Hamilton The Changing Face of World Oil Markets

Re: Hamilton The Changing Face of World Oil Markets

$this->bbcode_second_pass_quote('Pops', ' ')I think the perception is generally similar to Plant's (by those that pay enough attention to perceive anything about it) that the US LTO boom is going to change everything

I never said that. I wish you wouldn't attribute your ideas to me.

In my posts above I pointed out that the US LTO boom has changed things NOW. The predictions that global oil production would peak in 2005 have proven to be wrong. US LTO, along with other unconventional oil, is the reason why.

The only prediction about the future that I'm willing to make is that fracking and horizontal drilling is going to spread from the USA to other countries. We're going to see tight oil from Argentina, Russia, the UK, the EU, Africa, etc. etc.

As to whether your suggestion that this will "change everything" is correct, I frankly think you are completely wrong. I think at best tight oil will delay the oil production peak, and help slow the rate at which oil production falls after the peak.

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet - Expert

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Hamilton The Changing Face of World Oil Markets

$this->bbcode_second_pass_quote('Plantagenet', 'I') wish you wouldn't attribute your ideas to me.

...

As to whether your suggestion that this will "change everything" is correct, I frankly think you are completely wrong.

...

As to whether your suggestion that this will "change everything" is correct, I frankly think you are completely wrong.

You have a strange way of debating, reminds my of the grade school rhyme...

..."I'm rubber and you're glue, what you say bounces off me and sticks to you!"

Makes it hard to understand your point when you can't seem to remember who is arguing what point, LOL

As to your prediction that H. drilling and frac'g will become widespread outside the US, it isn't even widespread in the US. IIRC only about 6 of 30-something possible shale plays are doing much.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Hamilton The Changing Face of World Oil Markets

$this->bbcode_second_pass_quote('Pops', '

')As to your prediction that H. drilling and frac'g will become widespread outside the US, it isn't even widespread in the US. IIRC only about 6 of 30-something possible shale plays are doing much.

')As to your prediction that H. drilling and frac'g will become widespread outside the US, it isn't even widespread in the US. IIRC only about 6 of 30-something possible shale plays are doing much.

Obviously the best prospects get done first. So far we've got THREE major fracking booms going on right now in the USA----in the Bakken, in the Eagle Ford, and in the Permian Basin----.

And fracking and horizontal drilling actually ARE beginning to be utilized overseas even as we discuss this ---Exxon and Chevron are drilling and fracking right now at Vaca Muere in Argentina. Is there really any doubt in your mind that horizontal drilling and fracking will someday be used in other areas around the world?

"The future is already here — it's just not very evenly distributed...."

---William Gibson

-

Plantagenet - Expert

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Hamilton The Changing Face of World Oil Markets

If Pops is right and there are six places in the USA with fracking/horizontal drilling for LTO going on, then having three of them turn out to be giant multi-billion barrel oil fields now producing together about 3.6 million bbls of oil per day really isn't too bad.

Why not admit the facts? Drill baby drill and frack baby frack has been pretty darn successful. By some accounts oil production in the USA has now grown to the point that the USA is approaching being the largest oil producing nation in the world.

Why not admit the facts? Drill baby drill and frack baby frack has been pretty darn successful. By some accounts oil production in the USA has now grown to the point that the USA is approaching being the largest oil producing nation in the world.

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet - Expert

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Hamilton The Changing Face of World Oil Markets

My tight/shale comments:

Tight/Shale Plays to the Rescue?

The conventional wisdom is that increased production from North American and global tight/shale plays will power the globe to a virtually perpetual rate of increase in global oil and gas production.

However, while the strong rebound in US oil and gas production has been very impressive—and critically important to the US economy–it’s interesting to look at some regional declines in US oil and gas production, e.g., marketed Louisiana natural gas production (the EIA doesn’t have dry processed data by state).

According to the EIA, the observed simple percentage decline in Louisiana’s annual natural gas production from 2012 to 2013 was 20%. This would be the net change in production, after new wells were added. The gross decline rate (from existing wells in 2012) would be even higher. This puts a recent Citi Research estimate in perspective.

Citi estimates that the gross underlying decline rate for overall US natural gas production is about 24%/year. This would be the simple percentage change in annual production if no new sources of gas were put on line in the US. In round numbers, this requires the US to add about 16 BCF/day of new gas production every year, just to maintain about 66 BCF/day of dry processed natural gas production. To put 16 BCF/day in perspective, dry processed natural gas production from all of Texas was probably at about 18 BCF/day in 2013.

Based on the Citi report, the US would have to replace 100% of current natural gas production in about four years, just to maintain a dry processed gas production rate of 66 BCF/day (24 TCF/year) for four years.

Or, based on the Citi report, the US has to replace the productive equivalent of all of the 2012 dry natural gas production from the Middle East, in a little over three years (3.3 years), in order to maintain a dry production rate of 24 TCF/year. Over a 10 year period, we would need to put on line three times the 2012 production rate from the Middle East, in order to maintain current production for 10 years.

On the oil side, according to the EIA, the observed 10 year exponential rate of decline in Alaska’s annual Crude + Condensate (C+C) production from 2003 to 2013 was 6.5%/year. This would be the net change in production per year, after new wells were added. The gross decline rate from existing wells would be even higher.

If we assume a probably conservative gross decline rate of 10%/year from existing US C+C production, in order to just maintain current production for 10 years, we would have to replace the productive equivalent of every oil field in the US over the next 10 years–the productive equivalent of every oil well from the Gulf of Mexico to the Eagle Ford to the Permian Basin to the Bakken to Alaska.

Of course, the general consensus is that the tight/shale revolution will spread around the world, and it’s certainly possible, but note that in 2013, while overall Bakken Play production was still increasing, the average Bakken oil well produced a little over 100 bpd, while the median production rate was less than 100 bpd, with a very high per well decline rate. Furthermore, this does not take into account wells that have already been plugged and abandoned. I have a hard time believing that per well production rates like this will work in much higher operating cost areas around the world.

In addition, as the Monterey Shale Play case history shows (the EIA reduced their estimate of possible recoverable reserves by 95%), not all US shale plays will be commercially productive in meaningful quantities, and most commercial plays in the US tend to be gas prone.

Tight/Shale Plays to the Rescue?

The conventional wisdom is that increased production from North American and global tight/shale plays will power the globe to a virtually perpetual rate of increase in global oil and gas production.

However, while the strong rebound in US oil and gas production has been very impressive—and critically important to the US economy–it’s interesting to look at some regional declines in US oil and gas production, e.g., marketed Louisiana natural gas production (the EIA doesn’t have dry processed data by state).

According to the EIA, the observed simple percentage decline in Louisiana’s annual natural gas production from 2012 to 2013 was 20%. This would be the net change in production, after new wells were added. The gross decline rate (from existing wells in 2012) would be even higher. This puts a recent Citi Research estimate in perspective.

Citi estimates that the gross underlying decline rate for overall US natural gas production is about 24%/year. This would be the simple percentage change in annual production if no new sources of gas were put on line in the US. In round numbers, this requires the US to add about 16 BCF/day of new gas production every year, just to maintain about 66 BCF/day of dry processed natural gas production. To put 16 BCF/day in perspective, dry processed natural gas production from all of Texas was probably at about 18 BCF/day in 2013.

Based on the Citi report, the US would have to replace 100% of current natural gas production in about four years, just to maintain a dry processed gas production rate of 66 BCF/day (24 TCF/year) for four years.

Or, based on the Citi report, the US has to replace the productive equivalent of all of the 2012 dry natural gas production from the Middle East, in a little over three years (3.3 years), in order to maintain a dry production rate of 24 TCF/year. Over a 10 year period, we would need to put on line three times the 2012 production rate from the Middle East, in order to maintain current production for 10 years.

On the oil side, according to the EIA, the observed 10 year exponential rate of decline in Alaska’s annual Crude + Condensate (C+C) production from 2003 to 2013 was 6.5%/year. This would be the net change in production per year, after new wells were added. The gross decline rate from existing wells would be even higher.

If we assume a probably conservative gross decline rate of 10%/year from existing US C+C production, in order to just maintain current production for 10 years, we would have to replace the productive equivalent of every oil field in the US over the next 10 years–the productive equivalent of every oil well from the Gulf of Mexico to the Eagle Ford to the Permian Basin to the Bakken to Alaska.

Of course, the general consensus is that the tight/shale revolution will spread around the world, and it’s certainly possible, but note that in 2013, while overall Bakken Play production was still increasing, the average Bakken oil well produced a little over 100 bpd, while the median production rate was less than 100 bpd, with a very high per well decline rate. Furthermore, this does not take into account wells that have already been plugged and abandoned. I have a hard time believing that per well production rates like this will work in much higher operating cost areas around the world.

In addition, as the Monterey Shale Play case history shows (the EIA reduced their estimate of possible recoverable reserves by 95%), not all US shale plays will be commercially productive in meaningful quantities, and most commercial plays in the US tend to be gas prone.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Hamilton The Changing Face of World Oil Markets

$this->bbcode_second_pass_quote('Plantagenet', 'I')s there really any doubt in your mind that horizontal drilling and fracking will someday be used in other areas around the world?

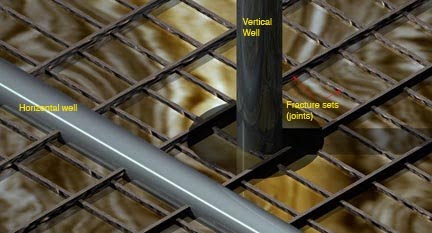

Horizontal drilling is the real technological marvel. I'm sure there will never be a return to vertical drilling, mainly because we're running out of nice, tidy, concentrated, pressurized pools of oil. A vertical well makes contact with a thin layer of oil bearing rock for only the thickness of the layer while a H. well can follow that layer for miles in contact with the oil all the way.

more on h. drilling

But fracking isn't a feature, it is a requirement. The proppants (sand) in frac fluid are necessary for horizontal drilling and do several things but first and foremost they prop open the sides of a horizontal wellbore that would be crushed tight otherwise. A horizontal well is subject to the same pressure from the sides that a vertical well is but also to the weight of all the rock above - there is no rock "above" a vertical hole. That vertical weight can be several times as large as the lateral pressure. Not only that but the pressure right at the wellbore is magnified as all that weight "transferred" around the hole - just like an archway in a rock wall. Without proppants injected under high pressure, the increased pressure right at the side of the bore closes up the pores in the rock adjacent to the horizontal well and nothing flows.

more on frac'g and h. drilling at TOD

But there's more. Shales are compressed mud, as they were compressed they developed vertical fractures. Vertical wells obviously can only cross a limited number of those fractures but horizontal wells can cross many. Horizontal wells then take advantage of the natural fracturing in the shale.

But then here is the thing, a horizontal well uses the natural fractures (propped open by frac fluid proppants) but what happens if there are too many natural fractures and the frac fluid escapes? Or the extractable 'oils" themselves have already escaped? Or what if there aren't enough natural fractures? Or the oil bearing layer has been folded too tightly by tectonic forces to follow? And, or, the target layer is interrupted by a more porous layer like sandstone? Or what if all the lightweight, fracable "oil" that was created in the layer has already migrated, leaving behind the heavier fractions that just are too big or too sticky to flow?

That is the thing overlooked. People see a map of shale like was posted earlier and think simply because it is shale that is the right age and was at the right depth and had the right dinosaurs tromping around it once that the fracers will just go in there and frac it and miraculously set all that trapped oil free. But it doesn't work that way, there are just a narrow set of conditions that make it work - I think that the fact all those other shale plays aren't producing much is proof. All those other shales aren't Bakkens and never will be, IMO.

I'm not going to say I was on the verge of becoming a hor. drilling, hydrofracing booster before the EIA said "Never Mind" on the Monterey. In fact, I "think" the economics are shaky and free government money looking for a home is what may be keeping lots of LTO afloat right now. But the fact that the EIA and USGS hired people who make money from the business to draw all those pretty maps without any real investigation makes me much more skeptical.

Didn't the mortgage scams teach us that "independent" guarantees (paid for by industry) are nothing more than PR Fluffing?

.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac