MC2 wrote:

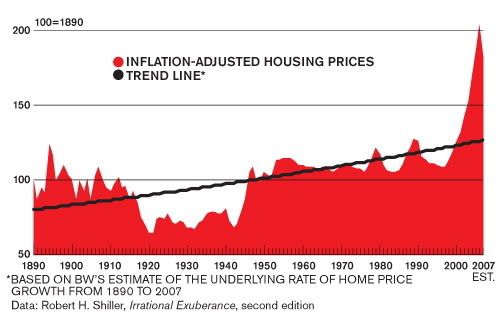

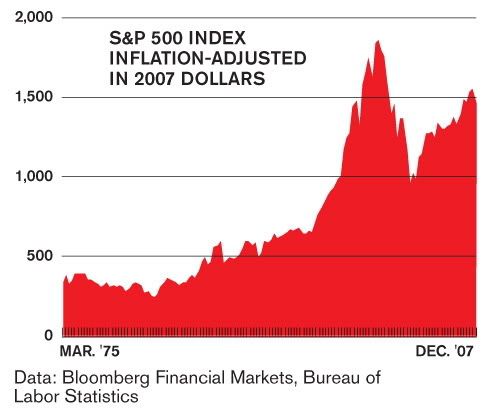

$this->bbcode_second_pass_quote('', 'I') think there's a problem with the idea that another bubble will be formed. What will it be made from? Housing was the last, what else is left to "bubble" up? Some have suggested oil and its related industry, others have suggested alternative energy, but I'm thinking the inflation is done. It's deflation now. It was hard to come to that conclusion, as I'd been in the camp that P.O. will force inflation willy nilly. But I don't see it that way anymore. P.O. will just add to the general level of despondency, suffer quite a bit of demand destruction, and fuels will be one of the more expensive things in every family's budget.

But I don't think we will see an inflationary bubble, much as they would like to be able to engineer one.

FED Cuts rates by 75 basis points

Re: FED Cuts rates by 75 basis points

STAGFLATION! Excessive money supply creation; weak currencies; low real interest rates; BUT NO GROWTH; would mean that just plain, old ordinary physical commodities, and the stuff you need, not luxury goods, but basics, just become more expensive for everyone!

No asset price bubbles, because assets are already historically high relative to incomes adjusted for inflation. This means falling living standards driven by excessive capacity and weak demand. It will be a global phenomenon, and not contained to the USA or developed countries.

And I think this alone is keeping central bankers awake at night. That is why I think they will address the deflation - by cutting interest rates first - and only then address the inflation issue by raising rates later. However, without coordination between central banks - and coherent government policies to deal with the slowdown - they could get it all horribly wrong, too!

$this->bbcode_second_pass_quote('', 'R')ogers looks at the Fed's willingness to add liquidity to an already inflationary environment and sees the history of the 1970s repeating itself. Does that mean stagflation? "It is a real danger and, in fact, a probability."

'It's going to be much worse'

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

-

MrBill - Expert

- Posts: 5630

- Joined: Thu 15 Sep 2005, 03:00:00

- Location: Eurasia

Re: FED Cuts rates by 75 basis points

Bill, possible, but I don't think it's likely. Take a look at what the U.S. Fed is having to do to defend the latest rate cuts. The EFF is all over the place. Slosh is down into the 'teens. The problem is that banks are not originating credit at any price. We are in a deflationary contraction.

Edit: let me add, they WILL cut, but it will do no good.

Edit: let me add, they WILL cut, but it will do no good.

-

MC2 - Lignite

- Posts: 230

- Joined: Mon 26 Jun 2006, 03:00:00

Re: FED Cuts rates by 75 basis points

The dollar went up sharply today, about 1%, up to 76.2 or so, very close to erasing the downward effects of the 75+50 BP cuts. Any thoughts?

INO USD

INO USD

Last edited by emersonbiggins on Tue 05 Feb 2008, 19:40:16, edited 2 times in total.

"It's called the American Dream because you'd have to be asleep to believe it."

George Carlin

George Carlin

-

emersonbiggins - Expert

- Posts: 5150

- Joined: Sun 10 Jul 2005, 03:00:00

- Location: Dallas

Re: FED Cuts rates by 75 basis points

$this->bbcode_second_pass_quote('MC2', 'B')ill, possible, but I don't think it's likely. Take a look at what the U.S. Fed is having to do to defend the latest rate cuts. The EFF is all over the place. Slosh is down into the 'teens. The problem is that banks are not originating credit at any price. We are in a deflationary contraction.

Edit: let me add, they WILL cut, but it will do no good.

Edit: let me add, they WILL cut, but it will do no good.

I hope you're right. It'd be nice if us savers got a break. I doubt it though. Deflation would swamp a system based on an ocean of debt.

TANSTAAFL

-

benzoil - Coal

- Posts: 443

- Joined: Fri 26 Aug 2005, 03:00:00

- Location: Windy City No Longer

Re: FED Cuts rates by 75 basis points

$this->bbcode_second_pass_quote('emersonbiggins', 'T')he dollar went up sharply today, about 1%, up to 76.2 or so, very close to erasing the downward effects of the 75+50 BP cuts. Any thoughts?

INO USD

INO USD

Yeah! The rest of the world is catching on to the fact that they are fucked worse than we are!

From another board (and someone much wiser than me!):

"What we have on our hands is a lender's strike!

The folks who pony up the money for debt origination, are saying to Bernanke: allow the existing debt to mark to market, or we will continue to raise the cost of our offerings, until the amount of money for new debt origination falls to zero and the cost of interbank borrowing to balance unneeded reserve falls to zero and you will have to choose between draining massive amounts of liquidity out of the system or lowering the FFT to zero. "

-

MC2 - Lignite

- Posts: 230

- Joined: Mon 26 Jun 2006, 03:00:00