Should this site be shut down?

Re: Should this site be shut down?

')

Everyone has to realize that shale has been there waiting to be exploited since the start. Even if we had all of 2020's technology, I doubt much of it would have been developed as long as there was easier to drill oil available.

Yep. Bears stop eating blueberries during the salmon run.

blog: http://blog.mounttotumas.com/

website: http://www.mounttotumas.com

-

Ibon - Expert

- Posts: 9572

- Joined: Fri 03 Dec 2004, 04:00:00

- Location: Volcan, Panama

Re: Should this site be shut down?

And product cost can not go up without cost at the pump eventually following suit. Point being that the invisible hand of the market does indeed self-regulate.

Everyone has to realize that shale has been there waiting to be exploited since the start. Even if we had all of 2020's technology, I doubt much of it would have been developed as long as there was easier to drill oil available. The factors that delayed the exploitation of shale then are not that different from the shuttering of shale now. In both cases all it does is pause things until a time when demand for oil drives prices back up to a level that is economical for shale. Also remember that it was The Oil Drum who completely miscalculated the economics of shale back in the day, leading to it being discredited and going defunct. But today that phenomenon of being overly pessimistic about shale's prospects persists. History has proven that while it IS more expensive to recover shale, it remains viable to do so while keeping oil safely in-the-pocket to persist BAU as we know it. Unconventional blew up the eschatology (yes, eschatology) of Hubert's conventional oil curve and so we are now in territory where classic peak oil concepts and assumptions are no longer useful.

The end result is that the much anticipated day of peak oil reckoning shifts further and further into the future to the point where one might question the validity of having a forum hosted on said domain.

BTW, I remember the old IEA chart where peakers mocked at the zone labeled "future discoveries" or "unconventional" meant to compensate for conventional oil depletion. This leaning on unconventional was also a hallmark of Daniel Yergin's book The Prize. All of this was mocked, mocked, mocked. Well, it turns out they were right all along, at least in the short to medium term.

The problem is after the peak in conventional of 2005, and the following crash of 2008, the U.S. never recovered. And massive debt was undertaken to keep things going, the fed used quantitative easing to prop the economy in the slowest nonrecovery ever.

All over the world debt has been ballooning signalling nonviability of current model.

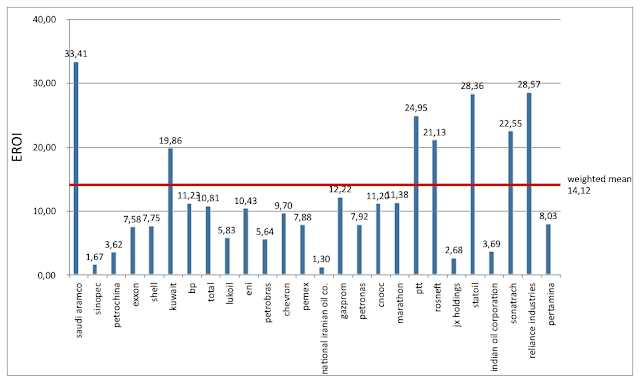

The EROI of many producers appears to be below that which would sustain civilization, and the few that have high EROI are near peak or have peaked and will be experiencing drops in production. Overall average EROI of oil has been dropping, some other sources suggest we are at or below 10 in average EROI already, at the edge of the cliff of net energy.

$this->bbcode_second_pass_quote('', 'T')he industrial society experiences Net Energy, not EROI, decline. As shown in the graph above, there is a strong non-linear relation between Net Energy and EROI. For a long range of EROI values, say from 100 to 10, the Net Energy is declining very slowly. Presently although the EROI decline is quite clear the Net Energy is still well above 90%. The society feels pretty safe. The problem is that we are walking along a cliff and it is increasingly urgent to make an energy transition, before finally ending up in the abyss.

https://www.resilience.org/stories/2019 ... -imagined/

- Darian S

- Peat

- Posts: 114

- Joined: Mon 29 Feb 2016, 16:47:02