Bitcoin & crypto? Pt. 3

Re: Bitcoin & crypto? Pt. 3

$this->bbcode_second_pass_quote('', 'A')s countries like China weaponize social credit systems, the U.S. quietly inches closer to implementing its own version under the guise of financial inclusion...

https://www.youtube.com/watch?v=EXbrNTJ8UNk

https://www.federalreserve.gov/cbdc-faqs.htm

$this->bbcode_second_pass_quote('', '1'). What is a central bank digital currency (CBDC)?

A CBDC is a digital form of central bank money that is widely available to the general public.

"Central bank money" refers to money that is a liability of the central bank. In the United States, there are currently two types of central bank money: physical currency issued by the Federal Reserve and digital balances held by commercial banks at the Federal Reserve.

While Americans have long held money predominantly in digital form—for example in bank accounts, payment apps or through online transactions—a CBDC would differ from existing digital money available to the general public because a CBDC would be a liability of the Federal Reserve, not of a commercial bank.

So you'll be saved from bank collapses, happy days. It's too bad no one transacts btc peer to peer like was intended, they will all have have to transact through the CBDC system too, and you'll no doubt receive a statement of the tax you owe based on your record of purchase (which already exists) Personally I doubt the tax will be an issue, you only pay that on Gains.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Bitcoin & crypto? Pt. 3

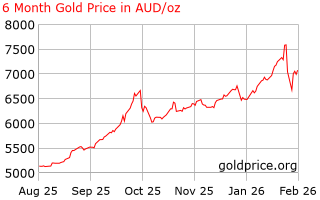

$this->bbcode_second_pass_quote('', 'T')hese peaks are often reached within a year after a halving, riding the wave of reduced supply and heightened demand, before the natural market correction takes hold due to profit-taking and the cyclical nature of investor sentiment.

The tops sheer off so quickly it hardly leaves time for profit taking, hence most hodlers ride it all the way down

I would think the big players have already sold a lot into the market, that's what fed the Trump top.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Bitcoin & crypto? Pt. 3

Guy could win an ugly contest hands down

https://www.zerohedge.com/the-market-ea ... oming-dump

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Bitcoin & crypto? Pt. 3

He made promises to the crypto community to get their votes, knowing that no one else would care, because we don't. He made promises to abolish EV subsidies to attract voters sick of subsidizing the crap, it didn't offend EV owners because they have already bought, and the number of those wanting to gets smaller by the day. He promised everything to everyone, even vague promises about ending the war, as though he had influence in Russia

Whatever crypto does going forward it will depend a lot more on the stock market than on the promises of a corporate toady having his second term in the oval office.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Bitcoin & crypto? Pt. 3

Well, some don't mind convicted felons and folks convicted of sexually assaulting women being the leader of the free world.

The average Americans just keep going about being exceptional and all. <yawn>

Good luck with rounding up some Aussie capable of building one of those 4 wheeled cages with a motor keeping the wheels moving and all, and getting rolling with being more like Americans....a century after Americans were doing this....but hey, your genes being what they are and all...its a start!

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26