Saudi Aramco IPO

Re: Saudi Aramco IPO

Tesla ring a bell?

-

Cog - Fusion

- Posts: 13416

- Joined: Sat 17 May 2008, 03:00:00

- Location: Northern Kekistan

Re: Saudi Aramco IPO

Cooking The Books? Saudi Aramco Could Be Overvalued By 500%

If you read through the entire press piece the underlying problem is identified. Nothing to do with reserves but all to do with the assumptions WoodMac has made regarding the contractor share (in this case Aramco).

$this->bbcode_second_pass_quote('', 'W')oodMac doesn’t dispute the figure of 261 billion barrels lying under Saudi Arabia and just offshore; that figure has been confirmed by independent sources. Where things get complicated, though, is in the management and taxation of Saudi Aramco, which does not release financial statements. It is known that the company, which is the bedrock of the Saudi economy and the major foundation for state finances, pays a twenty percent royalty on revenues and an 85 percent income tax, supporting the Saudi government and providing a living for the 15,000 members of the Saudi royal family. Tax commitments of that size could have a major impact on the company’s profitability, leaving little in dividends, a factor WoodMac considered in its valuation.

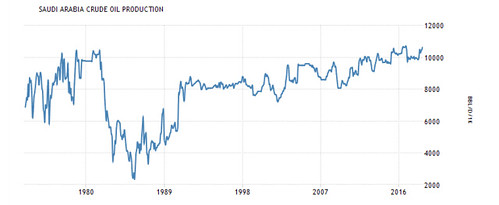

There has been a number of releases from the Saudi government indicating that they have changed both the royalty and tax structure as applies to Aramco. The income tax assessed to Aramco will drop to 50% and the royalty will be on a sliding scale based on production. The comment from other observers is that the royalty tax scheme for Aramco is comparable to many less oil-endowed countries in the world. At say 30% contractor take Aramco is in a pretty good spot. Lets assume they produce 10 MMB/d and see a $40 netback per bbl. Thats over a $140 billion in free cash flow a year much better than they are doing now. Regardless of what sort of discount factor you use 261 billion barrels is worth a lot more than $400 MM.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Saudi Aramco IPO

Tesla ring a bell?

I have no horse in the Tesla race, but it seems to me that with Tesla now showing profits (or at least certainly NOT showing massive losses any more), that to claim Tesla is "collapsing" isn't at all credible. (Though many of the shorts, with a clear axe to grind, and having been proven wrong MANY times in their claims the past several years, would agree with ANYTHING negative someone has to say about Tesla. Imagine that.)

BTW, I think Musk is basically a jerk (a genius, but a jerk) -- but that doesn't mean Tesla is imploding.

Disclosure: I remain neutral on Tesla overall, which I have been consistently for years. I remain bullish on the EV industry overall, over time, as I have been consistently for years, as the technology is clearly maturing. (To me, EV means all forms of EV's, including HEV, PHEV, and BEV. I think the BEV purists claiming anything but a BEV is horrible are making the imperfect the enemy of the good -- which, IMO, is clearly a stupid bias.)

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY