$this->bbcode_second_pass_quote('Darian S', '')$this->bbcode_second_pass_quote('Outcast_Searcher', '')$this->bbcode_second_pass_quote('GHung', '

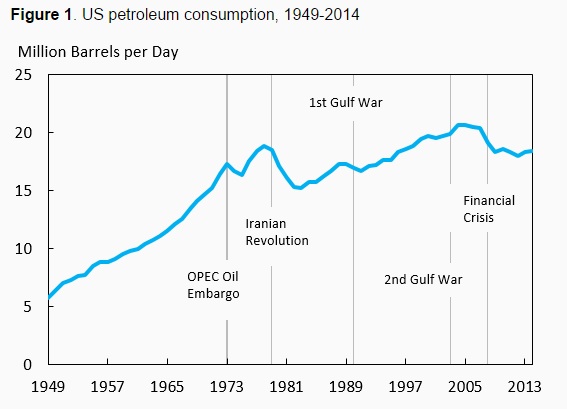

')After 2008, consumption dropped significantly until QE and ZIRP kicked in, which is about the time oil prices jumped up as consumption began to rise. Hard to determine true cause and effect when markets and consumer confidence are being manipulated to such an extent.

Effects of rising oil prices on the economy

Re: Effects of rising oil prices on the economy

Ah yes, that strawman again. If you don't like what the markets tell you or if you don't understand it, then blame the big "manipulation conspiracy", those shadowy figures that invisibly "manipulate" the markets in ways you dislike so.

Debt is up pretty much everywhere. Underemployment is rising. People are one check loss or emergency away from bankruptcy. The auto sales are down, phone sales are down, the retail apocalypse is going down. Exxon mobil failed to meet expectations despite rise of oil prices and has had to borrow to pay dividends.

That the global economy is stressed is evident. Spiralling debt is a sign that the can was kicked because the world could not afford.

Seems O_S is missing the part where QE, ZIRP, and NIRP were indeed market manipulation. Or maybe he's not man enough to admit it, and that this manipulation did help support consumption levels at high prices. He resorts to framing this as some conspiracy theory, "shadow figures",, all that. What a chump. This was market manipulation on a massive scale, in his face, and transparent for all to see. Further, those high oil prices were enabled, in part, by mass injections of conjured capital into markets.

The very real fact that O_S frames anything that doesn't fit his narrative as doomerism or conspiracy theories reveals he holds the same paranoia he accuses others of.

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung - Intermediate Crude

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

Re: Effects of rising oil prices on the economy

Don't agree with the oil price analysis but the rest of the article is good. Current oil prices should have a small drag on the economy going into summer and, if they plateau within $10 of the current price, I don't expect any major issues. However, if they keep rising those folks without any discretionary spending won't be able to afford their subprime loans again.

https://www.barrons.com/articles/crude-subdued-why-oil-prices-wont-spike-1517624714

$this->bbcode_second_pass_quote('', '

')At the same time, a doubling of energy costs takes a significant bite out of U.S. households’ budgets, with energy costs directly accounting for about 6.5% of consumer spending. Even more problematic, this is a regressive tax, disproportionately draining lower-income households’ discretionary spending power. Last year, energy represented 8.7% of spending by the bottom 20% of households, compared to 4.9% for the top quintile. Moreover, the bottom group lacks net assets to tide them over bad outcomes.

...

On balance, it’s likely that the economy-wide effects of the energy shock, though unpleasant, won’t derail growth. We are tentative, however, because commodity markets are volatile. In recent work with Christoph Trebesch of the Kiel Institute, we counted more than twice as many boom-bust cycles in commodity prices than in capital flows since 1820. The global economy looks to be riding a roller coaster.

https://www.barrons.com/articles/crude-subdued-why-oil-prices-wont-spike-1517624714

$this->bbcode_second_pass_quote('', '

')At the same time, a doubling of energy costs takes a significant bite out of U.S. households’ budgets, with energy costs directly accounting for about 6.5% of consumer spending. Even more problematic, this is a regressive tax, disproportionately draining lower-income households’ discretionary spending power. Last year, energy represented 8.7% of spending by the bottom 20% of households, compared to 4.9% for the top quintile. Moreover, the bottom group lacks net assets to tide them over bad outcomes.

...

On balance, it’s likely that the economy-wide effects of the energy shock, though unpleasant, won’t derail growth. We are tentative, however, because commodity markets are volatile. In recent work with Christoph Trebesch of the Kiel Institute, we counted more than twice as many boom-bust cycles in commodity prices than in capital flows since 1820. The global economy looks to be riding a roller coaster.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision