BK's may result in shut-in production

First unread post • 18 posts

• Page 1 of 1

BK's may result in shut-in production

In our area in 1998, almost half of the oil production was shut-in. Some was voluntary, but most was due to operators running out of cash and going bankrupt. The largest operator in the area went under, and its production dropped by 2/3 in a year as the money simply ran out.

I read where most assume that the producing shale wells will not be shut-in because they are profitable and the money has already been sunk to drill and complete them. I suppose some production may be bought by solvent operators at fire sale prices. However, if the price keeps dropping and stays there for awhile, why wouldn't the same thing happen that has happened in the past? The operator runs out of cash, lays off everyone and files BK. There is no one to pump the wells and no money to pay utilities, down hole chemical, water haulers, etc. It is not easy for the bankruptcy trustees to operate oil production, especially if there is no cash with which to hire contract operators.

Would appreciate input.

I read where most assume that the producing shale wells will not be shut-in because they are profitable and the money has already been sunk to drill and complete them. I suppose some production may be bought by solvent operators at fire sale prices. However, if the price keeps dropping and stays there for awhile, why wouldn't the same thing happen that has happened in the past? The operator runs out of cash, lays off everyone and files BK. There is no one to pump the wells and no money to pay utilities, down hole chemical, water haulers, etc. It is not easy for the bankruptcy trustees to operate oil production, especially if there is no cash with which to hire contract operators.

Would appreciate input.

- shallow sand

- Lignite

- Posts: 256

- Joined: Wed 20 Aug 2014, 23:54:55

Re: BK's may result in shut-in production

I would think that the 2008 to 2009 decline is more relevant:

2008 Vs. 2014

It’s interesting that the five month decline in monthly Brent prices, from $133 in July, 2008 to $52 in December, 2008 was sharper than the current five month decline, from $112 in June, 2014 to $79 in November, 2014, roughly a 60% decline in five months in 2008, versus a 30% decline in five months in 2014. However, the annual price in 2008, $97, is going to be quite similar to the annual price in 2014, probably right around $99.

The monthly decline bottomed out at $40 in December, 2008. The year over year change in annual prices was from $97 in 2008 to $62 in 2009. And of course two years later, annual prices ranged from $109 to $112 for 2011 to 2013 inclusive. The three year annual rate of increase in monthly Brent prices, from December, 2008 ($40) to December, 2011 ($108) was 33%/year.

However, according to the EIA, Saudi total petroleum liquids production (+ other liquids) declined from 11.2 mbpd in July, 2008 to 10.0 mbpd in December, 2008, which does not seem to be a pattern that the Saudis are currently emulating. Having said that, after Saudi net exports increased from 7.1 mbpd in 2002 to 9.1 mbpd in 2005, their annual net exports have been below their 2005 rate for eight straight years, and I estimate that the Saudis have already shipped, through 2013, about 40% of their post-2005 CNE.

Monthly Brent Prices:

http://www.eia.gov/dnav/pet/hist/LeafHa ... =RBRTE&f=M

And as I periodically note, CNE (Cumulative Net Exports) depletion marches on.

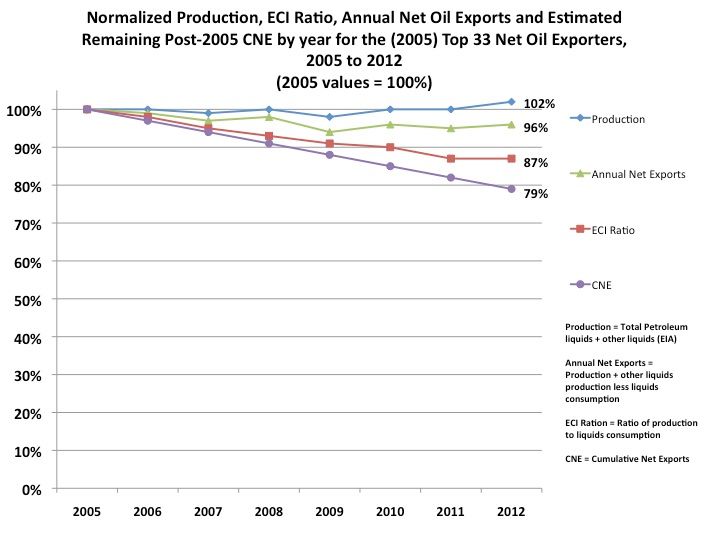

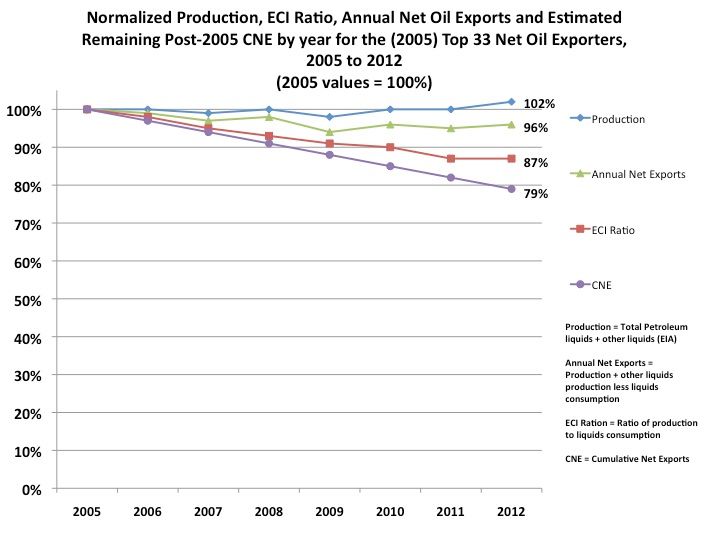

Normalized values for the (2005) Top 33 Net Oil Exporters, as a percentage of 2005 values, for 2005 to 2012:

Updated numbers 2013 (as a percentage of 2005 values):

Production: 101%

Net Exports: 94%

ECI Ratio: 83%

Estimated Remaining post-2005 CNE: 72%

(ECI = Ratio of production to consumption)

Note that (by definition) it is not whether remaining post-2005 Global CNE have declined; it’s a question of by what percentage. Based on the 2005 to 2013 rate of decline in the (2005) Top 33 ECI Ratio, I estimate that we consumed about 5% of remaining post-2005 CNE in 2013.

And of course, so far at least, through 2013, China & India have consumed an increasing share of a post-2005 declining volume of Global Net Exports of oil, as the supply of Global Net Exports of oil available to importers other than China & India fell from 41 mbpd in 2005 to 34 mbpd in 2013.

A friend sent me a note to the effect that net new global automotive sales (net being gross new sales less vehicles scrapped) are estimated to be about 50,000,000 units in 2014, or in round numbers about 140,000 net new vehicles per day.

2008 Vs. 2014

It’s interesting that the five month decline in monthly Brent prices, from $133 in July, 2008 to $52 in December, 2008 was sharper than the current five month decline, from $112 in June, 2014 to $79 in November, 2014, roughly a 60% decline in five months in 2008, versus a 30% decline in five months in 2014. However, the annual price in 2008, $97, is going to be quite similar to the annual price in 2014, probably right around $99.

The monthly decline bottomed out at $40 in December, 2008. The year over year change in annual prices was from $97 in 2008 to $62 in 2009. And of course two years later, annual prices ranged from $109 to $112 for 2011 to 2013 inclusive. The three year annual rate of increase in monthly Brent prices, from December, 2008 ($40) to December, 2011 ($108) was 33%/year.

However, according to the EIA, Saudi total petroleum liquids production (+ other liquids) declined from 11.2 mbpd in July, 2008 to 10.0 mbpd in December, 2008, which does not seem to be a pattern that the Saudis are currently emulating. Having said that, after Saudi net exports increased from 7.1 mbpd in 2002 to 9.1 mbpd in 2005, their annual net exports have been below their 2005 rate for eight straight years, and I estimate that the Saudis have already shipped, through 2013, about 40% of their post-2005 CNE.

Monthly Brent Prices:

http://www.eia.gov/dnav/pet/hist/LeafHa ... =RBRTE&f=M

And as I periodically note, CNE (Cumulative Net Exports) depletion marches on.

Normalized values for the (2005) Top 33 Net Oil Exporters, as a percentage of 2005 values, for 2005 to 2012:

Updated numbers 2013 (as a percentage of 2005 values):

Production: 101%

Net Exports: 94%

ECI Ratio: 83%

Estimated Remaining post-2005 CNE: 72%

(ECI = Ratio of production to consumption)

Note that (by definition) it is not whether remaining post-2005 Global CNE have declined; it’s a question of by what percentage. Based on the 2005 to 2013 rate of decline in the (2005) Top 33 ECI Ratio, I estimate that we consumed about 5% of remaining post-2005 CNE in 2013.

And of course, so far at least, through 2013, China & India have consumed an increasing share of a post-2005 declining volume of Global Net Exports of oil, as the supply of Global Net Exports of oil available to importers other than China & India fell from 41 mbpd in 2005 to 34 mbpd in 2013.

A friend sent me a note to the effect that net new global automotive sales (net being gross new sales less vehicles scrapped) are estimated to be about 50,000,000 units in 2014, or in round numbers about 140,000 net new vehicles per day.

Last edited by westexas on Fri 12 Dec 2014, 12:21:42, edited 2 times in total.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: BK's may result in shut-in production

$this->bbcode_second_pass_quote('shallow sand', 'I')n our area in 1998, almost half of the oil production was shut-in. Some was voluntary, but most was due to operators running out of cash and going bankrupt. The largest operator in the area went under, and its production dropped by 2/3 in a year as the money simply ran out.

I read where most assume that the producing shale wells will not be shut-in because they are profitable and the money has already been sunk to drill and complete them. I suppose some production may be bought by solvent operators at fire sale prices. However, if the price keeps dropping and stays there for awhile, why wouldn't the same thing happen that has happened in the past? The operator runs out of cash, lays off everyone and files BK. There is no one to pump the wells and no money to pay utilities, down hole chemical, water haulers, etc. It is not easy for the bankruptcy trustees to operate oil production, especially if there is no cash with which to hire contract operators.

Would appreciate input.

I read where most assume that the producing shale wells will not be shut-in because they are profitable and the money has already been sunk to drill and complete them. I suppose some production may be bought by solvent operators at fire sale prices. However, if the price keeps dropping and stays there for awhile, why wouldn't the same thing happen that has happened in the past? The operator runs out of cash, lays off everyone and files BK. There is no one to pump the wells and no money to pay utilities, down hole chemical, water haulers, etc. It is not easy for the bankruptcy trustees to operate oil production, especially if there is no cash with which to hire contract operators.

Would appreciate input.

Based on what I have read about fracked wells here and elsewhere they have massive decline rates in the first five years, then stabilize at a low slow decline rate.

If that is accurate and a company was having money trouble then the oldest slowest producing wells would get sold off to strippers or shut in while they concentrate their workforce on the highest producers. If they can't afford as much drilling and completion as before they will stick with the new and ditch the old before they get so bad off as to actually go bankrupt. I think this will lead to a steep decline in shale frack oil by mid 2015, but some drilling will continue and existing wells will stay in production. Once the decline rates stabilize we will know a lot more, but that could take a couple of years even at these prices.

Who will be the first fracker to fold up shop? Will they find buyers for their low slow wells before things get desperate? The sooner they divest the slow wells to the stripper companies the better the rest of us will be because that will keep them in production instead of shut in. Better 9 bbl/day than 0, times a thousand wells.

II Chronicles 7:14 if my people, who are called by my name, will humble themselves and pray and seek my face and turn from their wicked ways, then I will hear from heaven, and I will forgive their sin and will heal their land.

- Subjectivist

- Volunteer

- Posts: 4705

- Joined: Sat 28 Aug 2010, 07:38:26

- Location: Northwest Ohio

Re: BK's may result in shut-in production

World wide auto sales topped 70,000,000 not 50 million as westexas writes.

http://www.statista.com/statistics/2000 ... ince-1990/

In fact, vehicle sales (and motorcycle) have not had a down year since 2009.

Harley alone sold almost a half million bikes in the US this year.

China's soft landing attempts seem to bother growth investors. What would they prefer?

New methods of O&G extraction are not limited to the US. As always, crude oil has been an international bidness. When current techniques begin to show diminished yields in the US they will either move to Argentina or China or cut costs.

All this speculation about US E&P BK's is only playing into short the market speculation.

You need to understand, OPEC is at war with itself. Low oil prices are endangering

more then a few US highly leveraged drillers.

Venezuela is being thrown into China's arms. Iraq, potentially the world's biggest

crude oil contributor is fighting for its life as a coherent nation. Libya, for all intents a failed state.. primed for the picking. I could go on but most of you, already bored.

http://www.statista.com/statistics/2000 ... ince-1990/

In fact, vehicle sales (and motorcycle) have not had a down year since 2009.

Harley alone sold almost a half million bikes in the US this year.

China's soft landing attempts seem to bother growth investors. What would they prefer?

New methods of O&G extraction are not limited to the US. As always, crude oil has been an international bidness. When current techniques begin to show diminished yields in the US they will either move to Argentina or China or cut costs.

All this speculation about US E&P BK's is only playing into short the market speculation.

You need to understand, OPEC is at war with itself. Low oil prices are endangering

more then a few US highly leveraged drillers.

Venezuela is being thrown into China's arms. Iraq, potentially the world's biggest

crude oil contributor is fighting for its life as a coherent nation. Libya, for all intents a failed state.. primed for the picking. I could go on but most of you, already bored.

- BobInget

- Lignite

- Posts: 200

- Joined: Sun 12 Feb 2012, 17:46:44

Re: BK's may result in shut-in production

I agree if this is a short term situation, most will survive or at least be in a position to divest leases with bank approval. Some equity and bond holders would get burned. There could be some mergers.

However, I feel the low prices will last more than one year. I thought that before the OPEC meeting and the meeting confirmed.

I figured WTI would slide to $60-65 range and that would slow drilling. I think maybe I was wrong and we may be looking at much lower prices for 2015.

I agree 2008-2009 was more pronounced, but I would wager the debt levels held by public and private E & P's was not so high. We are not in a shale area, but aware of a lot of production which was sold for $100,000 per bbl range and was financed since 2010. Was not so much the case in 2008-2009. Compare shale drillers 2008-2009 debt levels to 2014. I think CLR has 10 times the liabilities it had in 2009.

If this is short term, most can manage. Year plus of sub $50 WTI will cause massive default IMO. Many 40 handles on Plains Marketing Price bulletin yesterday and those turn to 30 handles with sub $50 WTI. I think you will see a lot of production shut in if we have a long term event of below $50 WTI. Carnage. Followed by another super spike.

However, I feel the low prices will last more than one year. I thought that before the OPEC meeting and the meeting confirmed.

I figured WTI would slide to $60-65 range and that would slow drilling. I think maybe I was wrong and we may be looking at much lower prices for 2015.

I agree 2008-2009 was more pronounced, but I would wager the debt levels held by public and private E & P's was not so high. We are not in a shale area, but aware of a lot of production which was sold for $100,000 per bbl range and was financed since 2010. Was not so much the case in 2008-2009. Compare shale drillers 2008-2009 debt levels to 2014. I think CLR has 10 times the liabilities it had in 2009.

If this is short term, most can manage. Year plus of sub $50 WTI will cause massive default IMO. Many 40 handles on Plains Marketing Price bulletin yesterday and those turn to 30 handles with sub $50 WTI. I think you will see a lot of production shut in if we have a long term event of below $50 WTI. Carnage. Followed by another super spike.

- shallow sand

- Lignite

- Posts: 256

- Joined: Wed 20 Aug 2014, 23:54:55

Re: BK's may result in shut-in production

BobInget,

You might want to re-read what I wrote about vehicle sales.

You might want to re-read what I wrote about vehicle sales.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: BK's may result in shut-in production

The IEA estimates the surge in the US will continue through next year.

$this->bbcode_second_pass_quote('', 'T')he IEA boosted projections for supplies outside Opec in 2015 by 200,000 barrels a day, forecasting output will expand by 1.3 million barrels a day to 57.8 million a day. Non-Opec supply will climb by a record 1.9 million barrels a day this year, it estimated.

"Despite lower crude oil prices, we expect US production to continue to grow apace in 2015," expanding by 685,000 barrels a day, the agency said.

$this->bbcode_second_pass_quote('', 'T')he IEA boosted projections for supplies outside Opec in 2015 by 200,000 barrels a day, forecasting output will expand by 1.3 million barrels a day to 57.8 million a day. Non-Opec supply will climb by a record 1.9 million barrels a day this year, it estimated.

"Despite lower crude oil prices, we expect US production to continue to grow apace in 2015," expanding by 685,000 barrels a day, the agency said.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: BK's may result in shut-in production

$this->bbcode_second_pass_quote('GoghGoner', 'T')he IEA estimates the surge in the US will continue through next year.

$this->bbcode_second_pass_quote('', 'T')he IEA boosted projections for supplies outside Opec in 2015 by 200,000 barrels a day, forecasting output will expand by 1.3 million barrels a day to 57.8 million a day. Non-Opec supply will climb by a record 1.9 million barrels a day this year, it estimated.

"Despite lower crude oil prices, we expect US production to continue to grow apace in 2015," expanding by 685,000 barrels a day, the agency said.

$this->bbcode_second_pass_quote('', 'T')he IEA boosted projections for supplies outside Opec in 2015 by 200,000 barrels a day, forecasting output will expand by 1.3 million barrels a day to 57.8 million a day. Non-Opec supply will climb by a record 1.9 million barrels a day this year, it estimated.

"Despite lower crude oil prices, we expect US production to continue to grow apace in 2015," expanding by 685,000 barrels a day, the agency said.

Grow from where? Drilling permits were already down 40 percent last month, and WTI was $15.00/bbl higher last month than it is today.

IMO this forecast is based on the assumption that oil companies are too stupid to see the writing on the wall so they will blindly go forward drilling a massive number of wells that they know will lose money because they are drilling a massive number of wells. People in the real world do not stay in business for very long if they act in such a contrary fashion.

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

- Tanada

- Site Admin

- Posts: 17094

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA