The Duvernay - A game changer?

The Duvernay - A game changer?

The Duvernay Shale play is a huge, rich gas, condensate reservoir in Western Alberta. It is estimated to be 30% larger than the Eagle Ford, with 433 tcf of NG, and 61.7 Gb of liquids. Money from Australia, China, and over 22 oil companies is now pouring into it. These include heavy hitters like ConocoPhillips, Shell, Chevron, and Encana. Well depth is 16,000 ft.

Interest in the Duvernay has increased because of its close proximity to the bitumen fields around Fort McMurray. Condensate, because it has a very limited capacity to produce transportation fuels (about 7%) has a limited market. The market that pays the best price is as a diluent to produce dilbit, which allows the extra heavy bitumen to be transported by pipe. Over half of the condensate used for making dilbit now comes from the Eagle Ford, which is 2000 miles away. The Duvernay is 200 miles away, and the transportation saving will amount to $15 - $20/barrel.

The Durvernay will obviously be able to supply the tar sands with diluent for as long as they remain operational, and very competitively with any present US supply. But, how will this affect US shale development, that has been able to buzz along because it held a captive market in Canada? Also, what will the Durvernay producers do with 433 tcf of NG that has to come along with the condensate? 433 tcf of NG is enough to supply the entire US market for 16.5 years.

The gas will be shipped, and it will be shipped south. There is nothing to prevent a flood of Canadian NG from arriving at, and dominating the US market.

$this->bbcode_second_pass_quote('', '&')quot;Encana CEO Randy Eresman admitted as much at the company’s annual meeting in Calgary last week when he suggested the company could give away the gas and still make money on the liquids."

Interest in the Duvernay has increased because of its close proximity to the bitumen fields around Fort McMurray. Condensate, because it has a very limited capacity to produce transportation fuels (about 7%) has a limited market. The market that pays the best price is as a diluent to produce dilbit, which allows the extra heavy bitumen to be transported by pipe. Over half of the condensate used for making dilbit now comes from the Eagle Ford, which is 2000 miles away. The Duvernay is 200 miles away, and the transportation saving will amount to $15 - $20/barrel.

The Durvernay will obviously be able to supply the tar sands with diluent for as long as they remain operational, and very competitively with any present US supply. But, how will this affect US shale development, that has been able to buzz along because it held a captive market in Canada? Also, what will the Durvernay producers do with 433 tcf of NG that has to come along with the condensate? 433 tcf of NG is enough to supply the entire US market for 16.5 years.

The gas will be shipped, and it will be shipped south. There is nothing to prevent a flood of Canadian NG from arriving at, and dominating the US market.

$this->bbcode_second_pass_quote('', '&')quot;Encana CEO Randy Eresman admitted as much at the company’s annual meeting in Calgary last week when he suggested the company could give away the gas and still make money on the liquids."

The US shale industry is likely to be looking at a serious hit over the next few years!

http://www.thehillsgroup.org/

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: The Duvernay - A game changer?

Yup---- a shale with 60 billion barrels of oil is pretty impressive. Thats about 9 times bigger than the US Bakken. The Duvernay shale is also over 250 feet thick in places---should really help the economics of drilling and producing.

Duvernay Shale wiki

I hope Rocdoc will comment on this---he's Canadian and is pretty plugged in to what is happening in Canada.

Duvernay Shale wiki

I hope Rocdoc will comment on this---he's Canadian and is pretty plugged in to what is happening in Canada.

-

Plantagenet - Expert

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: The Duvernay - A game changer?

You should take this hype with a grain of salt given this report in put out by an investment newsletter. But the play does appear to be real. But what’s really interesting is they offer a NPV range (Net Present Value): how you compensate for decreasing value of production the future out in tine a well produces. They say the NPV ranges from $8 million to $27 million. But on a $12 million investment that ranges from a money loser (maybe depending if he’s using a net or gross NPV) to a 2 to 1 profit. And don’t be too impressed with the internal rate of return of 142%: a well can recover all of it costs in 12 months and not make a penny afterwards and it IROR would be 100%. That’s just how the math works out.

But it seems like the real boom aspect of the play is how it has the potential to make the oil sands even more economically viable. A little caution: don’t be too impressed by the thickness of the Durveray Shale: not all of the Eagle Ford Shale interval is productive. It also sounds like they still have some drilling to do to establish the more profitable window in the DS: the NG window in the EFS is not nearly as profitable as the oil window. But it does sound like it has the potential to be the real deal. Some folks thought the Marine Tuscaloosa Shale (at a similar depth and expense) might be the real deal also but so far it’s missed the mark badly.

“The Duvernay code has been cracked. It’s one of the biggest plays in Canada, and in a very short time it has gone from a very expensive science experiment to a money making play. Recent results from Chevron and Trilogy have very recently released results showing one year payouts on $12 million wells based on strong condensate production. “Recent results indicate IP30s have doubled, with much higher liquids yields,” says Chris Theal. “I would say the rate of change in IP rates has been so significant, that investors should dismiss well data on Duvernay wells older than six months.” It’s now attracting some VERY big names. Chevron announced in late October that they completed 12 wells in the Duvernay.

The Duvernay is the single most important play in Canada for 2014: 200,000 bopd of new oil sands production has been announced in the last week, which means A LOT of new condensate production is needed to dilute that heavy oil to help it flow in the pipelines. And the deep Duvernay—which is still costing $11-$15 million a well—is all about condensate. Chevron reports that its Duvernay wells are producing up to 1,300 barrels per day of condensate. The Duvernay produces condensate—a liquid that in Canada currently sells at a 10% premium to crude. And commands an ultra-low 5% royalty rate under Canadian rules—compared to up to 25% for condensate from the Eagle Ford or Marcellus.

Why is this happening now? From the press releases and research I’m reading, there really is no special magic bullet here—the code is being cracked by the same ways other formations are increasing production—by:

1. using slickwater fracks vs. oil fracks,

2. using more intense, tightly spaced fracks that used more frack sand per frack,

3. longer horizontals—2 km or more

The real kicker in terms of value is that 60% of the output is oil and natural gas liquids like condensate. Depending on production rates and gas prices, the net present value of one of these wells ranges from $8 million to as high as $27 million. The most eye-catching finding from Dundee is the return on investment from drilling here. The analysts calculate that the average internal rate of return on wells in Tier 1 areas of the play is 142%.

But it seems like the real boom aspect of the play is how it has the potential to make the oil sands even more economically viable. A little caution: don’t be too impressed by the thickness of the Durveray Shale: not all of the Eagle Ford Shale interval is productive. It also sounds like they still have some drilling to do to establish the more profitable window in the DS: the NG window in the EFS is not nearly as profitable as the oil window. But it does sound like it has the potential to be the real deal. Some folks thought the Marine Tuscaloosa Shale (at a similar depth and expense) might be the real deal also but so far it’s missed the mark badly.

“The Duvernay code has been cracked. It’s one of the biggest plays in Canada, and in a very short time it has gone from a very expensive science experiment to a money making play. Recent results from Chevron and Trilogy have very recently released results showing one year payouts on $12 million wells based on strong condensate production. “Recent results indicate IP30s have doubled, with much higher liquids yields,” says Chris Theal. “I would say the rate of change in IP rates has been so significant, that investors should dismiss well data on Duvernay wells older than six months.” It’s now attracting some VERY big names. Chevron announced in late October that they completed 12 wells in the Duvernay.

The Duvernay is the single most important play in Canada for 2014: 200,000 bopd of new oil sands production has been announced in the last week, which means A LOT of new condensate production is needed to dilute that heavy oil to help it flow in the pipelines. And the deep Duvernay—which is still costing $11-$15 million a well—is all about condensate. Chevron reports that its Duvernay wells are producing up to 1,300 barrels per day of condensate. The Duvernay produces condensate—a liquid that in Canada currently sells at a 10% premium to crude. And commands an ultra-low 5% royalty rate under Canadian rules—compared to up to 25% for condensate from the Eagle Ford or Marcellus.

Why is this happening now? From the press releases and research I’m reading, there really is no special magic bullet here—the code is being cracked by the same ways other formations are increasing production—by:

1. using slickwater fracks vs. oil fracks,

2. using more intense, tightly spaced fracks that used more frack sand per frack,

3. longer horizontals—2 km or more

The real kicker in terms of value is that 60% of the output is oil and natural gas liquids like condensate. Depending on production rates and gas prices, the net present value of one of these wells ranges from $8 million to as high as $27 million. The most eye-catching finding from Dundee is the return on investment from drilling here. The analysts calculate that the average internal rate of return on wells in Tier 1 areas of the play is 142%.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: The Duvernay - A game changer?

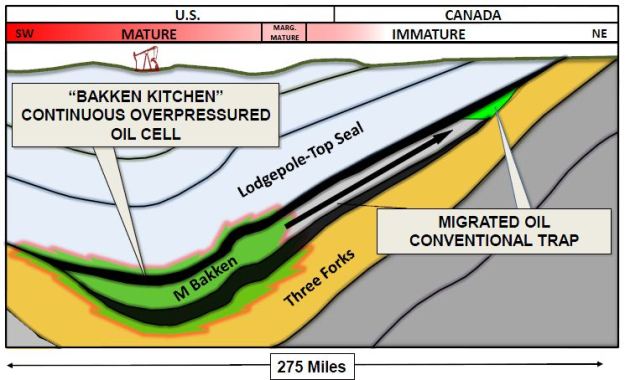

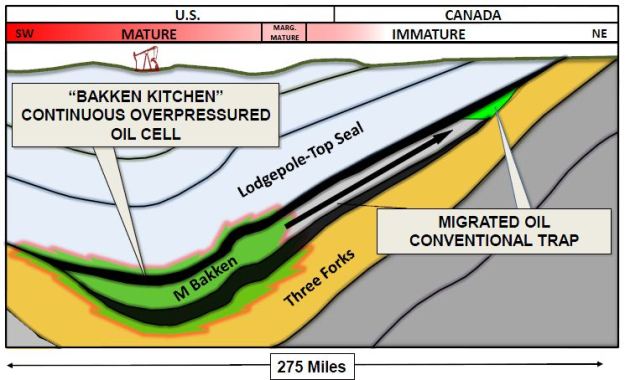

Not sure about "Alberta Bakken" on that map. Isn't it mostly in Sask & Manitoba?

OT, while looking that up I ran across this diagram:

OT, while looking that up I ran across this diagram:

Facebook knows you're a dog.

-

Keith_McClary - Light Sweet Crude

- Posts: 7344

- Joined: Wed 21 Jul 2004, 03:00:00

- Location: Suburban tar sands

Re: The Duvernay - A game changer?

$this->bbcode_second_pass_quote('ROCKMAN', '

')The Duvernay is the single most important play in Canada for 2014: 200,000 bopd of new oil sands production has been announced in the last week, which means A LOT of new condensate production is needed to dilute that heavy oil to help it flow in the pipelines.

')The Duvernay is the single most important play in Canada for 2014: 200,000 bopd of new oil sands production has been announced in the last week, which means A LOT of new condensate production is needed to dilute that heavy oil to help it flow in the pipelines.

Thanks for all the technical info, rockman. I didn't realize you'd have the goods on a Canadian play in addition to your insider knowledge of the Texas oil biz.

If the Duverny condensate is going to be used to help pump Alberta heavy oil down the pipeline, does that mean large scale Duverny development is dependent on approval of the Keystone XL Pipeline? What would happen in the Duverny if the Keystone XL is ultimately rejected by the O administration?

-

Plantagenet - Expert

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: The Duvernay - A game changer?

It seems to me that global crude oil production (45 or less API gravity, per RBN Energy) has probably peaked, while a peak in global natural gas production plus associated liquids--NGL's and condensates--does not yet appear to be in sight.

If we take the EIA’s global Crude + Condensate (C+C) data at face value (74 mbpd in 2005 increasing to 76 mbpd in 2012), actual crude production, i.e., 45 or lower API gravity oil, could not have increased by more than 2 mbpd from 2005 to 2012, which would mean no increase in condensate production, as global dry gas production reportedly went up by 21% according to the EIA (2005 to 2012), which needless to say, doesn’t seem like a likely scenario.

I think that a more likely scenario is that actual crude oil production virtually stopped increasing in 2005, as natural gas production–and the associated liquids, condensates and NGL’s–continued to increase, even as the annual price of Brent crude doubled from $55 in 2005 to $112 in 2012.

Following are estimated* values for global crude oil production (excluding lease condensate), 2002 to 2012, mbpd:

2002: 60

2003: 62

2004: 65

2005: 67

2006: 65

2007: 65

2008: 66

2009: 64

2010: 66

2011: 65

2012: 67

Global Crude + Condensate (C+C) production increased at about the same rate as global dry processed gas production from 2002 to 2005, but then we saw a significant divergence between the rates of increase in global gas production and global C+C production from 2005 to 2012, 2.8%/year versus 0.4%/year respectively.

My premise is that condensate, a byproduct of natural gas production, continued to increase at about the same rate as the rate of increase in global gas production.

*Assumptions: Global Condensate to Crude + Condensate Ratio was about 10% for 2002 to 2005 (versus 11% for Texas in 2005), and condensate production increased at the same rate as the rate of increase in global dry processed gas production from 2005 to 2012 (2.8%/year, EIA). Crude oil is defined as oil with an API gravity of 45 or less (per RBN Energy). Data rounded off to two significant figures.

If we take the EIA’s global Crude + Condensate (C+C) data at face value (74 mbpd in 2005 increasing to 76 mbpd in 2012), actual crude production, i.e., 45 or lower API gravity oil, could not have increased by more than 2 mbpd from 2005 to 2012, which would mean no increase in condensate production, as global dry gas production reportedly went up by 21% according to the EIA (2005 to 2012), which needless to say, doesn’t seem like a likely scenario.

I think that a more likely scenario is that actual crude oil production virtually stopped increasing in 2005, as natural gas production–and the associated liquids, condensates and NGL’s–continued to increase, even as the annual price of Brent crude doubled from $55 in 2005 to $112 in 2012.

Following are estimated* values for global crude oil production (excluding lease condensate), 2002 to 2012, mbpd:

2002: 60

2003: 62

2004: 65

2005: 67

2006: 65

2007: 65

2008: 66

2009: 64

2010: 66

2011: 65

2012: 67

Global Crude + Condensate (C+C) production increased at about the same rate as global dry processed gas production from 2002 to 2005, but then we saw a significant divergence between the rates of increase in global gas production and global C+C production from 2005 to 2012, 2.8%/year versus 0.4%/year respectively.

My premise is that condensate, a byproduct of natural gas production, continued to increase at about the same rate as the rate of increase in global gas production.

*Assumptions: Global Condensate to Crude + Condensate Ratio was about 10% for 2002 to 2005 (versus 11% for Texas in 2005), and condensate production increased at the same rate as the rate of increase in global dry processed gas production from 2005 to 2012 (2.8%/year, EIA). Crude oil is defined as oil with an API gravity of 45 or less (per RBN Energy). Data rounded off to two significant figures.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: The Duvernay - A game changer?

Thanks Rock, good overview. A lot of good things come out of Canada, including my first wife, and my darling second one. Just got an email from a client in Fort McMurray [he got a copy of our study, and sings it the highest praises. He is a retired oil man, and now oil investor]. But, after that plug... the Duvernay is going to be a game changer in our option because it will reduce the growth of shale production in the US, and crude prices will again begin to rise. It will also keep a lid on NG prices that are absolutely essential for North American industrial competitiveness. Crude price increase is necessay to keep US stripper wells from being shut-in, which we are going to need desperately over the next couple of decades.

After so much hoopala being blow around shale over the last couple of years it is good to see a real project with real potential. Duverany has good formational characteristics, experienced, and deep pocketed developers, and its in the back yard of its market. It also looks like the majors like Encana have locked up the mineral rights early enough to keep the speculators from bidding land prices to the moon.

Duverany is a real plus for Canada, and all of North America.

http://www.thehillsgroup.org

After so much hoopala being blow around shale over the last couple of years it is good to see a real project with real potential. Duverany has good formational characteristics, experienced, and deep pocketed developers, and its in the back yard of its market. It also looks like the majors like Encana have locked up the mineral rights early enough to keep the speculators from bidding land prices to the moon.

Duverany is a real plus for Canada, and all of North America.

http://www.thehillsgroup.org

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: The Duvernay - A game changer?

$this->bbcode_second_pass_quote('', ' ')They say the NPV ranges from $8 million to $27 million. But on a $12 million investment that ranges from a money loser (maybe depending if he’s using a net or gross NPV) to a 2 to 1 profit. And don’t be too impressed with the internal rate of return of 142%: a well can recover all of it costs in 12 months and not make a penny afterwards and it IROR would be 100%. That’s just how the math works out.

NPV is always calculated after Capex, Royalties and Opex….anybody doing it differently would get taken to the woodshed by any analyst. I always use a metric called Discounted Profit to Investment ratio (DPI) usually discounted at 10% which in this case would be somewhere between 0.6 and 2.0 which compared to what I always used as a hurdle of 0.35 are quite good. This is no doubt for the liquids rich gas fairway. The liquids rich gas poor fairway and the gas only fairway no doubt have economics that arent’ all that attractive.

The Duvernay has been chased now for about 5 years (I believe that was when the first Crown Land Sale posting acreage was conducted) but has been known about since God was in short pants because it is the shales providing source and seal not just to the Leduc reef trend but also probably to many of the large clastic reservoirs such as Pembina. Some have argued that the Duvernay is the ultimate source for all of the hydrocarbons in the Athabasca oil sands. It is a large area but like all shale plays there are sweet spots. A number of early entries into the play are now trying to sell some or all of their large positions prior to much activity having been conducted to prove their acreage.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: The Duvernay - A game changer?

P - "...does that mean large scale Duvernay development is dependent on approval of the Keystone XL Pipeline?" Not in the least IMHO. There’s not one bbl of production I know of not being exported today because the permit hasn’t been approved yet. The last number I saw was 2.23 million bbls of oil sands production per day…TODAY. I’ve read they dilute about 25-30%. That means today, without any further oil sands production then coming out of the ground then there is today, they’ll need about 240 million bbls of condensate to dilute the production for the next 12 months. The Duvernay may help the situation eventually but it’s going to be a very long time before it can have a significant impact. It might look like great synergism on paper but look at the time scale: it could easily 5+ years before it becomes a meaningful factor as far as helping out the oil sands.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: The Duvernay - A game changer?

it could easily 5+ years before it becomes a meaningful factor as far as helping out the oil sands.

Can't see how you get 5+ years. With an IP of 1000 b/d it would take 558 wells to supply all of the tar sands 2.23 m/d production with diluent. The Bakken is completing 140 wells per month. The biggest barrier would be the pipelines, but Fort McMurray is only 200 miles away. A year of exploratory development. A year to get rigs, fracking crews and pipeline built. 2 to 2.5 years at most, and they'll be shipping condensate.

This isn't Kazakstan, its Canada, and they do get things done!

http://www.thehillsgroup.org

Can't see how you get 5+ years. With an IP of 1000 b/d it would take 558 wells to supply all of the tar sands 2.23 m/d production with diluent. The Bakken is completing 140 wells per month. The biggest barrier would be the pipelines, but Fort McMurray is only 200 miles away. A year of exploratory development. A year to get rigs, fracking crews and pipeline built. 2 to 2.5 years at most, and they'll be shipping condensate.

This isn't Kazakstan, its Canada, and they do get things done!

http://www.thehillsgroup.org

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: The Duvernay - A game changer?

Shorty - I'll let you or doc dig the numbers out: how many rigs are drilling the D Shale today? How many idle BIG rotary rigs are there sitting in the yards today? Remember these are 16,000' TVD wells with at least 5,000' laterals. So you're probably talking about 22,000' of drill pipe. I'm guessing a 1,500 hp rig at a minimum. I doubt you're talking about 18 rotating days like the EFS.

So how many new rigs will need go be built? How many worms are they going to need to break out to get these not so easy wells to depth? How many new frac trucks will have to be put together? Took a couple of years to get things rolling good in Texas. And operators paid out the ass waiting for the infrastucture to be built out. And lastly: we don't have to sling dumb iron around at 30 degrees below. LOL. I wouldn't think about buying into the public oils and look real close at the service sector. If the play is real it is bound to turn into a real feeding frenzy.

So how many new rigs will need go be built? How many worms are they going to need to break out to get these not so easy wells to depth? How many new frac trucks will have to be put together? Took a couple of years to get things rolling good in Texas. And operators paid out the ass waiting for the infrastucture to be built out. And lastly: we don't have to sling dumb iron around at 30 degrees below. LOL. I wouldn't think about buying into the public oils and look real close at the service sector. If the play is real it is bound to turn into a real feeding frenzy.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: The Duvernay - A game changer?

Hi Rock Man/Doc

A selfish question, I was anticipating (Financially) a pop of the credit bubble in the USA shales in 2016-17sh, and a nice little recession after this.

Could this mean that the guys can re-locate up there and keep everything ticking over for a few more years ?

Simon

A selfish question, I was anticipating (Financially) a pop of the credit bubble in the USA shales in 2016-17sh, and a nice little recession after this.

Could this mean that the guys can re-locate up there and keep everything ticking over for a few more years ?

Simon

- Simon_R

- Lignite

- Posts: 234

- Joined: Thu 16 May 2013, 09:28:06

Re: The Duvernay - A game changer?

Simon - Based upon my years of experience in the stock market if you take any advice from me YOU'RE A FOOL! LOL. But, in the short term, I would focus on expectations of the general economic activity more then how much oil/NG is or isn't coming out the ground. In the time frame you mention I don't see a great deal of change in the production dynamics. Of course, that excludes geopolitical bumps in the road.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: The Duvernay - A game changer?

Hi Rockman

I was under the impression that with the declining yield of these wells (fracking for oil) that more and more needed to be drilled to pay back loans, and so in effect this was a bubble, and when all sweet spots are gone there is a possibility that the bubble would pop as not enough money could be made to pay back the loans.

Not investing in the stock market, just wanting to know if the light at the end of the tunnel is a train.

I was under the impression that with the declining yield of these wells (fracking for oil) that more and more needed to be drilled to pay back loans, and so in effect this was a bubble, and when all sweet spots are gone there is a possibility that the bubble would pop as not enough money could be made to pay back the loans.

Not investing in the stock market, just wanting to know if the light at the end of the tunnel is a train.

- Simon_R

- Lignite

- Posts: 234

- Joined: Thu 16 May 2013, 09:28:06

Re: The Duvernay - A game changer?

Simon,

My 2¢ worth follows. My standard comment about US tight/shale plays:

$this->bbcode_second_pass_quote('', 'I')t’s interesting to look at some regional declines in US oil and gas production, e.g., marketed Louisiana natural gas production (the EIA doesn’t have dry processed data by state).

According to the EIA, the observed simple percentage decline in Louisiana’s annual natural gas production from 2012 to 2013 was 20%. This would be the net change in production, after new wells were added. The gross decline rate (from existing wells in 2012) would be even higher. This puts a recent Citi Research estimate in perspective.

Citi estimates that the gross underlying decline rate for overall US natural gas production is about 24%/year. This would be the simple percentage change in annual production if no new sources of gas were put on line in the US. In round numbers, this requires the US to add about 16 BCF/day of new gas production every year, just to maintain about 66 BCF/day of dry processed natural gas production. To put 16 BCF/day in perspective, dry processed natural gas production from all of Texas was probably at about 18 BCF/day in 2013.

Based on the Citi report, the US would have to replace 100% of current natural gas production in about four years, just to maintain a dry processed gas production rate of 66 BCF/day (24 TCF/year) for four years.

Or, based on the Citi report, the US would have to put on line the productive equivalent of the 2013 natural gas production from the Marcellus Play--every six months--just to maintain current production.

Or, based on the Citi report, the US has to replace the productive equivalent of all of the 2012 dry natural gas production from the Middle East, in a little over three years (3.3 years), in order to maintain a dry production rate of 24 TCF/year. Over a 10 year period, we would need to put on line three times the 2012 production rate from the Middle East.

Or, based on the Citi report, in the next four years, the US has to replace the combined productive equivalent of the 2012 dry natural production from Canada, Norway, UK, Iran, Qatar and Indonesia, just to maintain a dry natural gas production rate of about 24 TCF/year.

On the oil side, if we assume a probably conservative decline rate of 10%/year from existing oil production, in order to just maintain current production for 10 years, we would have to replace the productive equivalent of every oil field in the US over the next 10 years--the productive equivalent of every oil well from the Gulf of Mexico to the Eagle Ford to the Permian Basin to the Bakken to Alaska.

My 2¢ worth follows. My standard comment about US tight/shale plays:

$this->bbcode_second_pass_quote('', 'I')t’s interesting to look at some regional declines in US oil and gas production, e.g., marketed Louisiana natural gas production (the EIA doesn’t have dry processed data by state).

According to the EIA, the observed simple percentage decline in Louisiana’s annual natural gas production from 2012 to 2013 was 20%. This would be the net change in production, after new wells were added. The gross decline rate (from existing wells in 2012) would be even higher. This puts a recent Citi Research estimate in perspective.

Citi estimates that the gross underlying decline rate for overall US natural gas production is about 24%/year. This would be the simple percentage change in annual production if no new sources of gas were put on line in the US. In round numbers, this requires the US to add about 16 BCF/day of new gas production every year, just to maintain about 66 BCF/day of dry processed natural gas production. To put 16 BCF/day in perspective, dry processed natural gas production from all of Texas was probably at about 18 BCF/day in 2013.

Based on the Citi report, the US would have to replace 100% of current natural gas production in about four years, just to maintain a dry processed gas production rate of 66 BCF/day (24 TCF/year) for four years.

Or, based on the Citi report, the US would have to put on line the productive equivalent of the 2013 natural gas production from the Marcellus Play--every six months--just to maintain current production.

Or, based on the Citi report, the US has to replace the productive equivalent of all of the 2012 dry natural gas production from the Middle East, in a little over three years (3.3 years), in order to maintain a dry production rate of 24 TCF/year. Over a 10 year period, we would need to put on line three times the 2012 production rate from the Middle East.

Or, based on the Citi report, in the next four years, the US has to replace the combined productive equivalent of the 2012 dry natural production from Canada, Norway, UK, Iran, Qatar and Indonesia, just to maintain a dry natural gas production rate of about 24 TCF/year.

On the oil side, if we assume a probably conservative decline rate of 10%/year from existing oil production, in order to just maintain current production for 10 years, we would have to replace the productive equivalent of every oil field in the US over the next 10 years--the productive equivalent of every oil well from the Gulf of Mexico to the Eagle Ford to the Permian Basin to the Bakken to Alaska.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53