Is There A Second Crash Coming? Have Your Say?

Re: Is There A Second Crash Coming? Have Your Say?

$this->bbcode_second_pass_quote('Kristen', 'S')o what to do in life if such a crash is underway? It is not easy to just dissappear without wealth or resources.

I lived on the streets for a while. When I quit, I was worried about the rent...my mentor said to me "did you ever worry about tomorrow when you were on the streets? Why are you worrying today?"

just sayin'

-

JJ - Heavy Crude

- Posts: 1422

- Joined: Tue 07 Aug 2007, 03:00:00

Re: Is There A Second Crash Coming? Have Your Say?

$this->bbcode_second_pass_quote('Hoops_Mckann', '

')

That is very well put. Seems to sum up the mindset of the vast majority of people here in America. Once everyone runs for the exit, things seem to go down hill very quickly due to the strong influence that everyone operates ON THEIR OWN to serve their own self interests. I have observed that many here will cling to this mindset despite the mutual benefit of banding together that comes in handy in many situations.

')

That is very well put. Seems to sum up the mindset of the vast majority of people here in America. Once everyone runs for the exit, things seem to go down hill very quickly due to the strong influence that everyone operates ON THEIR OWN to serve their own self interests. I have observed that many here will cling to this mindset despite the mutual benefit of banding together that comes in handy in many situations.

Do you think this is why people in the US, although facing the worst of this crisis so far compared to the Europeans, have not made any significant protests?

-

Grautr - Lignite

- Posts: 271

- Joined: Thu 09 Feb 2006, 04:00:00

- Location: Maastricht, the Netherlands

Re: Is There A Second Crash Coming? Have Your Say?

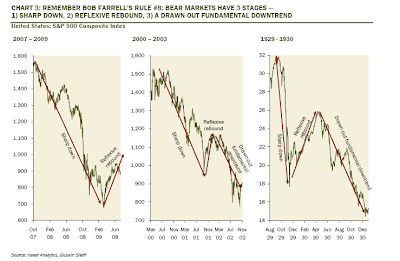

They are saying that we are going to get hit with a double whammy now

commercial real estate and credit card debt to be sort after....thats a big storm coming.

I am scared for the people been living off debt and the credit cards.

I know one couple paying off their mortgage with their credit card...man are they in for some trouble.

commercial real estate and credit card debt to be sort after....thats a big storm coming.

I am scared for the people been living off debt and the credit cards.

I know one couple paying off their mortgage with their credit card...man are they in for some trouble.

-

jesterx - Wood

- Posts: 17

- Joined: Sat 31 May 2008, 03:00:00

Re: Is There A Second Crash Coming? Have Your Say?

$this->bbcode_second_pass_quote('jesterx', 'T')his rich fat cat wall st bankers planned all this you know what from day 1. Absolutely disgusting. They even made the conspiracy theorist sound like extra idiots.

There is one thing to be said for certain Hollywood movies, the Matrix comes to mind, Deliverance is a classic too. It sounds like your awake, the world - at least the part under elite control - starts to become ridiculously predictable. Engineered economic collapse, engineered pandemics (seems they haven't quite figured that out yet), engineered food shortages in the form of terminator seeds and water privatization...etc, man made global warming with the only evidence so far being a push for global carbon taxation. War on terrorism, but when you consider war is the rich mans terrorism and terrorism is the poor mans war - you realize it is a war on little people. War on drugs means anything that grows naturally and we have evolved with and paves the way for mind numbing big pharma engineered brain paralyzers...

It is quite scary for most people in the industrialized world to come to terms with how much is real and how much of their reality is a complete fabrication.

There seems to be an ever increasing leak of information about the history we were never taught in our "educational institutions", whether it is deliberate or not is hard to say. Much of the information comes from insiders who are rather proud of being part of it all rather than dissent in the ranks. It is a different reality for these people, most believe they are doing everyone a favour.

$this->bbcode_second_pass_quote('Katzepfote', 'R')ead "Collapse" by Jared Diamond

I have it but haven't got through it yet. We are at an interesting point in this civilization to be sure. From what I can tell the elite may have a depopulation plan already underway. If we don't control ourselves mother nature will surely step in at some point and do it for us. I worry like everyone else but I am much more selective about what I worry about these days is the difference.

Put it this way, trying to predict 20 years down the road like previous generations did, for example "planning for financial retirement" is a rather risky proposition. They want the masses in the cities, they want to get rid of small farmers. It's all about control of food, water and shelter. It is no longer a secret there is a big push for global governance, the rush being once it is in place there is no longer a need to defend the idea. It will simply be enforced

-

pablonite - Tar Sands

- Posts: 723

- Joined: Sun 28 Sep 2008, 03:00:00