Uh, I'm sorry Pops but I think your original prediction failed to materialize. To wit:

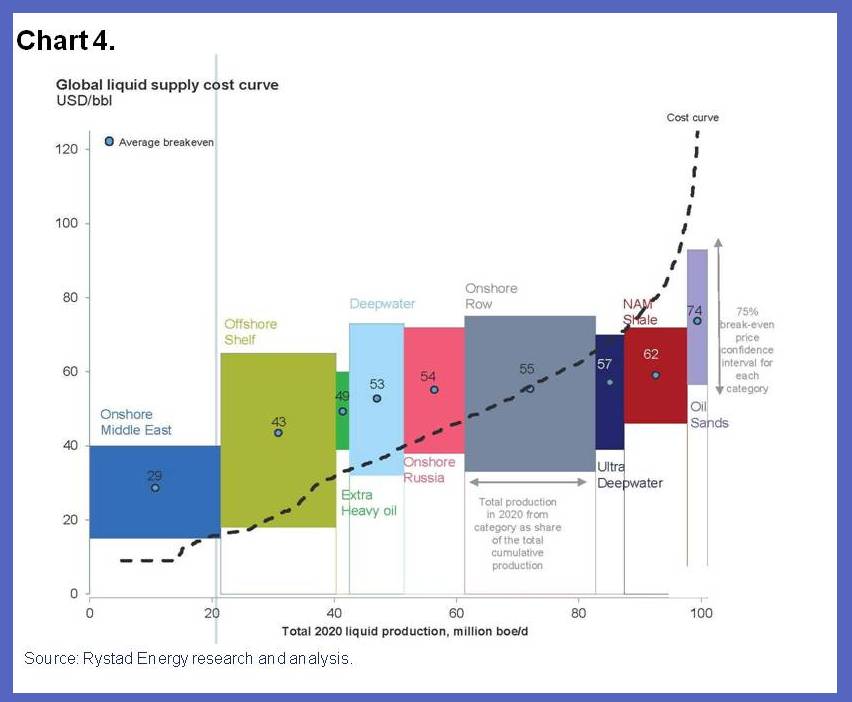

$this->bbcode_second_pass_quote('Pops', 'A')ccording to the model in my brain, the economy is not able to pay above $100 for new, 'non-conventional' oil fields. This isn't written down anywhere, the number might be $120 or $80 but it seems pretty certain it's in the ballpark that correlates to 5%-10% of US GDP. On the first chart the red band around $100 is where the economy chokes, the orange, eyeballed trendline of "base" oil price seems to be entering that range now...

The Wedge - extraction cost vs 'ability to pay'

Re: The Wedge - extraction cost vs 'ability to pay'

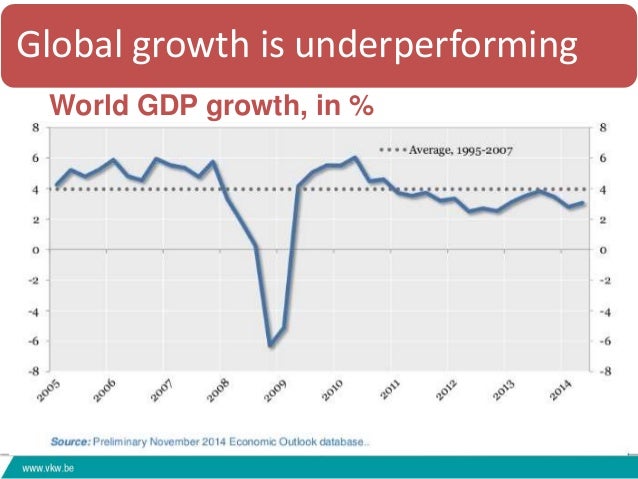

Basically you were saying that the $100 or so price could not be sustained because such a price would collapse the economy after some time. Only after such an economic crash would the price fall back down.

Unfortunately for your little model from 4 years ago, we have now gotten an oil price crash without it being caused by an economic crash. I don't see anything, anywhere in your first post here indicating you thought a repeat of 1985-86 would ever be possible again. But that's what we got.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: The Wedge - extraction cost vs 'ability to pay'

Epic fail.

$this->bbcode_second_pass_quote('Pops', '')$this->bbcode_second_pass_quote('', 'w')e are looking at more like a sustained $150/bl to start forcing contraction.

$this->bbcode_second_pass_quote('Pops', '')$this->bbcode_second_pass_quote('', 'w')e are looking at more like a sustained $150/bl to start forcing contraction.

Cool. Thanks.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: The Wedge - extraction cost vs 'ability to pay'

Why didn't I think of that, oh yeah I did, yesterday in this very thread:

$this->bbcode_second_pass_quote('Pops', 'T')he thing Wedge 2011 didn't contemplate was an oil glut combined with continuing economic growth and high demand. It is a failing of my PO bias combined with my under appreciation of the potential of tight oil to (i) cause a glut "overnight" (in oil development time-scale) (ii) kill the glut "overnight" on low price.

...

Will that bubble feed an out of control volatility cycle that eventually leads to the Big One? That was my basic idea in the 2020 oil price challenge thread although I thought price would be tied more to demand than production but who to tell the difference when the outcome is as predicted?

$this->bbcode_second_pass_quote('Pops', 'T')he thing Wedge 2011 didn't contemplate was an oil glut combined with continuing economic growth and high demand. It is a failing of my PO bias combined with my under appreciation of the potential of tight oil to (i) cause a glut "overnight" (in oil development time-scale) (ii) kill the glut "overnight" on low price.

...

Will that bubble feed an out of control volatility cycle that eventually leads to the Big One? That was my basic idea in the 2020 oil price challenge thread although I thought price would be tied more to demand than production but who to tell the difference when the outcome is as predicted?

You're right, it was a fail, contraction happened way before $150, only a few hundreds of billions of QE kept the roller coaster going.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac