New Home Sales...Fall

Re: New Home Sales...Fall

$this->bbcode_second_pass_quote('Cynus', '.')..do you want there to be an economic collapse and massive die off,...

Personally, I do not think anyone wants economic collapse or a die off, but how much longer can the US (and world, to a degree) continue on this unsustainable path of resource exploitation, deficit spending, etc.? I know few people with knowledge of economics or politics that feel that we can continue on this current path, utilizing the current economic model in an environment of finite resources – whether raw matrials or financial/monetary.

-

hull3551 - Peat

- Posts: 126

- Joined: Sun 13 Mar 2005, 04:00:00

- Location: Bellingham, Wash

Re: New Home Sales...Fall

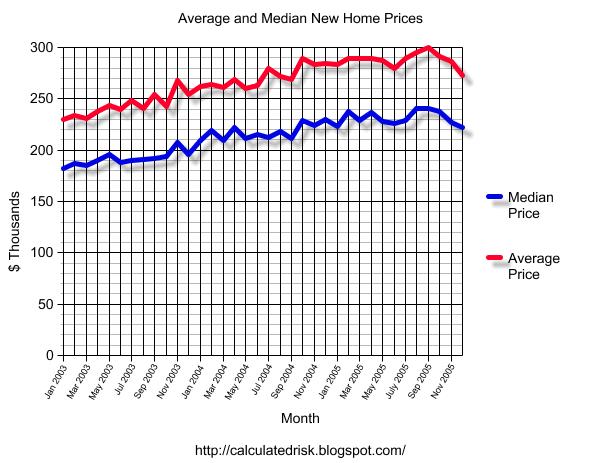

The real estate market has been up and down for months. I think there were record new home sales in October, followed by this huge drop-off in November. It has become a volatile market, but it is not clear to me that nationwide housing price declines are in the cards.

I agree with some other posts that the fed will try to inflate us out of this mess, despite their stated mission of fighting inflation.

I agree with some other posts that the fed will try to inflate us out of this mess, despite their stated mission of fighting inflation.

-

JoeW - Tar Sands

- Posts: 647

- Joined: Tue 12 Oct 2004, 03:00:00

- Location: The Pit of Despair

Re: New Home Sales...Fall

$this->bbcode_second_pass_quote('JoeW', 'I') agree with some other posts that the fed will try to inflate us out of this mess, despite their stated mission of fighting inflation.

There is a possibility that there will NOT be a housing crash. Think back to how Greenspan juiced up the money supply and "saved" the stock market. If the the gov. runs the printing press hard enough the economy will get flooded with "paper money". This will keep home prices from falling but all that extra money will cause massive inflation. If this happens there will be a bull market in commodity prices.

just a theory.

- cube

- Intermediate Crude

- Posts: 3909

- Joined: Sat 12 Mar 2005, 04:00:00

Re: New Home Sales...Fall

$this->bbcode_second_pass_quote('cube', '')$this->bbcode_second_pass_quote('JoeW', 'I') agree with some other posts that the fed will try to inflate us out of this mess, despite their stated mission of fighting inflation.

There is a possibility that there will NOT be a housing crash. Think back to how Greenspan juiced up the money supply and "saved" the stock market. If the the gov. runs the printing press hard enough the economy will get flooded with "paper money". This will keep home prices from falling but all that extra money will cause massive inflation. If this happens there will be a bull market in commodity prices.just a theory.

Bingo....

The Fed's position is absoultly never allow asset deflation to occur. This is Greenspan's position and the incoming Fed Chairman (Ben B.) has wirtten papers on all the techniques available to prevent deflation. They will run the money printing presses 24 x 7 and debase our currency to nothing before they let deflation run wild. Hell, starting in March 06, the fed is no longer going to report M3 money supply statistics.

As long as the Fed keeps raising rates, home prices will drop a little, but the fed is prepared to print all they need to prevent a whole sector crash.

The issue as you noted is that when all the money is created, it has to go somewhere: either assets (stocks/houses), general goods, commodities, or all.

-

dbarberic - Lignite

- Posts: 231

- Joined: Tue 27 Sep 2005, 03:00:00