Is peak oil dead?

Re: Is peak oil dead?

$this->bbcode_second_pass_quote('davep', 'M')odern economics relies on cheap energy.

I have no idea about anything else he said, but this part is true.

$this->bbcode_second_pass_quote('rockdoc123', '')$this->bbcode_second_pass_quote('SumYunGai', 'I')t is obvious that oil prices over $100 per barrel are not good for the economy. But rockdoc123 tries to claim that the biggest oil spike in history ($147.50) had absolutely no effect on the economy. He cannot support his wild claim logically, so instead he tries to pompously claim that every economist in the world agrees with him. This has been proven false.

If it is so obvious then please show us exactly your proof?

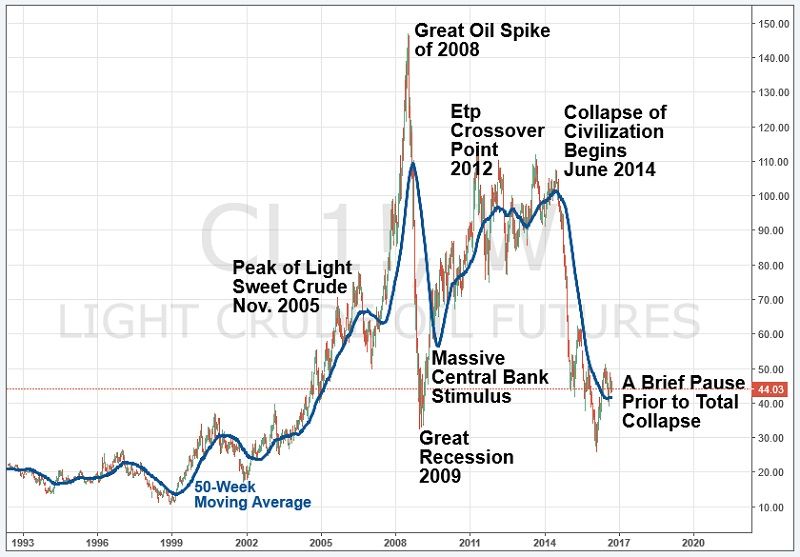

Look at the run up in oil prices from 4004-2008. That is the biggest oil spike in history. When oil reached around $100 per barrel, the housing bubble began to pop. The proof is logical. Since the economy runs on the energy from oil, it is very sensitive to the oil price. If the oil price rises a little, it produces a little drag on the economy. If the oil price rises a lot, it produces a lot of drag. Why wouldn't it?

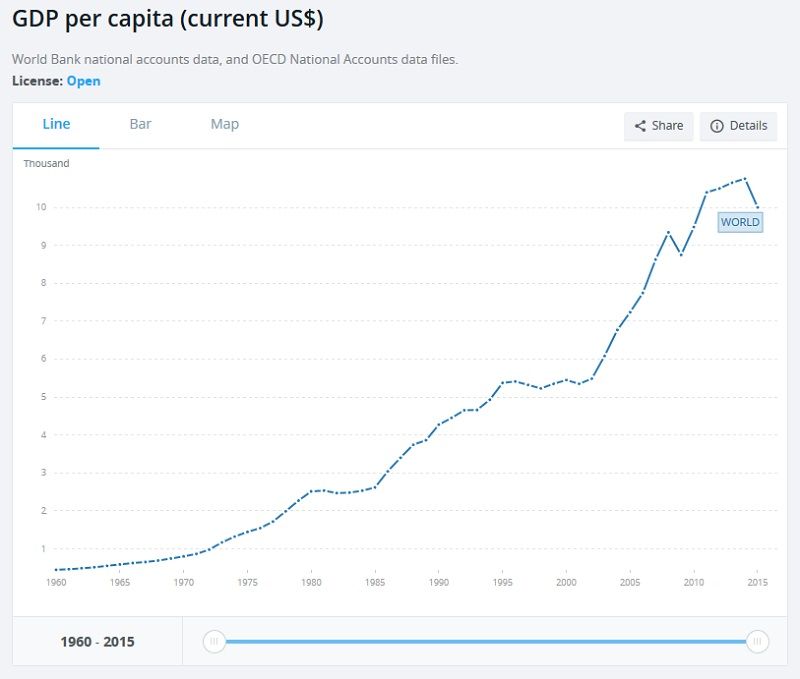

$this->bbcode_second_pass_quote('rockdoc123', 'W')hat you have been shown is that fro 3.5 years oil prices hovered above $100/bbl and during that period global GDP continued to increase and global oil demand/consumption continued to increase. How many times do we have to show the same plots? The run up to $140 oil also had no impact on GDP or consumption the flattening in GDP after 2008 as result of the financial crisis not the other way around.

The chart you keep showing is US GDP adjusted for inflation. It proves nothing. We are talking about WORLD GDP.

The point is that we know very high oil prices are not good for the economy. We had very high oil prices leading up to the Great Recession. That is a fact. So you have to to do more than offer an alternate view of the cause that ignores the high oil price. You also have to explain logically why the record high oil prices had absolutely no effect on the economy, since that is your claim. Good luck.

$this->bbcode_second_pass_quote('rockdoc123', 'A')s to what the reasons for the great recession were you may have found an outlier who disagrees with pretty much everyone else including The National Commission report:

So what? That is an argument from authority. Try making an argument from logic if you can.

Last edited by SumYunGai on Sun 18 Sep 2016, 19:42:03, edited 2 times in total.

-

SumYunGai - Permanently Banned

- Posts: 421

- Joined: Fri 29 Jul 2016, 21:02:21