THE Silver & Gold Thread (merged) Pt. 1

Re: THE Silver & Gold Thread (merged)

$this->bbcode_second_pass_quote('theluckycountry', 'I')s inke still doing those daily BC/Gold comparison posts?

Careinke is certainly demonstrating regularly that mindless fools, like you, have made claims that are ludicrous, yes.

Why, have you decided to go get educated and hopefully gain 50 IQ points to get yourself within shouting distance of Careinke?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: THE Silver & Gold Thread (merged)

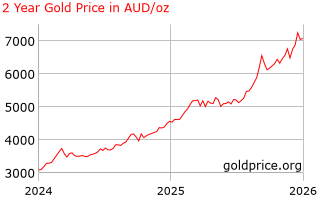

That little bit at the top RH corner? That, in financial circles, is know as "Consolidation"

Gold: Standing the test of time

Egyptian

Grecian

Roman

And another fallen Empire that eventually watered down its currency

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Silver & Gold Thread (merged)

$this->bbcode_second_pass_quote('theluckycountry', '

')And another fallen Empire that eventually watered down its currency

')And another fallen Empire that eventually watered down its currency

So...Lucky, doesn't know he lives in a Constitutional Monarchy, also doesn't know that the US ISN'T an Empire. I highlighted the pertinent word for the uneducated and naturally ignorant.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: THE Silver & Gold Thread (merged)

Oh look. BTC went up over the weekend while gold went down, go figure. Not you lucky, your not very good a figuring. At least you make a good reverse indicator.

To start off the week;

1 BTC = 35.815 Troy ounces of gold, over .62 more ounces of gold since the close on Friday.

Peace

To start off the week;

1 BTC = 35.815 Troy ounces of gold, over .62 more ounces of gold since the close on Friday.

Peace

Cliff (Start a rEVOLution, grow a garden)

-

careinke - Volunteer

- Posts: 5047

- Joined: Mon 01 Jan 2007, 04:00:00

- Location: Pacific Northwest

Re: THE Silver & Gold Thread (merged)

When it comes to manic bubbles, investors go mad in Herds.

Then one day they are sitting in front of computer wondering how they could have been so gullible.

09-14-2017: Gold is under-owned by investors… for now

https://www.schroders.com/en-us/us/inst ... s-for-now/

October 24, 2024: Gold is under owned… massively!

$this->bbcode_second_pass_quote('', 'T')he study reveals that 71% of investment advisors in the United States, who manage or advise on trillions of dollars, hold less than 1% of their assets in gold.

https://weekendinvesting.com/gold-is-un ... massively/Then one day they are sitting in front of computer wondering how they could have been so gullible.

09-14-2017: Gold is under-owned by investors… for now

https://www.schroders.com/en-us/us/inst ... s-for-now/

October 24, 2024: Gold is under owned… massively!

$this->bbcode_second_pass_quote('', 'T')he study reveals that 71% of investment advisors in the United States, who manage or advise on trillions of dollars, hold less than 1% of their assets in gold.

Well of course! They can't personally make real money off it, not like they can buying and selling stocks as they do. Gold is, and always was, the purchase of people who had money, not the people who wanted to make money.

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Silver & Gold Thread (merged)

$this->bbcode_second_pass_quote('theluckycountry', '

')09-14-2017: Gold is under-owned by investors… for now

')09-14-2017: Gold is under-owned by investors… for now

https://www.schroders.com/en-us/us/inst ... s-for-now/

$this->bbcode_second_pass_quote('', '

')October 24, 2024: Gold is under owned… massively!

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Looks like a big bull run coming.

Looks like a big bull run coming.