Peak oil is approaching

Peak oil is approaching

Peak oil is approaching

$this->bbcode_second_pass_quote('', '�')��By 2030, the growth in fossil fuel use will almost have stopped,” Bloomberg New Energy Finance founder Michael Liebreich told renewable-energy investors at the BNEF 2013 annual summit in New York last month.

The concept of “peak oil”, coined by a Shell Oil geologist named M. King Hubbert, implies that world oil production will plateau and decline, and hence cause prices to sky rocket, as less oil is supplied while demand increase. Recent research shows that we might experience the opposite scenario; demand peaks and decreases gradually as new forms of renewable energy becomes increasingly more available.

There are several factors pointing towards the new “peak oil” situation according to Seth M. Kleinman, a Citi Commodities Researcher. “Higher [oil] prices, the removal of many fuel subsidies and rising fuel economy mandates have dramatically improved the outlook for fuel efficiency in global automotive and truck fleets. [In combination with an] accelerating push to substitute natural gas for oil and ongoing improvements in fuel economy is enough to mean that oil demand growth may be topping out much sooner than the market expects”, Kleinman states in a recent report, and in this manner supports Liebreich’s view.

The Boston Company Asset Management’s recent analysis concluded that “consumers are finally thinking about consumption and exhibiting price-elastic behavior.” Meaning that price and consumption have become more closely coupled than the previously almost price inelastic consumer behavior towards oil, reported by IMF in 2011.

«These reports confirm what we have been stressing for years”, says Ina Bjørnrå from Young Friends of the Earth Norway. “Drilling for oil in the Arctic is a short-term race for short-term profits, as we in the near future we will see an energy revolution transitioning the world’s energy demands from fossil fuels to renewable energy sources. Arctic drilling is a crucial misinvestment,” she argues.

$this->bbcode_second_pass_quote('', '�')��By 2030, the growth in fossil fuel use will almost have stopped,” Bloomberg New Energy Finance founder Michael Liebreich told renewable-energy investors at the BNEF 2013 annual summit in New York last month.

The concept of “peak oil”, coined by a Shell Oil geologist named M. King Hubbert, implies that world oil production will plateau and decline, and hence cause prices to sky rocket, as less oil is supplied while demand increase. Recent research shows that we might experience the opposite scenario; demand peaks and decreases gradually as new forms of renewable energy becomes increasingly more available.

There are several factors pointing towards the new “peak oil” situation according to Seth M. Kleinman, a Citi Commodities Researcher. “Higher [oil] prices, the removal of many fuel subsidies and rising fuel economy mandates have dramatically improved the outlook for fuel efficiency in global automotive and truck fleets. [In combination with an] accelerating push to substitute natural gas for oil and ongoing improvements in fuel economy is enough to mean that oil demand growth may be topping out much sooner than the market expects”, Kleinman states in a recent report, and in this manner supports Liebreich’s view.

The Boston Company Asset Management’s recent analysis concluded that “consumers are finally thinking about consumption and exhibiting price-elastic behavior.” Meaning that price and consumption have become more closely coupled than the previously almost price inelastic consumer behavior towards oil, reported by IMF in 2011.

«These reports confirm what we have been stressing for years”, says Ina Bjørnrå from Young Friends of the Earth Norway. “Drilling for oil in the Arctic is a short-term race for short-term profits, as we in the near future we will see an energy revolution transitioning the world’s energy demands from fossil fuels to renewable energy sources. Arctic drilling is a crucial misinvestment,” she argues.

barentsobserver

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: Peak oil is approaching

$this->bbcode_second_pass_quote('Graeme', '[')b]Peak oil is approaching$this->bbcode_second_pass_quote('', 'T')here are several factors pointing towards the new “peak oil” situation according to Seth M. Kleinman, a Citi Commodities Researcher. “Higher [oil] prices ...

Facebook knows you're a dog.

-

Keith_McClary - Light Sweet Crude

- Posts: 7344

- Joined: Wed 21 Jul 2004, 03:00:00

- Location: Suburban tar sands

Re: Peak oil is approaching

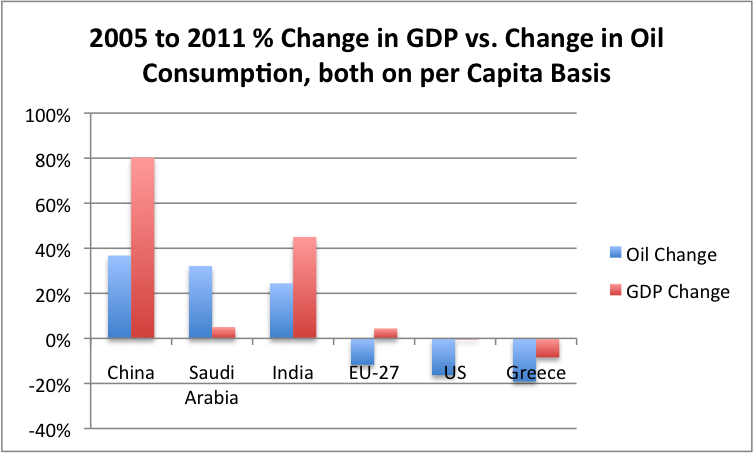

Graeme – Interesting perspective. Though titled “peak oil” the discussion seems more about peak consumption and price induced demand destruction. Which does obviously relate to PO on some levels: the world can’t produce more than the consumers can afford to buy regardless of the max rate oil could be achieved. Consider how much folks make of the recent increase in US oil production thanks to the priced induced drilling of the unconventional reservoirs. But in reality US oil consumption, on a PER CAPITA basis has been on a fairly steady plateau for more than 20 years. And recently even absolute consumption has declined a bit. The increase in US oil production hasn’t improved the conditions for US consumption but just replaced a portion of the imported oil. Demand destruction, both involuntary price induced consumption decrease as well as voluntary improved efficiency, has actually lead to peak in US oil requirements. The increased US oil production doesn’t appear to have provided much direct benefit to the overall economy except for a reduction in our trade deficit. It has certainly improved my economic wellbeing and that of my brothers. But for most everyone else…not so much.

Which may be part of the reason why our economic “recovery” is somewhat lacking in the opinion of many despite the fact that we’re experiencing the first domestic oil boom we’ve seen in many years. That does make one wonder why many folks (outside of the oil patch) appear so gleeful.

Which may be part of the reason why our economic “recovery” is somewhat lacking in the opinion of many despite the fact that we’re experiencing the first domestic oil boom we’ve seen in many years. That does make one wonder why many folks (outside of the oil patch) appear so gleeful.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Peak oil is approaching

$this->bbcode_second_pass_quote('Graeme', 'R')ecent research shows that we might experience the opposite scenario; demand peaks and decreases gradually as new forms of renewable energy becomes increasingly more available.

This is demonstrably wrong and it doesn't matter how much PR fluff you repost it will remain wrong.

For people in the bottom half of the economy, food and gas are between 20% & 50% of expenditures – gasoline alone is 4% to 10%.

Renewable energy has NOT replaced their FF energy use and if the glut of nat. gas from the land rush hadn't depressed prices they'd be using even less.

Because they are PRICED out of the market...

No Unicorns in sight, Graeme, the only thing renewable here is a bank trying to make a buck from thin air.

Really, the more of their sales pitches you post the more you perpetuate the idea that everything will be fine and we as individuals have no responsibility and should just keep on consuming because after all "they'll" think of something. You might as well join shorty and just deny the whole situation.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Saudi is not just increasing population but per capita consumption and for little GDP gain.

Saudi is not just increasing population but per capita consumption and for little GDP gain.