Has the danger of Peak Oil passed?

Re: Has the danger of Peak Oil passed?

I am not too worried about telling people any more about what's going on with peak oil. They don't hear me anyway. I was heartened to hear that nobody listens to the people who really are at the forefront of Peak Oil. Here's a quote by Ron Patterson, who is the main researcher at Peak Oil Barrel:

Ron Patterson says:

04/25/2016 AT 10:21 AM

" I have three sons, six grandchildren and four great-grandchildren. And I tell them exactly what I think. And none of them believe a goddamn word of it.

I can only quote Montaigne, ‘all I say is by way of discourse and nothing by way of advice. I should not speak so boldly, were it my duty to be believed."

I agree with him. All you can do is tell people once or twice.

Then it's up to them to either take it seriously or not. We tried...

Ron Patterson says:

04/25/2016 AT 10:21 AM

" I have three sons, six grandchildren and four great-grandchildren. And I tell them exactly what I think. And none of them believe a goddamn word of it.

I can only quote Montaigne, ‘all I say is by way of discourse and nothing by way of advice. I should not speak so boldly, were it my duty to be believed."

I agree with him. All you can do is tell people once or twice.

Then it's up to them to either take it seriously or not. We tried...

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Has the danger of Peak Oil passed?

Revi - Or as the great Texas comedian Ron White puts it more simply: "You can't fix stupid".

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has the danger of Peak Oil passed?

Here's a portion of another post I thought might put some of the "has the danger of PO passed" bullsh*t into perspective:

Consider when the Rockman started with Mobil Oil in 1975 the oil patch was very aware of the dangers of PO. His mentor explained PO and the struggle the oil patch faced THEN. Again this is 40+ years ago. We didn’t then nor now call it “peak oil” in the oil patch. It has always been the “reserve replacement problem”. The problem wasn’t a lack of new reserves to hunt for but the lack of new reserves as large as the ones we had already developed. Those were the reserves we’ve been trying to replace for more than 4 decades and it has always been a struggle. In the US not much success in that regards until we started expanding in the shallow water GOM in the 70’s and 80’s and then eventually the Deep Water GOM. Even when we had the price spike in the late 70’s and more than 4,500 drill rigs were put into the service the US did not see any meaningful increase in oil production.

Consider the reserve replacement goal: from 1949 to 2011 the US has produced 215 BILLION BBLS OF OIL. And many tens of billions of bbls produced before 1949. And since 1975 when the Rockman first learned of PO the US has produced 130 BILLION BBLS OF OIL. Now think about one of the biggest DW GOM that might produce 500 million bbls of oil. While it sounds big that field replaces only 0.4% of the reserves we’ve produced since 1975. Now drop back to the onshore. The Rockman is trying to increase production from just one relatively small trend in Texas. Small but still produced 4.5 BILLION BBLS OF OIL. And that trend is now DEAD as far as developing NEW RESERVES: there are no undeveloped reservoirs left to find. Which shouldn’t be a shock since the trend was heavily explored starting in the 1930’s. All the major fields had been discovered and developed 60 years ago. What’s left to recover from existing wells amount to only hundreds of thousands of bbls.

Of course high oil prices made developing the KNOWN oil reserves in the unconventional reservoirs economic since most of the drilling and frac’ng tech had already been refined.

But it’s easy to be impressed with some of the new numbers: the EIA now estimates 4.84 million bopd from all the unconventional trends. That’s 1.8 BILLION BBLS OF OIL PER YEAR. So if oil prices had not collapsed and there were an infinite number of unconventional wells left it would only take another 72 years of drilling with 1,600 rigs/day and $50+ TRILLION in new capex to replace the reserves the US has produced since the Rockman started in 1975. And 120 years to replace the US production since 1949. And another perspective: some estimate the KSA has produced about 150 BILION BBLS OF OIL since Ghawar Field came on in 1951. At a rate of 10.5 mm bopd it will require the KSA to hold its current rate for about 40 years to replace the reserves it has produced through 2015.

Helps to put some of those numbers into perspective, eh? LOL

Consider when the Rockman started with Mobil Oil in 1975 the oil patch was very aware of the dangers of PO. His mentor explained PO and the struggle the oil patch faced THEN. Again this is 40+ years ago. We didn’t then nor now call it “peak oil” in the oil patch. It has always been the “reserve replacement problem”. The problem wasn’t a lack of new reserves to hunt for but the lack of new reserves as large as the ones we had already developed. Those were the reserves we’ve been trying to replace for more than 4 decades and it has always been a struggle. In the US not much success in that regards until we started expanding in the shallow water GOM in the 70’s and 80’s and then eventually the Deep Water GOM. Even when we had the price spike in the late 70’s and more than 4,500 drill rigs were put into the service the US did not see any meaningful increase in oil production.

Consider the reserve replacement goal: from 1949 to 2011 the US has produced 215 BILLION BBLS OF OIL. And many tens of billions of bbls produced before 1949. And since 1975 when the Rockman first learned of PO the US has produced 130 BILLION BBLS OF OIL. Now think about one of the biggest DW GOM that might produce 500 million bbls of oil. While it sounds big that field replaces only 0.4% of the reserves we’ve produced since 1975. Now drop back to the onshore. The Rockman is trying to increase production from just one relatively small trend in Texas. Small but still produced 4.5 BILLION BBLS OF OIL. And that trend is now DEAD as far as developing NEW RESERVES: there are no undeveloped reservoirs left to find. Which shouldn’t be a shock since the trend was heavily explored starting in the 1930’s. All the major fields had been discovered and developed 60 years ago. What’s left to recover from existing wells amount to only hundreds of thousands of bbls.

Of course high oil prices made developing the KNOWN oil reserves in the unconventional reservoirs economic since most of the drilling and frac’ng tech had already been refined.

But it’s easy to be impressed with some of the new numbers: the EIA now estimates 4.84 million bopd from all the unconventional trends. That’s 1.8 BILLION BBLS OF OIL PER YEAR. So if oil prices had not collapsed and there were an infinite number of unconventional wells left it would only take another 72 years of drilling with 1,600 rigs/day and $50+ TRILLION in new capex to replace the reserves the US has produced since the Rockman started in 1975. And 120 years to replace the US production since 1949. And another perspective: some estimate the KSA has produced about 150 BILION BBLS OF OIL since Ghawar Field came on in 1951. At a rate of 10.5 mm bopd it will require the KSA to hold its current rate for about 40 years to replace the reserves it has produced through 2015.

Helps to put some of those numbers into perspective, eh? LOL

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has the danger of Peak Oil passed?

$this->bbcode_second_pass_quote('Revi', 'I') am not too worried about telling people any more about what's going on with peak oil. They don't hear me anyway.

Don't hear you? Or aren't about to fall for the same old same old when instead they were given low prices for oil and natural gas because drill-baby-drill worked out pretty well?

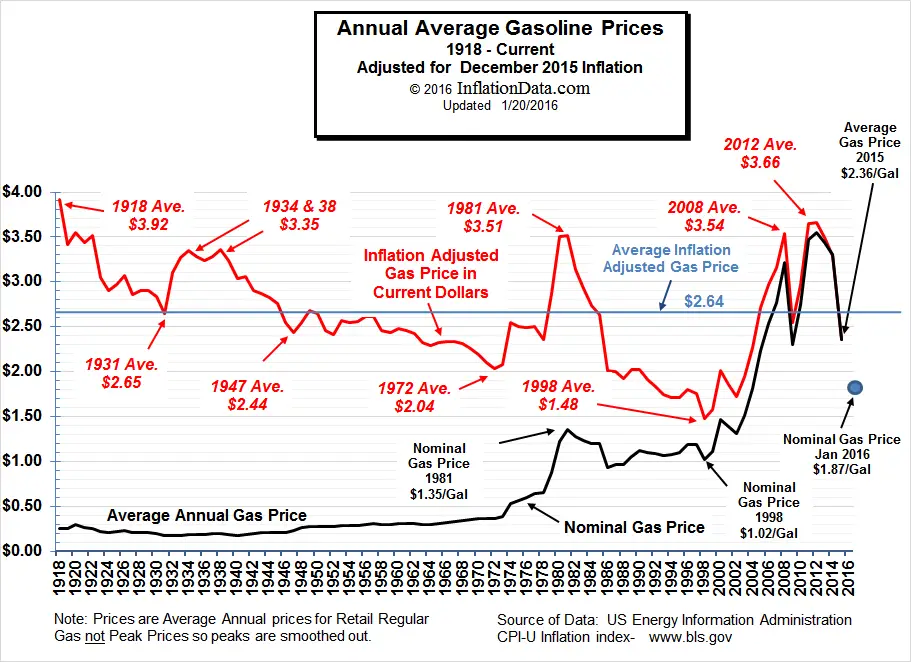

lest we forget, this is what peak oil was selling before we landed smack in the middle of glut instead...

$this->bbcode_second_pass_quote('Revi', '

') I was heartened to hear that nobody listens to the people who really are at the forefront of Peak Oil. Here's a quote by Ron Patterson, who is the main researcher at Peak Oil Barrel:

Ron Patterson says:

04/25/2016 AT 10:21 AM

" I have three sons, six grandchildren and four great-grandchildren. And I tell them exactly what I think. And none of them believe a goddamn word of it.

Sounds about right...maybe he sold them the original peak oil, and when they are out driving their 300HP aluminum bodied Ford trucks getting 20mpg, or EVing to work and not caring at all about fuel costs, they don't listen because he has been claiming the same thing ever since peak oil was supposed to have happened last time?

boy who cried wolf and all..

$this->bbcode_second_pass_quote('Revi', '

')I can only quote Montaigne, ‘all I say is by way of discourse and nothing by way of advice. I should not speak so boldly, were it my duty to be believed."

I agree with him. All you can do is tell people once or twice.

Then it's up to them to either take it seriously or not. We tried...

Yes...and can't be taken seriously yet because of how little we understood about resource economics. Guys like Lynch ate our lunch for a reason, and we should learn from it so as to not repeat the mistakes of the past. Be they the peak oil meme of 2005, or the running out of Jimmy Carter back in the 1970's. Let's face it, malthusians have been wrong since malthus died, and just..keep...hoping...just once....to be right.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

$this->bbcode_second_pass_quote('ROCKMAN', 'R')evi - Or as the great Texas comedian Ron White puts it more simply: "You can't fix stupid".

True...but to whom are you referring...the peak oilers who keep getting it wrong, forgetting the POD idea as you've explained well, not understanding the power of the unconventionals to rewrite the production landscape as Mr reserve pointed out years ago, or those who told everyone it was a load of bull, and are now laughing it up in the middle of the current glut?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26