by Pops » Sun 28 Jul 2013, 08:56:20

by Pops » Sun 28 Jul 2013, 08:56:20

I still haven't read Leo's entire paper but here are the high points:

It doesn't seem to be quite as effusive as his last, it even has a special section titled U.S. will Still Import Oil (for Diane Sawyer US news reader who reported on the last version saying we'd be the largest Exporter, lol))

Here is his assessment of well decline

$this->bbcode_second_pass_quote('', 'T')rue, like for shale gas, shale oil wells exhibit their peak production rates during the first weeks of operation, generally referred to as initial production during the first 30 days, or IP30. Eventually, they register 40–50 percent lower rates by the end of the first year of production and a further 30–40 percent decline rate by the end of the second year. To date, wells with longer observed production histories of 5–6 years reveal average production rates flattening by about more than 10 percent of IP30 after the fifth year.

The other thing that stands out is the idea the US is particularly suited for the drilling intensity shale production requires and what success we have will be hard to duplicate elsewhere - something rocdoc and others talked about.

Oh i found a summary,

$this->bbcode_second_pass_quote('', 'I')ncreased Shale Oil Production may Significantly Alter the U.S. Energy Outlook: The United States may produce five million barrels of shale oil per day by 2017 and may become the largest global oil producer with up to 16 million barrels of oil (shale, conventional, LNG, and biofuels) per day in just a few years.

U.S. Shale Oil Production has Unique Characteristics: The nature of shale oil production makes it particularly suited for the United States’ industrial, financial, demographic, and geologic landscape. These same characteristics make the expansion of the shale phenomenon to other parts of the world improbable – at least in the short term.

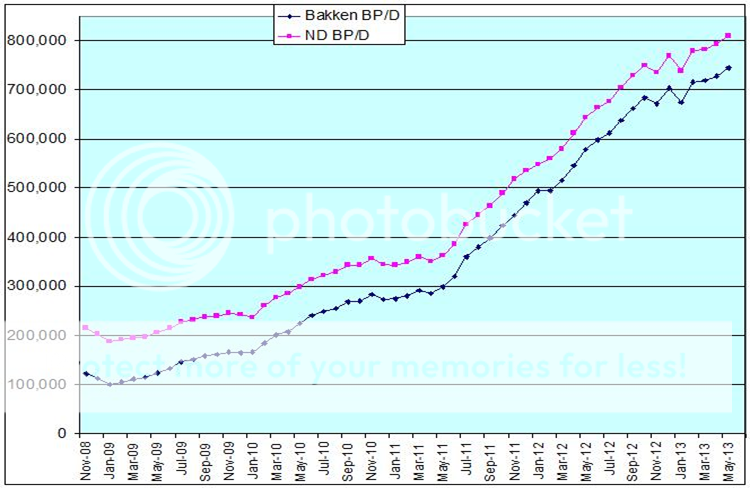

Sustained Shale Oil Production Requires Dramatic Drilling Intensity: No other country in the world has ever experienced even a fraction of the overall U.S. drilling intensity for oil and gas. Shale oil wells exhibit their peak production rates during the first weeks of operation then dramatically decline. Oil companies intensively drill for new wells that offset the loss of production from older wells.

Production will be Price Sensitive: There are two scenarios depending on oil prices: If the price of oil holds steady or slightly decreases, production could still reach 5mbd by 2017; if the oil price drops to below $65 per barrel, production could drop off substantially.

The U.S. will Still Import Oil from the Middle East: Conventional wisdom says that if the United States drops its oil imports to 25 percent of demand, the oil will come from North American sources. This scenario is price dependent. If the marginal price of oil drops, the cheapest oil will be from the Middle East, and oil from Venezuela and Canada will be more expensive.