Here Comes The Meltdown Pt. 9.2-Double Dip-

Re: Here Comes The Meltdown Pt. 9.2-Double Dip-

Sorry, I have a job, one more desirable than both manufacturing and farming.

And no, I don't collect disability. Nice try though. Also, I'm not the one claiming Americans want to do dirty jobs - you are. You can't ask me to do something I'm claiming nobody wants to do. If I acknowledge most people don't want a certain kind of job, why should I be expected to do it myself?

And no, I don't collect disability. Nice try though. Also, I'm not the one claiming Americans want to do dirty jobs - you are. You can't ask me to do something I'm claiming nobody wants to do. If I acknowledge most people don't want a certain kind of job, why should I be expected to do it myself?As for your real median household income, we already discussed this: It's at mid-1990's levels. Last time I heard most folks don't think the mid-1990's were particularly bad times.

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: Here Comes The Meltdown Pt. 9.2-Double Dip-

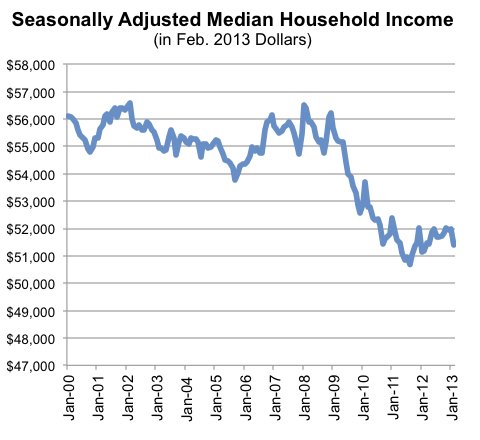

')As for your real median household income, we already discussed this: It's at mid-1990's levels. Last time I heard most folks don't think the mid-1990's were particularly bad times.

It would be great to have median household income at the same level as the mid 1990s if we were still in the mid 1990s. But we're not---two decades have gone by.

AND median household income peaked during the Bush II administration at levels about 10% above where they are today. That means todays MEDIAN HOUSEHOLD INCOMES HAVE FALLEN 10% from their peak.

Most folks aren't happy when their income goes down.

Median family incomes peaked during the 2000s and have since fallen by about 10%.

-

Plantagenet - Expert

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Here Comes The Meltdown Pt. 9.2-Double Dip-

You did realize that "real" means adjusted for inflation, didn't you. IOW real median income is as if it were 1995 all over again. Horrors!

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: Here Comes The Meltdown Pt. 9.2-Double Dip-

Its not "horrors" but its not great either. I can't imagine why you want to gloss over the real issue, which is FALLING incomes.

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet - Expert

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).