The Federal Reserve announced Wednesday it is coordinating with other central banks to deal with the global credit crunch.

The central bank said it had reached an agreement with the European Central Bank as well as the Bank of England, the Bank of Canada and the Swiss National Bank to address what it termed "elevated pressures" in credit markets.

YahooNews

Fed Strikes Deal with ECB, BOE, BOC, Swiss To Inflate

First unread post • 14 posts

• Page 1 of 1

Re: Fed Strikes Deal with ECB, BOE, BOC, Swiss To Inflate

In other news, the Fed is inventing new ways of printing money

FinancialTimes

and Russian oligarchs are buying gold mines

GlobeAndMail

(from GATA)

FinancialTimes

and Russian oligarchs are buying gold mines

GlobeAndMail

(from GATA)

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: Fed Strikes Deal with ECB, BOE, BOC, Swiss To Inflate

The alternative to printing money is for your government to spend over $1/2 trillion to repay the bond holders. No matter what, workers will be paying off their boss's home equity lines of credit. If they don't work it off in higher taxes, they'll work it off with by not eating. Those who didn't borrow $1 million at 3% interest will be the losers.

-

heroineworshipper - Tar Sands

- Posts: 890

- Joined: Fri 14 Jul 2006, 03:00:00

- Location: Calif*

Re: Fed Strikes Deal with ECB, BOE, BOC, Swiss To Inflate

$this->bbcode_second_pass_quote('heroineworshipper', 'T')he alternative to printing money is for your government to spend over $1/2 trillion to repay the bond holders. No matter what, workers will be paying off their boss's home equity lines of credit. If they don't work it off in higher taxes, they'll work it off with by not eating. Those who didn't borrow $1 million at 3% interest will be the losers.

No, the alternative is allowing banks to fail and take their bad debt with them. That's the free market approach.

-

Ayoob - Expert

- Posts: 1520

- Joined: Thu 15 Jul 2004, 03:00:00

Re: Fed Strikes Deal with ECB, BOE, BOC, Swiss To Inflate

An important factor with regards to inflation that is often overlooked is the velocity of money. Velocity is the number of times in a year that a given dollar is used to purchased goods and services.

If consumer spending crashes, corporate investment takes a dive, and move stops moving around the money...the result is a deflationary depression.

Now that the home equity line of credit game is played out and banks are more cautious, velocity is dropping. The Fed has to increase the money supply in order to compensate. In times of recession, velocity can drop off significantly.

MV=PY

MoneySupply*MoneyVelocity=Prices*Income

Pretending that changes in velocity do not matter ignores an important factor in prices.

If consumer spending crashes, corporate investment takes a dive, and move stops moving around the money...the result is a deflationary depression.

Now that the home equity line of credit game is played out and banks are more cautious, velocity is dropping. The Fed has to increase the money supply in order to compensate. In times of recession, velocity can drop off significantly.

MV=PY

MoneySupply*MoneyVelocity=Prices*Income

Pretending that changes in velocity do not matter ignores an important factor in prices.

"www.peakoil.com is the Myspace of the Apocalypse."

- Tyler_JC

- Expert

- Posts: 5438

- Joined: Sat 25 Sep 2004, 03:00:00

- Location: Boston, MA

Re: Fed Strikes Deal with ECB, BOE, BOC, Swiss To Inflate

That equation, pulled from thin air, has done so much harm to people's understanding of the effect of inflation on the economy. It implies that increases in the supply of money do nothing more than raise prices, when in fact it distorts the productive structure of the economy depending upon who receives the new money first. Also, I see no reason to use the "velocity" terminology, when the "demand" terminology used everywhere else in economics is sufficient and more obvious. I for one have very much reduced my demand for dollars. Every month when I get a paycheck it's hot-potato time and I sell them ASAP.

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Fed, ECB, Central Banks Join in First Global Injection of Ca

here's a link to bloomberg:

http://www.bloomberg.com/apps/news?pid= ... refer=homebloomberg

I don't understand: were does the money they're injecting come from?

From these auctions mentioned at the end of the article?

What impact will this have on the economy?

And isn't this just about devaluating the dollar or / and more depth?

http://www.bloomberg.com/apps/news?pid= ... refer=homebloomberg

I don't understand: were does the money they're injecting come from?

From these auctions mentioned at the end of the article?

What impact will this have on the economy?

And isn't this just about devaluating the dollar or / and more depth?

-

alokin - Heavy Crude

- Posts: 1255

- Joined: Fri 24 Aug 2007, 03:00:00

Re: Fed, ECB, Central Banks Join in First Global Injection o

Monopoly Land. Keep those printing presses going fellas.

Your blood, sweat and tears will add value to the paper after its been issued so be prepared for even more leaner but harder times at work, thats assuming you are a worker.

Your blood, sweat and tears will add value to the paper after its been issued so be prepared for even more leaner but harder times at work, thats assuming you are a worker.

- americandream

- Permanently Banned

- Posts: 8650

- Joined: Mon 18 Oct 2004, 03:00:00

Re: Fed, ECB, Central Banks Join in First Global Injection o

The money is backed by "assets" owned by the banks. The money also has a certain interest rate, determined by the auction.

As long as sheep believe the money is backed by assets, they won't get rid of their dollars. The problem is these low interest rates & auctions are pumping up housing prices even more, increasing the need for yet more money.

As long as sheep believe the money is backed by assets, they won't get rid of their dollars. The problem is these low interest rates & auctions are pumping up housing prices even more, increasing the need for yet more money.

-

heroineworshipper - Tar Sands

- Posts: 890

- Joined: Fri 14 Jul 2006, 03:00:00

- Location: Calif*

Re: Fed, ECB, Central Banks Join in First Global Injection o

$this->bbcode_second_pass_quote('alokin', 'h')ere's a link to bloomberg:

http://www.bloomberg.com/apps/news?pid= ... refer=homebloomberg

I don't understand: were does the money they're injecting come from?

http://www.bloomberg.com/apps/news?pid= ... refer=homebloomberg

I don't understand: were does the money they're injecting come from?

Out of thin air - a little like counterfeiting, only legalised.

"Who knows what the Second Law of Thermodynamics will be like in a hundred years?" - Economist speaking during planning for World Population Conference in early 1970s

-

CrudeAwakening - Tar Sands

- Posts: 834

- Joined: Tue 28 Jun 2005, 03:00:00

Re: Fed Strikes Deal with ECB, BOE, BOC, Swiss To Inflate

For what it is worth here is my forecast that I wrote before the central banks decided to coordinate their intervention in credit markets yesterday.

$this->bbcode_second_pass_quote('', 'M')y forecast is for a 'near' US recession in 2008 (low, slow, no growth) that eventually spreads to Asia and other emerging markets, but not likely until after the Beijing Olympics next summer. The UK and EU may slowdown sooner. No decoupling. In the meantime emerging markets, commodities, energy and metals should benefit from Asian growth and US dollar weakness. However, I would expect some sort of a US dollar recovery later in the year as other central banks continue to ease and OPEC and non-OPEC oil producers as well as Asian manufacturers try desperately to keep their own currencies export competitive due to the slowdown in the USA. A continuation of the informal Bretton Woods II agreement of exporting goods 'and' capital to developed markets to finance consumption.

The 4% YTD gain in the S&P 500 turns into a 6-7% YTD loss as measured in euros, so it is the flipside of US currency weakness. Therefore, with ongoing credit tightening I expect the real economy to decelerate quickly despite lower interest rates and a weak US dollar. I believe the banks have been the first to take write-downs only because they have been earning strong profits and had the reserves to take these losses. However, other non-bank financial institutions, hedge funds and private investors have not yet disclosed all their losses on credit derivatives, and they were the primary buyers of the risks that banks did not want on their own balance sheets. Where are those securities now?

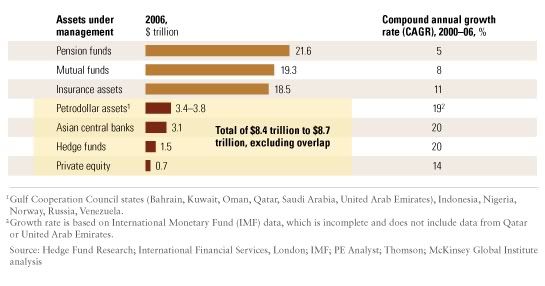

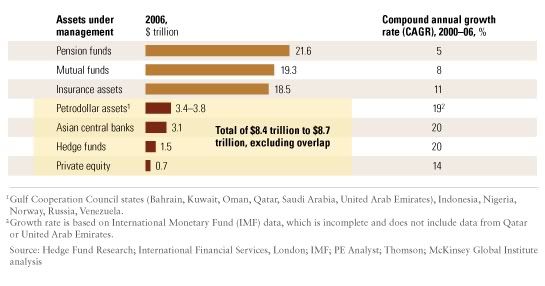

That is going to drag this whole credit issue into 2008 even as real-estate and home prices in the USA, and elsewhere, continue to correct lower. So any stock market rally on the back of lower interest rate expectations is bound to disappoint equity investors if they do not arrive in time to avoid that slowdown in the real economy. The market is still buying minus 10% corrections. Probably on the expectation that sovereign wealth funds and petrodollars coming from the ME and Asia will be attracted to a low US dollar and cheaper stock valuations. I suppose that buy on dips strategy will work until it doesn't? Those sovereign wealth funds are a lot smaller in size compared to total assets than many commentators realize (see graph Global Capital).

Anyway that is my take on the current situation. I was hoping for the S&P500 at 1250 for year-end. And I believe we would have been there or even lower had the Fed, Treasury and White House not started capitulatinig to capital markets so soon. That would have set us up for a nice rally in Q1'08 had we dipped say 20-25% as opposed to 10-11%. So in the absense of such a market dive I think it makes Q1'08 a whole lot less attractive other than to stay invested in what has been profitable in 2007. Namely emerging markets, energy, commodities, metals and any non-US denominated assets. But by mid-year those rallies might have also run their course. Especially if growth in Asia starts to falter in H2'08 after the Olympic games.

$this->bbcode_second_pass_quote('', 'M')y forecast is for a 'near' US recession in 2008 (low, slow, no growth) that eventually spreads to Asia and other emerging markets, but not likely until after the Beijing Olympics next summer. The UK and EU may slowdown sooner. No decoupling. In the meantime emerging markets, commodities, energy and metals should benefit from Asian growth and US dollar weakness. However, I would expect some sort of a US dollar recovery later in the year as other central banks continue to ease and OPEC and non-OPEC oil producers as well as Asian manufacturers try desperately to keep their own currencies export competitive due to the slowdown in the USA. A continuation of the informal Bretton Woods II agreement of exporting goods 'and' capital to developed markets to finance consumption.

The 4% YTD gain in the S&P 500 turns into a 6-7% YTD loss as measured in euros, so it is the flipside of US currency weakness. Therefore, with ongoing credit tightening I expect the real economy to decelerate quickly despite lower interest rates and a weak US dollar. I believe the banks have been the first to take write-downs only because they have been earning strong profits and had the reserves to take these losses. However, other non-bank financial institutions, hedge funds and private investors have not yet disclosed all their losses on credit derivatives, and they were the primary buyers of the risks that banks did not want on their own balance sheets. Where are those securities now?

That is going to drag this whole credit issue into 2008 even as real-estate and home prices in the USA, and elsewhere, continue to correct lower. So any stock market rally on the back of lower interest rate expectations is bound to disappoint equity investors if they do not arrive in time to avoid that slowdown in the real economy. The market is still buying minus 10% corrections. Probably on the expectation that sovereign wealth funds and petrodollars coming from the ME and Asia will be attracted to a low US dollar and cheaper stock valuations. I suppose that buy on dips strategy will work until it doesn't? Those sovereign wealth funds are a lot smaller in size compared to total assets than many commentators realize (see graph Global Capital).

Anyway that is my take on the current situation. I was hoping for the S&P500 at 1250 for year-end. And I believe we would have been there or even lower had the Fed, Treasury and White House not started capitulatinig to capital markets so soon. That would have set us up for a nice rally in Q1'08 had we dipped say 20-25% as opposed to 10-11%. So in the absense of such a market dive I think it makes Q1'08 a whole lot less attractive other than to stay invested in what has been profitable in 2007. Namely emerging markets, energy, commodities, metals and any non-US denominated assets. But by mid-year those rallies might have also run their course. Especially if growth in Asia starts to falter in H2'08 after the Olympic games.

As inflationary as these central bank interventions may be by increasing money supply - because they are coordinated between central banks - they are not necessarily the equivalent of a US dollar devaluation. How do money supply injections in euros, Canadian dollars, Sterling or Swiss franc devalue the US dollar?

Tyler wrote:

$this->bbcode_second_pass_quote('', ' ')An important factor with regards to inflation that is often overlooked is the velocity of money. Velocity is the number of times in a year that a given dollar is used to purchased goods and services.

How inflationary money supply growth is depends crucially on where you are at in your business cycle. Adding liquidity after markets are headed lower and there is no appetite to either borrow or to lend has a different effect on inflation than adding money supply while the economy is still expanding. Ask Japan!

So money supply velocity is an important concept for the overall demand for money as money used to pay-off existing debt (i.e. mortgage) will have a different effect on the real economy, and therefore prices, than money used to make new purchases (i.e. car) or to fund new borrowing (i.e. used as a downpayment).

Velocity is related to the demand for money, but they are not interchangeable terms, Mattduke.

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

-

MrBill - Expert

- Posts: 5630

- Joined: Thu 15 Sep 2005, 03:00:00

- Location: Eurasia