Rystad: Not Enough Oil for >1.8º warming

Re: Rystad: Not Enough Oil for >1.8º warming

$this->bbcode_second_pass_quote('Outcast_Searcher', '')$this->bbcode_second_pass_quote('Gmark', '

')

I agree. The energy industry evolved completely from people trying to make money, and as things tighten in the future, I expect oodles of cash will be thrown at nuclear, geothermal electric, kerogen extraction, wind, solar, and ideas we haven't even thought of yet. Lots of that cash will be wasted, but that financial motivation might lead to something significant.

It's just a race now, to see if they can find some combination of technologies that will keep the air conditioner running before the lights go out.

')

I agree. The energy industry evolved completely from people trying to make money, and as things tighten in the future, I expect oodles of cash will be thrown at nuclear, geothermal electric, kerogen extraction, wind, solar, and ideas we haven't even thought of yet. Lots of that cash will be wasted, but that financial motivation might lead to something significant.

It's just a race now, to see if they can find some combination of technologies that will keep the air conditioner running before the lights go out.

So you're just discounting all green energy? And batteries?

There are a LOT of improvements being made over time in terms of relative cost and efficiency, even if it will be decades before green energy can run most of the A/C, for example.

So why are the lights "going out" and are you saying that will happen real soon, or someday, or something in between? (I believe in slow decline vs. the instadoom so many preach on this site. And I think much of the decline can be managed over time by having a smaller population IF people will wake up enough over time to accept that reality. What China has done recently re its rules for having children is not a good sign in the short term, of course.)

No, I'm not discounting green energy at all. Significant and valuable progress has been made. And old technology is much more efficient now.

But we have a long way to go. Where I live, wind power provides about 20% of the electricity. Solar isn't a very good option here, so wind has to increase, and storage technology has to develop.

Some people think oil production has peaked, others think there's another decade or more before the peak is reached.

But I think that just like investors threw money at Shale Oil, and most lost money in that, I think the same will happen with other technologies. Investment money isn't flowing into solar as much as it needs to, and maybe they don't think there's enough return, so they're looking for other technologies that will be the 'next big thing'.

And from the news, you can see that some investment funds think that MSR nuclear, or Geothermal electric, or other infant technologies could be a next big thing. These groups are hoping to have something by 2030. Maybe.

The WSJ story yesterday on the iron-air battery storage developed by Form Energy could also be a next big thing. I'm kind of hopeful for that since they seem to think they'll be operational by 2025 and that's a short enough timeline that we won't have to wait long to see if this technology has legs.

The progress made here isn't getting to the third world very quickly, and that's a concern. They are already facing lights going out.

I don't think it will be a collapse either, but I think it will be messy.

- Gmark

- Peat

- Posts: 65

- Joined: Fri 23 Jul 2021, 22:11:08

Re: Rystad: Not Enough Oil for >1.8º warming

Pops, your post is silly and just further refuted your point. Your filter argument simply means the diminishing returns happen faster. Only the first few inches of insulation matter and the rest is irrelevant, it's obvious you don't believe anything you're saying.

Now ban me.

Now ban me.

- mustang19

- Permanently Banned

- Posts: 816

- Joined: Fri 06 Nov 2020, 20:43:52

Re: Rystad: Not Enough Oil for >1.8º warming

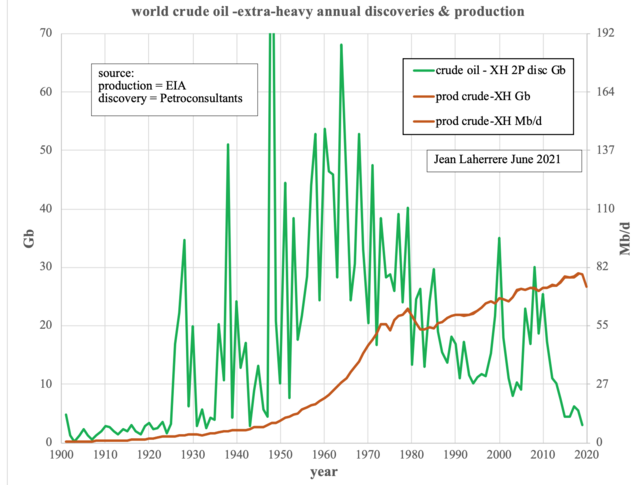

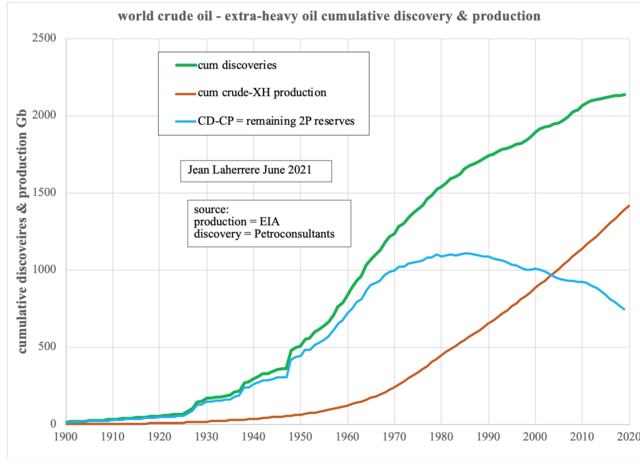

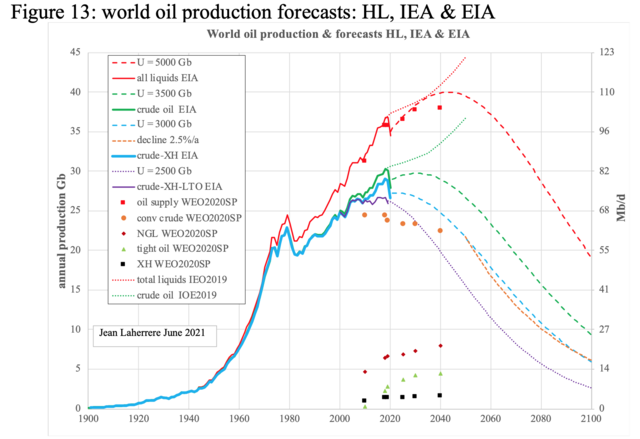

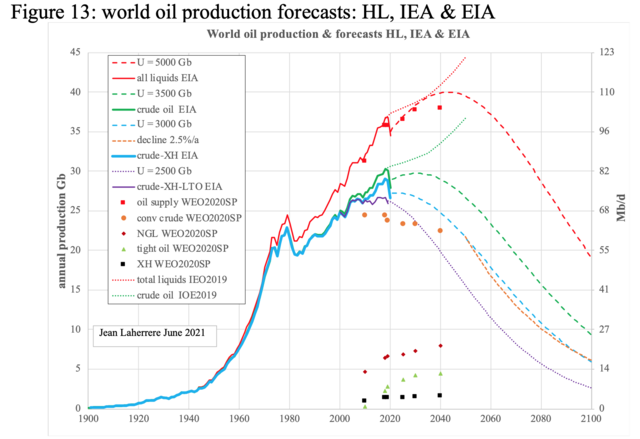

I tracked down Laherrere's latest from the ASPO France site

His quote:

$this->bbcode_second_pass_quote('', 'T')he peak of conventional (excluding extra-heavy oil) crude oil is past = 2019

His quote:

$this->bbcode_second_pass_quote('', 'T')he peak of conventional (excluding extra-heavy oil) crude oil is past = 2019

Just to guide on the plot,

the Red line is EIA All Liquids,

The green and Light blue are Hubert Linearizations of an URR of 3500 and 3000GB respectively (LESS x-heavy and LTO)

The purple line is 2500Gb URR less x & LTO which seems to be his mark.

This is a good read if for nothing else but his typical rant over how much BS is reported as 1-2-3p reserves, what is counted and what isn't.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Rystad: Not Enough Oil for >1.8º warming

$this->bbcode_second_pass_quote('Tanada', 'T')he latest EIA data I can find says that fracking in the USA produced 2.67 billion barrels of petroleum and natural gas liquids in 2020. Watching the URR number doesn't seem to help much as every time the price dips the number plummets because it is based on economically recoverable oil.

Only companies under SEC rules must report 1P provable (economical) reserves. Every year they change, because every year more are proven to be workable. But, everyone else just makes them up. You'll remember the fight of the paper barrels where each OPEC producer doubled their reserves overnight and hasn't revised them in decades. The reason is their reserves determine their quota. and of course they aren't audited.

Laherrere

$this->bbcode_second_pass_quote('', 'O')il reserves are reported following different classifications in use (JHL 2007)

US: all energy companies listed on the US stock market are obliged by the SEC to

report only proved reserves (1P), assumed to be the minimum (reasonable certainty if

deterministic or 90% probability if probabilistic); these reserves are audited.

OPEC: because quotas depend upon reserves, OPEC members report proved reserves

(1P), which is their national wish (of course non-audited).

Former Soviet Union: ABC1 (Khalimov 1979) reports maximum theoretical

recovery, being equal to proven plus probable plus possible (3P).

Rest of the world: SPE/WPC (1997) regulations report reserves as proven plus

probable (2P), close to the mean value or a probability of 50%. Oil companies use SPE 2P

reserves to decide the development of their fields, but they are obliged to report only SEC 1P

reserves!

But as he says, you have to make a guess at the ultimate if you're going to make a forecast. He's still sticking to the linearization, which really about all there is.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac