THE 2012 PO.com Oil Price Challenge

Re: THE 2012 PO.com Oil Price Challenge

After the war with Iran begins, you will be sitting pretty Revi.

-

Cog - Fusion

- Posts: 13416

- Joined: Sat 17 May 2008, 03:00:00

- Location: Northern Kekistan

Re: THE 2012 PO.com Oil Price Challenge

Since WTI has drifted down to around $103/bbl, I wonder if this has changed the standings.

-

Cog - Fusion

- Posts: 13416

- Joined: Sat 17 May 2008, 03:00:00

- Location: Northern Kekistan

Re: THE 2012 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('Cog', 'S')ince WTI has drifted down to around $103/bbl, I wonder if this has changed the standings.

We'll have to see what the EIA reports in a few days. As of last week's report, kublikhan was still #1 with the closing price of 107.33 (on the 27th), but if the close stays below 103.5, you'll be #1 for a little while.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: THE 2012 PO.com Oil Price Challenge

Highs--185.00

Lows---100.00

...and I am hyper conservative.

Lows---100.00

...and I am hyper conservative.

- threadbare

- Wood

- Posts: 30

- Joined: Sun 04 Apr 2010, 17:33:17

Re: THE 2012 PO.com Oil Price Challenge

Brent/ Tapis/ WTI spread is huge this year and seems to be staying that way, indicating Cog & Kub's very conservative positions early may well stay out the pack with our more outlandish (& based more on real global pricing perhaps) predictions. So far very well done gentlemen, but there are still 2 turns to run before the final straight!

- SeaGypsy

- Master Prognosticator

- Posts: 9285

- Joined: Wed 04 Feb 2009, 04:00:00

Re: THE 2012 PO.com Oil Price Challenge

Cog was #1 for two days this last week but with the close of $104.01 on April 3, kublikhan retook the lead. There won't be any significant changes until either a new high or a new low is set.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: THE 2012 PO.com Oil Price Challenge

I want all of you to reduce driving as much as possible to bring the prices back down to my sweet spot of $103/bbl.

-

Cog - Fusion

- Posts: 13416

- Joined: Sat 17 May 2008, 03:00:00

- Location: Northern Kekistan

Re: THE 2012 PO.com Oil Price Challenge

Speaking of which, its time for an update and time to shower the new leader with glory and honor.

-

Cog - Fusion

- Posts: 13416

- Joined: Sat 17 May 2008, 03:00:00

- Location: Northern Kekistan

Re: THE 2012 PO.com Oil Price Challenge

Well Cog, you should know by now that the EIA doesn't release their report until Wednesday (and sometimes Thursday if there's a holiday). How can I post a scorecard when the last release date was April 4 and the last reported day by the EIA was the 3rd? We are using the EIA as the reference source after all.

Just a reminder...

Just a reminder...

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: THE 2012 PO.com Oil Price Challenge

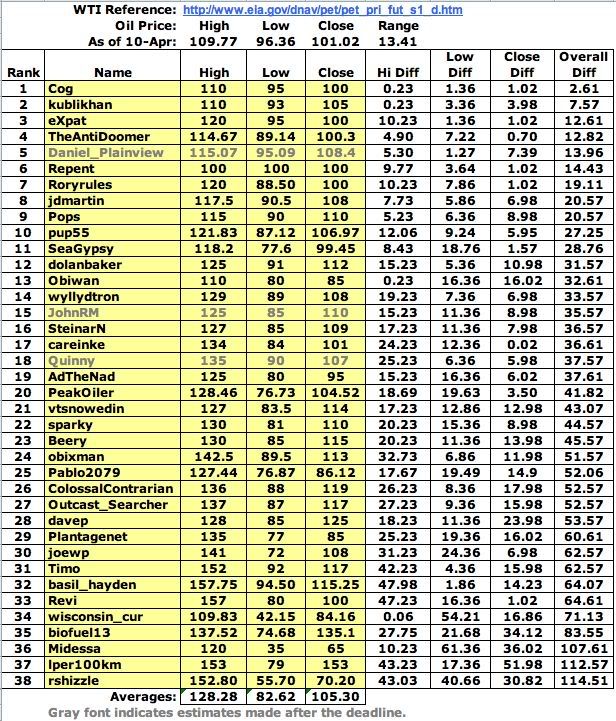

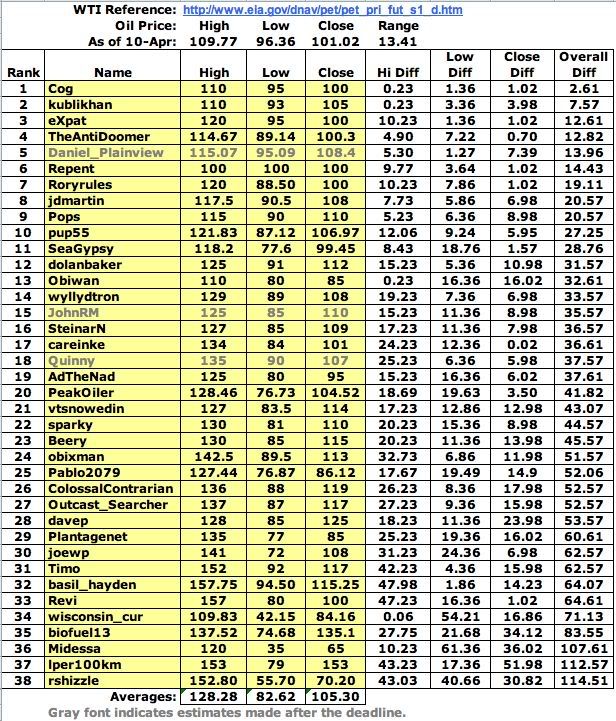

Cog is #1 with yesterday's close:

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: THE 2012 PO.com Oil Price Challenge

I shall enjoy my 15 minutes of fame before sliding back to my usual double digit placing.

Taking kublikhan with me.

Taking kublikhan with me.

-

Cog - Fusion

- Posts: 13416

- Joined: Sat 17 May 2008, 03:00:00

- Location: Northern Kekistan

Re: THE 2012 PO.com Oil Price Challenge

Hang on. How can I be back down at 23? I was creeping up there dammit! Now look at me! It must be the closing price.

Oh closing price, must you be so fickle?

Oh closing price, must you be so fickle?

"I'm gonna have to ask you boys to stop raping our doctor."

- Beery1

- Tar Sands

- Posts: 690

- Joined: Tue 17 Jan 2012, 21:31:15

Re: THE 2012 PO.com Oil Price Challenge

Cog is being coy, with plenty of pace left and barely having touched the stick. It's still anyone's race, but WTI does seem stuck in a much narrower band than other key indices. Unless something happens suddenly to bump the price, it does seem Cog & Kub will race it out.

- SeaGypsy

- Master Prognosticator

- Posts: 9285

- Joined: Wed 04 Feb 2009, 04:00:00

Re: THE 2012 PO.com Oil Price Challenge

Don't forget Seaway is going to be reversed in June. Goldman Sachs is predicting a much narrower WTI-Brent spread after this. We could be seeing those who predicted a higher price take the lead.

$this->bbcode_second_pass_quote('', 'W')TI crude oil may soon cost almost the same as Brent oil prices, a research note by Goldman Sachs states. The WTI-Brent spread, the differential between both these oil prices, had spiked to about $ 20/barrel over the past weeks as WTI prices were depressed from high level of inventories.

Goldman expects that the proposed reversal of the seaway pipeline could solve the problem of WTI inventory buildup, thus forcing the spread to narrow down. The seaway pipeline reversal is due on June 01, 2012 and when that happens, Goldman projects that the WTI-Brent spread could narrow to $ 5/barrel by the end of 2012.

Brent WTI oil prices will come closer in H2 2012: Goldman Sachs$this->bbcode_second_pass_quote('', 'W')TI crude oil may soon cost almost the same as Brent oil prices, a research note by Goldman Sachs states. The WTI-Brent spread, the differential between both these oil prices, had spiked to about $ 20/barrel over the past weeks as WTI prices were depressed from high level of inventories.

Goldman expects that the proposed reversal of the seaway pipeline could solve the problem of WTI inventory buildup, thus forcing the spread to narrow down. The seaway pipeline reversal is due on June 01, 2012 and when that happens, Goldman projects that the WTI-Brent spread could narrow to $ 5/barrel by the end of 2012.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5064

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: THE 2012 PO.com Oil Price Challenge

Well I had managed to scratch my way to 4th place, then backslid to 8th. I guess that's good news, as it means oil is declining in price!

After fueling up their cars, Twyman says they bowed their heads and asked God for cheaper gas.There was no immediate answer, but he says other motorists joined in and the service station owner didn't run them off.

-

jdmartin - Heavy Crude

- Posts: 1272

- Joined: Thu 19 May 2005, 03:00:00

- Location: Merry Ol' USA

Re: THE 2012 PO.com Oil Price Challenge

I am just about ready to concede! Early as it is in the year still, it seems Cog and Kub were on the money predicting some stability emerging in 'post peak/ plateau new normal'. Anything could still happen; I was expecting the volatility of the last couple of years to continue/ looks like I am going to be hobbled this year.

- SeaGypsy

- Master Prognosticator

- Posts: 9285

- Joined: Wed 04 Feb 2009, 04:00:00

Re: THE 2012 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('SeaGypsy', 'I') am just about ready to concede! Early as it is in the year still, it seems Cog and Kub were on the money predicting some stability emerging in 'post peak/ plateau new normal'. Anything could still happen; I was expecting the volatility of the last couple of years to continue/ looks like I am going to be hobbled this year.

We're not yet halfway through the year, a lot could still happen. I agree though that this is shaping up to be a fairly stable year with any increase in oil demand largely being met through higher production and vice versa. As such, short of a major geopolitical upset or economic shock I doubt we'll see any substantial swings in oil prices this year.

- Roryrules

- Peat

- Posts: 75

- Joined: Sun 08 Jan 2012, 13:26:38

Re: THE 2012 PO.com Oil Price Challenge

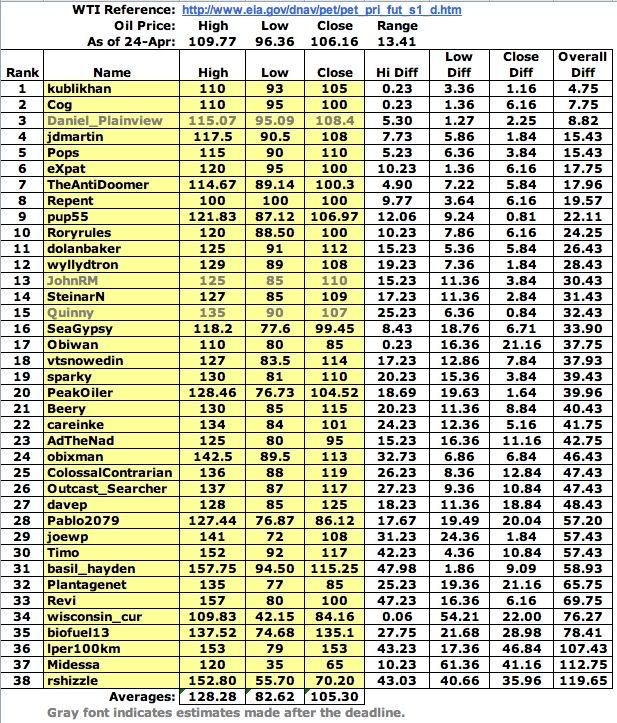

No need to post another scorecard yet. There have been no significant changes with the lack of volatility in the price range this year. So far.

Below shows the leaders percentage of the time they held the #1 spot so far in this slow motion race:

Repent_________34/79_43%

Kublikhan_______29/79_37%

Cog____________13/79_16%

Daniel_Plainview_3/79_4%

The EIA have reported WTI price data for 79 days this year.

Kublikhan and Cog have their stirrups (and/or perhaps other tack) tangled up! They'll be neck and neck till the end...

Kublikhan retook the #1 spot as of 4/24/12, btw.

It will be interesting to see what happens to the WTI price once the Seaway pipeline(s) are serving the Gulf Coast in just a few weeks, especially by the end of the year.

Below shows the leaders percentage of the time they held the #1 spot so far in this slow motion race:

Repent_________34/79_43%

Kublikhan_______29/79_37%

Cog____________13/79_16%

Daniel_Plainview_3/79_4%

The EIA have reported WTI price data for 79 days this year.

Kublikhan and Cog have their stirrups (and/or perhaps other tack) tangled up! They'll be neck and neck till the end...

Kublikhan retook the #1 spot as of 4/24/12, btw.

It will be interesting to see what happens to the WTI price once the Seaway pipeline(s) are serving the Gulf Coast in just a few weeks, especially by the end of the year.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: THE 2012 PO.com Oil Price Challenge

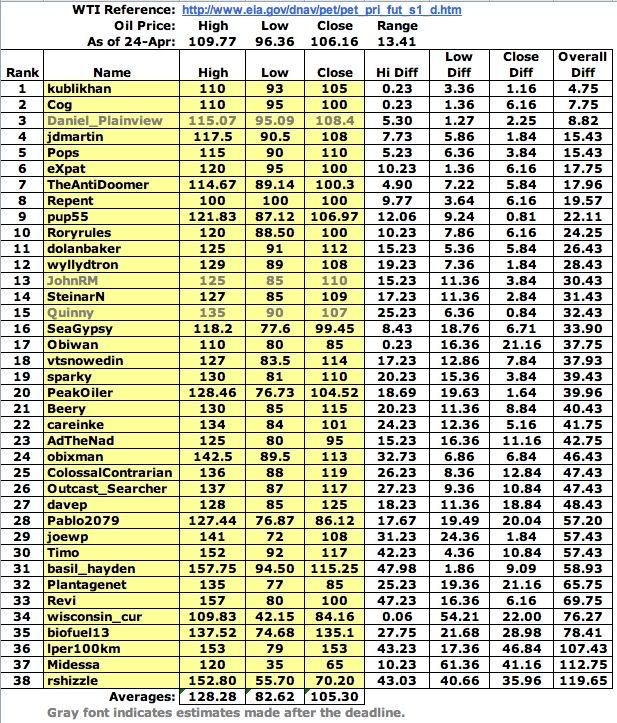

The latest scorecard:

Edit: Oops. I forgot to change the date. The scorecard should read "As of May 1st".

Edit: Oops. I forgot to change the date. The scorecard should read "As of May 1st".

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: THE 2012 PO.com Oil Price Challenge

I'm glad to see that my 33rd place is holding. I'm not ready to concede defeat yet.

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Who is online

Users browsing this forum: No registered users and 0 guests