THE Demand Destruction Thread Pt. 3

First unread post • 19 posts

• Page 1 of 1

THE Demand Destruction Thread Pt. 3

<i>Over the last four weeks, crude oil imports have averaged nearly 9.4 million barrels per day, 925,000 barrels per day below the same four-week period last year.</i>

link

Just a flesh wound. The economy will be cruisin' right along by the 4th quarter.

http://www.youtube.com/watch?v=2eMkth8FWno

link

Just a flesh wound. The economy will be cruisin' right along by the 4th quarter.

http://www.youtube.com/watch?v=2eMkth8FWno

"For my part, whatever anguish of spirit it may cost, I am willing to know the whole truth; to know the worst and provide for it." - Patrick Henry

The level of injustice and wrong you endure is directly determined by how much you quietly submit to. Even to the point of extinction.

The level of injustice and wrong you endure is directly determined by how much you quietly submit to. Even to the point of extinction.

-

Cid_Yama - Light Sweet Crude

- Posts: 7169

- Joined: Sun 27 May 2007, 03:00:00

- Location: The Post Peak Oil Historian

The Demand Destruction Thread Pt. 3

Given that it looks to me as if 2014 might be the year when we have to finally face price rationing I looked around for a Demand Destruction thread and this is the one I found.

We have done a hundred or so variations on the theme like the recent how much can you pay for a gallon of fuel thread, but demand destruction is a fundamentally simple concept with a complex result.

It isn't just how much you pay for fuel, it is how much you consume of everything else being limited by how much fuel you have to buy no matter what the cost. Heating in the winter is not optional for much of North America and Europe. Even if you are using cheap natural gas it isn't free, and if you are using Propane or Fuel Oil it is increasingly expensive. The more you spend on fuel the less you spend on everything else, and even worse the more everything else costs because somewhere along the line it is shipped too you with increasingly expensive fuel.

We have done a hundred or so variations on the theme like the recent how much can you pay for a gallon of fuel thread, but demand destruction is a fundamentally simple concept with a complex result.

It isn't just how much you pay for fuel, it is how much you consume of everything else being limited by how much fuel you have to buy no matter what the cost. Heating in the winter is not optional for much of North America and Europe. Even if you are using cheap natural gas it isn't free, and if you are using Propane or Fuel Oil it is increasingly expensive. The more you spend on fuel the less you spend on everything else, and even worse the more everything else costs because somewhere along the line it is shipped too you with increasingly expensive fuel.

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

- Tanada

- Site Admin

- Posts: 17094

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: Demand destruction: the flip side to the oil argument

Demand destruction is related to disposable income, when fuel costs were at an all time low (relative to income) many people started to spend the "extra" disposable income on more expensive housing and greater commutes. After the 50% drop in house prices (Rural Ireland) and with fuel prices effectively stuck at a high but stable level, the few who are buying rural houses now will have more of their income available after buying fuel than the previous generation.

Demand destruction will really only affect those who splashed out during the "Celtic Tiger" years and still have the big SUV and overpriced house in the country, many can't really afford to downsize as they'll still end up paying back the loans on stuff that lost about half of its of value. When they do eventually clear the loan, they'll still never get back what they paid for the house.

Fuel consumption in Ireland has already shown "demand destruction" in progress, it has dropped some 25% since the peak of the boom years.

Demand destruction will really only affect those who splashed out during the "Celtic Tiger" years and still have the big SUV and overpriced house in the country, many can't really afford to downsize as they'll still end up paying back the loans on stuff that lost about half of its of value. When they do eventually clear the loan, they'll still never get back what they paid for the house.

Fuel consumption in Ireland has already shown "demand destruction" in progress, it has dropped some 25% since the peak of the boom years.

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: Demand destruction: the flip side to the oil argument

With the economy being what it is and the unemployment being what it is a lot of that disposable income has already left the market, at least in the midwest USA.

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

- Tanada

- Site Admin

- Posts: 17094

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: Demand destruction: the flip side to the oil argument

Actually I think demand will return some this year.

Right now home values have risen tremendously in the hardest hit areas as the vultures have swooped in and bought up the foreclosures. Lots of folks will get their head out of the water enough to be able to sell, that will free up lots of cash.

The equity market rose 24% in 2013 . . Bonds will rise on the Taper (bad if you are holding but good if you want to get some interest on your savings) . . GDP (FWIW) rose over 4% 3rd qtr, Consumer confidence is bound to rise I think, ditto faith in government after one of the least productive congresses ever, "uncertainty" is going to be passé so businesses won't have that excuse anymore - even Ted Cruz gave up on killing government for the time being

I think oil can rise some, if it doesn't move too fast, and folks will start to use a little more. That's the key, it has to move slow enough folks can cope. But of course there isn't much spare capacity to allow it to rise slowly unless Libya/Iran/Sudan/Nigeria loosen up some. US LTO might help a little next year but not too much.

My outrageous forecast is things look really peachy early next year and everyone gets into a feel good groove and demand creeps up and up and then *wham* spare capacity tanks, the price zooms up and dashes all their hopes for happy motoring! BWAHAHAHAHA!

Or maybe something slightly less dramatic, LOL

Right now home values have risen tremendously in the hardest hit areas as the vultures have swooped in and bought up the foreclosures. Lots of folks will get their head out of the water enough to be able to sell, that will free up lots of cash.

The equity market rose 24% in 2013 . . Bonds will rise on the Taper (bad if you are holding but good if you want to get some interest on your savings) . . GDP (FWIW) rose over 4% 3rd qtr, Consumer confidence is bound to rise I think, ditto faith in government after one of the least productive congresses ever, "uncertainty" is going to be passé so businesses won't have that excuse anymore - even Ted Cruz gave up on killing government for the time being

I think oil can rise some, if it doesn't move too fast, and folks will start to use a little more. That's the key, it has to move slow enough folks can cope. But of course there isn't much spare capacity to allow it to rise slowly unless Libya/Iran/Sudan/Nigeria loosen up some. US LTO might help a little next year but not too much.

My outrageous forecast is things look really peachy early next year and everyone gets into a feel good groove and demand creeps up and up and then *wham* spare capacity tanks, the price zooms up and dashes all their hopes for happy motoring! BWAHAHAHAHA!

Or maybe something slightly less dramatic, LOL

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Demand destruction: the flip side to the oil argument

$this->bbcode_second_pass_quote('', 'N')ow we hear nothing from the Kingdom.

I don't think that is true as they added barrels when Libya was taken out of the equation and when Iran was sanctioned.

Their stated spare capacity is around 12 MMbbl/d which is precisely where they predicted back then in 2006 when they first started to work on the mega-projects.

As I've said for a long time they are caught between a rock and a hard place. If the price goes too low they don't have enough income to satisfy internal developments that keep the masses happy, if it goes too high it risks a demand collapse. I believe the Saudis have learned that it is better to work quietly in the background to achieve their goals rather than broadcast them which gives the traders all sorts of reason to screw around.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Demand destruction: the flip side to the oil argument

Seems like the Saudis have run out of megaprojects to take out of mothball status - after Haradh, Manifa, Kurais, what's left in the way of aces in holes for them? There's always more EOR etc I suppose. Or addressing their own demand issues, the way things are going they won't have any oil left to export in 15 years or so, which doesn't seem like quite the eternity it used to. With such secular (long-term) issues they have a long long time to try and come up with solutions though, while still living like Kings with a Capital K and placating their populace with $.015/gal gasoline etc.

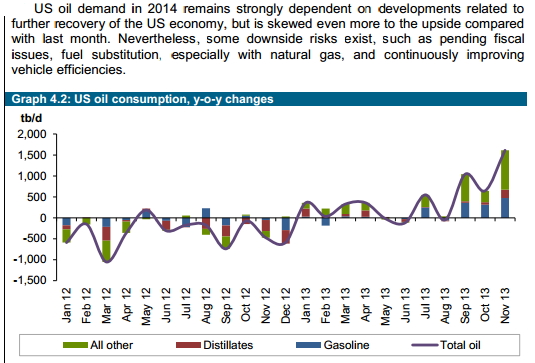

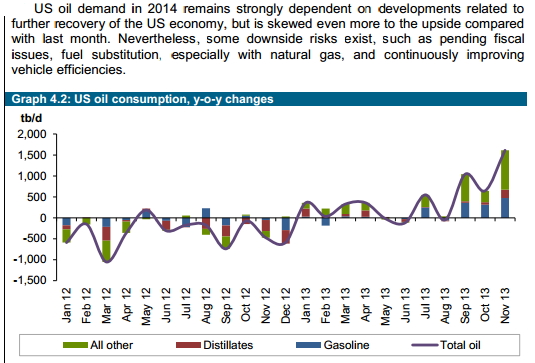

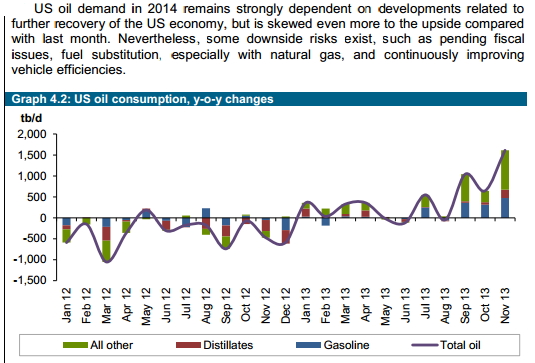

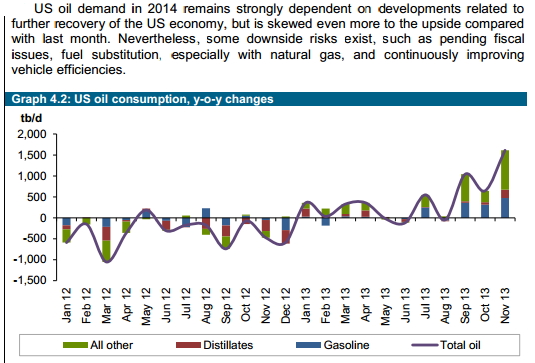

Regarding the US, yes, we are back to our old demand shenanigans:

Which isn't good for those forecasts that projected decades of never-ending air being taken out of the ODEC's demand needs while the BRICs etc gobble more and more, with some kind of bumpy stasis as a result.

I've always looked to the past for clues to the future - what else is there to do? After prices hit the local ceiling in 1981 demand slowly trended down before prices went through the floor in 1986. Substitute 2008 for 1981 and 2013 for 1986 and you don't get the same result at all, notice. Or anything like the same profiles demand/supply wise, either.

Regarding the US, yes, we are back to our old demand shenanigans:

Which isn't good for those forecasts that projected decades of never-ending air being taken out of the ODEC's demand needs while the BRICs etc gobble more and more, with some kind of bumpy stasis as a result.

I've always looked to the past for clues to the future - what else is there to do? After prices hit the local ceiling in 1981 demand slowly trended down before prices went through the floor in 1986. Substitute 2008 for 1981 and 2013 for 1986 and you don't get the same result at all, notice. Or anything like the same profiles demand/supply wise, either.

Cogito, ergo non satis bibivi

And let me tell you something: I dig your work.

And let me tell you something: I dig your work.

-

TheDude - Expert

- Posts: 4896

- Joined: Thu 06 Apr 2006, 03:00:00

- Location: 3 miles NW of Champoeg, Republic of Cascadia

Re: Demand destruction: the flip side to the oil argument

Related:

http://ourfiniteworld.com/2013/04/11/pe ... e-problem/

i.e., demand destruction for EU, US, and Japan, but increasing oil consumption for the rest of the world.

http://ourfiniteworld.com/2013/04/11/pe ... e-problem/

i.e., demand destruction for EU, US, and Japan, but increasing oil consumption for the rest of the world.

-

ralfy - Light Sweet Crude

- Posts: 5651

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Re: Demand destruction: the flip side to the oil argument

$this->bbcode_second_pass_quote('TheDude', 'S')eems like the Saudis have run out of megaprojects to take out of mothball status - after Haradh, Manifa, Kurais, what's left in the way of aces in holes for them? There's always more EOR etc I suppose. Or addressing their own demand issues, the way things are going they won't have any oil left to export in 15 years or so, which doesn't seem like quite the eternity it used to. With such secular (long-term) issues they have a long long time to try and come up with solutions though, while still living like Kings with a Capital K and placating their populace with $.015/gal gasoline etc.

Regarding the US, yes, we are back to our old demand shenanigans:

Which isn't good for those forecasts that projected decades of never-ending air being taken out of the ODEC's demand needs while the BRICs etc gobble more and more, with some kind of bumpy stasis as a result.

I've always looked to the past for clues to the future - what else is there to do? After prices hit the local ceiling in 1981 demand slowly trended down before prices went through the floor in 1986. Substitute 2008 for 1981 and 2013 for 1986 and you don't get the same result at all, notice. Or anything like the same profiles demand/supply wise, either.

Regarding the US, yes, we are back to our old demand shenanigans:

Which isn't good for those forecasts that projected decades of never-ending air being taken out of the ODEC's demand needs while the BRICs etc gobble more and more, with some kind of bumpy stasis as a result.

I've always looked to the past for clues to the future - what else is there to do? After prices hit the local ceiling in 1981 demand slowly trended down before prices went through the floor in 1986. Substitute 2008 for 1981 and 2013 for 1986 and you don't get the same result at all, notice. Or anything like the same profiles demand/supply wise, either.

Nice graph. The thing that surprises me is the number of 'analysts' who crow about Libya or Iran coming back into the market increasing supply but ignore the fact that KSA likes prices where they are so they are motivated to produce less and offset those increases from Iran/ Libya/ Angola/ wherever.

Even if KSA can cut back 1 or 2 MMbbl/d as others come into the market to get a little spare capacity how much does it change the 2014 outlook? China's import demand growth is going to soak up a lot of world oil supply. Pretending otherwise is IMO extremely short sighted.

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

- Tanada

- Site Admin

- Posts: 17094

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA