by Whatever » Mon 13 Jun 2016, 09:43:48

by Whatever » Mon 13 Jun 2016, 09:43:48

Hey ennui2,

You missed my important question to you. Here it is again:

Is there a thermodynamic limit to the price of oil?

$this->bbcode_second_pass_quote('marmico', 'T')he proof of the ETP is absurd. Back of the envelope a $50 WTI price equals 75% net energy, a $100 price equals 50% net energy, a $150 price equals 25% net energy.

I have no idea what you are talking about here. If you are somehow applying this weirdness to a calculation from page 49 of the Etp model book, you are just making sh*t up.

$this->bbcode_second_pass_quote('marmico', 'P')lug and play with the 2012 proof.

US data for 2015:

GDP; $17.947 trillion *1

The price of WTI; $48.67/ barrel

Petroleum consumption; 19,616,000 barrels/day = 7.079 Gb/ year *2

% energy consumption from petroleum, EIA; 36.3% *3

Total US crude cost = $344.5 billion (consumption x price)

Method 1

Converting $344.5 billion of crude consumed into goods and services required: $634.73/0.2045 = $1.685 trillion.

36.3% x GDP = $6.515 trillion

Percent of total petroleum dollars used to extract, process, and distribute it: $1.685 trillion/ $6.515 trillion = 25.9%.

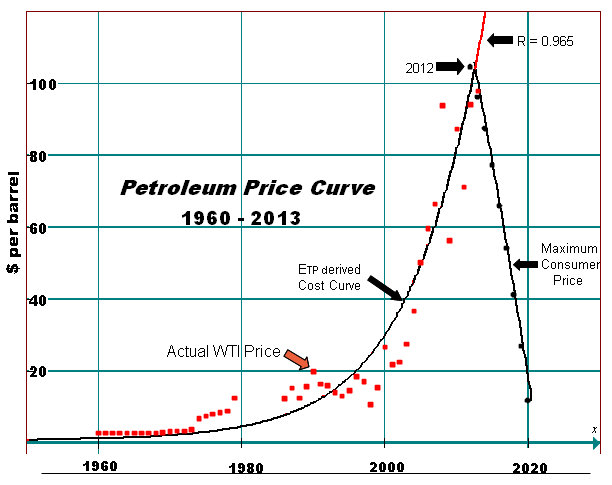

The ETP proof calc shows a magical "half way" or point or 50% in 2012 translating to EROI of 2. The same proof calc shows a 2015 EROI of 4.

The 2012 "proof" as you call it, has nothing to do with any ERoEI calculation. It doesn't show a magical half way point. It just shows that the EIA's estimate for extraction, processing and distribution energy costs for 2012, when summed, equal 70,000 BTU/gal and that matches the model's prediction. That is all. Here is the passage from the book:

$this->bbcode_second_pass_quote('', 'T')he constraints imposed by the First and Second Law restrict upper and lower limits. The 99,400

BTU/gal limit that the study shows as being extractable from petroleum is an upper limit. In all

probability the value is somewhat less. P 140 is limited by E G and the entropy production of the PPS.

Its value can not be more, but it could be less. This implies that the E TP model is a "best case" scenario.

Empirical estimates, however, indicate that it is not far from the mark. One example is the EIA's

estimate for petroleum refining energy costs, which they give as 16,300 BTU/$ of finished product. If

calculated at $3.00 per gallon for 2012, this produces 48,900 BTU/gal. With 48,000 fields around the

world under production, the industry is very competitive. It therefore follows that average extraction

costs are close to sale price. Employing the BTU/$ method, the 2012 production energy costs at the

well head can be estimated at 14,735 BTU/gal. Distribution costs of raw material, and finished product

are estimated at $42/barrel, giving 6,365 BTU/gal. The extraction, processing and distribution energy

costs for 2012, when summed, equal 70,000 BTU/gal; which is what the E TP model predicts. It is

therefore concluded that the petroleum industry is operating at an efficiency level that is close to its

theoretical limit.

~BWHill

In the Etp model thread, you claimed that the passage above was actually false by comparing irrelevant anonymous ERoEI estimates:

$this->bbcode_second_pass_quote('marmico', 'T')he ETP model has been empirically falsified in the author's own words. The following statement at 10.0 - Conclusion (page 49) of the author's model is false.

Extraction (wellhead) EROI of 10 is at the low end of the range in the literature. Processing (refining) EROI of 3.5 is overstated by a factor of 3. I have no opinion on distribution EROI.

![bduh [smilie=bduh.gif]](https://udev.peakoil.com/forums/images/smilies/bduh.gif)