THE Silver & Gold Thread (merged) Pt. 1

Re: THE Silver & Gold Thread (merged)

Who is in Singapore? Some the smartest/wealthiest people on the planet that's who.

$this->bbcode_second_pass_quote('', 'S')INGAPORE: Gold dealers in Singapore have seen sales of physical bars and coins soar in the first four months of the year. In the first quarter, Singaporeans bought 2.5 tonnes of gold bullion, a 35 per cent increase compared with the same period last year – the biggest on-year jump since 2010.

Despite the precious metal’s spot price breaking US$3,000 (S$3,900) in March and surging to US$3,500 less than two months later, buyers do not appear deterred and sales are still going strong. Mr Fan pointed out that central banks have been buying huge amounts of gold for the last three years. “Central banks are ultimately much more sensitive about some of these political developments that we've been seeing. They, like other investors, also need to find ways to build more resilience,” he said.

Analysts said that with growing volatility in the world, the rush to gold looks set to continue in the mid- to long-term.

Article – How Singapore became a Global Financial Center

https://fepfinanceclub.org/2024/05/02/a ... al-center/

47 billionaires relocated to Singapore in 2024: UBS report

https://e.vnexpress.net/news/business/e ... 25017.html

That's a big influx considering Singapore is a flyspeck of a nation. In comparison, the United States has 902 billionaires, according to Forbes.

29 Apr 2025 Indonesians queue overnight to buy gold amid economic uncertainty

$this->bbcode_second_pass_quote('', 'O')ther countries in the region have also reported seeing symptoms of gold fever.

In Malaysia, some stores reported a 25 per cent increase in customers, according to local media.

Vietnam has also reported long queues outside stores to buy gold. In Thailand, where gold also retains strong cultural significance, younger generations are entering the market through social media-driven financial advice. As a result, gold-trading apps and platforms are flourishing.

Indonesia? It has a Huge wealthy Chinese population, these are probably leading the phenomena there. But the Asians were always pretty savvy when it came to money.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Silver & Gold Thread (merged)

https://www.youtube.com/watch?v=QnIQtX31l_g

Meanwhile in America...

Freight Fraud, Cargo Theft, Deadly Collisions - Ghost Carriers Are Growing National Security Threat

$this->bbcode_second_pass_quote('', 'w')e see a tractor-trailer drive full speed into stopped traffic at an intersection, almost as if on purpose. Cars appeared to be vaporized in the crash, or flung aside as if toys. Two innocent motorists were killed instantly, and four others sent to the hospital... The driver of the semi, Andrii Dmyterko, 45, was arrested and charged with two counts of vehicular manslaughter. What is notable about Mr Dmyterko is that he is in the United States from Ukraine on a work visa... If this incident sounds familiar, that is because it is. Back on March 13 in Austin, Texas, a truck driver named Solomun Weldekeal-Araya crashed his truck into parked traffic on Interstate 35, killing five people, including an entire family, and sending another 11 to hospital. Mr Araya reportedly did not slow down, and his rig didn't stop until it had smashed into 17 vehicles. Mr Araya, originally from Ethiopia, was likewise in America on a work visa, and in this incident, was working for a subcontractor hauling products for Amazon.

Vid https://x.com/atutruckers/status/1920187966778974670

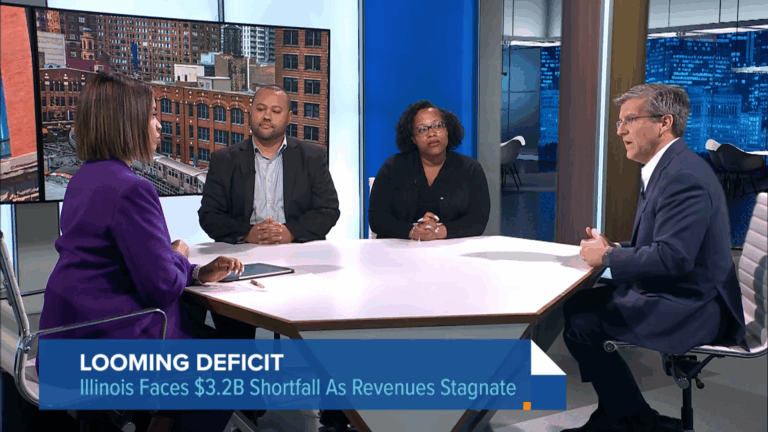

They've Destroyed Jobs And Opportunity For Black Chicagoans

https://wirepoints.org/theyve-destroyed ... irepoints/

That's a third world country folks. Suck it up you evil White men.

That's a third world country folks. Suck it up you evil White men.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Silver & Gold Thread (merged)

And your mindless drivel is...what? 6 year olds can pick something off a list....and you can't.

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26