by Pops » Wed 22 Aug 2012, 17:19:26

by Pops » Wed 22 Aug 2012, 17:19:26

Hey careinke, I meant to add that when I set the price to 150 you were the one in first place.

--

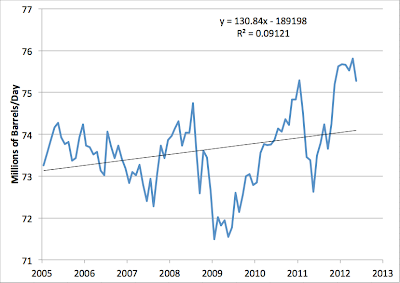

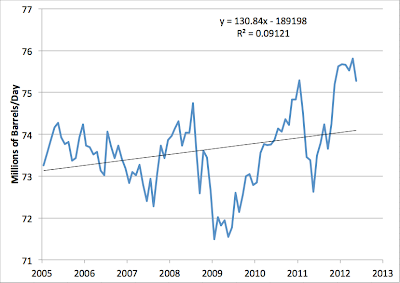

For the price to continue higher like it seems to want to, increasing demand in the poor world would need to continue to more than offset destruction in the rich wouldn't it? I mean we rich worlders seem to be puttering along at a pretty anemic rate, about the same as the All Liquids rate of growth.

On the strength of KSAs latest bump in production, the 7 year trendline of C+C has finally risen from flat to about a .2% per year increase so by the best measure we're not in depletion mode yet. But if you look at each one of the peaks in the chart below of C+C, except for '08 they were exactly that, a one month peak, the anomaly is the last 5 or 6 months at a sustained peak level.

So it will be interesting to see what happens, is the price high enough to keep production up? Can production stay up enough to keep the price in check? Or will the economy fold and crash the price?

I'm gonna guess production is falling right now and that is why the price is rising but I don't think it's gonna rise much more just because the economy everywhere is at a standstill. Obviously big news out of China, EU or the ME will change all that, and too it's the end of the summer and all the bad things happen in the fall...

http://earlywarn.blogspot.com/2012/08/t ... nsate.html

http://earlywarn.blogspot.com/2012/08/t ... nsate.htmlThe legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)