The dirty little secret is that we always did and always will live in the here and now. Borrowing from the future in any sense is always an uncertain bet.

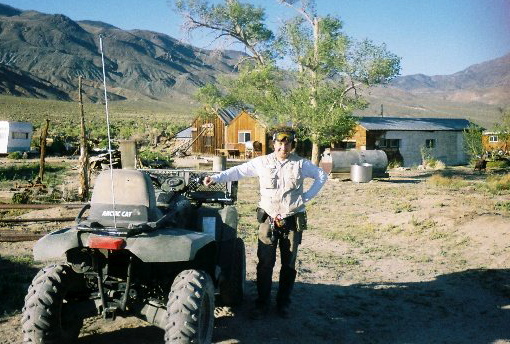

Thinking outside the box? You mean like this?

$this->bbcode_second_pass_quote('', 'M')arch 19 (Bloomberg) -- Starbucks Corp. Chief Executive

Officer Howard Schultz described the U.S. economy as being in a

``tailspin'' and said the company will introduce a new espresso

machine with freshly ground beans at most U.S. locations to

reverse a decline in customer visits.

In Case of Emergency, Break Glass

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

-

MrBill - Expert

- Posts: 5630

- Joined: Thu 15 Sep 2005, 03:00:00

- Location: Eurasia

Re: In Case of Emergency, Break Glass

$this->bbcode_second_pass_quote('MrBill', 'T')he dirty little secret is that we always did and always will live in the here and now. Borrowing from the future in any sense is always an uncertain bet.

Thinking outside the box? You mean like this?

$this->bbcode_second_pass_quote('', 'M')arch 19 (Bloomberg) -- Starbucks Corp. Chief Executive

Officer Howard Schultz described the U.S. economy as being in a

``tailspin'' and said the company will introduce a new espresso

machine with freshly ground beans at most U.S. locations to

reverse a decline in customer visits.

Thinking outside the box? You mean like this?

$this->bbcode_second_pass_quote('', 'M')arch 19 (Bloomberg) -- Starbucks Corp. Chief Executive

Officer Howard Schultz described the U.S. economy as being in a

``tailspin'' and said the company will introduce a new espresso

machine with freshly ground beans at most U.S. locations to

reverse a decline in customer visits.

That's just a beautiful quote Mr. Bill, he can see demand falling for his overpriced hyped luxury service and his solution is to introduce another expensive luxury to the service chain in hopes that marketing can reverse the trends!

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

- Tanada

- Site Admin

- Posts: 17094

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA