Peak oil looks a bit silly now

Peak oil looks a bit silly now

The price of oil has dropped by nearly 2/3 and no matter how people try and rationalize it you have to admit peak oil is now a hard sell.

Moved to Open forum. The Current Events forum is for Discussions on energy-related breaking news.-FL

Moved to Open forum. The Current Events forum is for Discussions on energy-related breaking news.-FL

-

Rambo - Peat

- Posts: 145

- Joined: Tue 03 Jan 2006, 04:00:00

Re: Peak oil looks a bit silly now

It always was to the SUV driving public.

It always was to the SUV driving public.

At least the price of bunker supplies will stay low for a while so the wise can stock up without going in debt or depriving family members of what they see as essentials.

Will it matter if we run out of oil before or after we run out of money to buy it. Is not one just as bad as the other? And will not a bunker full of food taste as good in a depression winter as it will in an oil deprived winter?

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: Peak oil looks a bit silly now

It only looks silly to those that don't understand peak oil. Oil prices dropped because demand was crushed by high oil prices, not because we found more oil. So, to those who are aware of the economic cycles predicted by PO theorist, this was predictable. Try reading Colin Campbell's book "The Coming Oil Crisis" published in 1999 where he discusses this very cycle. You'll find it elsewhere as well.

-

seahorse - Expert

- Posts: 2275

- Joined: Fri 15 Oct 2004, 03:00:00

- Location: Arkansas

Re: Peak oil looks a bit silly now

One of the problems is that "Peak Oil" is misunderstood to be short for "Peak Oil Prices" when that is not and has never been the case. The correct expansion for "Peak Oil" is "Peak Oil Production Rates" and even with the economy in flames and you know it's a depression once the news starts using the term "recession" openly just as it will be a great depression if they ever get around to calling it a depression or "slight depression", yes even with the economy burning like a house on fire that people sit around in and watch TV in rather than acting like this is somehow a problem, the production rates of oil are still in decline which is what Peak Oil Production Rates is about, OK?

The fall of the economy with the collapse of industry means that industry is not using oil the way it used to and therefor demand and purchasing power are both falling. This will put a crimp in oil production rates that operates alongside the geophysical crimp in oil production that has been going on since about 2005 or so. The new crimp will be composed of lower motivation to produce oil since the price is not so good and less ability to raise capital to build rigs, offshore equipment, ANWR/polar oil extraction facilities, etc.

The price of oil is not collapsing because an upturn in oil production rates. It's the dwindling buying power that is forcing sellers to try lower prices in order to keep moving oil inventory rather than become the owners of a product that never sells a drop.

In other words, Rambo, G. S. Y. H. in a P.

The fall of the economy with the collapse of industry means that industry is not using oil the way it used to and therefor demand and purchasing power are both falling. This will put a crimp in oil production rates that operates alongside the geophysical crimp in oil production that has been going on since about 2005 or so. The new crimp will be composed of lower motivation to produce oil since the price is not so good and less ability to raise capital to build rigs, offshore equipment, ANWR/polar oil extraction facilities, etc.

The price of oil is not collapsing because an upturn in oil production rates. It's the dwindling buying power that is forcing sellers to try lower prices in order to keep moving oil inventory rather than become the owners of a product that never sells a drop.

In other words, Rambo, G. S. Y. H. in a P.

-

bratticus - Permanently Banned

- Posts: 2368

- Joined: Thu 12 Jun 2008, 03:00:00

- Location: Bratislava

Re: Peak oil looks a bit silly now

$this->bbcode_second_pass_quote('seahorse', 'I')t only looks silly to those that don't understand peak oil. Oil prices dropped because demand was crushed by high oil prices, not because we found more oil. So, to those who are aware of the economic cycles predicted by PO theorist, this was predictable. Try reading Colin Campbell's book "The Coming Oil Crisis" published in 1999 where he discusses this very cycle. You'll find it elsewhere as well.

Oil prices were still going up even after demand was dropping. Can anyone say "bubble"?

-

outcast - Tar Sands

- Posts: 885

- Joined: Mon 21 Apr 2008, 03:00:00

Re: Peak oil looks a bit silly now

The economic unwind is doing quite a job on E&P and downstream: Refiners pinched as gas price falls faster than oil

What interests me lately is how domestic US production is slowly going down the drain, and where we on the West Coast will have to turn to to take up the slack. Our two primary domestic sources:

Chart (large)

Chart (large)

Couldn't care less about "selling" the message, or wasting time debating anymore either. You don't get it, think we're in BAU for the foreseeable eon, fine. You've got billions of others for company and attempting to make a difference winning over people through internet arguments is really a futile venture.

Edit: Converted [img] to [url] per COC 3.1.2 "Graphic content" -FL

What interests me lately is how domestic US production is slowly going down the drain, and where we on the West Coast will have to turn to to take up the slack. Our two primary domestic sources:

Chart (large)

Chart (large)

Couldn't care less about "selling" the message, or wasting time debating anymore either. You don't get it, think we're in BAU for the foreseeable eon, fine. You've got billions of others for company and attempting to make a difference winning over people through internet arguments is really a futile venture.

Edit: Converted [img] to [url] per COC 3.1.2 "Graphic content" -FL

Cogito, ergo non satis bibivi

And let me tell you something: I dig your work.

And let me tell you something: I dig your work.

-

TheDude - Expert

- Posts: 4896

- Joined: Thu 06 Apr 2006, 03:00:00

- Location: 3 miles NW of Champoeg, Republic of Cascadia

Re: Peak oil looks a bit silly now

Yes, it's a hard sell. But this was not unexpected. Many peak oilers predicted a "Greater Depression" or "Grand Depression" that would lower oil prices and hide the peak.

And it's not unrelated to peak oil. An Overlooked Detail - Finite Resources Explain the Financial Crisis

And it's not unrelated to peak oil. An Overlooked Detail - Finite Resources Explain the Financial Crisis

"The problems of today will not be solved by the same thinking that produced the problems in the first place." - Albert Einstein

-

Leanan - News Editor

- Posts: 4582

- Joined: Thu 20 May 2004, 03:00:00

Re: Peak oil looks a bit silly now

As far as I know, economic crises don't result in the formation of oil. In fact, the crisis will probably exacerbate peak oil, with low investment in discovery and drilling. I'd say we'll never produce more oil than we have recently produced, meaning peak oil has been reached. We're just not feeling the effects due to the drop in demand.

-

RSFB - Lignite

- Posts: 309

- Joined: Sun 03 Aug 2008, 03:00:00

Re: Peak oil looks a bit silly now

1909 man standing on the corner, talking to another man:

"I read an article in the newspaper saying that we've passed 'peak horse', meaning that every year fewer and fewer people are going to be using horses, and therefore there are going to be less horses around. But I don't believe it a bit! How could that possibly be the case, what with the price of a horse going lower and lower?"

"I read an article in the newspaper saying that we've passed 'peak horse', meaning that every year fewer and fewer people are going to be using horses, and therefore there are going to be less horses around. But I don't believe it a bit! How could that possibly be the case, what with the price of a horse going lower and lower?"

Space Ghost: Oh boy, the Shatner's really hit the fan now. I'm up Dawson's Creek without a paddle.

-

Hermes - Lignite

- Posts: 257

- Joined: Sat 20 Nov 2004, 04:00:00

- Location: Land of the Tonkawa/Karankawa

Re: Peak oil looks a bit silly now

I tell people that the good news is that the price of oil is in the toilet. The bad news is that so is the economy.

-

DaleFromCalgary - Peat

- Posts: 66

- Joined: Thu 31 Jul 2008, 03:00:00

Re: Peak oil looks a bit silly now

Rambo- Hell of an argument. Nice of you to explain your comments so well  PO has gone nowhere. Oil production is still heading off a cliff and sooner or later we'll have an entirely new crisis which involves massive shortages and higher prices.

PO has gone nowhere. Oil production is still heading off a cliff and sooner or later we'll have an entirely new crisis which involves massive shortages and higher prices.

Oil has been following the DOW right down the gutter...You've got cheap gasoline, but no longer have a retirement

PO has gone nowhere. Oil production is still heading off a cliff and sooner or later we'll have an entirely new crisis which involves massive shortages and higher prices.

PO has gone nowhere. Oil production is still heading off a cliff and sooner or later we'll have an entirely new crisis which involves massive shortages and higher prices.

Oil has been following the DOW right down the gutter...You've got cheap gasoline, but no longer have a retirement

lawns should be outlawed.

-

frankthetank - Light Sweet Crude

- Posts: 6202

- Joined: Thu 16 Sep 2004, 03:00:00

- Location: Southwest WI

Re: Peak oil looks a bit silly now

$this->bbcode_second_pass_quote('seahorse', 'S')o, to those who are aware of the economic cycles predicted by PO theorist, this was predictable.

Actually, many PO theorists were predicting the exact opposite before July, 2008. Here's Robert Rapier rejecting a journalist's comment that oil is cyclical:

$this->bbcode_second_pass_quote('', 'J')ournalist (in an article called "What Goes Up Must Come Down"): The length of the cycles may vary, but in the end, oil, too, is a cyclical business.

Robert Rapier: Encouraging signs that we are reducing our consumption, but I think the author misses the mark with that last statement. Oil has historically been a cyclical business. This will change when supply growth can no longer outstrip demand. This is going to be the case when oil production peaks, and all signs indicate to me that the erosion of excess capacity is driving the current surge in prices. Unless we have enormous demand destruction (and how is that going to occur other than through very high prices?), or there are a couple of Saudi Arabia’s hiding in the Arctic and soon to be discovered, I can’t easily see supply getting far ahead of demand. That is what would be required to continue the cycles - an oversupply situation.

Here's a subthread of sarcastic chuckling over at the Oil Drum about how dumb you'd have to be to think oil was still cyclic: Link

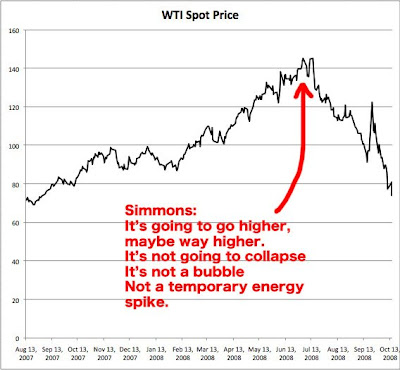

That comes from a thread at the very peak of the oil bubble in July, where Matt Simmons made the following asinine statements:

On this forum, I myself was completely trashed as an ridiculous idiot for posting a commodity correction warning on June 5, 2008. If the collapse was so "predictable" from peak oil theory, why didn't those smug a-holes, who live and breathe peak oil 24 hours a day, predict it? They thought the very possibility was ludicrous, and oil was headed to $200 and beyond.

In fact, it was the old school "flat earthers" who run the oil business, not the peak oilers, who were talking about cycles:

$this->bbcode_second_pass_quote('', '"')We're a cyclical business," David J. O'Reilly, chief executive of ChevronTexaco, the second-largest American oil company, said in a telephone interview, "and at the high end of the cycle it makes sense to get the company in good shape and strengthen our balance sheet.

"History tells us that what goes up also goes down.

Comments like that were consistently tarred and feathered in peak oil circles. Peak oil was going to end the cycles. It was a new era.

What happened to Boone Pickens? He was Mr. Peak Oil for years, and he got completely mauled by the oil price collapse, to the tune of $2 billion. What happened? He didn't understand it was cyclic? If it was so predictable from peak oil theory, why didn't he predict it in time to save his own ass?

What happened to Goldman Sachs' prediction of $200 oil? What happened to "We'll never see $50 oil again"? What happened to Jerome's "Countdown to $200 oil"? Hmm?

I've been on this group since Aug. 2004, and peak oilers claiming that oil would come back down were as scarce as hen's teeth, until just recently. So what we have here is just another in a long line of blown calls by peak oil theorists, which they will paper over with the usual of ex post facto weasely bullshit. Peak oil theorists (with the notable exception of HeadingOut from TOD) have a hardwired inability to frankly fess up to their mistakes. No matter what happens, they spin it so they were right all along.

- JohnDenver

- Intermediate Crude

- Posts: 2145

- Joined: Sun 29 Aug 2004, 03:00:00