When will prices break the current record?

When will prices break the current record?

Anyone have any bets on when prices will go above $145.

- Tikib

- Lignite

- Posts: 336

- Joined: Mon 08 Dec 2014, 03:13:28

Re: When will prices break the current record?

Current WTI crude is $48.52. This is a pretty juicy thread for bad predictions.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: When will prices break the current record?

I would say, never, unless the Straits of Hormuz gets blockaded, or something...(in constant dollars adjusted for inflation.) A sudden shock could spike big time with resulting immediate consequences.

I think the economy is too sick and we are struggling, big time. If the oil price goes up the economy will falter. As the economy descends exploration and/or production will decline....the price of oil will rises again and economy tanks all over again. Like a diminishing sine wave. Like today. It is a very sick industry producing a very expensive product. At least it is expensive for the average Joe.

But hey, we are in uncharted territory here.

As an aside I have been tracking my costs for town trips. For a return trip on my MC it costs $8.00 Canadian at $1.279/litre. My truck (old Toyota) is approx $25, and our economical Yaris is an honest $18.00. Needless to say I use the MC for many many trips. I have outfitted it with a decent carrier (holds two 15 pack beer), and soft sided saddle bags which hold a huge amount of, whatever. Plus, it is a veritible rocket which allows me to zip around the tourist motorhome mammoths. It must be the low Canadian dollar, but I have never seen bigger US motorhomes or as many. They are often towing huge aluminum trailers for the their toys and 'stuff', or a huge boat or SUV. It is quite disgusting and I always give thanks they usually head right on past our turn off. I just don't understand how you need so much 'stuff'? My buddy has a trailer and it is a small 5th wheel that he tows with a small Nissan Frontier PU. He has a rack for a tin boat.

I think the economy is too sick and we are struggling, big time. If the oil price goes up the economy will falter. As the economy descends exploration and/or production will decline....the price of oil will rises again and economy tanks all over again. Like a diminishing sine wave. Like today. It is a very sick industry producing a very expensive product. At least it is expensive for the average Joe.

But hey, we are in uncharted territory here.

As an aside I have been tracking my costs for town trips. For a return trip on my MC it costs $8.00 Canadian at $1.279/litre. My truck (old Toyota) is approx $25, and our economical Yaris is an honest $18.00. Needless to say I use the MC for many many trips. I have outfitted it with a decent carrier (holds two 15 pack beer), and soft sided saddle bags which hold a huge amount of, whatever. Plus, it is a veritible rocket which allows me to zip around the tourist motorhome mammoths. It must be the low Canadian dollar, but I have never seen bigger US motorhomes or as many. They are often towing huge aluminum trailers for the their toys and 'stuff', or a huge boat or SUV. It is quite disgusting and I always give thanks they usually head right on past our turn off. I just don't understand how you need so much 'stuff'? My buddy has a trailer and it is a small 5th wheel that he tows with a small Nissan Frontier PU. He has a rack for a tin boat.

- Paulo1

- Coal

- Posts: 425

- Joined: Sun 07 Apr 2013, 15:50:35

- Location: East Coast Vancouver Island

Re: When will prices break the current record?

In the news-of-the-day, the inflationary pressures on commodity prices look negative. Globally, central bankers are still fighting deflation. This would change when global growth charges ahead again. When that happens is anyone's guess but I don't see it for a few years since student debt, sub-prime auto loans, zombie corporations, baby boomers, etc... will all have a deflationary effect on the economy in the US and I don't see much activity happening elsewhere right now.

$this->bbcode_second_pass_quote('', 'I')n a shocking result, the employment cost index rose only 0.2 percent in the second quarter which is far below expectations and the lowest result in the 33-year history of the report. Year-on-year, the ECI fell 6 tenths to plus 2.0 percent which is among the lowest readings on record. The record low for this reading is plus 1.4 percent back in the early recovery days of 2009 when, apparently unlike today, there was enormous slack in the labor market.

$this->bbcode_second_pass_quote('', 'I')n a shocking result, the employment cost index rose only 0.2 percent in the second quarter which is far below expectations and the lowest result in the 33-year history of the report. Year-on-year, the ECI fell 6 tenths to plus 2.0 percent which is among the lowest readings on record. The record low for this reading is plus 1.4 percent back in the early recovery days of 2009 when, apparently unlike today, there was enormous slack in the labor market.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: When will prices break the current record?

Here is EIAs wild ass guess

(This was put out in March, I don't really get why the high scenario starts back last year sometime? Does that mean the EIA doesn't know what is going on or the market doesn't?)

An EIA projection isn't going to predict swings, they like predictability (I can't figure out why they show little variations out 10 or 20 years as if they really know, they can't tell what is going to happen in the morning, LoL) But no one pays any attention to my predictions so I can predict swings, in fact I think swings are the future!

I think Paulo is right, prices can't go high and stay there because people simply can't continue to buy the same amount, they either cut back on fuel or cut back elsewhere and eventually get a pink slip because everyone else is cutting back too — so they don't need to commute and voilá the price falls. But price can go high for a little while, and will just enough to sucker in some more rubes to drill a few more losing holes. So prices will always shoot up on shortage and then fall on a glut, the flavor of the glut might change; supply or demand or both.

I think the swings we've seen the last 15 years are just the start.

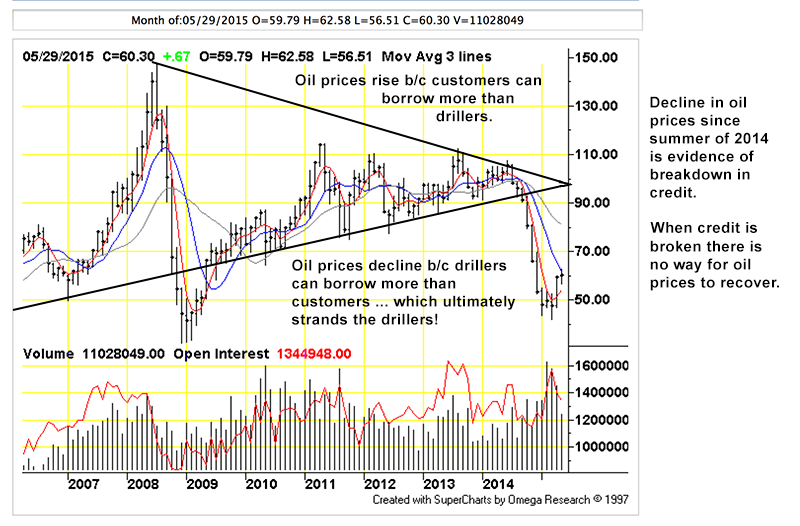

But notice the swings trend downward in my chart. I think price pressure from the highs and general uncertainty from the swings will push the economy generally down. Add in some aging population induced deflation, some automation and labor arbitrage effects on the middle class, and the great sucking squid of financialization and trickle up economics and you have deflation just as GoGone pointed out.

Or not, LoL

(This was put out in March, I don't really get why the high scenario starts back last year sometime? Does that mean the EIA doesn't know what is going on or the market doesn't?)

An EIA projection isn't going to predict swings, they like predictability (I can't figure out why they show little variations out 10 or 20 years as if they really know, they can't tell what is going to happen in the morning, LoL) But no one pays any attention to my predictions so I can predict swings, in fact I think swings are the future!

I think Paulo is right, prices can't go high and stay there because people simply can't continue to buy the same amount, they either cut back on fuel or cut back elsewhere and eventually get a pink slip because everyone else is cutting back too — so they don't need to commute and voilá the price falls. But price can go high for a little while, and will just enough to sucker in some more rubes to drill a few more losing holes. So prices will always shoot up on shortage and then fall on a glut, the flavor of the glut might change; supply or demand or both.

I think the swings we've seen the last 15 years are just the start.

But notice the swings trend downward in my chart. I think price pressure from the highs and general uncertainty from the swings will push the economy generally down. Add in some aging population induced deflation, some automation and labor arbitrage effects on the middle class, and the great sucking squid of financialization and trickle up economics and you have deflation just as GoGone pointed out.

Or not, LoL

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: When will prices break the current record?

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung - Intermediate Crude

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

Re: When will prices break the current record?

http://euanmearns.com/oil-production-vi ... #more-9496

If you look at every 4th to 1st quarter since the recession there is a decline in demand.

There is a good demand increase from the 1st to 2nd qtr in 4 of the 6 years of this chart, not much last year but another decline this year though not as steep as in 2011.

2 months decline in a row is really the first sign of demand fail I can seen since '11, 3 will be a dot.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: When will prices break the current record?

$this->bbcode_second_pass_quote('Pops', '[')url=http://www.eia.gov/forecasts/aeo/section_prices.cfm]Here is EIAs wild ass guess[/url]

(This was put out in March, I don't really get why the high scenario starts back last year sometime? Does that mean the EIA doesn't know what is going on or the market doesn't?)

An EIA projection isn't going to predict swings, they like predictability (I can't figure out why they show little variations out 10 or 20 years as if they really know, they can't tell what is going to happen in the morning, LoL)

(This was put out in March, I don't really get why the high scenario starts back last year sometime? Does that mean the EIA doesn't know what is going on or the market doesn't?)

An EIA projection isn't going to predict swings, they like predictability (I can't figure out why they show little variations out 10 or 20 years as if they really know, they can't tell what is going to happen in the morning, LoL)

Pops, from the EIA reading I've done, their long term forecasts differing low/reference/high price scenarios are primarily about major factors like differing assumptions about underlying economic fundamentals over time. (Like price affecting both supply and demand, economic vitality affecting demand, etc).

Actually, I think the complete lack of price "squiggles" in the long term forecasts is refreshingly honest. They admit they don't know the details -- and at least they are documenting their basic methodology and major underlying assumptions (unlike the pundits here, including yours truly). And after all, basic components like Chindia demand will have a FAR larger impact on longer term prices than say, a given year's US inflation rate.

Not having gotten into the nitty gritty, I like you, am baffled at then starting the three projection lines from different starting dates (but no, I don't want to take the time to figure it out).

I know the EIA takes a lot of heat for their projections. But at least they're using more economics and science and definitions than a giant herd of broker/bankers and investment news letter writers).

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: When will prices break the current record?

$this->bbcode_second_pass_quote('Paulo1', '

')I think the economy is too sick and we are struggling, big time. If the oil price goes up the economy will falter. As the economy descends exploration and/or production will decline....the price of oil will rises again and economy tanks all over again. Like a diminishing sine wave. Like today. It is a very sick industry producing a very expensive product. At least it is expensive for the average Joe.

')I think the economy is too sick and we are struggling, big time. If the oil price goes up the economy will falter. As the economy descends exploration and/or production will decline....the price of oil will rises again and economy tanks all over again. Like a diminishing sine wave. Like today. It is a very sick industry producing a very expensive product. At least it is expensive for the average Joe.

Interesting how folks on this site keep saying how "sick" the economy is, and yet growth continues despite all the projections of doom, claims we are really in a depression or recession, etc.

I was just reading "The Conundrum" today, and it reminds us that:

1). Global burning of fossil fuels continues to increase, with rare big economic dips like the 2008-2009 recession the rare exception.

2). The reason we're burning more fossil fuels net is mainly that stuff is so CHEAP. More affordable stuff means more consumption. This is a sign of overall economic health, even as it invites us to consume (including expanding the population of consumers) until we ruin the planet. Thus the conundrum.

....

One example: Rents, along with housing prices are rising markedly in the US, even as the rental vacancy rate reaches a 20 year low. Hint: this is due to economic strength, not because people can't afford to pay their rent.

https://research.stlouisfed.org/fred2/series/USRVAC

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: When will prices break the current record?

$this->bbcode_second_pass_quote('Outcast_Searcher', 'O')ne example: Rents, along with housing prices are rising markedly in the US, even as the rental vacancy rate reaches a 20 year low. Hint: this is due to economic strength, not because people can't afford to pay their rent.

Well yeah rental vacancies are low, if you are afraid or unable to buy that's what you do.

You are poking "doomers" for picking cherries; you are doing the same.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac