66.05 9.41

2007 72.34 6.29

2008 99.67 27.33

2009 61.33 -38.34

')

Were 2008/2009 just outliers? Diff between the two is -11.01. Average of set is 4.26. 2010 could just be a tedious slog towards a high of $90, or spike and crash like '08. Are we starting from a higher baseline? It was curious that the startups of megaprojects in the wiki loosely correlated with prices in 2009, too - Khurais Ph 1 coming online in the middle of the year presaged a drop in price. Maybe this was just investors feeling reassured.

Like I said before, we aren't bringing much online this year.

If the wiki data is correct we'll need to eat up some of that spare capacity this year to stay ahead of the game.

On an annual basis the price was:

$this->bbcode_second_pass_code('', '

Year WTI Diff

1999 19.34 4.92

2000 30.38 11.04

2001 25.98 -4.4

2002 26.18 0.2

2003 31.08 4.9

2004 41.51 10.43

2005 56.64 15.13

2006 66.05 9.41

2007 72.34 6.29

2008 99.67 27.33

2009 61.33 -38.34

')

Were 2008/2009 just outliers? Diff between the two is -11.01. Average of set is 4.26. 2010 could just be a tedious slog towards a high of $90, or spike and crash like '08. Are we starting from a higher baseline? It was curious that the startups of megaprojects in the wiki loosely correlated with prices in 2009, too - Khurais Ph 1 coming online in the middle of the year presaged a drop in price. Maybe this was just investors feeling reassured.

Like I said before, we aren't bringing much online this year.

If the wiki data is correct we'll need to eat up some of that spare capacity this year to stay ahead of the game.

Cogito, ergo non satis bibivi

And let me tell you something: I dig your work.

And let me tell you something: I dig your work.

-

TheDude - Expert

- Posts: 4896

- Joined: Thu 06 Apr 2006, 03:00:00

- Location: 3 miles NW of Champoeg, Republic of Cascadia

Re: The 2010 PO.com Oil Price Challenge

Hi, TheDude...

I am intriged by the trend idea;;;;;

Fundamentals are litoo easy to be wrong on this year... I still do not think that we have hit the bottom in the real estate market, nor on diesel, nor on jet fuel.

I am intriged by the trend idea;;;;;

Fundamentals are litoo easy to be wrong on this year... I still do not think that we have hit the bottom in the real estate market, nor on diesel, nor on jet fuel.

-

pup55 - Light Sweet Crude

- Posts: 5249

- Joined: Wed 26 May 2004, 03:00:00

Who is online

Users browsing this forum: No registered users and 0 guests