The Imminent Peak in US Oil Production

Re: The Imminent Peak in US Oil Production

pstarr - The interesting aspect of Ron's projection is that it's based mostly on data generated during periods of much higher oil prices then we currently have. especially true for the Bakken. That seems to imply a geologic limit. Now superimpose the effect of prices being as much as 1/3rd less on top of the apparent geologic limit and it might make his projections look a tad optimistic. As I've said before we'll get a clear picture by the end of 1Q 2017. In the meantime everyone can just speculate to their heart's content. lol

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: The Imminent Peak in US Oil Production

$this->bbcode_second_pass_quote('ROCKMAN', 'p')starr - The interesting aspect of Ron's projection is that it's based mostly on data generated during periods of much higher oil prices then we currently have. especially true for the Bakken. That seems to imply a geologic limit. Now superimpose the effect of prices being as much as 1/3rd less on top of the apparent geologic limit and it might make his projections look a tad optimistic. As I've said before we'll get a clear picture by the end of 1Q 2017. In the meantime everyone can just speculate to their heart's content. lol

Have no fear Rock, people on this board are champion level speculation typing experts!

II Chronicles 7:14 if my people, who are called by my name, will humble themselves and pray and seek my face and turn from their wicked ways, then I will hear from heaven, and I will forgive their sin and will heal their land.

- Subjectivist

- Volunteer

- Posts: 4705

- Joined: Sat 28 Aug 2010, 07:38:26

- Location: Northwest Ohio

Re: The Imminent Peak in US Oil Production

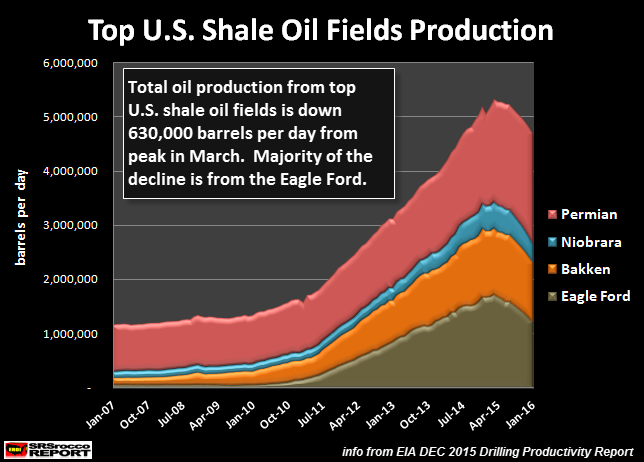

$this->bbcode_second_pass_quote('Pops', 'H')ats off to Ron Patterson at POB for continuing good work, this is from a post by David Archibald

$this->bbcode_second_pass_quote('', '[')img]http://peakoilbarrel.com/wp-content/uploads/2014/08/US-Tight-Oil-Production.png[/img]

$this->bbcode_second_pass_quote('', '[')img]http://peakoilbarrel.com/wp-content/uploads/2014/08/US-Tight-Oil-Production.png[/img]

Just over a year ago I commented that it looked like Ron had done a pretty darn good job with his projection.

I have come to rethink that a bit. That isn't to say Ron Patterson was wrong and Peak Oil isn't real. However it has turned out that once you get past that first year of 50-70 percent depletion rate things start to stabilize and by the time a fracked well has been producing for three years its decline rate is much more pleasant for all of us. Sure it is only producing 15 percent more or less of what it lifted in that first month. But 15 percent of a 500 bbl/d well is still 75 bbl/d which generates a good chunk of money if you were able to pay the well off during the high depletion phase. For wells from say 2013 and earlier the sunk costs were pretty much paid off when the price crash came in late 2014, and we need to remember something. The price pre crash was around $80/bbl. From December 2014 right through June 2015 it held at around $60/bbl. It was only in July 2015 that prices started their slide to critical levels which bottomed out in January 2016 when Iran sanctions were lifted. That bottom was unsuitably low and by March 2016 prices were bouncing around $45/bbl and they gyrated up and down all summer around that until OPEC set their new quota's in November 2016.

For close to three months prices have been holding over $50/bbl. In the last four or five months the depletion rate for USA oil in general has fallen off as the vast majority of wells completed and put into service were completed before June 2015 which puts us now 18 months or longer into their 'rapid depletion' phase. IOW they have passed out of the rapid depletion period and are in the steady depletion period. At the same time as prices have stabilized new drilling and completions are up a little from where they were a year ago. We are not yet at the price point where new drilling offsets depletion, but we are not all that far away from it any longer either. If or when prices get back to $60/bbl or perhaps $65/bbl the USA fracking industry will be able to offset the declines with new wells.

I have searched several times over the last year to try and find out how many of the wells drilled and fracked in 2008-2011 are still producing and at what rate. Unfortunately it seems like either nobody is tracking that data, or the data is proprietary and not published to the general public. That does seem like the kind of information the finance companies would want access too before lending more money to any fracking company, I know if it were my money being lent I would want details on depletion rates and well lifetimes.

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

- Tanada

- Site Admin

- Posts: 17094

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA