Stock Market Crash! (merged) Pt. 26

Re: Stock Market Crash! (merged) Pt. 26

$this->bbcode_second_pass_quote('', 'P')ost by Armageddon » Tue 17 May 2022, 17:22:18

Armageddon wrote:

Crude -2.445MM

Gasoline -5.102MM

Cushing -3.071MM

Distillates +1.075MM

Ouch

$this->bbcode_second_pass_quote('AdamB', '

')Sounds bad. So..you having a tough time getting fuel for your Mercedes in St. Louie? Or are you just a cheapskate whining about the cost of a tank?

$this->bbcode_second_pass_quote('Armageddon', '

')Ford F-150 for me. I don’t drive cars. I drive a man’s vehicle.

Cages are for cowards. "I don't drive cars". Sure....you are so scared of your poor driving ability you don't need a small safety cage wrapped around you, but you need a BIG one.

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Stock Market Crash! (merged) Pt. 26

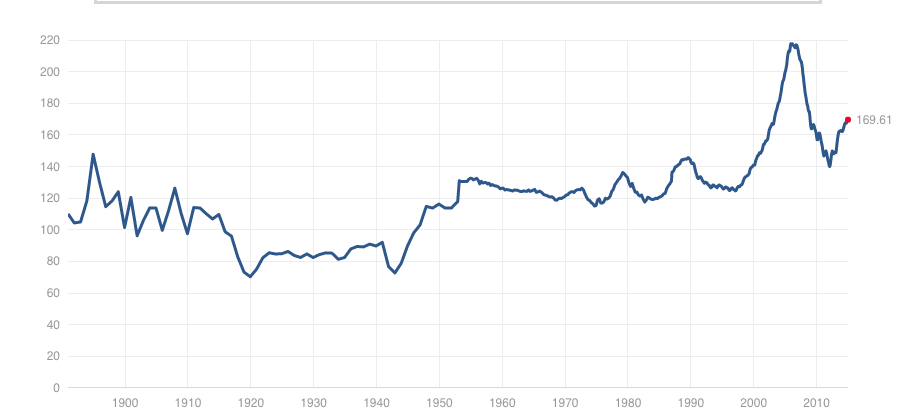

And there is nothing wrong with that either. In the age of PeakOil the pressure is on and gains are not easy to make. Plus there was a long period in there with no inflation, which adds to the slow growth. There is no comparison between the ASX to the bubble US markets. Us markets are driven by the financial economy, it's all they have left. Paper shuffling. To say it's ripe for a crash is an understatement. Just look at Tesla! It's $425 a share now, it was $400 at the peak of the Battcar mania, then it slumped as the the fundamentals of Tesla started to go down the toilet, but then it rose, consistently. It's been climbing for over a year and is about to surpass it's all time high. But earnings have halved now, the company is dead on it's feet. So what they hell is going on?

To suggest the savvy investors are bidding up because of the Robot promises would be incorrect, as that's a relatively new addition to the marketing hype. No it's simply being bid up by the shares shuffling back and forth between big holders. The FED itself might be working to backstop it for all we know? The President's working group on markets. Certainly it's with the "in crowd" as far as the AI bubble goes but aside from all that the valuations are ridiculous from any long term rational perspective. Like when people want to access their retirement savings in 10 years. The US markets are in (mild) exponential growth, but the companies fortunes, their sales, are not. The period from 2004 to the GFC saw similar growth, but not as steep. This bubble curve began around 2016 and is not giving way despite all the intractable woes, the Massive overall debt burden all the corporations are carrying for one.

In the years leading up to the GFC I was listening to podcasts and reading articles from (not the mainstream) and they convinced me a crash was coming. It took a couple of years, but I was OUT of the paper markets and IN Physical Gold and Silver. When the crash finally came everyone was gobsmacked, how could this happen! Well it's going to happen again, and as always, they don't ring a bell at the top. I could have gone back in at the lows, or even during the recovery, but I was OVER the BS paper markets by then and the profits I was accruing in Gold were more than enough. In fact the profits I had already made by 2008 eclipsed the Paper gains in the stock market at it's peak. And since then the appreciation of Gold over the ASX capital gains and dividends has been astonishing! Gold here has gone from $1400 odd in 2010 to $5500 today. And I wouldn't mind betting that Gold gains in $US over there has outpaced even the frenetic stock gains (on average). No one pays dividends there aside from the likes of Caterpillar so forget them. CAT's div yield = 1.33% laughable.

The trigger for the GFC was said to have been the collapse of bear sterns and some insurance company I can't recall the name of. Later it was blamed on the collapse of the US housing bubble. Now we have Tesla with a market cap of 1.3 Trillion, and Nvidea with double that, what if one of them collapsed? What was bear sterns market cap before it's collapse? 25 Billion. If you're in these paper markets your sitting on a crate of Semtex.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Stock Market Crash! (merged) Pt. 26

')In the years leading up to the GFC I was listening to podcasts and reading articles from (not the mainstream) and they convinced me a crash was coming.

Yes. We know you've been thinking the end was coming since you dropped out of high school. It is obvious that you are that ignorant of how the world works...you don't have to highlight it as often as you do....but hey....at least you're on a break from the "servicing your King" position, right?

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26