THE OPEC Thread pt 9

OPEC Countries Become the Biggest Fans of Solar Energy

Energy Revolution? OPEC Countries Become the Biggest Fans of Solar Energy

$this->bbcode_second_pass_quote('', 'W')ouldn't it be ironic if the biggest oil exporters in the world became the biggest solar energy investors with plans to export solar energy?

That may seem like a far-fetched idea but it's exactly what Saudi Arabia has in mind. Here's a telling quote from one of the companies looking to provide some of the country's solar energy needs.

I think in 2020 we're going to look back and say -- if we pick one year as a point of inflexion -- I'm very confident it will be 2015."

-- Paddy Padmanathan, CEO of ACWA Power, a renewable energy developer in the Middle East

What's driving the world's largest oil exporter to solar may tell us more about the future of energy than you think.

Saudi Arabia is better off selling oil than consuming it

One of the challenges being a developing nation that's made its money on oil exports is that a rising standard of living can eat into previous energy exports. Over the past decade, Saudi Arabia's oil consumption has risen 53% while its production is up just 5%. The result is falling oil exports, which is where the country makes its money.

A recent Chatham House paper suggested that at its current pace Saudi Arabia would actually become a net oil importer by 2038. That's only 23 years away, hardly a long time in the oil industry.

On top of the fact that Saudi Arabia would like to export more oil instead of consuming it, oil is a relatively expensive way to produce electricity. Renewable energy is much cheaper than oil power generators today, particularly in desert areas. A project bid below $0.06 per kWh in Dubai earlier this year showed the potential solar energy has in the Middle East and with Saudi Arabia getting 55% of its electricity from oil, there's an economic driver to making a change.

$this->bbcode_second_pass_quote('', 'W')ouldn't it be ironic if the biggest oil exporters in the world became the biggest solar energy investors with plans to export solar energy?

That may seem like a far-fetched idea but it's exactly what Saudi Arabia has in mind. Here's a telling quote from one of the companies looking to provide some of the country's solar energy needs.

I think in 2020 we're going to look back and say -- if we pick one year as a point of inflexion -- I'm very confident it will be 2015."

-- Paddy Padmanathan, CEO of ACWA Power, a renewable energy developer in the Middle East

What's driving the world's largest oil exporter to solar may tell us more about the future of energy than you think.

Saudi Arabia is better off selling oil than consuming it

One of the challenges being a developing nation that's made its money on oil exports is that a rising standard of living can eat into previous energy exports. Over the past decade, Saudi Arabia's oil consumption has risen 53% while its production is up just 5%. The result is falling oil exports, which is where the country makes its money.

A recent Chatham House paper suggested that at its current pace Saudi Arabia would actually become a net oil importer by 2038. That's only 23 years away, hardly a long time in the oil industry.

On top of the fact that Saudi Arabia would like to export more oil instead of consuming it, oil is a relatively expensive way to produce electricity. Renewable energy is much cheaper than oil power generators today, particularly in desert areas. A project bid below $0.06 per kWh in Dubai earlier this year showed the potential solar energy has in the Middle East and with Saudi Arabia getting 55% of its electricity from oil, there's an economic driver to making a change.

fool

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: OPEC Countries Become the Biggest Fans of Solar Energy

not sure where I read the article but the reality of SA solar is pretty grim so far. It appears their engineering is not very reliable and the solar units made have lots of slipshod problems. They also have a terrible time with sandstorms. Some guy has to use a broom and wipe the sand off of the panels. When you get to thousands of panels this becomes very expensive to have an army of people do this- many panels do not function anyway.

There seems to be a big gulf between the PR reports and the reality. I am not sure the sandstorm issue can be overcome at all given the resources it requires.

There seems to be a big gulf between the PR reports and the reality. I am not sure the sandstorm issue can be overcome at all given the resources it requires.

-

C8 - Heavy Crude

- Posts: 1074

- Joined: Sun 14 Apr 2013, 09:02:48

Re: OPEC Countries Become the Biggest Fans of Solar Energy

$this->bbcode_second_pass_quote('pstarr', 'I')t's why Iran has embraced nuclear

That may be true, but do you have any reference to back this up?

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

THE OPEC Thread pt 9

OPEC "says" it is ready to cut 0.4 to 0.9 mb/d for a market that is 4.75 mb/d oversupplied.

<i>Now, that should really solve the problem?</i>

As we have been saying for almost three years the market will never again come back into balance, and for almost 3 years it has not. Petroleum production is the act of producing energy, not volume. As long as that is not understood, and appreciated they will just keep pushing on a string.

http://www.thehillsgroup.org/

<i>Now, that should really solve the problem?</i>

As we have been saying for almost three years the market will never again come back into balance, and for almost 3 years it has not. Petroleum production is the act of producing energy, not volume. As long as that is not understood, and appreciated they will just keep pushing on a string.

http://www.thehillsgroup.org/

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: OPEC to cut oil production 9-28-2016

"I've been at a loss to explain this long drop in prices." And can you explain why the current oil price (after the "long drop") is 30% higher then the inflation adjusted average oil price for the great majority of the last 60 years?

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: OPEC to cut oil production 9-28-2016

$this->bbcode_second_pass_quote('rockdoc123', '')$this->bbcode_second_pass_quote('', 'E')ntropy mate, entropy. The world economy is weaker than it was two years ago. And far weaker than in 2008. It could only support oil at $140+ up to 2008 and only $100+ up to 2014.

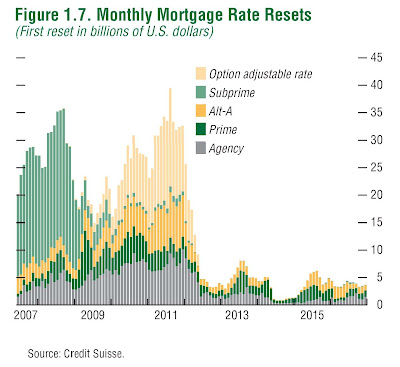

as has been argued numerous times here there is zero evidence that high oil prices had much effect given the reason for the 2008 collapse according to pretty much any financial analyst including the special commission that was struck by the US government to analyse the reasons for the great crash concluded it was all to due with the sub-prime mortgage fiasco complicated by related derivative trading in North America and Europe. The collapse in 2014 was a supply related issue which is easily seen in any supply demand curve out there, again the explanation supported by pretty much every financial analyst out there. The fact that global GDP continued to increase through theses periods does not support a weaker economy. If you can supply actual data to support your claims rather than anecdotes or "well it makes sense" arguments then please do.

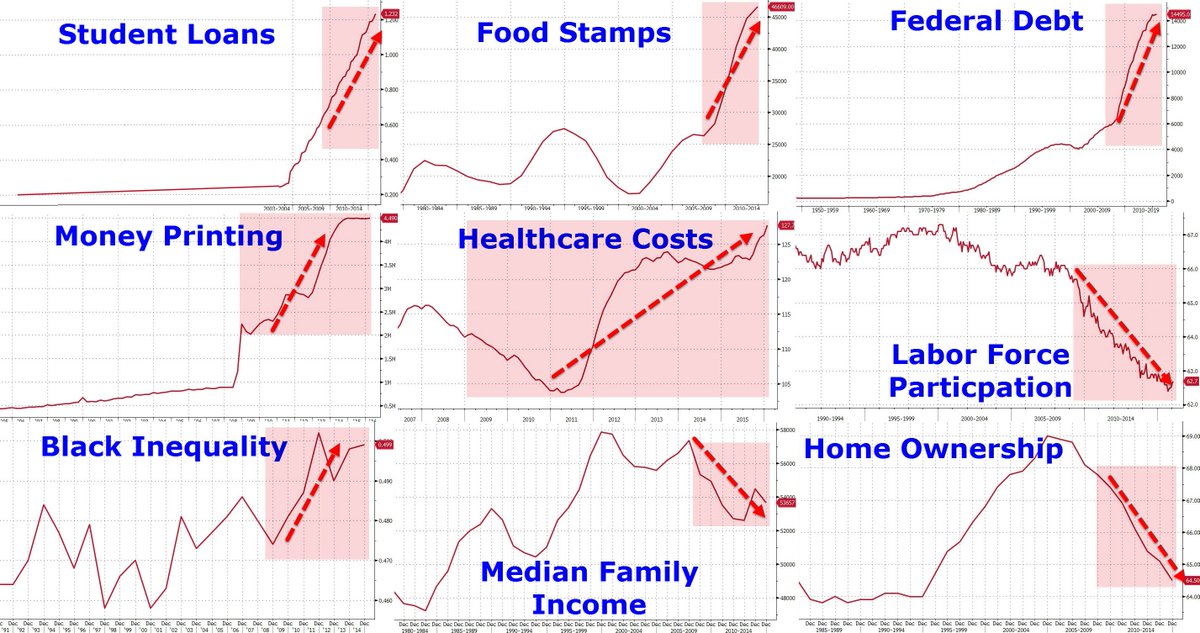

$this->bbcode_second_pass_quote('', 'O')rdinary people are unable afford oil at those old prices since they have to pay so much more today for the necessities of life, like food, housing, education etc thanks to all the bubble blowing.

what's your proof for this? GDP has been increasing, inflation has been at at an all time low averaging somewhere around 1.5% over that period of time. Us unemployment rate is currently around 5% versus 9% when oil was at $100/bbl. From 2014 to 2015 the CPI increased 0.5% but average salaries increased 1.5%. None of this seems to support your claims.

If you say so...

Link

"Don’t panic, Wall St. is safe!"

-

peripato - Heavy Crude

- Posts: 1335

- Joined: Tue 03 May 2005, 03:00:00

- Location: Reality