by Plantagenet » Fri 07 Dec 2018, 17:55:53

by Plantagenet » Fri 07 Dec 2018, 17:55:53

$this->bbcode_second_pass_quote('Outcast_Searcher', '

')Yes. I did mess up.

Thank you.

Its no big deal. Everybody messes up sometimes.

Now lets all stop caterwauling about other posters, and lets get back to the topics of the interesting discussions at this site.

It will much nicer here if people talk about the topics instead of bashing other posters.

It will also be more informative, more interesting, and more efficient.

It will be better in every way.

Here.....I'll go first. Here's an interesting bit of news relevant to this topic ....

------------------------------------

Stocks plunge again---down 558 points...wipe out all 2018 gains.

stock-market-dow-fall-558 Experience shows that plunges in the stock market often precede slowdowns and recessions in the economy.

I'm looking for a US and global recession in late 2019.....just in time for the 2020 election season.

Cheers!

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet

- Expert

-

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

-

by copious.abundance » Tue 18 Dec 2018, 23:32:16

by copious.abundance » Tue 18 Dec 2018, 23:32:16

Long article but lots of interesting stuff.

Here's Why Stocks Could Be Headed A Lot Lower From Here$this->bbcode_second_pass_quote('', '[')...]

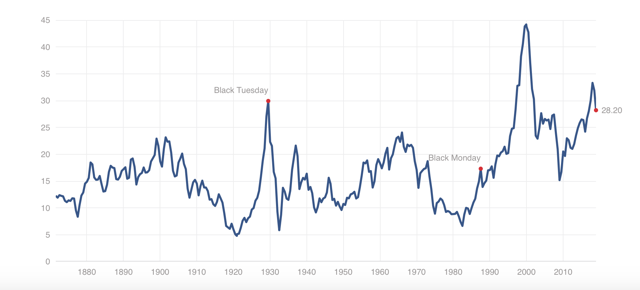

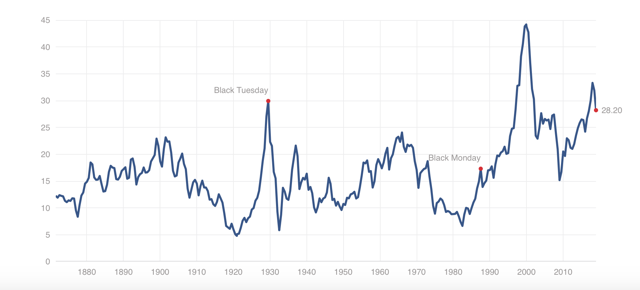

The S&P 500’s P/E ratio is currently at about 19.94, which is well below its recent high of roughly 24, but is still much higher than its historical median 14.73. Perhaps even more telling, the Schiller P/E ratio is currently at 28.20, just starting to come off its second highest level ever of about 33.5, and still far higher than the median 15.69.

So, let’s break this down. For the S&P 500, just to get back to its historic median, the Schiller P/E would need to decline by about 46%. For the S&P 500’s overall P/E ratio to get back to its median range it would have to decline by an additional 26%.

We are essentially talking about the S&P 500 having to decline by another 26 – 46% from current levels so that these valuation metrics could return to their historical averages. Another factor to consider is that in a bear market valuations don’t typically decline to their historic average, they overshoot to the downside, and sometimes by a lot.

[...]

There's a lot of debate about whether that P/E ratio is all that important anymore, but given all the other things discussed in the article, not to mention the conniptions the market has been undergoing all year, it's probably a decent barometer.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance

- Fission

-

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

-

by copious.abundance » Wed 02 Jan 2019, 19:51:00

by copious.abundance » Wed 02 Jan 2019, 19:51:00

^

And an article on that:

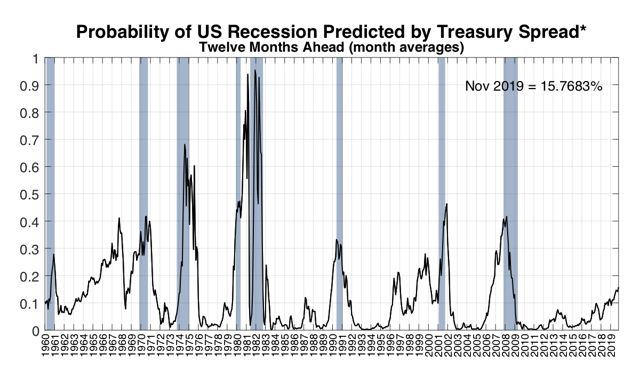

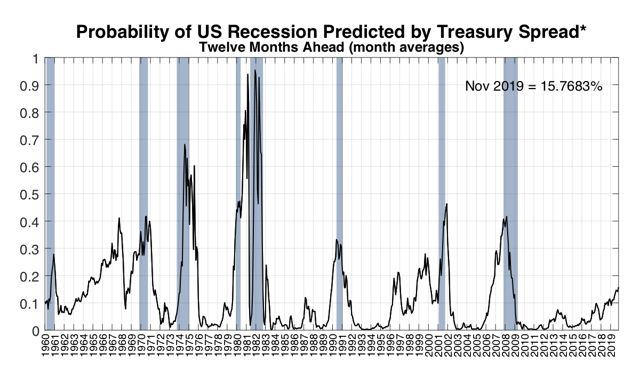

January Yield Curve Update: Inching Closer$this->bbcode_second_pass_quote('', '[')img]https://static.seekingalpha.com/uploads/2019/1/1/49663329-15463622900310075.png[/img]

Too long? Didn't read? Here's some handy bullets:

-- The trend in yield curve spreads continues to be negative.

-- The changes in the spread are being driven by the long end, the rates least in the Fed's control.

-- Models based around the yield curve are starting to predict recessions coming sooner rather than later. The earliest seems to be the end of 2019.

-- The price of consumer and corporate risk is rising.

Last edited by

copious.abundance on Wed 02 Jan 2019, 19:53:28, edited 1 time in total.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance

- Fission

-

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

-

by copious.abundance » Tue 22 Jan 2019, 18:34:49

by copious.abundance » Tue 22 Jan 2019, 18:34:49

Some pretty clear signs the housing market is starting to turn.

NAR: Existing-Home Sales Decreased to 4.99 million in December$this->bbcode_second_pass_quote('', 'T')otal existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 6.4 percent from November to a seasonally adjusted rate of 4.99 million in December. Sales are now down 10.3 percent from a year ago (5.56 million in December 2017).

...

Total housing inventory at the end of December decreased to 1.55 million, down from 1.74 million existing homes available for sale in November, but represents an increase from 1.46 million a year ago. Unsold inventory is at a 3.7-month supply at the current sales pace, down from 3.9 last month and up from 3.2 months a year ago.

Be sure to check out

the chart at the link.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance

- Fission

-

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

-

by GHung » Thu 24 Jan 2019, 12:56:29

by GHung » Thu 24 Jan 2019, 12:56:29

$this->bbcode_second_pass_quote('marmico', 'T')he Conference Board LEI did not turn down in December 2018. .......

From your link:

The Conference Board Leading Economic Index (LEI) for the U.S. Declined$this->bbcode_second_pass_quote('', 'N')EW YORK, January 24, 2019

...

The Conference Board Leading Economic Index ® (LEI) for the U.S.

declined 0.1 percent in December to 11.7 ........

Color me confused. You are either lying and think we wouldn't check, or you need new glasses. Or maybe it's my glasses........

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

by Outcast_Searcher » Thu 24 Jan 2019, 16:29:50

by Outcast_Searcher » Thu 24 Jan 2019, 16:29:50

$this->bbcode_second_pass_quote('GHung', '')$this->bbcode_second_pass_quote('marmico', 'T')he Conference Board LEI did not turn down in December 2018. .......

From your link:

The Conference Board Leading Economic Index (LEI) for the U.S. Declined$this->bbcode_second_pass_quote('', 'N')EW YORK, January 24, 2019

...

The Conference Board Leading Economic Index ® (LEI) for the U.S.

declined 0.1 percent in December to 11.7 ........

Color me confused. You are either lying and think we wouldn't check, or you need new glasses. Or maybe it's my glasses........

Let's pretend that 0.1% is a gigantic number, and that in casual conversation, it's impossible for someone talking in round numbers, that 0.1% change means roughly flat, or unchanged.

If you want to pick at nits, fine. But if someone who disagreed with you called you a liar for picking at such nits on ANY chart, I'm 99% sure you wouldn't like it one bit. ***

...

https://www.advisorperspectives.com/dsh ... be-peakingWhen I look at the LEI for 2018, I'd say that for Jan. to August, the trend was clearly up (by about 5 points), and from Sept. through Dec. the trend was basically flat (hovering near 112). Does that make me a liar too, or must everyone be as pedantic as say, Star Trek's "Data", when casually discussing figures?

....

*** Not to mention that people make mistakes. Without calling someone a liar, you could just say, something like "Hey, it looks to me like it was slightly down, and that's not unchanged. Am I missing something?"

I think we can disagree about things around here without frequent name calling. At least for those of us who are mature enough to discuss real data with real citations, and aren't frequently or flagrantly distorting data (again, everyone including me makes mistakes through haste or distraction, etc), instead of just making things up.

Just one man's opinion.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

by GHung » Thu 24 Jan 2019, 18:49:45

by GHung » Thu 24 Jan 2019, 18:49:45

$this->bbcode_second_pass_quote('Outcast_Searcher', ' ')......

Let's pretend that 0.1% is a gigantic number, and that in casual conversation, it's impossible for someone talking in round numbers, that 0.1% change means roughly flat, or unchanged.

If you want to pick at nits, fine. But if someone who disagreed with you called you a liar for picking at such nits on ANY chart, I'm 99% sure you wouldn't like it one bit. *** ........

Nope. I don't cut Marmico one inch of slack because he never does the same for others. Quid-fucking-Pro-Quo.

He made a statement of "fact" that was clearly false. He didn't say "about" or "pretty much", or use any other qualifiers. He said;

"The Conference Board LEI did not turn down in December 2018". It did. I called him on it. If you have a problem with that, it's YOUR problem.

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung

- Intermediate Crude

-

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

-

by Outcast_Searcher » Fri 25 Jan 2019, 03:06:37

by Outcast_Searcher » Fri 25 Jan 2019, 03:06:37

$this->bbcode_second_pass_quote('GHung', '')$this->bbcode_second_pass_quote('Outcast_Searcher', ' ')......

Let's pretend that 0.1% is a gigantic number, and that in casual conversation, it's impossible for someone talking in round numbers, that 0.1% change means roughly flat, or unchanged.

If you want to pick at nits, fine. But if someone who disagreed with you called you a liar for picking at such nits on ANY chart, I'm 99% sure you wouldn't like it one bit. *** ........

Nope. I don't cut Marmico one inch of slack because he never does the same for others. Quid-fucking-Pro-Quo.

He made a statement of "fact" that was clearly false. He didn't say "about" or "pretty much", or use any other qualifiers. He said;

"The Conference Board LEI did not turn down in December 2018". It did. I called him on it. If you have a problem with that, it's YOUR problem.

Just remember that when, for example, someone calls you a doomer for making doomerish posts, and then you get bent out of shape about it.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

by copious.abundance » Fri 01 Feb 2019, 20:02:16

by copious.abundance » Fri 01 Feb 2019, 20:02:16

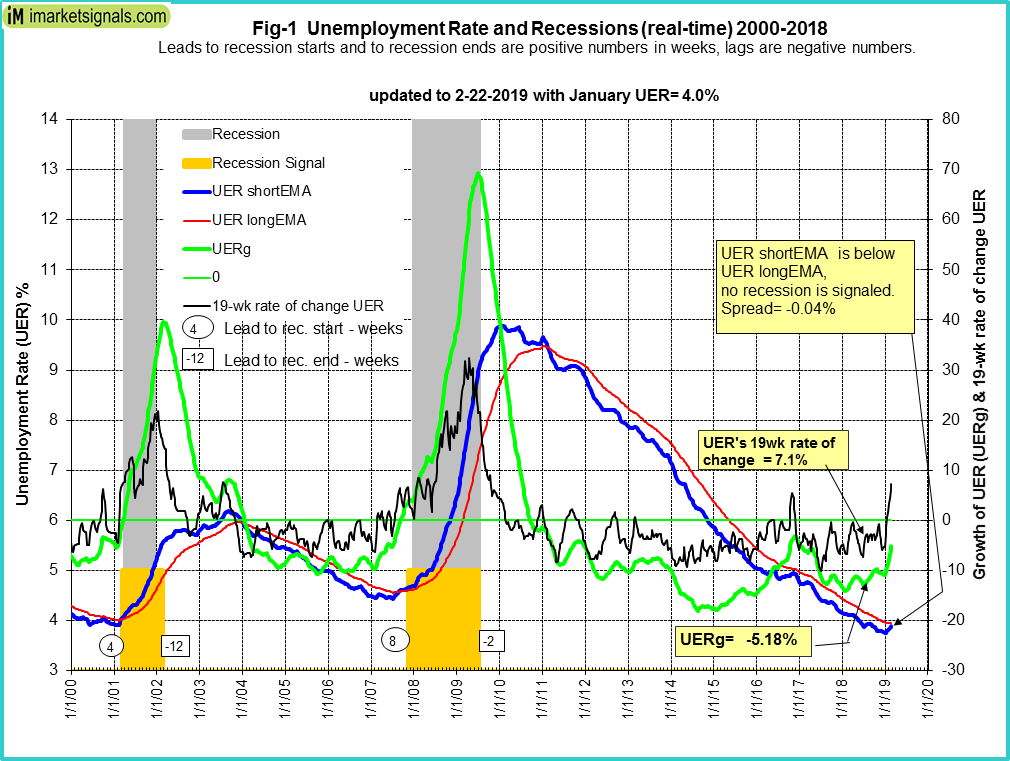

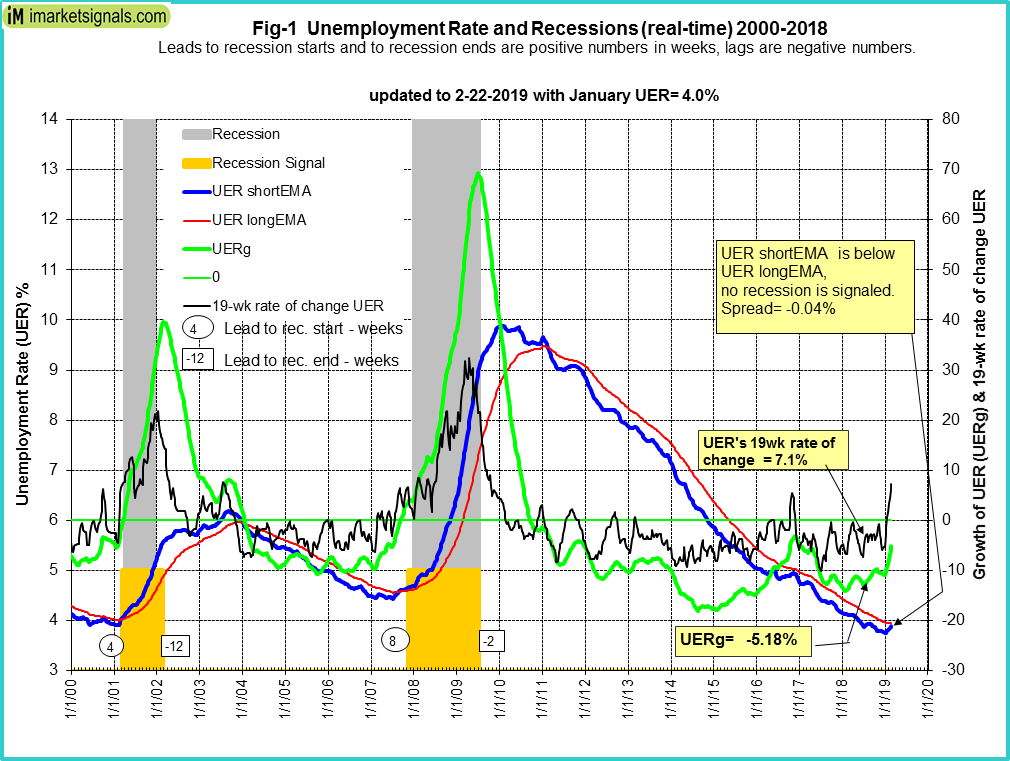

The Unemployment Rate May Soon Signal A Recession: Update - February 1, 2018$this->bbcode_second_pass_quote('', '-')- For what is considered to be a lagging indicator of the economy, the unemployment rate provides surprisingly good signals for the beginning and end of recessions.

-- This model, backtested to 1948, reliably provided recession signals.

-- The model, updated with the January 2019 rate of 4.0%, does not signal a recession.

--

However, if the unemployment rate should rise to 4.1% in the coming months the model would then signal recession.

^

On the chart, notice that when the blue line goes above the red line, either a recession has just started, or will very soon. It is >this< close to doing so.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance

- Fission

-

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

-

Now it's barely 2 pages and the biggest thing going on in it are 2 people arguing with each other over something not even having much to do with the original topic.

Now it's barely 2 pages and the biggest thing going on in it are 2 people arguing with each other over something not even having much to do with the original topic.