by Graeme » Sun 14 Jun 2015, 21:58:13

by Graeme » Sun 14 Jun 2015, 21:58:13

Pops, No it hasn't stalled. Your charts are from Bloomberg; mine are from the UNEP report, which offers more details. You don't quote UNEP. Investments for renewables for the entire year of 2014 went up 17%. Here are some of the key findings from the UNEP report:

$this->bbcode_second_pass_quote('', 'A')dditional highlights:

China saw by far the biggest renewable energy investments in 2014 — a record $83.3 billion, up 39% from 2013. The US was second at $38.3 billion, up 7% on the year but well below its all-time high reached in 2011. Third came Japan, at $35.7 billion, 10% higher than in 2013 and its biggest total ever.

A key feature of the 2014 result was the rapid expansion of renewables into new markets in developing countries. Investment in developing countries, at $131.3 billion, was up 36% on the previous year and came the closest ever to overhauling the total for developed economies, at $138.9 billion, up just 3% on the year. Additional to China, Brazil ($7.6 billion), India ($7.4 billion) and South Africa ($5.5 billion) were all in the top 10 of investing countries while more than $1 billion was invested in Indonesia, Chile, Mexico, Kenya and Turkey.

Wind, solar, biomass and waste-to-power, geothermal, small hydro and marine power contributed an estimated 9.1% of world electricity generation in 2014, compared to 8.5% in 2013. This would be equivalent to a saving of 1.3 gigatonnes of CO2 taking place as a result of the installed capacity of those renewable sources.

As in previous years, the market in 2014 was dominated by record investments in solar and wind, which accounted for 92% of overall investment in renewable power and fuels. Investment in solar jumped 29% to $149.6 billion, the second highest figure ever, while wind investment increased 11% to a record $99.5 billion. These expenditures added 49GW of wind capacity and 46GW of solar PV, both records.

Investment in Europe advanced less than 1% to $57.5 billion. There were seven billion-dollar-plus financings of offshore wind projects, boosting the investment totals for the Netherlands, the UK and Germany. These included, at the euro equivalent of $3.8 billion, the largest single renewable energy asset finance deal ever, outside large hydro – that of the 600MW Gemini project in Dutch waters.

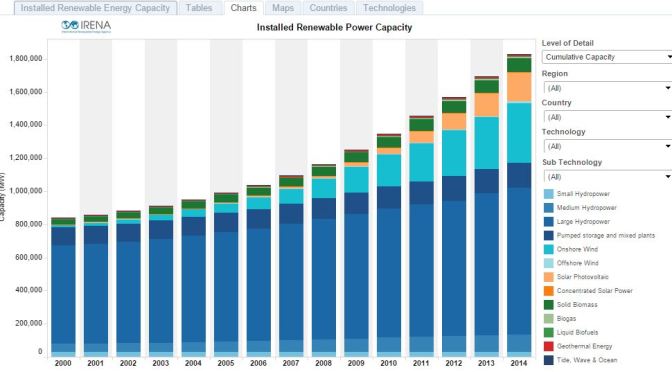

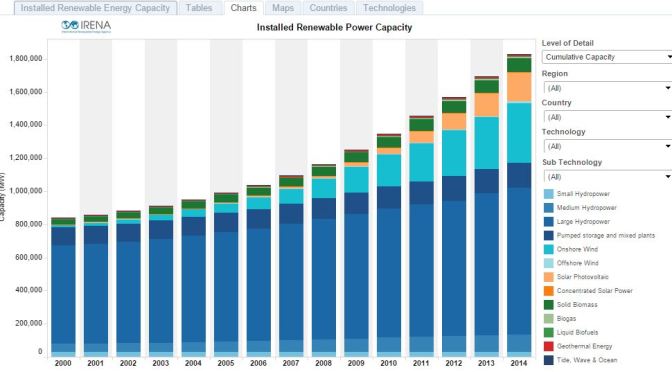

And just to emphasize there is no stalling, IRENA has just published a new

report, which provides even more detail:

$this->bbcode_second_pass_quote('', 'T')he world’s most comprehensive, up-to-date and accessible figures on renewable energy capacity have just been released by IRENA.

Renewable Energy Capacity Statistics 2015, which includes figures from 2000 to 2014, contains 12,000 data points from more than 200 countries and territories. While capacity data is readily available for larger markets like China and Germany, information for smaller markets like Small Island Developing States (SIDS) can be more difficult to find.

Data reveals that global renewable energy capacity has increased 120% since 2000. While SIDS were not able to keep pace with this growth rate, the data indicates they did use a more diversified mix of renewable energy than other countries, including hydropower, bagasse, solar and wind power. Among SIDS themselves, notable trends include the rise of wind power in the Caribbean and a broader range of renewable energy developments in solar, wind and geothermal energy for Pacific SIDS.

Another impressive trend is the growth in biogas, which was present in only 26 countries in 2000 and has now reached 63 countries worldwide.

I hoped that I did't have to repeat myself but in your case it appears that I have to. A simple google search can reveal:

I hoped that I did't have to repeat myself but in your case it appears that I have to. A simple google search can reveal: