by kublikhan » Fri 04 Jan 2013, 12:26:07

by kublikhan » Fri 04 Jan 2013, 12:26:07

$this->bbcode_second_pass_quote('rockdoc123', '')$this->bbcode_second_pass_quote('MrEnergyCzar', 'S')ince we peaked globally over 50 years ago, of the good stuff, shouldn't there be some sort of multiplier to discount the poor resource discoveries i.e. oil in shale rock, Tar oil etc..? Is there an adjusted discovery graph to reflect this discounting?

simply put it is price. The reason unconventionals became economic was due to dwindling ready supply of cheaper conventionals and resultant price rises. An interesting bit of trivia in this regard, however, is that certain unconventionals are now cheaper to extract than remaining conventionals (eg: liquid rich shale gas versus deepwater GOM gas).

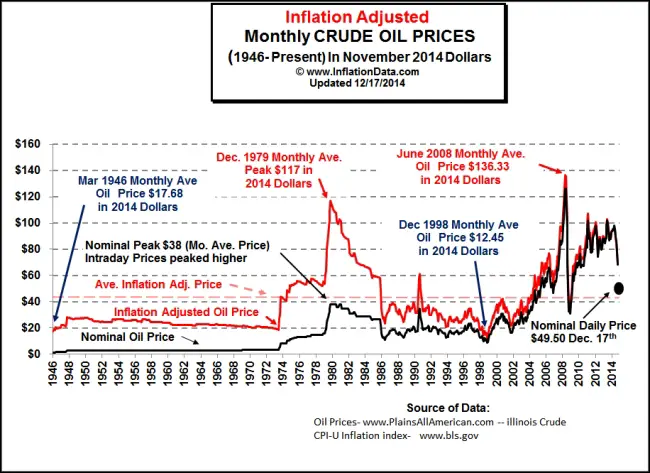

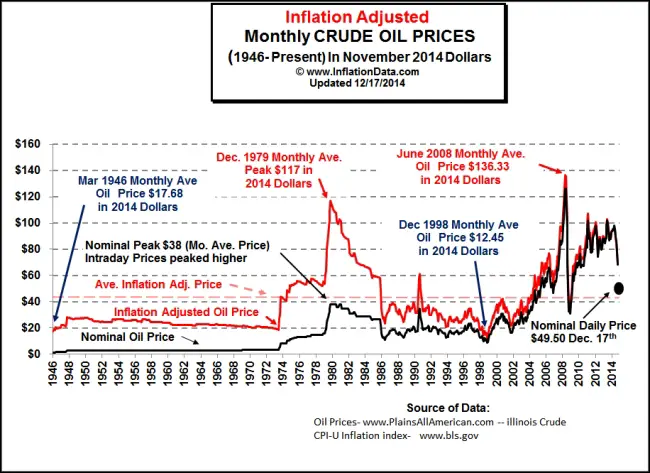

This is a good suggestion. Price is a good metric to look at as it captures many factors. Notice how much higher the price of oil is today compared to historically. This is a good indication how much more difficult it is today to get at the oil.

The oil barrel is half-full.

by kublikhan » Fri 04 Jan 2013, 12:30:27

by kublikhan » Fri 04 Jan 2013, 12:30:27

$this->bbcode_second_pass_quote('Quinny', 'I')t's way beyond me (most things are), but I agree that a 'net' useful energy figure would be useful to help understand what's happening. I know someone's bound to scream that this is built into pricing, but IMO that is not a direct enough link.

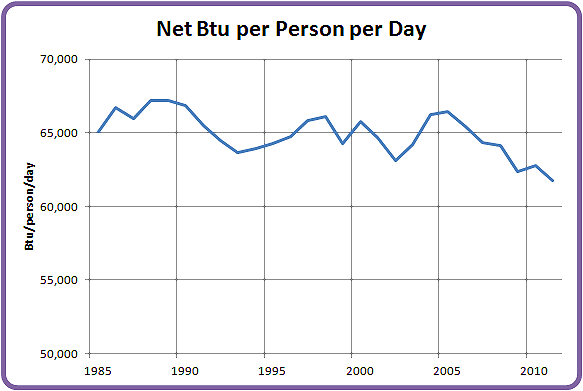

Even if it could be done historically on actual production data it'd be interesting. It may even show us already on the downslope if EROEI is taken into account.

Here's the best post I found thus far on net energy:

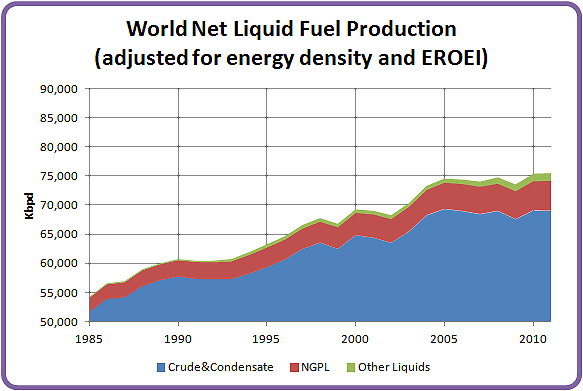

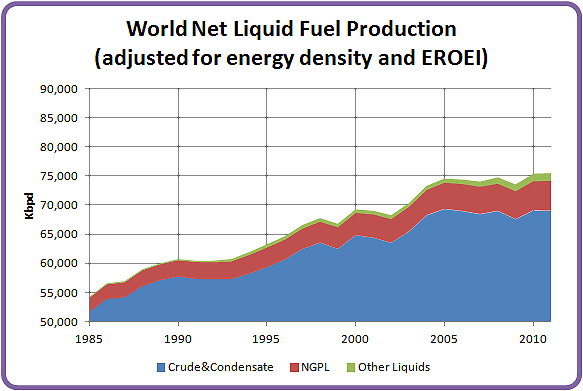

$this->bbcode_second_pass_quote('GliderGuider', 'I') took your suggestion and used the new EIA data to make the following graphs.

I used these assumptions:

C&C yields 5.9 MBTU/bbl;

NGPL yields 3.8 MBTU/bbl;

Other Liquids yields 4.0 MBTU/bbl;

EROEI declines linearly from 25:1 in 1980 to 15:1 in 2011.

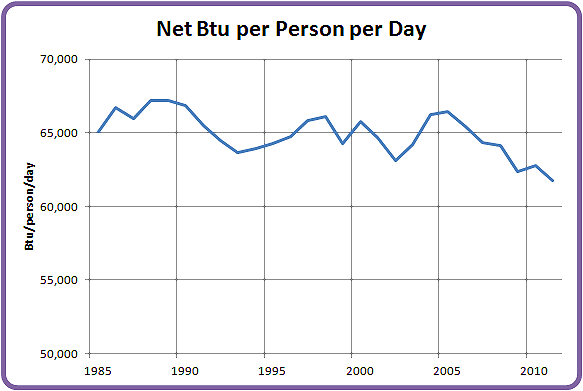

The story is quite clear: net energy from liquid fuels plateaued in 2005, and net energy per capita has been dropping rapidly ever since.

The original data was provided by the EIA. Total Oil Supply, World: International Energy Statistics

The numbers were then adjusted based on their energy content. The EIA also provides data on the heat content of various fuels by year:

Heat ContentFinally, all 3 categories were adjusted based on declining EROEI over time. I am not sure where the author got his EROEI data from, but I don't think it came from the EIA. However it matches up with other estimates I have heard for EROEI. For example:

Fossil Fuels-Energy Return on Energy InvestedYou can see the original EIA data graphed as well as intermediate graphs in the original post:

World Gross Liquid Fuel ProductionOne thing noted in a follow up post is that even though our per capita energy from liquid fuels is dropping, our total per capita energy use is still rising. In other worlds, our declining energy from liquid fuels is more than offset by rising energy from other sources:

$this->bbcode_second_pass_quote('Gail the Actuary', 'G')lider--what you have shown is net energy from oil and other liquids, per capita per day.

Energy use from coal, natural gas and hydroelectric is rising to offset this decline, even on a per capita basis.

This is my image of long-term world per capita energy consumption from my post World Energy Consumption since 1820.

World per Capita Energy use since 1820

The oil barrel is half-full.

by kublikhan » Fri 04 Jan 2013, 12:33:49

by kublikhan » Fri 04 Jan 2013, 12:33:49

$this->bbcode_second_pass_quote('SamInNebraska', '')$this->bbcode_second_pass_quote('pstarr', 'T')he national average price for gas in 2012 was $3.60 per gallon, which is the most expensive annual average on record. The previous annual record was $3.51 a gallon set in 2011, while the third most expensive year for gas prices nationwide was 2008, when the average was $3.25 per gallon. Spot a trend?

Yes. Current prices are going down. And apparently car buyers are noticing as well.

I think you might be drawing the wrong conclusion from that article. The article notes people are migrating to more fuel efficient vehicles. High gasoline prices are encouraging high sales of fuel efficient vehicles.

$this->bbcode_second_pass_quote('', '�')��We were again one of the fastest growing automakers in the country,” Reid Bigland, Chrysler’s head of U.S. sales said in a statement. “Seven of our vehicles recorded their best ever annual sales in 2012 demonstrating how the quality, design and fuel efficiency of our product line up continues to resonate with consumers.”

"Ford finished 2012 strong, with retail sales showing improved strength as more customers returned to dealer showrooms," said Ken Czubay, Ford vice president, U.S. marketing, sales and service. "Ford's fuel-efficient cars and hybrid vehicles showed the most dramatic growth for the year.

Auto industry's 2012 sales$this->bbcode_second_pass_quote('', 'U').S. Automobile sales in August increased by nearly 15 percent over last year, even with gas prices rising at the end of the month to $3.80 a gallon. The New York Times highlighted the trends driving strong vehicle sales:

“Although trucks had a solid month, the small-car performance is what’s most impressive about G.M.’s numbers today” The Ford Motor Company said its August sales increased 12.6 percent, to 196,000 vehicles. It reported its biggest gains in the Focus compact car and the new Escape, its smallest sport utility vehicle. Focus sales were up 35 percent compared with the same period a year earlier, and Escape sales rose 36 percent.

“As fuel prices rose again during August, we saw growing numbers of people gravitate toward our fuel-efficient vehicles,” said Ken Czubay, Ford’s head of United States sales and marketing.

An executive from Chrysler called the U.S. auto market “incredibly resilient” due to the surge in demand for fuel-sipping cars. Chrysler saw a 14.1 percent increase in vehicle sales, partly due to its new compact sedan, the Dodge Dart.

In May, the Congressional Budget Office issued a report concluding that the only way to protect consumers from oil price shocks is to use less petroleum — not more drilling: “Policies that reduced the use of oil and its products would create an incentive for consumers to use less oil or make decisions that reduced their exposure to higher oil prices in the future, such as purchasing more fuel-efficient vehicles or living closer to work.”

The oil barrel is half-full.