Has Global Crude Oil (Not C+C) Production Peaked?

42 posts

• Page 1 of 3 • 1, 2, 3

Has Global Crude Oil (Not C+C) Production Peaked?

Ron Patterson pulled together some annual OPEC 12 production data for me. In regard to Crude + Condensate (C+C) production data, note that condensate production is a byproduct of natural gas production. The OPEC countries track crude only production (not C+C).

If we round off to the nearest one mbpd (assuming that we have two significant figures of semi-accurate data) and use complete annual data (through 2012), OPEC 12 crude only production was 31 mbpd in 2005 and in 2012 (no increase in seven years), while EIA OPEC 12 C+C production was 32 mbpd in 2005 and 33 mbpd in 2012 (3.1% higher than 2005).

Global C+C was 74 mbpd in 2005 and 76 mbpd in 2012 (2.7% higher than 2005). If we assume that the OPEC 12 countries are a reasonable representative sampling of global production (and of course we have a lot of condensate production in the US, which accounts for all of the recent increase in global C+C production), in my opinion it’s a reasonable inference that we have not seen a material increase in global crude oil production (generally defined as 45 or lower API gravity) since 2005. Of course, we need crude oil to refine petroleum based distillates (although distillates can be synthesized using a gas to liquids process).

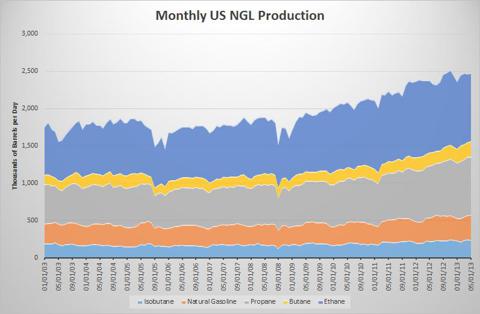

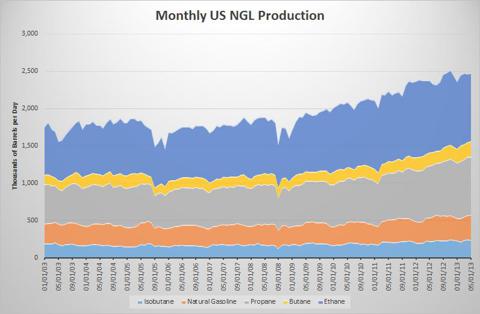

So, based on the foregoing, in my opinion it’s a reasonable conclusion that virtually 100% of the increase in global liquids production since 2005 has been condensate, NGL’s and biofuels. In other words, in my opinion virtually 100% of the increase in global liquids production since 2005 has been from byproducts of natural gas production and from biofuels.

If we round off to the nearest one mbpd (assuming that we have two significant figures of semi-accurate data) and use complete annual data (through 2012), OPEC 12 crude only production was 31 mbpd in 2005 and in 2012 (no increase in seven years), while EIA OPEC 12 C+C production was 32 mbpd in 2005 and 33 mbpd in 2012 (3.1% higher than 2005).

Global C+C was 74 mbpd in 2005 and 76 mbpd in 2012 (2.7% higher than 2005). If we assume that the OPEC 12 countries are a reasonable representative sampling of global production (and of course we have a lot of condensate production in the US, which accounts for all of the recent increase in global C+C production), in my opinion it’s a reasonable inference that we have not seen a material increase in global crude oil production (generally defined as 45 or lower API gravity) since 2005. Of course, we need crude oil to refine petroleum based distillates (although distillates can be synthesized using a gas to liquids process).

So, based on the foregoing, in my opinion it’s a reasonable conclusion that virtually 100% of the increase in global liquids production since 2005 has been condensate, NGL’s and biofuels. In other words, in my opinion virtually 100% of the increase in global liquids production since 2005 has been from byproducts of natural gas production and from biofuels.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Has Global Crude Oil (Not C+C) Production Peaked?

This has been doing the rounds suggesting that US shale alone is keeping the C&C figures up. Saudi likely has some spare capacity and Iraq may have a bit more to squeeze out, but its looking closish to peak from my uneducated position.

-

dorlomin - Light Sweet Crude

- Posts: 5193

- Joined: Sun 05 Aug 2007, 03:00:00

Re: Has Global Crude Oil (Not C+C) Production Peaked?

"...it’s a reasonable conclusion that virtually 100% of the increase in global liquids production since 2005 has been condensate". Actually no. It might be the majority of the increase but I'm not sure even about that. None of the new DW GOM production since 2005 has been C. The majority of the wells I drilled in the last 4 years have produced oil and not C. I've been producing 400 bopd of nice sweet crude for a well in La. for over a year. But that's just little ole me. But there are a lot of little ole me's that have been drilling oil wells in the Gulf Coast since 2005. And then there’s someone a tad bigger than little ole me: Angola is the second-largest oil producer in Sub-Saharan Africa, behind Nigeria. In 2013, Angola produced 1.8 million barrels per day (bbl/d) of petroleum and other liquids, of which more than 1.7 million bbl/d was crude oil. Angola's oil production grew by an annual average of more than 15% from 2002 to 2008 as production started from multiple deepwater fields.

I also wonder how much C has been produced in the ME that was blended with their heavy crude and sold for a higher price.

Again I won't try to guess the magnitude of the difference between C and "crude oil". And remember what I've pointed out before: some of the "condensate" produced for the Eagle Ford Shale is reported as "oil" by the state and not C.

I also wonder how much C has been produced in the ME that was blended with their heavy crude and sold for a higher price.

Again I won't try to guess the magnitude of the difference between C and "crude oil". And remember what I've pointed out before: some of the "condensate" produced for the Eagle Ford Shale is reported as "oil" by the state and not C.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has Global Crude Oil (Not C+C) Production Peaked?

With no significant increase in 9 years despite incredible prices compared to 10 years ago IMO the only thing holding up production is the price. There is at least one TV show in the USA dedicated to the phenomenon that people with property holding in Kentucky are wildcatting wells in dreams of getting rich because even a 10 bpd stripper well pays off in months and after that its pure profit. I know they don't add up to a heck of a lot, but they slow down the decline year in and year out.

Careful with the volume the web page has an embedded add that plays loudly over the speakers if it catches you off guard. http://www.discovery.com/tv-shows/backyard-oil

Careful with the volume the web page has an embedded add that plays loudly over the speakers if it catches you off guard. http://www.discovery.com/tv-shows/backyard-oil

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

- Tanada

- Site Admin

- Posts: 17094

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: Has Global Crude Oil (Not C+C) Production Peaked?

I got your million barrels right here WT - or most of it . . .

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Has Global Crude Oil (Not C+C) Production Peaked?

Rockman said,

$this->bbcode_second_pass_quote('', 'I') also wonder how much C has been produced in the ME that was blended with their heavy crude and sold for a higher price.

$this->bbcode_second_pass_quote('', 'I') also wonder how much C has been produced in the ME that was blended with their heavy crude and sold for a higher price.

Can you answer a question about that? Is the heavy crude easier to move about when mixed with C, and is that why it is done? In addition, of course, to getting that premium price.

Craig

Interesting species, homo sapiens sapiens. Wonder if they'll be missed.

- zaphod42

- Wood

- Posts: 13

- Joined: Thu 06 Jun 2013, 13:11:23

- Location: Dallas

Re: Has Global Crude Oil (Not C+C) Production Peaked?

Rock,

Rounding off to two significant figures, if we focus on C+C, the increase in global production from 2005 to 2012 was 2 mbpd. So, the question is, what percentage of that 2 mbpd was condensate?

If we go back to the OPEC versus EIA data for the OPEC 12 production and take the data sets at face value, it implies that OPEC accounted for about one mbpd of increased condensate production from 2005 to 2012 (OPEC crude was flat and the EIA showed a one mbpd increase from 2005 to 2012), and OPEC accounts for 43% of global C+C production.

Again taking the above OPEC/EIA data at face value, If the other producing countries, accounting for 57% of global production, had no increase in condensate production--not likely since that number includes the US--the implied increase in global crude oil production would only be one mbpd.

I think a more likely scenario is that the other 57% accounted for at least another one mbpd increase in condensate production, and actual global crude oil production--the stuff that Jed Clampitt* found--was probably flat to down from 2005 to 2012.

Incidentally, if we look at the Texas RRC data versus the EIA data, it appears that the implied increase in Texas condensate production from 2005 to 2012 was about 0.2 mbpd. So, OPEC + Texas, accounting for 46% of global C+C production, would account for about 1.2 mbpd of increased condensate production, which alone would account for about 60% of the 2 mbpd increase in C+C production from 2005 to 2012.

*Beverly Hillbillies, "Black gold, Texas tea"

Rounding off to two significant figures, if we focus on C+C, the increase in global production from 2005 to 2012 was 2 mbpd. So, the question is, what percentage of that 2 mbpd was condensate?

If we go back to the OPEC versus EIA data for the OPEC 12 production and take the data sets at face value, it implies that OPEC accounted for about one mbpd of increased condensate production from 2005 to 2012 (OPEC crude was flat and the EIA showed a one mbpd increase from 2005 to 2012), and OPEC accounts for 43% of global C+C production.

Again taking the above OPEC/EIA data at face value, If the other producing countries, accounting for 57% of global production, had no increase in condensate production--not likely since that number includes the US--the implied increase in global crude oil production would only be one mbpd.

I think a more likely scenario is that the other 57% accounted for at least another one mbpd increase in condensate production, and actual global crude oil production--the stuff that Jed Clampitt* found--was probably flat to down from 2005 to 2012.

Incidentally, if we look at the Texas RRC data versus the EIA data, it appears that the implied increase in Texas condensate production from 2005 to 2012 was about 0.2 mbpd. So, OPEC + Texas, accounting for 46% of global C+C production, would account for about 1.2 mbpd of increased condensate production, which alone would account for about 60% of the 2 mbpd increase in C+C production from 2005 to 2012.

*Beverly Hillbillies, "Black gold, Texas tea"

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Has Global Crude Oil (Not C+C) Production Peaked?

Wt - "...the question is, what percentage of that 2 mbpd was condensate?" but the difficulty there is that your number must be a net increase.

Consider how much non-condensate oil has come on from just the DW GOM and the Canadian oil sands.

Consider how much non-condensate oil has come on from just the DW GOM and the Canadian oil sands.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has Global Crude Oil (Not C+C) Production Peaked?

Zap - "Can you answer a question about that? Is the heavy crude easier to move about when mixed with C, and is that why it is done?" Here's an indirect way to answer: are you aware that the millions of bbls of Canadian oil sands production has to be diluted about 30% with distillate so it can be pumped? Believe it or that's one of the problems exporting that crap: the need for condensate diluent. They are planning to build a pipeline to haul the condensate from the Gulf Coast to Alberta. One company is building the first diluent recovery faculty to pull the condensate out after they pipeline the crap from the fields to the border. From there the undiluted crap is hauled by heated tank cars or unheated ones that have to be heated once the peanut butter consistency crap gets to where it's going.

And when the crap + condensate diluent reach the refinery it's all cracked together.

And when the crap + condensate diluent reach the refinery it's all cracked together.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has Global Crude Oil (Not C+C) Production Peaked?

Rock,

I'm not saying that no one has shown an increase, but we also have lots of countries and regions with declining production, e.g. the North Sea, down by 2 mbpd from 2005 to 2012. In any case, let me put it this way:

The increase in Global C+C production from 2005 to 2012 was 2 mbpd--from 74 mbpd to 76 mbpd. If, for the sake of argument, global condensate production increased by 2 mbpd from 2005 to 2012, what would the increase in crude oil production have been?

Note that the EIA shows that global dry (processed) gas production increased by 22% from 2005 to 2012, while Global C+C production increased by 2.7%. And as noted above, OPEC showed no increase in crude oil production from 2005 to 2012 (rounding off to two significant figures). Whatcha think happened to global condensate production as global gas production increased by 22%?

The more I think about it, the more likely it seems to me that actual crude oil production in 2012 was less than actual crude oil production in 2005.

I'm not saying that no one has shown an increase, but we also have lots of countries and regions with declining production, e.g. the North Sea, down by 2 mbpd from 2005 to 2012. In any case, let me put it this way:

The increase in Global C+C production from 2005 to 2012 was 2 mbpd--from 74 mbpd to 76 mbpd. If, for the sake of argument, global condensate production increased by 2 mbpd from 2005 to 2012, what would the increase in crude oil production have been?

Note that the EIA shows that global dry (processed) gas production increased by 22% from 2005 to 2012, while Global C+C production increased by 2.7%. And as noted above, OPEC showed no increase in crude oil production from 2005 to 2012 (rounding off to two significant figures). Whatcha think happened to global condensate production as global gas production increased by 22%?

The more I think about it, the more likely it seems to me that actual crude oil production in 2012 was less than actual crude oil production in 2005.

Last edited by westexas on Fri 28 Mar 2014, 21:39:56, edited 3 times in total.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Has Global Crude Oil (Not C+C) Production Peaked?

$this->bbcode_second_pass_quote('ROCKMAN', 'Z')ap - "Can you answer a question about that? Is the heavy crude easier to move about when mixed with C, and is that why it is done?" Here's an indirect way to answer: are you aware that the millions of bbls of Canadian oil sands production has to be diluted about 30% with distillate so it can be pumped? Believe it or that's one of the problems exporting that crap: the need for condensate diluent. They are planning to build a pipeline to haul the condensate from the Gulf Coast to Alberta. One company is building the first diluent recovery faculty to pull the condensate out after they pipeline the crap from the fields to the border. From there the undiluted crap is hauled by heated tank cars or unheated ones that have to be heated once the peanut butter consistency crap gets to where it's going.

And when the crap + condensate diluent reach the refinery it's all cracked together.

And when the crap + condensate diluent reach the refinery it's all cracked together.

Brings to mind an old phrase that lorry drivers used to say when they were driving unloaded; "I've got a load of Volkswagen radiators!". But of course they needed to bring back the empty trailers to get them reloaded.

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: Has Global Crude Oil (Not C+C) Production Peaked?

C&C is currently 2mbpd higher then 2005, I'd say it's unlikely that 2mbpd increase is all condensate. Or is all LTO classed as condensate?

$this->bbcode_second_pass_quote('', 'N')ote that the EIA shows that global dry (processed) gas production increased by 22% from 2005 to 2012, while Global C+C production increased by 2.7%. And as noted above, OPEC showed no increase in crude oil production from 2005 to 2012 (rounding off to two significant figures). Whatcha think happened to global condensate production as global gas production increased by 22%?

$this->bbcode_second_pass_quote('', 'N')ote that the EIA shows that global dry (processed) gas production increased by 22% from 2005 to 2012, while Global C+C production increased by 2.7%. And as noted above, OPEC showed no increase in crude oil production from 2005 to 2012 (rounding off to two significant figures). Whatcha think happened to global condensate production as global gas production increased by 22%?

Say the increase was 20tcf, and 17% of that was condensate. 3.4tcf of condensate /365..... gives me about 1.65mbboe/pd. So it is an interesting point, and plausible, though it looks to me like there has been a small increase in CO production as well. Very interesting. It sounds as though oil production is up because we include condensate, but when most of the gains are condensate and what we actually want is oil then really it's like getting a bigger bag of chips that still has the same amount of chips and more air. Though condensate is useful.

If you want the truth to stand clear before you, never be for or against. The struggle between "for" and "against" is the mind's worst disease. -Sen-ts'an

- AndyA

- Lignite

- Posts: 303

- Joined: Sat 10 Aug 2013, 01:26:33