Have we hit the peak?

Re: Have we hit the peak?

I wonder if that IEA chart that Pops posted takes into account the drop in supply that was caused by the Saudi attacks?

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Have we hit the peak?

It is from 9/12 report so current to maybe July?

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Have we hit the peak?

$this->bbcode_second_pass_quote('Revi', 'I') wonder if that IEA chart that Pops posted takes into account the drop in supply that was caused by the Saudi attacks?

Since that was a brief blip, I don't see how that is meaningful to be big picture over time.

Only if ongoing serious attacks continue, would that meaningfully hit the big picture.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Have we hit the peak?

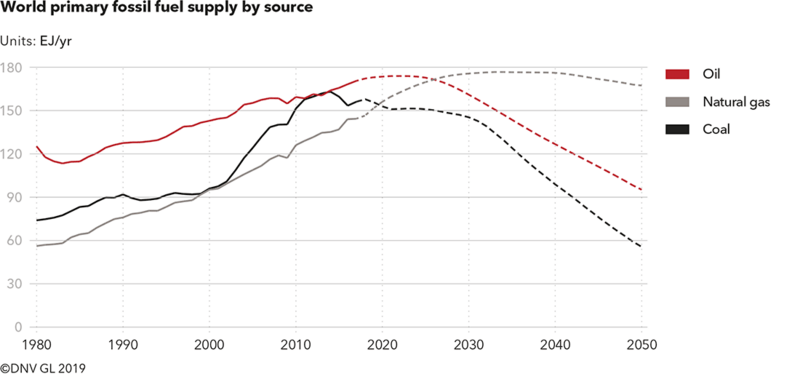

The sign of peak won't be the supply number, the contiguous US was in decline for 40 years. The sign will be economic, price to be exact. And even then it will be a long rearview look at a price high enough to cause conservation. The 4 years of $100+ price at the end of the outies was a preview.

Offshore brazil is just now going on sale. Venezuela's production is the lowest in 50 years even though it has the largest resource. etc, etc.

Offshore brazil is just now going on sale. Venezuela's production is the lowest in 50 years even though it has the largest resource. etc, etc.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Have we hit the peak?

Will the Fracking Revolution Peak Before Ever Making Money?

$this->bbcode_second_pass_quote('', 'J')ames West, a managing director at Investment bank Evercore ISI, assessed the situation for the Wall Street Journal. “We’re getting closer to peak production and we are reaching the peak of the general physics of these wells,” he said.

$this->bbcode_second_pass_quote('', 'J')ames West, a managing director at Investment bank Evercore ISI, assessed the situation for the Wall Street Journal. “We’re getting closer to peak production and we are reaching the peak of the general physics of these wells,” he said.

Facebook knows you're a dog.

-

Keith_McClary - Light Sweet Crude

- Posts: 7344

- Joined: Wed 21 Jul 2004, 03:00:00

- Location: Suburban tar sands

Re: Have we hit the peak?

Bumpy plateau, with lots of tiny peaks and troughs along the way???? July seems to have given US production a little trough.

"Recent decrease in U.S. crude oil production was geographically isolated, likely temporary", so read the headlines of an EIA report dated 9th October 2019.

However, they also added:

$this->bbcode_second_pass_quote('', 'M')onthly U.S. crude oil production fell by 276,000 barrels per day (b/d) in July 2019, based on the latest data in the U.S. Energy Information Administration’s (EIA) Petroleum Supply Monthly. This hurricane-related decrease was the largest decline in monthly crude oil production in more than a decade. The decline was temporary and geographically isolated to the Federal Offshore Gulf of Mexico. EIA expects that U.S. crude oil production will continue to increase through the remainder of 2019.

"Recent decrease in U.S. crude oil production was geographically isolated, likely temporary", so read the headlines of an EIA report dated 9th October 2019.

However, they also added:

$this->bbcode_second_pass_quote('', 'M')onthly U.S. crude oil production fell by 276,000 barrels per day (b/d) in July 2019, based on the latest data in the U.S. Energy Information Administration’s (EIA) Petroleum Supply Monthly. This hurricane-related decrease was the largest decline in monthly crude oil production in more than a decade. The decline was temporary and geographically isolated to the Federal Offshore Gulf of Mexico. EIA expects that U.S. crude oil production will continue to increase through the remainder of 2019.

https://www.eia.gov/todayinenergy/detail.php?id=41613

- EdwinSm

- Tar Sands

- Posts: 601

- Joined: Thu 07 Jun 2012, 04:23:59

Re: Have we hit the peak?

I posted a story about EXXONs big fracking plans in the permian and in the fine print was something about the shrinking size of "sweet spots" to infill.

Anyone have more info?

Anyone have more info?

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Have we hit the peak?

As we were told many times, the Peak will only be visible in the rear view mirror. This report is too close in time to call Peak, rather than the ups and downs of a bumpy plateau.'' But any more down turns make the end of last year more likely for the candidate for THE Peak. (that is providing the chart below is not based on false data).

If the Peak was around November last year, we have done well to keep going a year without major collapse (signs of stress are there, but the economic system is still holding together).

If the Peak was around November last year, we have done well to keep going a year without major collapse (signs of stress are there, but the economic system is still holding together).

- EdwinSm

- Tar Sands

- Posts: 601

- Joined: Thu 07 Jun 2012, 04:23:59

Re: Have we hit the peak?

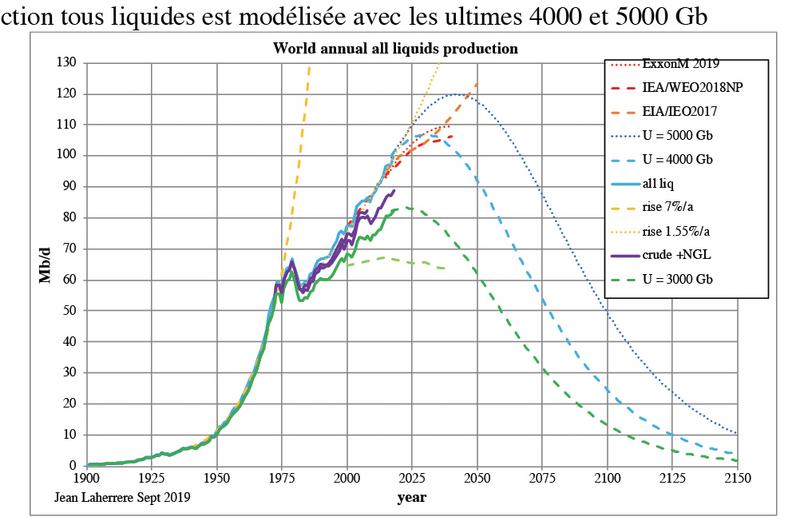

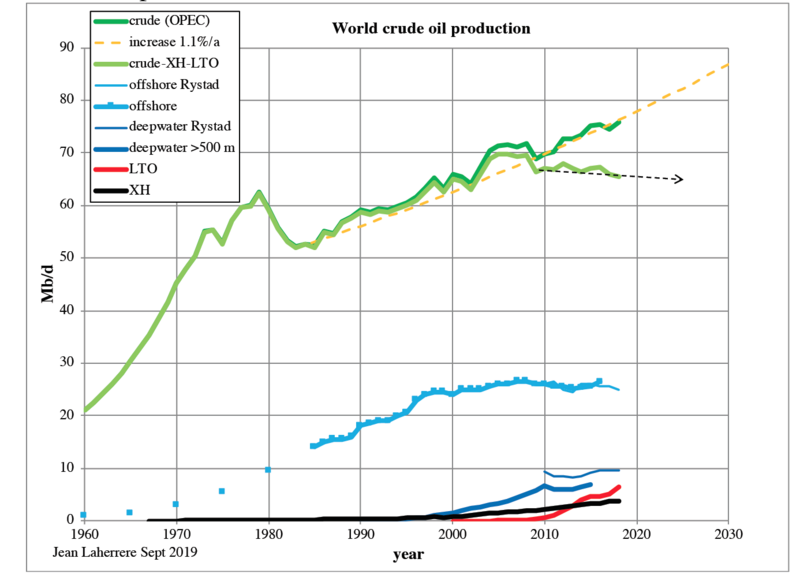

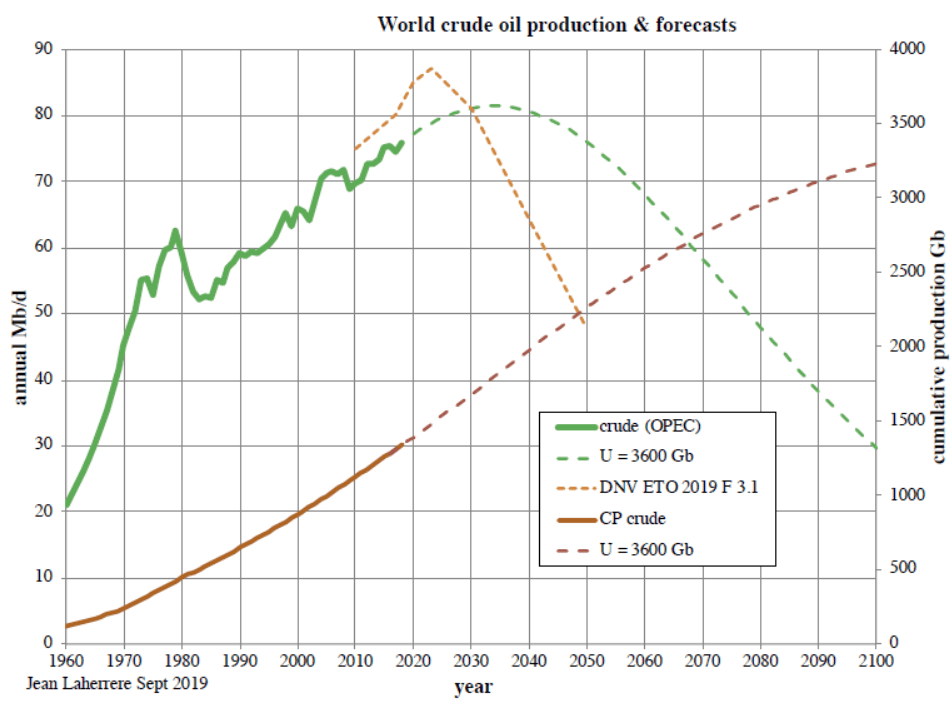

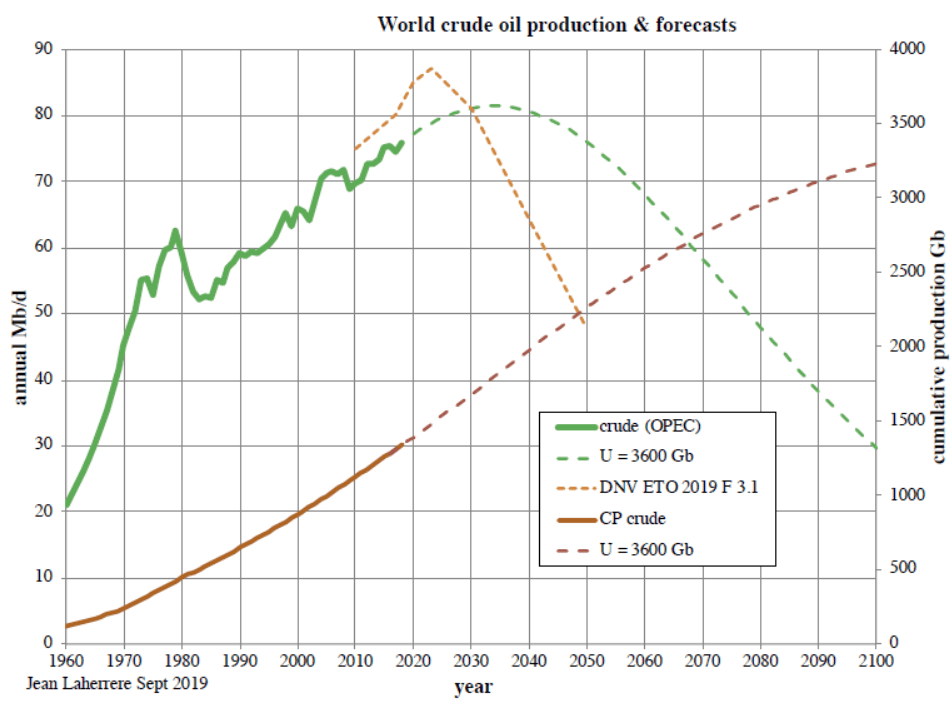

One of the peak oilers go to guys for modelling fame was Jean Laherrère. He of the Campbell/Laherrère essay in Scientific American in 1998 forecasting a 2005 global peak and being the precursor of the modern peak oil movement.

https://nature.berkeley.edu/er100/readi ... l_1998.pdf

Well he has had quite the conversion recently. Maybe it is just dementia. But he now models peak oil (crude oil only, no condensate) in 2035 (green dashed line).

The new model says that oil extraction in 2050 will be the same as in 2019. So there is plenty of time to find transportation fuel substitutes.

https://nature.berkeley.edu/er100/readi ... l_1998.pdf

Well he has had quite the conversion recently. Maybe it is just dementia. But he now models peak oil (crude oil only, no condensate) in 2035 (green dashed line).

The new model says that oil extraction in 2050 will be the same as in 2019. So there is plenty of time to find transportation fuel substitutes.

- marmico

- Heavy Crude

- Posts: 1112

- Joined: Mon 28 Jul 2014, 14:46:35

Re: Have we hit the peak?

$this->bbcode_second_pass_quote('EdwinSm', '

')If the Peak was around November last year, we have done well to keep going a year without major collapse (signs of stress are there, but the economic system is still holding together).

')If the Peak was around November last year, we have done well to keep going a year without major collapse (signs of stress are there, but the economic system is still holding together).

If you were being sarcastic, sorry I missed it. Assuming you're serious:

In the real world, prices react to "stress" due to lack of supply, the system doesn't magically "collapse" in the short term, especially when there's LOTS of oil in storage to handle any production shortfalls in the short term.

It amazes me how on this site the doomers never seem to be able to learn this simple concept. They can claim doom tomorrow, next week, etc. re the economy, peak oil, etc. and it doesn't make it any more real, BTW.

First, clearly the markets aren't worried about the prospects of a significant oil shortage over time, or the oil futures markets would be reflecting that.

Second, as the mid-2010 to mid-2014 period showed, even a MUCH higher oil price (i.e. approaching $100) doesn't cause anything approaching "collapse" in less than a year, much less 4 years. In fact, it doesn't even cause US or global recession.

In mid 2008 we saw that a $140ish WTI price for months caused inconvenience and worry. Not collapse.

Third, oil storage exists, and the amount the oil production was decreasing re the chart was on the order of one or two percent. So even if prices were rising rapidly, there wouldn't be a physical problem re oil unavailability in the short term.

A "shortage" that doesn't even scare up a meaningful price rise is pretty much the OPPOSITE of something that's going to cause "collapse" of the economic system.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY