The 2011 PO.com Oil Price Challenge

Re: The 2011 PO.com Oil Price Challenge

Today I learned that the EIA does give price data for Brent crude.

http://www.eia.gov/dnav/pet/pet_pri_spt_s1_d.htm

The data are given in an Excel workbook which can be downloaded. So perhaps next year the game can be based on Brent spot prices.

Opinions?

http://www.eia.gov/dnav/pet/pet_pri_spt_s1_d.htm

The data are given in an Excel workbook which can be downloaded. So perhaps next year the game can be based on Brent spot prices.

Opinions?

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

Nope, why choose a specific regional price?

The point is global pricing as peak oil is a global issue.

Singapore exchange is the closest to me, the West Texas could be closest to more posters than any other.

The point is global pricing as peak oil is a global issue.

Singapore exchange is the closest to me, the West Texas could be closest to more posters than any other.

- SeaGypsy

- Master Prognosticator

- Posts: 9285

- Joined: Wed 04 Feb 2009, 04:00:00

Re: The 2011 PO.com Oil Price Challenge

Another thing about using the Brent reference that I posted above is that it gives spot prices instead of contract prices.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

So the difference being? We all know tankers full of oil are being bought in real time to sit and wait for a price bump, so physical oil aint much different to paper nowdays. Paper just stores longer cheaper.

- SeaGypsy

- Master Prognosticator

- Posts: 9285

- Joined: Wed 04 Feb 2009, 04:00:00

Re: The 2011 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('SeaGypsy', 'N')ope, why choose a specific regional price?

The point is global pricing as peak oil is a global issue.

Singapore exchange is the closest to me, the West Texas could be closest to more posters than any other.

The point is global pricing as peak oil is a global issue.

Singapore exchange is the closest to me, the West Texas could be closest to more posters than any other.

I think the point is that WTI is essentially land locked leading to a large differential between it and other regional prices, and so isn't really reflecting the world oil price.

- AdTheNad

- Coal

- Posts: 433

- Joined: Wed 22 Dec 2010, 07:47:48

Re: The 2011 PO.com Oil Price Challenge

Actually WTI is the more "regional" price since it is the price of crude at (for the moment) landlocked Cushing, OK and is vulnerable to all sorts of infrastructure and local supply and demand effects that have nothing to do with the global market. Even Louisiana Light Sweet trades more in line with OPECs basket price and Brent than it does with WTI.

But really, it makes no difference, it's just a game.

http://www.energyandcapital.com/article ... crude/1282

http://seekingalpha.com/article/249307- ... ic-factors

http://blogs.wsj.com/marketbeat/2011/06 ... est-texas/

But really, it makes no difference, it's just a game.

http://www.energyandcapital.com/article ... crude/1282

http://seekingalpha.com/article/249307- ... ic-factors

http://blogs.wsj.com/marketbeat/2011/06 ... est-texas/

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: The 2011 PO.com Oil Price Challenge

The main reason I want to stick with WTI is it's what is in the news every day around the world. It's what I grew up watching and people don't have to go digging around the net to find it. Pretty much every newspaper I have ever seen anywhere in 3 trips around the world has the WTI price on a day by day basis.

To my mind, this is enough argument to stick with it. The site should as much as possible reflect common awareness, rather than appealing to specialists.

IMHO.

To my mind, this is enough argument to stick with it. The site should as much as possible reflect common awareness, rather than appealing to specialists.

IMHO.

- SeaGypsy

- Master Prognosticator

- Posts: 9285

- Joined: Wed 04 Feb 2009, 04:00:00

Re: The 2011 PO.com Oil Price Challenge

We should stick with WTI because, WEST TEXAS! I mean really, if we go to Brent, then what? We'll have a talking gecko with a cockney accent saying "sorry guvna, but ere's no updates available right now, tea time innit" that's what. We don't want that do we?

Just kidding, whatever is fine with me.

Just kidding, whatever is fine with me.

-

Midessa - Wood

- Posts: 21

- Joined: Thu 12 Jun 2008, 03:00:00

- Location: Midland/Odessa Texas

Re: The 2011 PO.com Oil Price Challenge

I prefer staying with WTI as well. But anyone can start a spinoff game of this thread if they want to keep up with the additional data.

btw, the better sports analogy to the side stats I've posted would be a horse race.

It would be something like this:

"And out of the gates it's Daniel_Plainview and Cog running neck and neck, with OilFinder2, pup55 and TheDude just behind."

"And now, coming out of the first turn the loud fireworks in the Libyan section of the stands has scared the leaders, and it's now no_name and TheDude running neck and neck with Kublikhan, Midessa and PeakOiler not far behind."

"And now TheDude holds a strong lead into the second half of the track, but a tight group is not far behind..."

btw, the better sports analogy to the side stats I've posted would be a horse race.

It would be something like this:

"And out of the gates it's Daniel_Plainview and Cog running neck and neck, with OilFinder2, pup55 and TheDude just behind."

"And now, coming out of the first turn the loud fireworks in the Libyan section of the stands has scared the leaders, and it's now no_name and TheDude running neck and neck with Kublikhan, Midessa and PeakOiler not far behind."

"And now TheDude holds a strong lead into the second half of the track, but a tight group is not far behind..."

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('Midessa', 'W')e should stick with WTI because, WEST TEXAS! I mean really, if we go to Brent, then what? We'll have a talking gecko with a cockney accent saying "sorry guvna, but ere's no updates available right now, tea time innit" that's what. We don't want that do we?

Just kidding, whatever is fine with me.

Just kidding, whatever is fine with me.

Once that pipe to China is in place it'll be the same price anyway, ya know wot a mean!

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: The 2011 PO.com Oil Price Challenge

Hey, we're lookin' good, thanks to the friendly close this week.

The long timers may remember a couple of years ago when we attempted to run a sub-contest where we allowed forecasts in "euros per barrel", which would have been pretty entertaining, but I think only about 2 people entered it, making it marginally worth doing the calculation every week.

Peakoiler has done an excellent job of the thankless and rewardless job of keeping up with the weekly totals in "US Dollars per Barrel of WTI" and simple is good.

I am sure that if a volunteer steps forward next December to keep track of "Ounces of Gold per Barrel of Brent" or whatever other measurement you want, then a few of us will participate, and the winner will get some portion of the love and respect of the people on the forum, which is, after all, what we are about, right?

But, most people understand WTI and US Dollars, and the 45 or so of us who do this every year are having an entertaining year and if I am not mistaken, this tread is one of the more frequently viewed threads every week, so we're doing something right by keeping it low key and simple.

p.s. thanks again to PeakOiler who has diligently followed this every week, and made it all the more fun.

I the laid back judge, give him the six-month "pup55 seal of approval"

The long timers may remember a couple of years ago when we attempted to run a sub-contest where we allowed forecasts in "euros per barrel", which would have been pretty entertaining, but I think only about 2 people entered it, making it marginally worth doing the calculation every week.

Peakoiler has done an excellent job of the thankless and rewardless job of keeping up with the weekly totals in "US Dollars per Barrel of WTI" and simple is good.

I am sure that if a volunteer steps forward next December to keep track of "Ounces of Gold per Barrel of Brent" or whatever other measurement you want, then a few of us will participate, and the winner will get some portion of the love and respect of the people on the forum, which is, after all, what we are about, right?

But, most people understand WTI and US Dollars, and the 45 or so of us who do this every year are having an entertaining year and if I am not mistaken, this tread is one of the more frequently viewed threads every week, so we're doing something right by keeping it low key and simple.

p.s. thanks again to PeakOiler who has diligently followed this every week, and made it all the more fun.

I the laid back judge, give him the six-month "pup55 seal of approval"

-

pup55 - Light Sweet Crude

- Posts: 5249

- Joined: Wed 26 May 2004, 03:00:00

Re: The 2011 PO.com Oil Price Challenge

LOL!

Thanks pup.

Thanks pup.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

I rather see us stick with WTI. I think it's a better indicator overall. We use the most oil, it's on our shores, and it's been used before there even was a Brent indicator.

After fueling up their cars, Twyman says they bowed their heads and asked God for cheaper gas.There was no immediate answer, but he says other motorists joined in and the service station owner didn't run them off.

-

jdmartin - Heavy Crude

- Posts: 1272

- Joined: Thu 19 May 2005, 03:00:00

- Location: Merry Ol' USA

Re: The 2011 PO.com Oil Price Challenge

TheDude still has the #1 spot, and will continue to hold the #1 spot until the closing price gets to $100.25 (or drops back down to ~ $90). At a closing price of $100.25, no_name will tie TheDude, and anything over $100.25, no_name will have the #1 spot until oil reaches a new high price for the year. (i.e. > $113.93)

I haven't estimated who the leaders might be if the price falls less than $90.

I haven't estimated who the leaders might be if the price falls less than $90.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

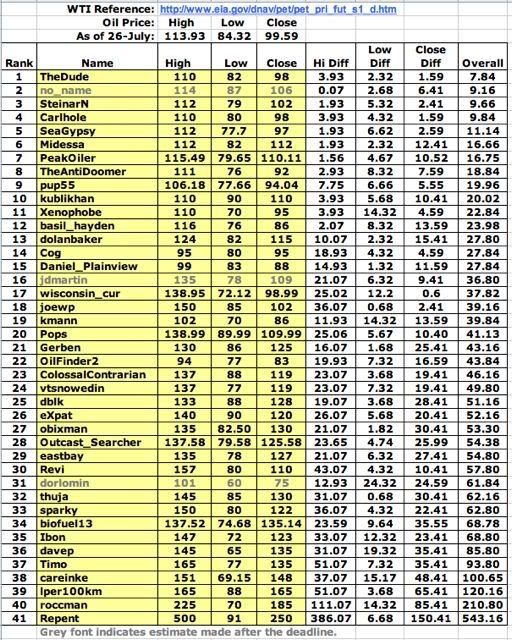

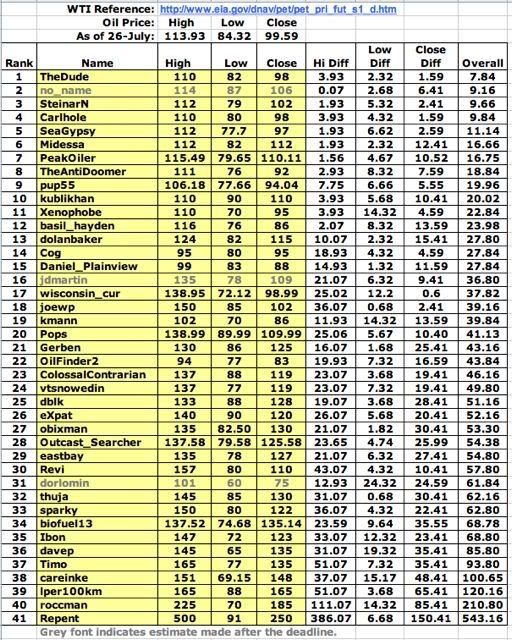

Here's the scorecard as of July 26th:

TheDude has held the #1 spot 40% of the race.

"And as they enter the third turn, TheDude keeps the pace, but with stormy weather on the horizon, no_name, SteinarN, and Carlhole are running neck in neck, and catching up..."

TheDude has held the #1 spot 40% of the race.

"And as they enter the third turn, TheDude keeps the pace, but with stormy weather on the horizon, no_name, SteinarN, and Carlhole are running neck in neck, and catching up..."

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

I didn't price in the SPR release and clearly that is why I'm not #1 and my forecast is off.

/sarc

/sarc

- ColossalContrarian

- Heavy Crude

- Posts: 1374

- Joined: Tue 20 Jun 2006, 03:00:00

Re: The 2011 PO.com Oil Price Challenge

As of today's EIA's report on WTI, TheDude still holds first place, but with the way the price is dropping, we may have a new leader next week. I'll post another scorecard then if there is a change at #1.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

What a lot of people are missing is that the economy, in its weakened condition, is less prone to price spikes than in 2008. Barring some major black swan event, I don't believe that the price can exceed $125 per barrel before the economy begins to recede. As it were, we hit just over $120 per barrel (Brent) and the signals went out that growth was coming to a near-halt. This put downward pressure on prices and, in general, this trend has continued, since then.

On the lower end, though the economy is weak and very fragile, I don't think that there are any more soft spots to be exploited to cause another deep recession like we experienced in 2008. We know what our problems are and despite the reality that there are no easy fixes to them, they cannot very well cause enough panic to drive crude prices anywhere near the depths that we saw after the July '08 spike. Demand is simply too strong, even in weakness, for that.

If I had to make a guess, right now...

High - $125

Low - $80

EOY - $105

On the lower end, though the economy is weak and very fragile, I don't think that there are any more soft spots to be exploited to cause another deep recession like we experienced in 2008. We know what our problems are and despite the reality that there are no easy fixes to them, they cannot very well cause enough panic to drive crude prices anywhere near the depths that we saw after the July '08 spike. Demand is simply too strong, even in weakness, for that.

If I had to make a guess, right now...

High - $125

Low - $80

EOY - $105

"The world is my country, all mankind are my brethren, and to do good is my religion." -- Thomas Paine

-

JohnRM - Peat

- Posts: 152

- Joined: Fri 04 Mar 2011, 01:36:44

- Location: Eastern Pennsylvania

Re: The 2011 PO.com Oil Price Challenge

It appears a new low price for WTI will be set for the year this week. I'll post a new scorecard after the EIA releases their report.

JohnRM: pup55 is the laid back judge of the game and he should decide if you can be added to the list of players. Other readers should voice their opinions as well. Almost seven months past the deadline is pretty late and not really fair to the other players...

JohnRM: pup55 is the laid back judge of the game and he should decide if you can be added to the list of players. Other readers should voice their opinions as well. Almost seven months past the deadline is pretty late and not really fair to the other players...

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('PeakOiler', 'I')t appears a new low price for WTI will be set for the year this week. I'll post a new scorecard after the EIA releases their report.

JohnRM: pup55 is the laid back judge of the game and he should decide if you can be added to the list of players. Other readers should voice their opinions as well. Almost seven months past the deadline is pretty late and not really fair to the other players...

JohnRM: pup55 is the laid back judge of the game and he should decide if you can be added to the list of players. Other readers should voice their opinions as well. Almost seven months past the deadline is pretty late and not really fair to the other players...

Sure, let his guess in, it's as good as he rest but only deserves 5/12ths the respect!

-

basil_hayden - Heavy Crude

- Posts: 1581

- Joined: Mon 08 Aug 2005, 03:00:00

- Location: CT, USA

Who is online

Users browsing this forum: No registered users and 1 guest