Middle East Remains Central to Oil Markets

Middle East Remains Central to Oil Markets

IEA Chief Economist: Middle East Remains Central to Oil Markets

$this->bbcode_second_pass_quote('', 'L')ong held tenets of the oil and gas sector are being rewritten, but the Middle East remains central to the wider market, according to Dr Fatih Birol, Chief Economist and Director of Global Energy Economics at the International Energy Agency (IEA).

The IEA expert has lent his voice to market assumptions about US oil production being almost exclusively used domestically, despite recent moves and industry noises to the contrary. Speaking at UK business lobby group CBI’s recently concluded 2014 Energy Conference in London, Birol opined that attention ought to be paid to the words “almost exclusively.”

While US crude oil might enter the global supply pool in minor volumes at some point, he said, “The world would need Middle Eastern oil for many decades to come. However, trade-flows and energy policy frameworks of several countries, including the US, will see fundamental changes.”

The US for one has predicated its energy policy in recent decades on the basis of it being an oil and gas importer. “But within a short space of seven years, this has been turned on its head in a positive way. With more domestic tight oil and shale gas factored in, the US government now has to worry about calls for exporting rather than importing.

“Invariably, the country’s energy policy choices will be influenced by the new reality of its richer resource base, with implications for the world. It is why the US shale revolution’s impact extends beyond physical barrels – its influence on the global energy landscape, economy and geopolitics is unprecedented,” Birol said.

And there are profound changes all around. For instance, while it can meet its current needs, the Middle East is actually becoming a major oil and gas demand zone. “Importers are becoming exporters, and exporters are becoming major centres of demand while some supply nations are rethinking. For instance, exporting crude oil was a lot simpler for Canada before the US bonanza. Now, the US is becoming less of an import market for exporters of Canadian oil, who are looking to Asia.”

Later on, at the sidelines of the conference, I got a chance to quiz Birol about the perceived abundance of natural gas and its impact on gas pricing plus the recent supply deal between Russia and China. “Regardless of how much is out there, regional natural gas price variations will continue. For example, gas prices in Europe are likely to remain at twice level of the US as far as I can see into the medium-term. As for Russia, it will remain crucial to the global oil and gas markets,” he told me.

$this->bbcode_second_pass_quote('', 'L')ong held tenets of the oil and gas sector are being rewritten, but the Middle East remains central to the wider market, according to Dr Fatih Birol, Chief Economist and Director of Global Energy Economics at the International Energy Agency (IEA).

The IEA expert has lent his voice to market assumptions about US oil production being almost exclusively used domestically, despite recent moves and industry noises to the contrary. Speaking at UK business lobby group CBI’s recently concluded 2014 Energy Conference in London, Birol opined that attention ought to be paid to the words “almost exclusively.”

While US crude oil might enter the global supply pool in minor volumes at some point, he said, “The world would need Middle Eastern oil for many decades to come. However, trade-flows and energy policy frameworks of several countries, including the US, will see fundamental changes.”

The US for one has predicated its energy policy in recent decades on the basis of it being an oil and gas importer. “But within a short space of seven years, this has been turned on its head in a positive way. With more domestic tight oil and shale gas factored in, the US government now has to worry about calls for exporting rather than importing.

“Invariably, the country’s energy policy choices will be influenced by the new reality of its richer resource base, with implications for the world. It is why the US shale revolution’s impact extends beyond physical barrels – its influence on the global energy landscape, economy and geopolitics is unprecedented,” Birol said.

And there are profound changes all around. For instance, while it can meet its current needs, the Middle East is actually becoming a major oil and gas demand zone. “Importers are becoming exporters, and exporters are becoming major centres of demand while some supply nations are rethinking. For instance, exporting crude oil was a lot simpler for Canada before the US bonanza. Now, the US is becoming less of an import market for exporters of Canadian oil, who are looking to Asia.”

Later on, at the sidelines of the conference, I got a chance to quiz Birol about the perceived abundance of natural gas and its impact on gas pricing plus the recent supply deal between Russia and China. “Regardless of how much is out there, regional natural gas price variations will continue. For example, gas prices in Europe are likely to remain at twice level of the US as far as I can see into the medium-term. As for Russia, it will remain crucial to the global oil and gas markets,” he told me.

forbes

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: Middle East Remains Central to Oil Markets

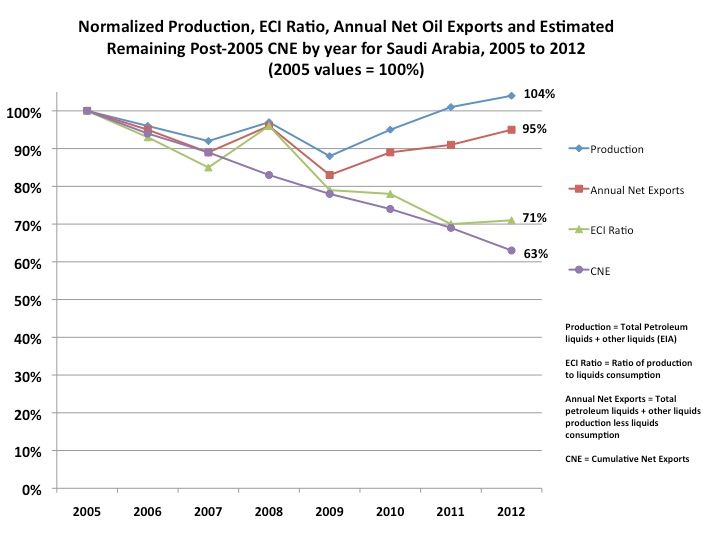

I estimate that Saudi Arabia shipped about 37% of their post-2005 CNE (Cumulative Net Exports) in the seven year period from 2006 to 2012 inclusive:

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Middle East Remains Central to Oil Markets

How do other ME countries (e.g. Iraq and Iran) compare?

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: Middle East Remains Central to Oil Markets

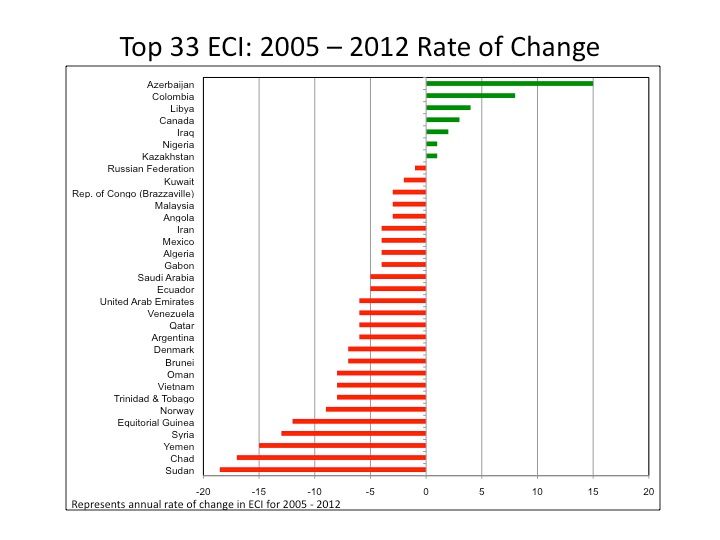

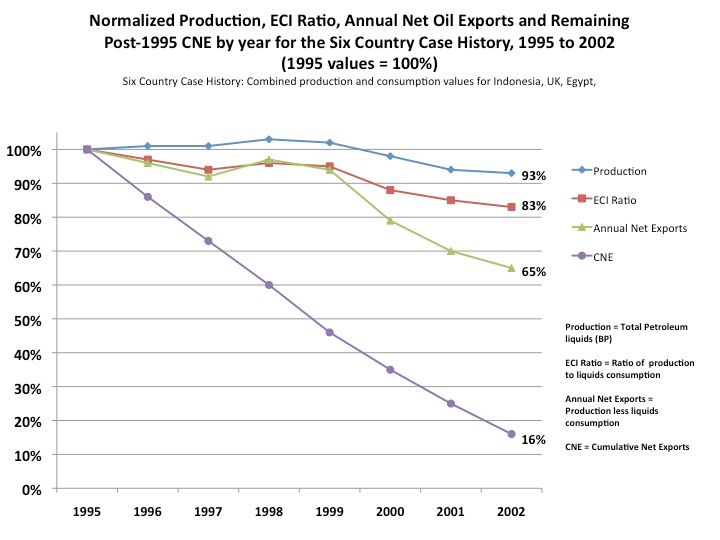

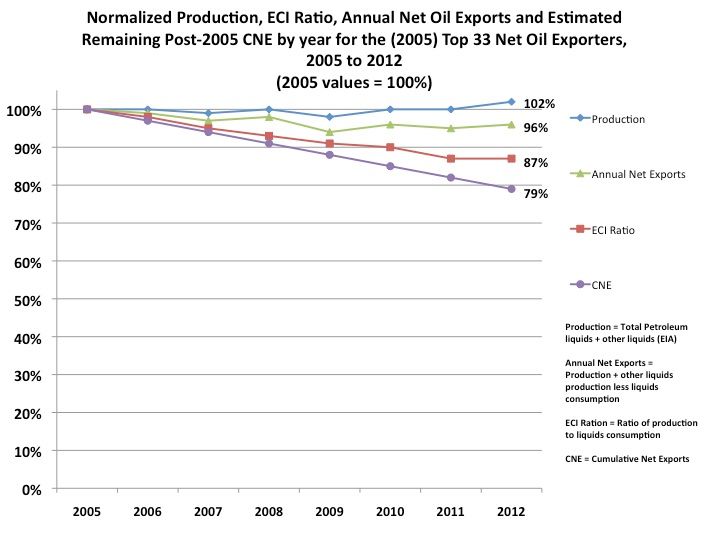

The following chart shows the 2005 to 2012 rates of change for each of the ECI Ratios* for each of the (2005) Top 33 net oil exporters. Iran had a declining ECI Ratio, while Iraq showed an increasing ECI Ratio. Any country with a declining ECI Ratio is, mathematically, trending toward zero net exports (at an ECI Ratio of 1.0, production = consumption and net exports = zero).

As you can see, Saudi Arabia is actually pretty much the median case history for the Top 33 group.

*Ratio of production (total petroleum liquids + other liquids, EIA) to liquids consumption

As you can see, Saudi Arabia is actually pretty much the median case history for the Top 33 group.

*Ratio of production (total petroleum liquids + other liquids, EIA) to liquids consumption

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Middle East Remains Central to Oil Markets

Thanks for posting the above figure which I see comes from this report. I found your remark "consuming 100% of Global Net Exports of oil in the year 2030" just before figure 21 to be quite interesting. Why do you believe it won't actually happen?

I just seen this report which I think is relevant..

China's oil imports from Iran rise nearly 50 pct Jan-June

$this->bbcode_second_pass_quote('', 'C')hina's crude imports from Iran in the first half of the year were up nearly 50 percent, although shipments in June dropped nearly a third from May to the lowest level in four months.

China, Tehran's largest oil client, began stepping up purchases from the OPEC member after a preliminary nuclear deal in November of last year eased some sanctions on Iran. China has been making up the main portion of Asia's higher Iranian oil imports since then.

Iran and six world powers have failed to negotiate a final resolution to a decade-old standoff over Tehran's atomic activities, but talks have been extended for another four months past the July 20 deadline.

Mostly owing to China's increases since the interim deal was agreed, Asian buyers are expected to import about 1.25 million to 1.3 million barrels per day (bpd) of Iranian oil in the first half of the year, industry and government sources have said.

Iran ranks No.3 among China's top suppliers, according to customs, with growth in the January-June period the fastest among China's top suppliers, outpacing that of Iraq, Oman, Angola, Russia and Saudi Arabia.

I just seen this report which I think is relevant..

China's oil imports from Iran rise nearly 50 pct Jan-June

$this->bbcode_second_pass_quote('', 'C')hina's crude imports from Iran in the first half of the year were up nearly 50 percent, although shipments in June dropped nearly a third from May to the lowest level in four months.

China, Tehran's largest oil client, began stepping up purchases from the OPEC member after a preliminary nuclear deal in November of last year eased some sanctions on Iran. China has been making up the main portion of Asia's higher Iranian oil imports since then.

Iran and six world powers have failed to negotiate a final resolution to a decade-old standoff over Tehran's atomic activities, but talks have been extended for another four months past the July 20 deadline.

Mostly owing to China's increases since the interim deal was agreed, Asian buyers are expected to import about 1.25 million to 1.3 million barrels per day (bpd) of Iranian oil in the first half of the year, industry and government sources have said.

Iran ranks No.3 among China's top suppliers, according to customs, with growth in the January-June period the fastest among China's top suppliers, outpacing that of Iraq, Oman, Angola, Russia and Saudi Arabia.

reuters

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: Middle East Remains Central to Oil Markets

Note that the above ECI chart is an updated version of the one in the Export Capacity Index Paper.

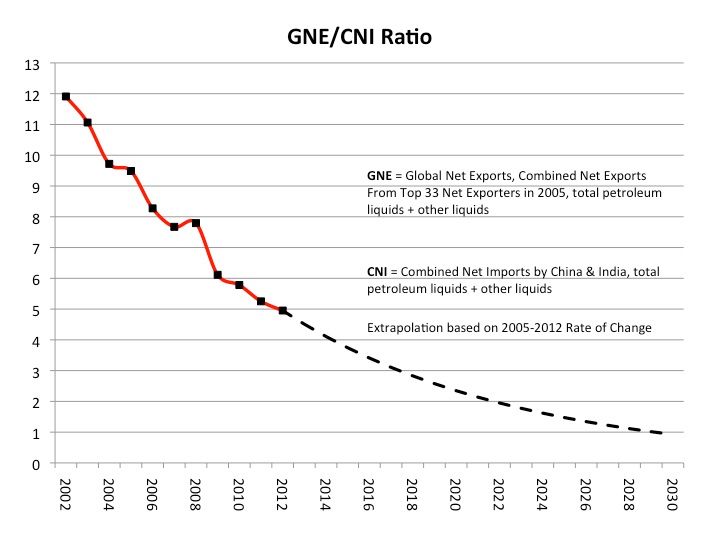

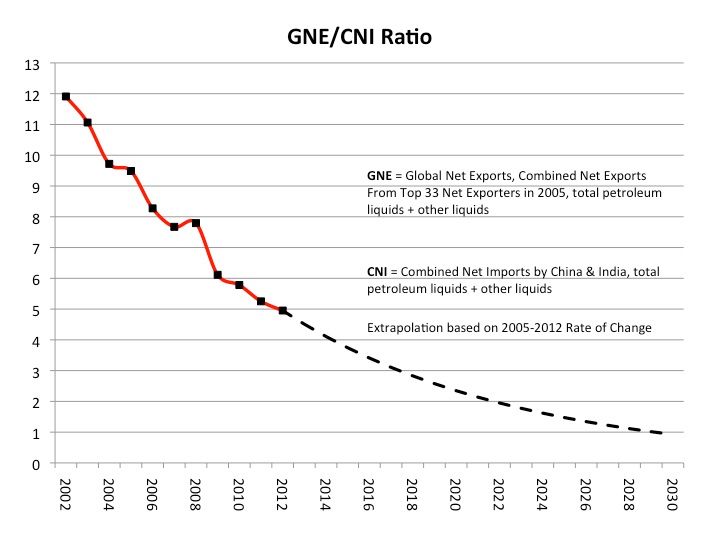

Regarding Available Net Exports (Global Net Exports, GNE, less Chindia's Net Imports, CNI), the key metric is the GNE/CNI Ratio. The following chart shows the 2002 to 2012 data, with the extrapolation based on the 2005 to 2012 rate of decline.

The problem is that I can't see how the world economy can stand anything remotely close to only two countries consuming anywhere close to 100% of GNE, but in 2013 I estimate that the GNE/CNI Ratio fell to between 4.6 and 4.7, so we probably continued to fall to a point in time (GNE/CNI = 1.0) that cannot arrive at.

However, given an inevitable ongoing decline in GNE, unless the Chindia region cuts their consumption of GNE at the same rate as the rate of decline in GNE, or at a faster rate, the resulting ANE decline rate will exceed the GNE decline rate and the ANE decline rate will accelerate with time (year over year).

Regarding Available Net Exports (Global Net Exports, GNE, less Chindia's Net Imports, CNI), the key metric is the GNE/CNI Ratio. The following chart shows the 2002 to 2012 data, with the extrapolation based on the 2005 to 2012 rate of decline.

The problem is that I can't see how the world economy can stand anything remotely close to only two countries consuming anywhere close to 100% of GNE, but in 2013 I estimate that the GNE/CNI Ratio fell to between 4.6 and 4.7, so we probably continued to fall to a point in time (GNE/CNI = 1.0) that cannot arrive at.

However, given an inevitable ongoing decline in GNE, unless the Chindia region cuts their consumption of GNE at the same rate as the rate of decline in GNE, or at a faster rate, the resulting ANE decline rate will exceed the GNE decline rate and the ANE decline rate will accelerate with time (year over year).

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Middle East Remains Central to Oil Markets

According to BP, the world has 53 years of oil left to consume.

$this->bbcode_second_pass_quote('', 'T')otal world proved oil reserves reached 1687.9 billion barrels at the end of 2013, sufficient to meet 53.3 years of global production. The largest additions to reserves came from Russia, adding 900 million barrels and Venezuela adding 800 million barrels. OPEC members continue to hold the majority of reserves, accounting for 71.9% of the global total.

$this->bbcode_second_pass_quote('', 'T')otal world proved oil reserves reached 1687.9 billion barrels at the end of 2013, sufficient to meet 53.3 years of global production. The largest additions to reserves came from Russia, adding 900 million barrels and Venezuela adding 800 million barrels. OPEC members continue to hold the majority of reserves, accounting for 71.9% of the global total.

According to wiki, America is the world's largest consumer but China is expected to overtake it by 2030:

$this->bbcode_second_pass_quote('', 'D')espite this growth, the US remains by far the largest user of oil, consuming more than China in 2010. China may overtake the US around 2030. "BP Energy Outlook 2035". p. 38.

In your opinion, are these numbers reasonable? Too big? or too small? Do we have more or less than 50 years of "oil and gas" left? Perhaps I'm asking the wrong question. Maybe others forms of transport "fuel" will become dominant within a few decades. It's hard the predict the future, isn't it?

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

/cdn0.vox-cdn.com/uploads/chorus_asset/file/679546/map_china_oil_imports.0.png)