Consumer producer price wedge and EROI

Consumer producer price wedge and EROI

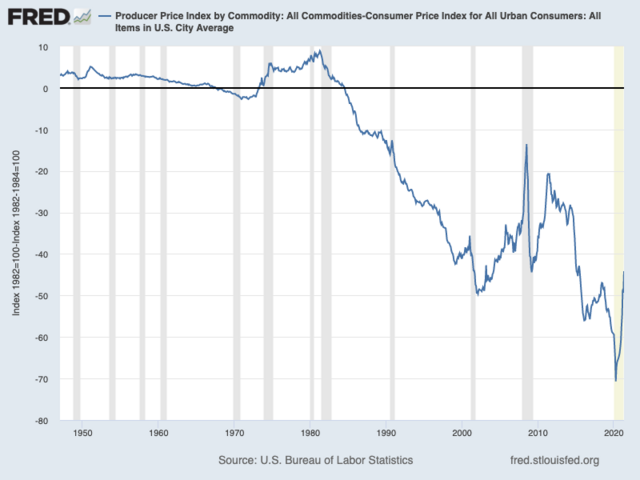

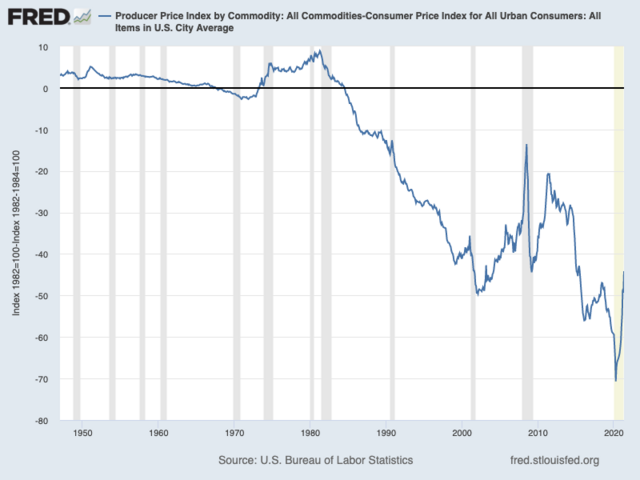

https://fred.stlouisfed.org/graph/?g=Fib2

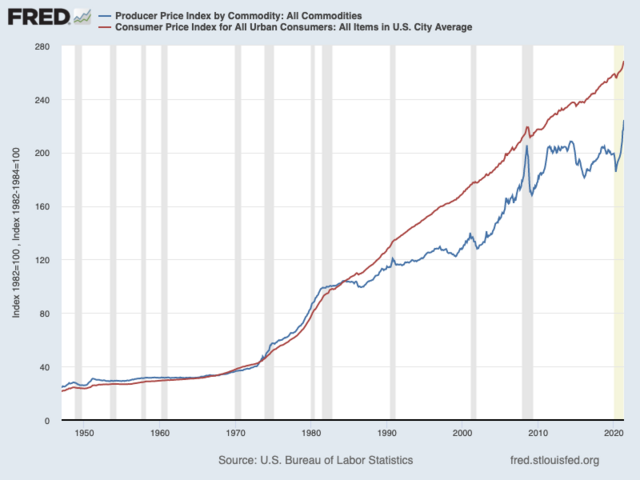

Producer prices inflate slower than consumer prices. In fact, they've fallen by half since 1950 relatively.

This is usually attributed to electronics and whatnot. But any capital improvement should flow to consumer prices, indicating that more inputs are needed for the same output- like predicted by EROI.

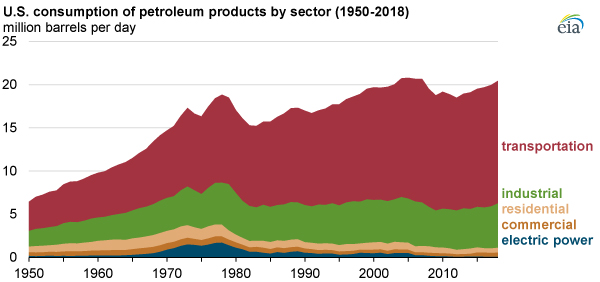

Rail miles, vehicle production, housing starts, oil wells, any measure of per capita capital stock has fallen since 1950 and so have living standards.

Producer prices inflate slower than consumer prices. In fact, they've fallen by half since 1950 relatively.

This is usually attributed to electronics and whatnot. But any capital improvement should flow to consumer prices, indicating that more inputs are needed for the same output- like predicted by EROI.

Rail miles, vehicle production, housing starts, oil wells, any measure of per capita capital stock has fallen since 1950 and so have living standards.

- mustang19

- Permanently Banned

- Posts: 816

- Joined: Fri 06 Nov 2020, 20:43:52

Re: Consumer producer price wedge and EROI

Hmm. Math isn't my thing but why divide?

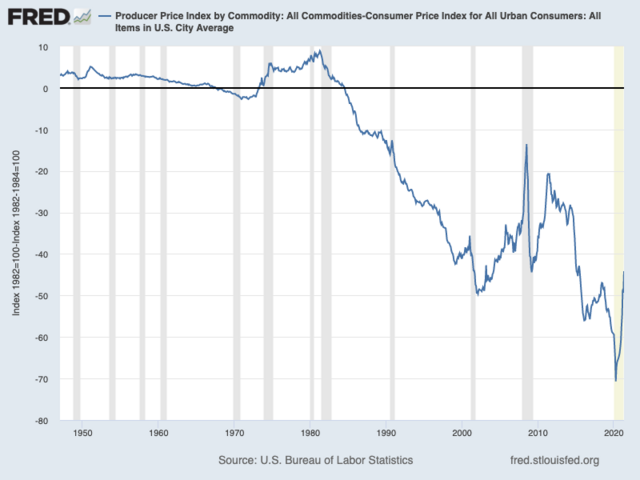

If you subtract CPI index from PPI index the picture is more interesting...

First thing is that the two were fairly balanced until US conventional peak / OPEC / end of gold standard, so either something structural changed or the resetting of the index that happened in 1980 either made the two more accurate or dramatically less so.

Second is that in the last months the spread has narrowed PPI closer to CPI (the index difference shrinking) so you can expect a big surge in consumer prices soon because that difference is profits I think.

Don't know if that's right or not or if you can do that to indexes of different things (raw materials and services vs consumer goods and services) but that's never stopped me before, LOL

If you subtract CPI index from PPI index the picture is more interesting...

First thing is that the two were fairly balanced until US conventional peak / OPEC / end of gold standard, so either something structural changed or the resetting of the index that happened in 1980 either made the two more accurate or dramatically less so.

Second is that in the last months the spread has narrowed PPI closer to CPI (the index difference shrinking) so you can expect a big surge in consumer prices soon because that difference is profits I think.

Don't know if that's right or not or if you can do that to indexes of different things (raw materials and services vs consumer goods and services) but that's never stopped me before, LOL

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Consumer producer price wedge and EROI

$this->bbcode_second_pass_quote('Pops', 'H')mm. Math isn't my thing but why divide?

If you subtract CPI index from PPI index the picture is more interesting...

First thing is that the two were fairly balanced until US conventional peak / OPEC / end of gold standard, so either something structural changed or the resetting of the index that happened in 1980 either made the two more accurate or dramatically less so.

Second is that in the last months the spread has narrowed PPI closer to CPI (the index difference shrinking) so you can expect a big surge in consumer prices soon because that difference is profits I think.

Don't know if that's right or not or if you can do that to indexes of different things (raw materials and services vs consumer goods and services) but that's never stopped me before, LOL

If you subtract CPI index from PPI index the picture is more interesting...

First thing is that the two were fairly balanced until US conventional peak / OPEC / end of gold standard, so either something structural changed or the resetting of the index that happened in 1980 either made the two more accurate or dramatically less so.

Second is that in the last months the spread has narrowed PPI closer to CPI (the index difference shrinking) so you can expect a big surge in consumer prices soon because that difference is profits I think.

Don't know if that's right or not or if you can do that to indexes of different things (raw materials and services vs consumer goods and services) but that's never stopped me before, LOL

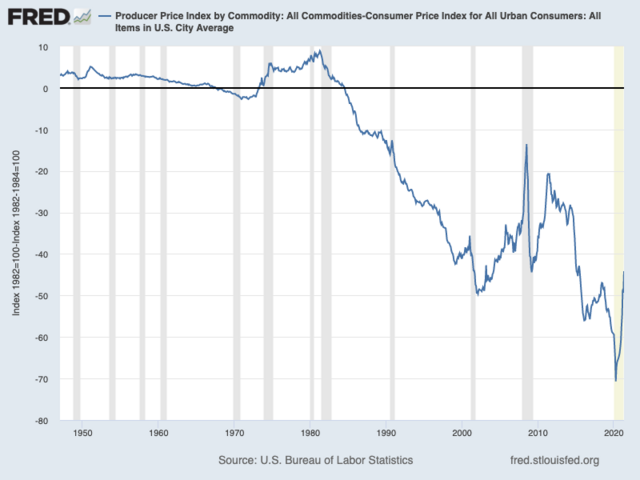

The wedge shows up when there's a lot of discoveries and materials prices are falling. This does, however not reflect a change in supply and consumer prices inflate to make up the difference.

The falling resource prices before the 90s were used to argue for abundance when they were really just a shift toward consumer inflation.

- mustang19

- Permanently Banned

- Posts: 816

- Joined: Fri 06 Nov 2020, 20:43:52

Re: Consumer producer price wedge and EROI

$this->bbcode_second_pass_quote('mustang19', '

')The falling resource prices before the 90s were used to argue for abundance when they were really just a shift toward consumer inflation.

')The falling resource prices before the 90s were used to argue for abundance when they were really just a shift toward consumer inflation.

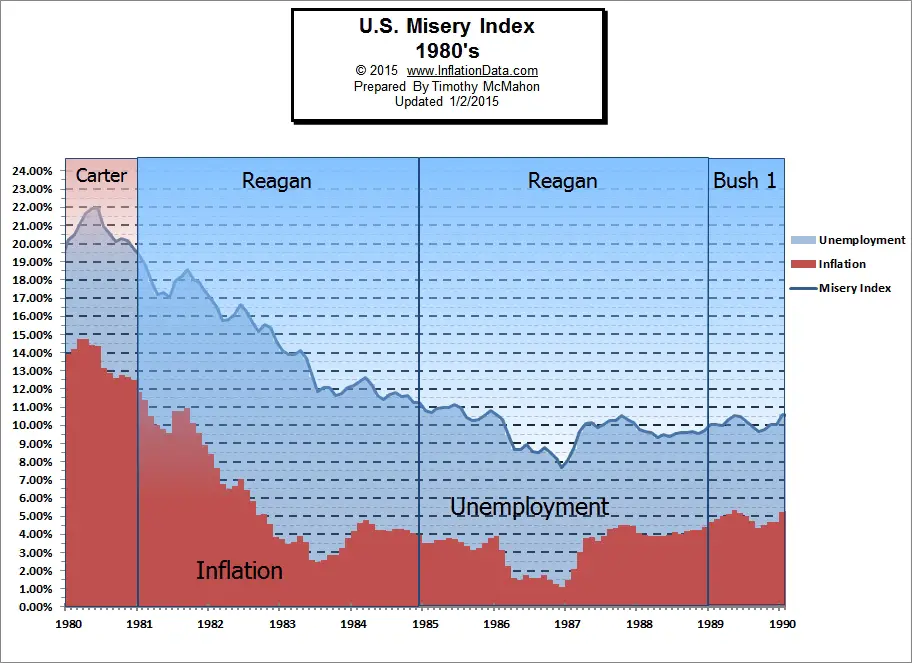

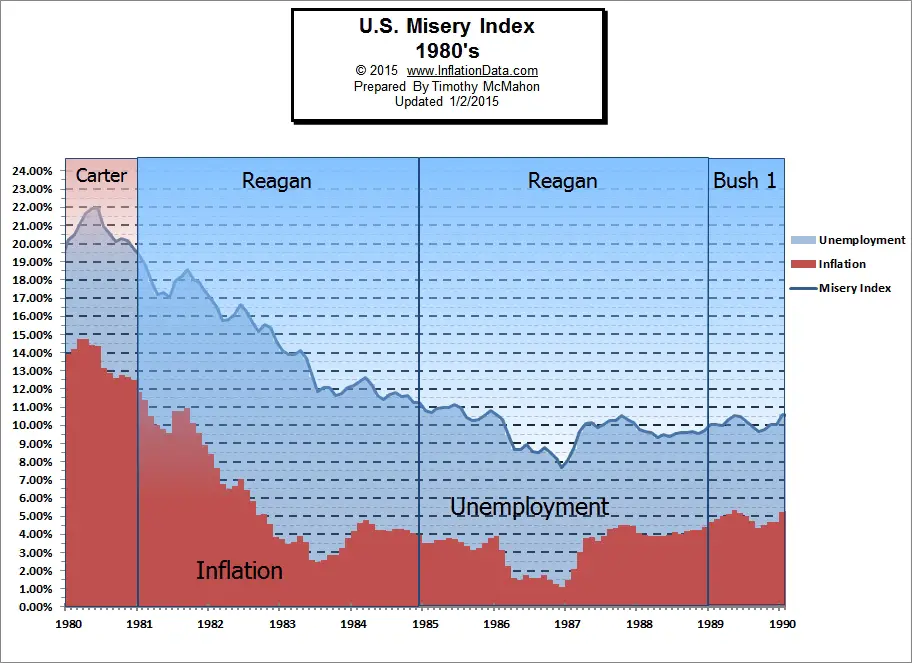

So..you want to troll claiming that inflation was going up in the 1980's? Huh.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Consumer producer price wedge and EROI

$this->bbcode_second_pass_quote('AdamB', '')$this->bbcode_second_pass_quote('mustang19', '

')The falling resource prices before the 90s were used to argue for abundance when they were really just a shift toward consumer inflation.

')The falling resource prices before the 90s were used to argue for abundance when they were really just a shift toward consumer inflation.

So..you want to troll claiming that inflation was going up in the 1980's? Huh.

No, that wasn't my claim. I merely pointed out that the cheapening of commodities didn't pass to consumer prices. But it barely matters anyway. Commodities going up or down relative to cpi will lower living standards regardless, because gas costs will dominate if it goes up. Commodity prices go down until eroi is so bad it's limiting production.

- mustang19

- Permanently Banned

- Posts: 816

- Joined: Fri 06 Nov 2020, 20:43:52