by SeaGypsy » Thu 09 Dec 2010, 05:52:32

by SeaGypsy » Thu 09 Dec 2010, 05:52:32

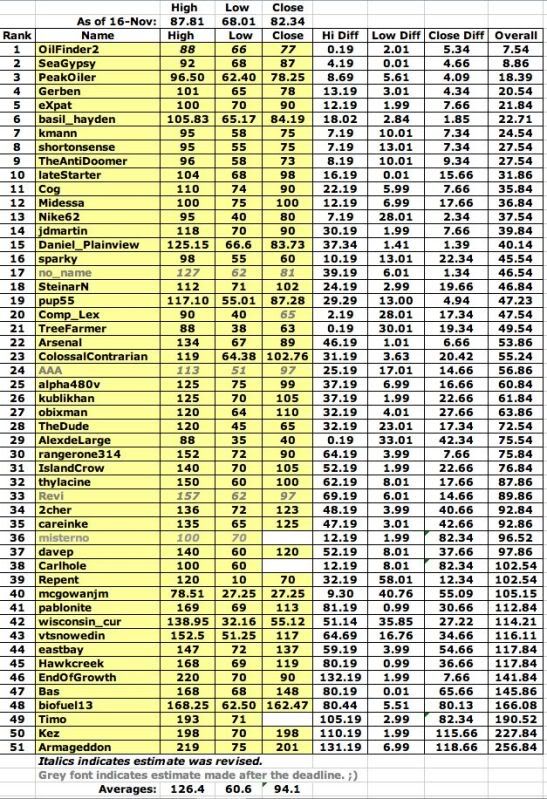

$this->bbcode_second_pass_quote('SeaGypsy', 'H')igh $92

Low $68

Close $87

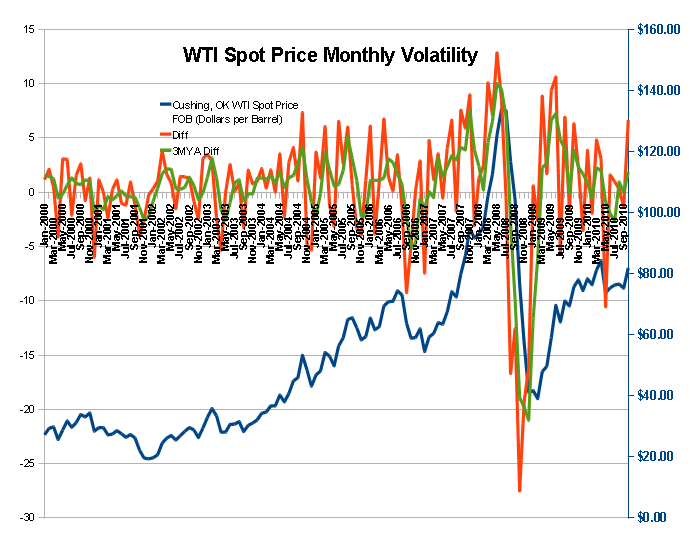

Based on current USD$ values. This year will test price control mechanisms like no other has. There is a strong possibility of US inflation/ hence my base on today's dollar values.

Given how the price bounced in 09 tankers will sit out a dip below $70; above $90 capped wells will open. My logic for what it's worth!

Very simple formula; basicly I figured that bailout 1 had enabled a version of BAU to continue in which an attempt at price stabilisation would be a huge effort but likely would be achieved at 'new normal' range.

The price is still worrysome of course. The following year I think will be more difficult to predict. Further demise of the $USD is a given (QE2/3?); thus overall price increases are inevitable. Freight train China along with the Tigers and some others will take up any slack in the market, along with investors generally.

If TPTB have their way, the new normal range will stick for some time; as in maybe another whole year.

I will hold off on my predictions for 2011 until the thread PeakOiler puts it up.