Monterey Shale

Re: Monterey Shale oil reserves cut by 96%

The great imaginary California oil boom: Over before it started

$this->bbcode_second_pass_quote('', 'I')t turns out that the oil industry has been pulling our collective leg.

The pending 96 percent reduction in estimated deep shale oil resources in California revealed last week in the Los Angeles Times calls into question the oil industry's premise of a decades-long revival in U.S. oil production and the already implausible predictions of American energy independence. The reduction also appears to bolster the view of long-time skeptics that the U.S. shale oil boom--now centered in North Dakota and Texas--will likely be short-lived, petering out by the end of this decade. (I've been expressing my skepticism in writing about resource claims made for both shale gas and oil since 2008.)

t's no surprise that those who work in the oil industry are perennially optimistic. This high-risk business isn't for the timid. And that optimism is necessary if the industry is going to raise the capital it needs from investors. But it should be obvious that relying on the oil industry for objective information that will form the basis for public policy is a mistake. Independent sources and objective data are important cross-checks on the industry's understandable but often misleading enthusiasm.

The other explanation for the Monterey miss is that the analysts at INTEK are simply colossally inept. Note that INTEK was also responsible for the overall U.S. assessment of 23.9 billion barrels of technically recoverable oil lodged in deep shale formations. The California miss alone reduced estimated U.S. resources to 9.1 billion barrels, a cut which by itself calls into question the entire premise of renewed American oil abundance. But, the gargantuan misreading of the Monterey Shale's resources also suggests that the firm's estimates for other areas of the country need review as well.

Moreover, while technology can improve, the laws of physics don't. The industry is already moving from the so-called "sweet spots" in shale deposits to those that are more difficult to exploit. That process will continue until the laws of physics and economics team up to make drilling unprofitable, and that will be the end of the shale boom in the rest of the country.

$this->bbcode_second_pass_quote('', 'I')t turns out that the oil industry has been pulling our collective leg.

The pending 96 percent reduction in estimated deep shale oil resources in California revealed last week in the Los Angeles Times calls into question the oil industry's premise of a decades-long revival in U.S. oil production and the already implausible predictions of American energy independence. The reduction also appears to bolster the view of long-time skeptics that the U.S. shale oil boom--now centered in North Dakota and Texas--will likely be short-lived, petering out by the end of this decade. (I've been expressing my skepticism in writing about resource claims made for both shale gas and oil since 2008.)

t's no surprise that those who work in the oil industry are perennially optimistic. This high-risk business isn't for the timid. And that optimism is necessary if the industry is going to raise the capital it needs from investors. But it should be obvious that relying on the oil industry for objective information that will form the basis for public policy is a mistake. Independent sources and objective data are important cross-checks on the industry's understandable but often misleading enthusiasm.

The other explanation for the Monterey miss is that the analysts at INTEK are simply colossally inept. Note that INTEK was also responsible for the overall U.S. assessment of 23.9 billion barrels of technically recoverable oil lodged in deep shale formations. The California miss alone reduced estimated U.S. resources to 9.1 billion barrels, a cut which by itself calls into question the entire premise of renewed American oil abundance. But, the gargantuan misreading of the Monterey Shale's resources also suggests that the firm's estimates for other areas of the country need review as well.

Moreover, while technology can improve, the laws of physics don't. The industry is already moving from the so-called "sweet spots" in shale deposits to those that are more difficult to exploit. That process will continue until the laws of physics and economics team up to make drilling unprofitable, and that will be the end of the shale boom in the rest of the country.

resilience

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: Monterey Shale oil reserves cut by 96%

$this->bbcode_second_pass_quote('Plantagenet', 'T')he oil in the Monterey Shale is still there---it just isn't recoverable with current technology and at current prices.

Thats exactly what the Feds said about the Bakken in 2004 and look at the Bakken today.

Thats exactly what the Feds said about the Bakken in 2004 and look at the Bakken today.

I agree 100%. Technology changes so much. Yes the land rush was crazy in the Monterey Shale and tons of leases will expire but someone (most likely a small independent) will figure out how to produce the MS and people will rush in again. However it could be later this year or 5+ years from now but with that much oil in place some companies will be experimenting every which way to unlock it and eventually figure it out.

"The Future Belongs to Those Who Prepare For It."

Peter Hurd

Peter Hurd

- Unit30Bull

- Wood

- Posts: 18

- Joined: Thu 23 Jan 2014, 16:20:50

Re: Monterey Shale oil reserves cut by 96%

The catch is that there are costs for experimentation and technologies implemented that has to contend with a price range that the market can tolerate.

-

ralfy - Light Sweet Crude

- Posts: 5651

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Re: Monterey Shale oil reserves cut by 96%

So what evidence shows there is 15B bbs of oil left in the MS?

Hughes points out that Intek in part used production of vertical wells drilled into sandstone reservoirs (of migrated oil) then extrapolated those results out to the entire extent of sourcerock @ 16 wells/sq mile. I don't know anything but thats certainly seems wrong to me, reservoirs are called that because they trap and concentrate migrating oil.

Sec. 4.3 - http://montereyoil.org/the-report/

$this->bbcode_second_pass_quote('', 'T')wo things strongly call into question these so-called “typical” shale well decline curves presented by EIA/INTEK. The first is that the Elk Hills Field primarily produces from the Stevens Sand member of the Monterey Formation, a conventional reservoir charged with migrated oil from Monterey source rocks. Thus it is in no way “typical” of what to expect from a tight oil well, which would produce from non-migrated oil in source rock as done in other tight oil plays.

Hughes points out that Intek in part used production of vertical wells drilled into sandstone reservoirs (of migrated oil) then extrapolated those results out to the entire extent of sourcerock @ 16 wells/sq mile. I don't know anything but thats certainly seems wrong to me, reservoirs are called that because they trap and concentrate migrating oil.

Sec. 4.3 - http://montereyoil.org/the-report/

$this->bbcode_second_pass_quote('', 'T')wo things strongly call into question these so-called “typical” shale well decline curves presented by EIA/INTEK. The first is that the Elk Hills Field primarily produces from the Stevens Sand member of the Monterey Formation, a conventional reservoir charged with migrated oil from Monterey source rocks. Thus it is in no way “typical” of what to expect from a tight oil well, which would produce from non-migrated oil in source rock as done in other tight oil plays.

I'll be interested to see what the report says about the entire methodology of the Intek report and how much oil they believe is actually still in the source rocks.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Monterey Shale oil reserves cut by 96%

The Peak Oil Crisis: The Monterrey Shale Debacle

$this->bbcode_second_pass_quote('', 'T')he underlying study, which was prepared by a small consulting company, INTEK, Inc., in Arlington, Virginia, purports to have been based on a wide range of sources and methods. However when it came to California the report’s author, Hitesh Mohan, said the California portion was primarily based on technical reports and presentations from oil companies. Presentations from oil companies are prepared to raise money from investors and can be expected to lay out the most optimistic view possible.

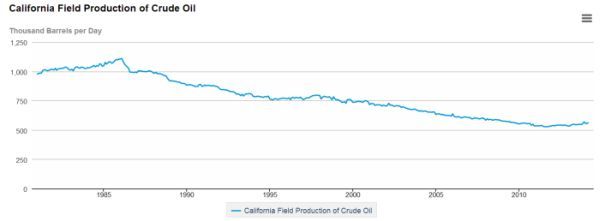

The methodology that produced the mythical estimate seems to have been something like this: take the 1,700 square miles of the Monterrey Shale, drill 28,000 wells in it at the rate of 16 wells per square mile, wait until each well produces 550,000 barrels of oil and you have your 15.4 billion barrels. Later research showed that only a handful of California oil wells ever produced 550,000 barrels of oil or anything close.

The California story only gets worse. The California oil industry funded a joint industry – University of Southern California study concluding that exploiting the supposed 15 billion barrels of shale oil would result in from 512,000 to 2.8 million new jobs in the state; would increase per capita GDP by $11,000 and boost government revenue by up to $24.6 billion per year. All the politicians had to do was get out of the way, stop all this environmental nonsense over fracking and more regulations, and the state would be rich.

$this->bbcode_second_pass_quote('', 'T')he underlying study, which was prepared by a small consulting company, INTEK, Inc., in Arlington, Virginia, purports to have been based on a wide range of sources and methods. However when it came to California the report’s author, Hitesh Mohan, said the California portion was primarily based on technical reports and presentations from oil companies. Presentations from oil companies are prepared to raise money from investors and can be expected to lay out the most optimistic view possible.

The methodology that produced the mythical estimate seems to have been something like this: take the 1,700 square miles of the Monterrey Shale, drill 28,000 wells in it at the rate of 16 wells per square mile, wait until each well produces 550,000 barrels of oil and you have your 15.4 billion barrels. Later research showed that only a handful of California oil wells ever produced 550,000 barrels of oil or anything close.

The California story only gets worse. The California oil industry funded a joint industry – University of Southern California study concluding that exploiting the supposed 15 billion barrels of shale oil would result in from 512,000 to 2.8 million new jobs in the state; would increase per capita GDP by $11,000 and boost government revenue by up to $24.6 billion per year. All the politicians had to do was get out of the way, stop all this environmental nonsense over fracking and more regulations, and the state would be rich.

fcnp

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand