by theluckycountry » Fri 08 Sep 2023, 15:34:23

by theluckycountry » Fri 08 Sep 2023, 15:34:23

$this->bbcode_second_pass_quote('AgentR11', '

')

Its the sell high part I think people have a real problem with, they see the asset going up, and think if it keeps going up how much richer they'll be. Or worse, they sell, and it goes up a little more and they have huge remorse.

Yes, quite. Investing your hard earned is like raising children, you need to put a lot of thought into it I believe, and have a set of rules, rules that you stick to. A lot of savvy financial gurus have said over the years that when your assert has gone up a lot you sell enough to recoup you're initial investment, then you can play with the rest. Unfortunately for a lot of people today an investment is a oneshot affair, they are "all-in" for the long haul, no rules, just faith and hope.

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

-

theluckycountry

- Light Sweet Crude

-

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

-

by careinke » Fri 08 Sep 2023, 20:10:20

by careinke » Fri 08 Sep 2023, 20:10:20

$this->bbcode_second_pass_quote('theluckycountry', '')$this->bbcode_second_pass_quote('AgentR11', '

')

Its the sell high part I think people have a real problem with, they see the asset going up, and think if it keeps going up how much richer they'll be. Or worse, they sell, and it goes up a little more and they have huge remorse.

Yes, quite. Investing your hard earned is like raising children, you need to put a lot of thought into it I believe, and have a set of rules, rules that you stick to. A lot of savvy financial gurus have said over the years that when your assert has gone up a lot you sell enough to recoup you're initial investment, then you can play with the rest. Unfortunately for a lot of people today an investment is a oneshot affair, they are "all-in" for the long haul, no rules, just faith and hope.

That is the hardest thing to do, and I suck at it. Fear Of Missing Out, FOMO, is a strong emotion and makes people jump in at the highs and hold on when the asset starts declining.

This cycle with the help of TA , some trailing stop losses, and a lot of learning/study, I HOPE to do better.

Still the average cost of my BTC is under a grand per coin, so I'm way up since my first purchase in 2014.

Fun fact: If you had .1 BTC costing about $2,500.00 USD today, and then every millionaire in the world decided to by BTC, you would own more BTC than the average millionaire. Simple math.

Peace

Cliff (Start a rEVOLution, grow a garden)

by theluckycountry » Tue 24 Oct 2023, 07:21:49

by theluckycountry » Tue 24 Oct 2023, 07:21:49

$this->bbcode_second_pass_quote('careinke', 'H')ey All,

BTC has started it's bull run today... BTC jumped 12% so far today.

One day's action signals a bull run? Ok, that sounds like a crypto analysis. Lets say the run lasts 5 days, then we enter a new bear market for 3 weeks, sound about right?

BTC Oct 2021 $62,000

BTC Oct 2023 $35,000 (Down by 44% in 2 years)

$this->bbcode_second_pass_quote('', '

')while major banks are dropping and

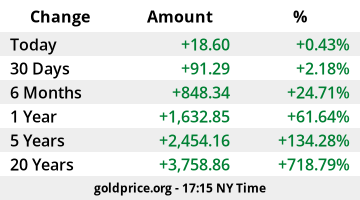

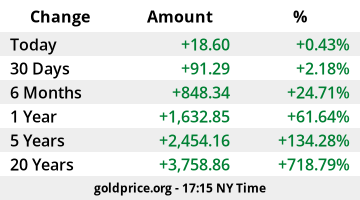

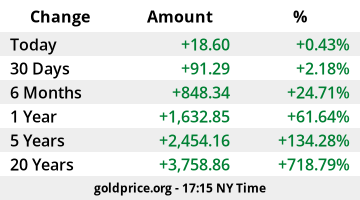

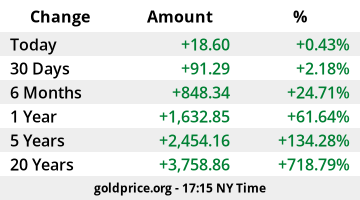

Gold has not really moved in the last five years.

So an increase of 60% is not really moving? You see. This is the problem I have with crypto. No one involved with it has a

clue what they are talking about.

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

by careinke » Tue 24 Oct 2023, 18:16:34

by careinke » Tue 24 Oct 2023, 18:16:34

$this->bbcode_second_pass_quote('theluckycountry', '')$this->bbcode_second_pass_quote('careinke', 'H')ey All,

BTC has started it's bull run today... BTC jumped 12% so far today.

One day's action signals a bull run? Ok, that sounds like a crypto analysis. Lets say the run lasts 5 days, then we enter a new bear market for 3 weeks, sound about right?

BTC Oct 2021 $62,000

BTC Oct 2023 $35,000 (Down by 44% in 2 years)

$this->bbcode_second_pass_quote('', '

')while major banks are dropping and

Gold has not really moved in the last five years.

So an increase of 60% is not really moving? You see. This is the problem I have with crypto. No one involved with it has a

clue what they are talking about.

Lucky,

Sorry I was very tired when I wrote that and posted based on my unreliable memory. I'll try and do better.

What I was thinking about with the gold prices for the last three years, taking into account our inflation rate.

I asked Bard to figure this one out. Here is its response.

$this->bbcode_second_pass_quote('', 'T')o calculate the current gold price using the 2021 dollar, we need to divide the current gold price by the inflation rate since 2021.

The current gold price is $1,975.70 per ounce. The inflation rate since 2021 is 14%.

Therefore, the current gold price using the 2021 dollar would be:

$1,975.70 / (1 + 14%) = $1,722.29

In other words, gold would be about $253 cheaper per ounce today if we were using the 2021 dollar.

(Note: This is just a rough estimate, as inflation rates can vary depending on the specific goods and services being measured.)

by theluckycountry » Wed 25 Oct 2023, 07:20:31

by theluckycountry » Wed 25 Oct 2023, 07:20:31

$this->bbcode_second_pass_quote('careinke', '

')Lucky,

Sorry I was very tired when I wrote that and posted based on my unreliable memory. I'll try and do better.

lol, yes I figured that, but I couldn't help myself taking a cheap shot. My apologies.

$this->bbcode_second_pass_quote('', '

')What I was thinking about with the gold prices for the last three years, taking into account our inflation rate. I asked Bard to figure this one out. Here is its response.

To calculate the current gold price using the 2021 dollar, we need to divide the current gold price by the inflation rate since 2021. The current gold price is $1,975.70 per ounce. The inflation rate since 2021 is 14%.

Therefore, the current gold price using the 2021 dollar would be:

$1,975.70 / (1 + 14%) = $1,722.29

In other words, gold would be about $253 cheaper per ounce today if we were using the 2021 dollar.

Yes you are quite correct, and I have noticed that too. But what you will see throughout history is that gold price inflation lags general price inflation which lags monetary inflation.

Consider the long term chart of gold in view of the monetary inflation that began in 1971 with the shift off the international gold standard. That triggered higher inflation in general prices. Gold didn't really begin moving though until late in the decade.

$this->bbcode_second_pass_quote('', 'I')n the winters of 1972 and 1973, Burns began to worry about inflation. In 1973, inflation more than doubled to 8.8%. Later in the decade, it would go to 12%. By 1980, inflation was at 14%.

https://www.investopedia.com/articles/e ... lation.asp

Consider also the gold price in 2006, which was the peak of the US housing bubble that began after 911 when under the Bush administration the Fed lowered interest rates precipitously to save us from the IT bubble.

As you can see, it took gold a few more years to catch up with the general inflation. But it certainly did, then overshot. Then it settled back to a level over twice that of before. In other words it compensated for all the inflation of the 00's. Knowing this one could buy a pile of paper gold as well and use it to sell at the next overshoot, thereby making a nice profit. I don't seek that from gold myself though. I just seek the preservation of purchasing power and the protection of savings.

There are many factors in the world today that

should have pushed the price much much higher, or lower! The mass accumulation by the BRICS nations for example, or the end of the gold standard. But the Gold price doesn't seem to be easily influenced. It just goes along on it's merry way, tracking inflation as it always has.

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

by theluckycountry » Thu 26 Oct 2023, 08:38:54

by theluckycountry » Thu 26 Oct 2023, 08:38:54

$this->bbcode_second_pass_quote('mousepad', '

')

700kWh for one bitcoin transaction.

0.0015kWh for one credit card transaction.

The stupidity of man truly has no upper bound.

Fix stupidity, fix the world.

Peace

Amen brother. It makes about as much sense as building an EV with a 10 year lifespan, covering every high hill with wind generators having a 15 year lifespan.

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

-

theluckycountry

- Light Sweet Crude

-

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

-

by careinke » Thu 02 Nov 2023, 00:57:47

by careinke » Thu 02 Nov 2023, 00:57:47

$this->bbcode_second_pass_quote('mousepad', 'h')ttps://ccaf.io/cbnsi/cbeci

15GW for the whole bitcoin operation

https://www.statista.com/statistics/881 ... ison-visa/700kWh for one bitcoin transaction.

0.0015kWh for one credit card transaction.

The stupidity of man truly has no upper bound.

Fix stupidity, fix the world.

Peace

Yawn, we've been over this before. Here are some more numbers:

Bitcoin: 133.68 TWh/year

Lightbulbs: 1,617.6 TWh/year

Clothes dryers: 335.28 TWh/year, just in the U.S. alone.

I tried to find Fiat central bank numbers but they seem to be closely guarded.

I suggest you read:

A Progressive's Case for Bitcoin: A Path Toward a More Just, Equitable, and Peaceful World . Bitcoin Magazine Books. Kindle Edition.

Then we can speak the same language.

$this->bbcode_second_pass_quote('', 'F')ix stupidity, fix the world

We both agree on that one, we just have different solutions.

Peace

Cliff (Start a rEVOLution, grow a garden)

by mousepad » Thu 02 Nov 2023, 06:43:59

by mousepad » Thu 02 Nov 2023, 06:43:59

$this->bbcode_second_pass_quote('careinke', '')$this->bbcode_second_pass_quote('mousepad', '

')

700kWh for one bitcoin transaction.

0.0015kWh for one credit card transaction.

Bitcoin: 133.68 TWh/year

Lightbulbs: 1,617.6 TWh/year

Clothes dryers: 335.28 TWh/year, just in the U.S. alone.

Yes, we're comparing financial transaction with cloth dryers and light bulps. Good job!!!!!

No wonder you've fallen for crypto head over heel.

by careinke » Fri 03 Nov 2023, 00:53:19

by careinke » Fri 03 Nov 2023, 00:53:19

$this->bbcode_second_pass_quote('mousepad', '')$this->bbcode_second_pass_quote('careinke', '')$this->bbcode_second_pass_quote('mousepad', '

')

700kWh for one bitcoin transaction.

0.0015kWh for one credit card transaction.

Bitcoin: 133.68 TWh/year

Lightbulbs: 1,617.6 TWh/year

Clothes dryers: 335.28 TWh/year, just in the U.S. alone.

Yes, we're comparing financial transaction with cloth dryers and light bulps. Good job!!!!!

No wonder you've fallen for crypto head over heel.

You were the one to bring up the false narrative. Besides how could you stop it? You can't, this Pandora's treasure has already escaped the box.

Peace

by Plantagenet » Tue 07 Nov 2023, 19:39:32

by Plantagenet » Tue 07 Nov 2023, 19:39:32

$this->bbcode_second_pass_quote('careinke', '.')... this Pandora's treasure has already escaped the box.

Peace

Bitcoin is currently up again. Congrats!

But crypto hasn't entirely escaped the box.

The facts show the crypto industry has been riddled with conmen and cheats.

In fact, some of cryptocurrencies biggest proponents turned out to be crooks and fraudsters and are now being put in little boxes with bars on them....hopefully for the rest of their lives.

Cheers!

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet

- Expert

-

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

-

by theluckycountry » Tue 07 Nov 2023, 21:27:43

by theluckycountry » Tue 07 Nov 2023, 21:27:43

On The (Eventual) Irrelevance Of SBF

$this->bbcode_second_pass_quote('', 'S')am Bankman-Fried’s recent conviction inspired many front page stories, most of which read like obituaries. Not just of his time as a free man but also the broader dreams of crypto. It all makes me laugh because none of this will matter in the long run. The afroed and acronymed psychopath will be forgotten long before he gets out of jail. Anyone who disagrees should take a moment to reflect on the importance of Bernie Ebbers to the modern internet.

If you’ve never heard of him then you are in good company, none of my students knew anything about him or his company either.

Bernard John Ebbers was the founder and CEO of Worldcom, once one of the largest telecommunication companies in the world and a contributor to the physical infrastructure of the internet, until it collapsed due to an accounting scandal — still the largest in US history. Far more value was destroyed by Worldcom than FTX, and Ebbers was sentenced to 25 years in prison.

So what does this story have to do with the modern internet? Virtually nothing. A network of computers that transmit packets of data was always going to be a thing. The soap opera of who did what when during its awkward adolescent years is now just a footnote in history. The same is true for most other tech revolutions, despite their own bubbles, frauds, and charismatic psychopaths. The only question that mattered in the long run was whether the proposed solution did something useful.

The money management industry is ten times bigger today than it was when a different Bernie went down in flames. The railroad bubbles of the 1800s didn’t invalidate the idea of trains and Ken Lay didn’t make us turn off the lights. Mortgage-backed securities are still an important thing, even if Lehman isn’t. You probably live off of electronic payments, but have never heard of Wirecard...

Full Articlehttps://omid-malekan.medium.com/on-the- ... a14b2ddafe

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

-

theluckycountry

- Light Sweet Crude

-

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

-