by Darian S » Fri 30 Nov 2018, 18:20:30

by Darian S » Fri 30 Nov 2018, 18:20:30

$this->bbcode_second_pass_quote('Outcast_Searcher', '')$this->bbcode_second_pass_quote('pstarr', '

')Did I miss anything??

Yes you did. The usual false Cassandra claim that there are no more major productive oil deposits to be found globally. Or the implication that improving technology can't help. Or that market forces (if prices rise due to REAL WORLD shortages), that more oil can't be found.

Or your track record of literally thousands of completely bogus predictions of "doom" on this site over the past decade plus, which you pretend have no bearing on how credible your empty claims are.

But by all means, do carry on. Cassandras need hobbies too.

New Major deposits have to not only match all the declining production, to substitute such, but produce in excess to increase overall world production. Discoveries peaked last century, and there doesn't seem to be any reason to expect fields of such gargantuan magnitude as to replace, substitute, the entire global decline from most fields and then some, to produce notable excess above such, there is no evidence they are anywhere to be found.

Money is but a token to signal, ration, finite resource allocation, prices cannot rise arbitrarily high and allow for production above what the world is physically capable of producing. An attempt to increase prices above what the world can 'afford' will result in an attempt to unreasonably reallocate, divert, resources from the rest of the economy towards oil production, this will result in economic contraction and will be self defeating. The prices only have a viable range, and if within that range production can't match global demand at reasonable cost to producers the system will experience hardship.

$this->bbcode_second_pass_quote('Tanada', '

')So if you want to call peak how do you know it is peak? In the USA we peaked at the start of the 70's but in 2018 we are now exceeding that peak and setting new all time records of production. Certainly the USA is still consuming more than we produce, but we are importing several million barrels fewer a day than we were in 2005-08 and those bbls/d we do not buy are flowing in China and India who have ballooning private ICE vehicle fleets.

A quarter trillion debt ponzi scheme, while the fed provides the banks with zero interest to in turn give low interest to others. Yet what did it buy? A little more than a decade was bought, or are we expected to see shale still significantly increasing production into the 2030~s?

Most shale wells are said experience near 50% per year decline, bringing thousands upon thousands of wells rapidly online is no long term solution.

$this->bbcode_second_pass_quote('asg70', '')$this->bbcode_second_pass_quote('pstarr', 'Y')ou do realize that maximum production occurs right before the peak?

by rockdoc123 » Fri 30 Nov 2018, 19:16:30

by rockdoc123 » Fri 30 Nov 2018, 19:16:30

$this->bbcode_second_pass_quote('', 'N')ew Major deposits have to not only match all the declining production, to substitute such, but produce in excess to increase overall world production.

Not true simply because the “reserves” everyone refers to is generally equivalent to what BP reports on which are Proven reserves (the only number commonly reported). There are Probable and Possible reserves that are waiting in the isles along with discovered Contingent resources. The discoveries were made some time ago.

$this->bbcode_second_pass_quote('', 'T')he prices only have a viable range, and if within that range production can't match global demand at reasonable cost to producers the system will experience hardship.

And we have yet to test that. To this point in time global production has been able to match demand and the IEA projections show that still being the case out to 2030 at least.

$this->bbcode_second_pass_quote('', 'M')ost shale wells are said experience near 50% per year decline, bringing thousands upon thousands of wells rapidly online is no long term solution.

It depends on how many wells you have that are producing at the lower late stage decline rate. The theory is that decline rate can be as low as a couple of %/year and that has been shown in some of the older unconventional fields. If there were 2 million producing wells in the US hypothetically (all things being equal) that equates to ~15 billion bbls per year if each one were producing 20 bopd. It is that scalability that drove oil companies to pursue the unconventional plays in the first place. The exponential part of the decline pays for the well (higher production rate and quick payout) the low rate part of the decline creates a longer predictable production profile with enough wells producing.

by Darian S » Sat 01 Dec 2018, 16:19:23

by Darian S » Sat 01 Dec 2018, 16:19:23

$this->bbcode_second_pass_quote('rockdoc123', '')$this->bbcode_second_pass_quote('', 'N')ew Major deposits have to not only match all the declining production, to substitute such, but produce in excess to increase overall world production.

Not true simply because the “reserves” everyone refers to is generally equivalent to what BP reports on which are Proven reserves (the only number commonly reported). There are Probable and Possible reserves that are waiting in the isles along with discovered Contingent resources. The discoveries were made some time ago.

.

The production has to come online, and it has to match or exceed total decline and then some for decades to come, if we don't bring the myth of peak demand. In about just two decades we need about 4 saudi arabias worth of additional production or so some say to compensate for global decline, and that might be just to sustain production not significantly increase it as is likely required.

by Darian S » Sat 01 Dec 2018, 19:35:36

by Darian S » Sat 01 Dec 2018, 19:35:36

$this->bbcode_second_pass_quote('rockdoc123', '')$this->bbcode_second_pass_quote('', 'T')he production has to come online, and it has to match or exceed total decline

which is exactly what has been happening in the US (see E&Y annual reserves report for 2018) as well as internationally (see BP annual energy review for 2018). In the US as an example, the top 50 companies have replaced production by 150% on average over the past 5 years.

The permian is expected to peak before 2025, as will most U.S. fields be in decline. How fast will the post total final peak decline in the U.S shale plays be?

Already HSBC says 81% of global liquid oil production is in decline. So somewhere enough oil production will have to come online to surpass the soon falling U.S production as well as 81% of global production, and still after replacing millions of barrels fall in production, produce several million barrels above to provide for growth in production above current production to allow for economic growth.

by Outcast_Searcher » Sat 01 Dec 2018, 22:54:28

by Outcast_Searcher » Sat 01 Dec 2018, 22:54:28

$this->bbcode_second_pass_quote('pstarr', 'E')

So IE 'reserve' measures are often BS, political numbers. Real peak oil is all about collapsing production in virtually every major oil region.

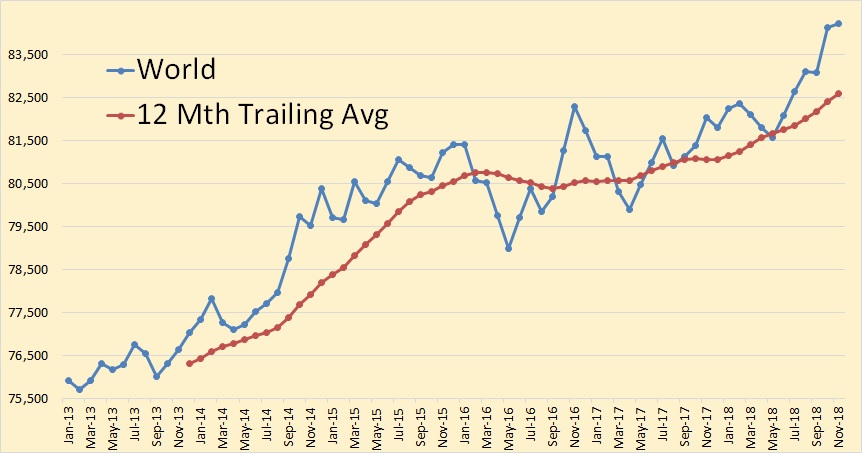

And yet, in the real world, global production numbers continue to increase over time, as they always do except in times of a global recession.

If you want BS, look in the mirror and ponder your long history of unending spewed nonsense including endless terrible calls about short term doom.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher

- COB

-

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

-

by Outcast_Searcher » Sat 01 Dec 2018, 22:59:30

by Outcast_Searcher » Sat 01 Dec 2018, 22:59:30

$this->bbcode_second_pass_quote('Darian S', '

')The permian is expected to peak before 2025, as will most U.S. fields be in decline. How fast will the post total final peak decline in the U.S shale plays be?

And let's pretend that there are NO more productive fields to frac oil from, ANYWHERE globally. Because that's what the doomers want to believe.

(Hint: Politics, environmentalism, and lack of incentive (prices not high enough YET to justify producing where costs are relatively high) can change when prices escalate enough.

When we have ACTUAL falling production causing rising prices due to unfilled demand, and this persists for, say, 5 years, be sure and get back to us. Meanwhile, credible sources like the IEA and EIA keep showing how global production continues to trend up.

Meanwhile, the EV revolution quietly continues, which will eventually lead to a decline in global transport demand.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher

- COB

-

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

-

by rockdoc123 » Sun 02 Dec 2018, 13:22:46

by rockdoc123 » Sun 02 Dec 2018, 13:22:46

$this->bbcode_second_pass_quote('', 'E')ach time EIA Dark State and their lapdoc rockdentest mumbles anything about 'reserves' you must ask yourself . . . 'at what price point?'

either you never bothered to read what I have written on the subject or you are just too thick to understand it. I'm guessing it is a combination of the two.

The term "reserves" implies it is economic, that is the definition. Resources, on the other hand are not currently economic. The division of P1, P2 and P3 speaks to the ability to get at a certain level of reserves. Generally to move P2 to P1 or P3 to P2 or P1 requires additional investment in drilling and/or facilities. The only relationship to "price point" Probable reserves has versus Proven reserves would be the price at which new wells can be drilled economically, if the price is above wellhead breakeven then it doesn't come into the equation.

$this->bbcode_second_pass_quote('', 'I')s Green River Shale p5, p50 or p95 reserve? Is it 'reserves' at $70/barrel or only at $1,000/barrel? Will the real world ever use Green River Shale? What is a 'reserve'? Apparently what the Dark State wants us to believe it is a 'reserve'. But no serious working petroleum geologist would call Green River a 'reserve'.

As I stated above, you haven't paid attention to the definitions. So once more, the Green River Shale is a Resource as it is not economic. It would not be classified as a Reserve until it was economically feasible to develop it and currently there is no technology to make that hurdle.

When the term Reserves is used it means only that oil that is currently economically recovered. And the Reserves that are reported by companies to SEC and appear in all of their financial documents are Proven reserves only. The EIA reports Proven reserves only as does the IEA as does BP in it's annual review. You've imagined a problem that doesn't exist in reality.

$this->bbcode_second_pass_quote('', 'S')o IE 'reserve' measures are often BS, political numbers.

Horseshit. They report those numbers that are filed by companies as Proven reserves. The rules are quite explicit as to what constitutes a Proven reserve, there are no political games going on except in your mind.

by Darian S » Sun 02 Dec 2018, 21:39:39

by Darian S » Sun 02 Dec 2018, 21:39:39

$this->bbcode_second_pass_quote('', 'O')il discoveries peaked in the 1960’s.

Every year since 1984 oil consumption has exceeded oil discovery.

In 2017 oil discoveries were about 7 billion barrels; consumption was about 35 billion barrels

Of the world’s 20 largest oil fields, 18 were discovered 1917-1968; 2 in the 1970’s; 0 since...

More than 75% of dedicated US shale oil companies are unprofitable-cliffhanger1983

It is said IEA expects global peak before 2020.

$this->bbcode_second_pass_quote('', '�')�� then the US would need to add another ‘Russia’ to the global oil balance in 7 years.

In this case, US tight liquids production would need to grow by an additional 6 mb/d between now and 2025. Total growth in US tight liquids between 2018 and 2025 would therefore be around 11 mb/d: roughly equivalent to adding another “Russia” to the global oil balance over the next 7 years.

https://www.iea.org/newsroom/news/2018/ ... shock.html $this->bbcode_second_pass_quote('', 'T')here will be an oil shortage in the 2020s, Goldman Sachs says-cnbc

Let's hope that other russia is there in the shale, and it can not only be sustained but increased for decades to come

Shale was allowed by artificially low interest rates, and still unprofitable even at high prices. You expect even harder to get stuff can be brought online and produce sustainable increase in production for decades to come? A higher price is a query to the system, a query asking to divert more resources from the global economy towards oil production, this will severely affect the economy and demand, it cannot be sustained.

by asg70 » Mon 03 Dec 2018, 11:41:43

by asg70 » Mon 03 Dec 2018, 11:41:43

$this->bbcode_second_pass_quote('pstarr', 't')hey have more keyboards then you have fingers

You've got all of us beat many times over with your trolling skills.

BOLD PREDICTIONS

-Billions are on the verge of starvation as the lockdown continues. (yoshua, 5/20/20)

HALL OF SHAME:

-Short welched on a bet and should be shunned.

-Frequent-flyers should not cry crocodile-tears over climate-change.

-

asg70

- Permanently Banned

-

- Posts: 4289

- Joined: Sun 05 Feb 2017, 14:17:28

by Outcast_Searcher » Sat 09 Mar 2019, 14:35:11

by Outcast_Searcher » Sat 09 Mar 2019, 14:35:11

$this->bbcode_second_pass_quote('asg70', 'P')eak oil...denied.

With more to come, re the Permian, as they build pipelines to overcome the transport bottlenecks. Roughly doubling production to 8 million BPD in 4 years.

https://www.cnbc.com/2019/03/08/permian ... ports.htmlSo much for peak Permian by 2020.

And as I've long predicted, we're hearing more about international oil fracking becoming more of a thing. Pretty silly for the peakers to insist that meaningful amounts of fracked oil could only come from the US.

So much for shorty's insistence that the global peak has passed. Of course, now, he'll keep insisting that we can't possibly afford to lift the oil because -- randomized FUD.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher

- COB

-

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

-