THE Michael C. Lynch Thread Pt. 2

Re: THE Michael C. Lynch Thread (merged)

$this->bbcode_second_pass_quote('', 'N')ot having any way to tease out a prediction via science means the discussion falls back to individual predictions based on little more than hunches and predisposition. It's the equivalent to people betting on college sports.

To some extent I agree but the point some are making here is that the failed predictions are important simply from looking at the aspect of why they failed. It instructs as to what might actually be happening. In my view the prediction of what near term future hydrocarbon production looks like is something best handled using a probabilistic approach given there are many variables some that are independent and some that are dependent and each variable has a potential range of impact. My guess is that the range of possible outcomes would be quite large.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: THE Michael C. Lynch Thread (merged)

Obviously, asg, either you give no merit to the Etp modeling or have not even looked into it. The modeling though not strictly intended as a prediction tool nevertheless produces results that logically suggest the timing of a catastrophic fall in oil production and/or cessation of oil industry functions via an scientific analysis of energy inputs and outputs. From there one can surmise devastating consequences

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: THE Michael C. Lynch Thread (merged)

$this->bbcode_second_pass_quote('asg70', '

')

Not having any way to tease out a prediction via science means the discussion falls back to individual predictions based on little more than hunches and predisposition. It's the equivalent to people betting on college sports.

')

Not having any way to tease out a prediction via science means the discussion falls back to individual predictions based on little more than hunches and predisposition. It's the equivalent to people betting on college sports.

???

You and Spike don't understand the nature of the data that producers have on their active oil fields.

While past predictions of a global peak in oil production have proven wrong, the predictions of peaks in individual conventional oil fields are still quite possible. You will agree, I hope, that Oil fields like Ghawar are most definitely finite?

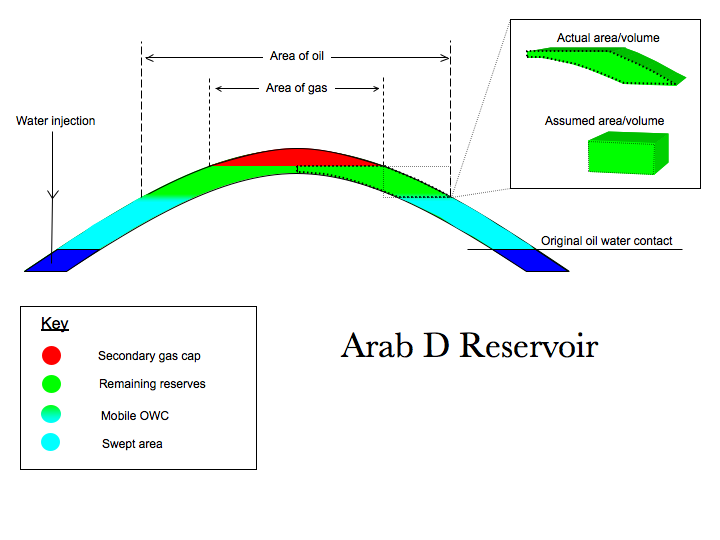

OK. Lets stipulate then that the folks at Aramco are very aware of exactly what the current water cut is in the oil they produce, and what is the exact elevation of the water-oil contact produced by the water flood they have been pumping in at the base of the field for decades and what the thickness of the remaining production zone is. They know exactly what their recovery rate is. They have even recently planned to accelerate the recovery of the remaining oil by redrilling the top of the reservoir using horizontal techniques.

Given that kind of data together with oil production rates from the field it isn't very difficult to predict when Ghawar will peak and then be depleted.

Of course you have to be willing to look at the data instead of relying on "hunches" and the misguided belief that understanding oil reservoirs is like "betting on college sports".

CHEERS!

-

Plantagenet - Expert

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: THE Michael C. Lynch Thread (merged)

$this->bbcode_second_pass_quote('onlooker', 'O')bviously, asg, either you give no merit to the Etp modeling or have not even looked into it. The modeling though not strictly intended as a prediction tool nevertheless produces results that logically suggest the timing of a catastrophic fall in oil production and/or cessation of oil industry functions via an scientific analysis of energy inputs and outputs. From there one can surmise devastating consequences

Why would anyone give merit to the ETP when simple economic modeling also matches events of the last three years? Free money from the Federal Reserve created a bubble of fracking investment that created a temporary glut in world oil supply. It is no more complicated than that so why throw away conventional economics with some complicated Doom today theory in its place?

II Chronicles 7:14 if my people, who are called by my name, will humble themselves and pray and seek my face and turn from their wicked ways, then I will hear from heaven, and I will forgive their sin and will heal their land.

- Subjectivist

- Volunteer

- Posts: 4705

- Joined: Sat 28 Aug 2010, 07:38:26

- Location: Northwest Ohio

Re: THE Michael C. Lynch Thread (merged)

$this->bbcode_second_pass_quote('', 'O')bviously, asg, either you give no merit to the Etp modeling or have not even looked into it. The modeling though not strictly intended as a prediction tool nevertheless produces results that logically suggest the timing of a catastrophic fall in oil production and/or cessation of oil industry functions via an scientific analysis of energy inputs and outputs.

Or, alternatively, we could just through a bunch of chicken bones on an old blanket and spit a stream of rum over them. Just as much chance of getting the right answer and likely has fewer holes in the theory.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00