Page added on August 15, 2017

World GDP in current US dollars seems to have peaked; this is a problem

Falling interest rates have huge power. My background is as an actuary, so I am very much aware of the great power of interest rates. But a lot of people are not aware of this power, including, I suspect, some of the people making today’s decisions to raise interest rates. Similar people want to sell securities now being held by the Federal Reserve and by other central banks. This would further ramp up interest rates. With high interest rates, practically nothing that is bought using credit is affordable. This is frightening.

Another group of people who don’t understand the power of interest rates is the group of people who put together the Peak Oil story. In my opinion, the story of finite resources, including oil, is true. But the way the problem manifests itself is quite different from what Peak Oilers have imagined because the economy is far more complex than the Hubbert Model assumes. One big piece that has been left out of the Hubbert Model is the impact of changing interest rates. When interest rates fall, this tends to allow oil prices to rise, and thus allows increased production. This postpones the Peak Oil crisis, but makes the ultimate crisis worse.

The new crisis can be expected to be “Peak Economy” instead of Peak Oil. Peak Economy is likely to have a far different shape than Peak Oil–a much sharper downturn. It is likely to affect many aspects of the economy at once. The financial system will be especially affected. We will have gluts of all energy products, because no energy product will be affordable to consumers at a price that is profitable to producers. Grid electricity is likely to fail at essentially the same time as other parts of the system.

Interest rates are very important in determining when we hit “Peak Economy.” As I will explain in this article, falling interest rates between 1981 and 2014 are one of the things that allowed Peak Oil to be postponed for many years.

These falling interest rates allowed oil prices to be much higher than they otherwise would have been, and thus allowed far more oil to be extracted than would otherwise have been the case.

Since mid 2014, the big change that has taken place was the elimination of Quantitative Easing (QE) by the US. This change had the effect of disrupting the “carry trade” in US dollars (borrowing in US dollars and purchasing investments, often debt with a slightly higher yield, in another currency).

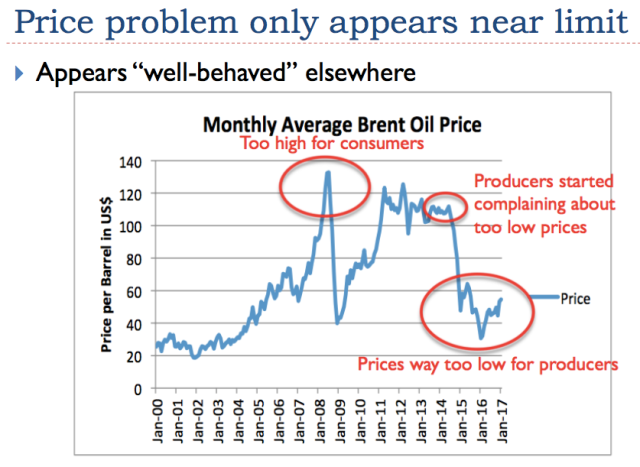

Figure 2. At this point, oil prices are both too high for many would-be consumers and too low for producers.

As a result, the US dollar rose, relative to other currencies. This tended to send oil prices to a level that is too low for oil producers to make an adequate profit (Figure 2). In addition, governments of oil exporting countries (such as Venezuela, Nigeria, and Saudi Arabia) cannot collect adequate taxes. This kind of problem does not lead to immediate collapse. Instead, it “sets the wheels in motion,” leading to collapse. This is a major reason why “Peak Economy” seems to be ahead, even if no one attempts to raise interest rates.

The problem is not yet very visible, because oil prices that are too low for producers are favorable for importers of oil, such as the US and Europe. Our economy actually functions better with these low oil prices. Unfortunately, this situation is not sustainable. In fact, rising interest rates are likely to make the situation much worse, quickly.

In this post, I will explain more details relating to these problems.

Low interest rates are extremely beneficial to the economy; high interest rates are a huge problem.

Low interest rates allow consumers to purchase high-priced goods with affordable monthly payments. With low interest rates, consumers can afford to buy more consumer goods (such as homes and cars) than they could otherwise. Thus, low interest rates tend to lead to high demand for commodities of all kinds, thus raising the price of commodities, such as oil.

Low interest rates are also good for businesses and governments. Their borrowing costs are favorable. Because consumers are doing well, business revenues and tax revenues tend to grow at a brisk pace. It becomes easier to afford new factories, roads, and schools.

While low interest rates are good, a reduction in interest rates is even better.

A reduction in interest rates tends to make asset prices rise. The reason this happens is because if someone already owns an asset (examples: a home, factory, a business, shares of stock) and interest rates fall, that asset suddenly becomes more affordable to other people, so the price of that asset rises because of increased demand. For example, if the monthly mortgage payment for a house suddenly drops from $600 per month to $500 per month because of a reduction in interest rates, many more potential homeowners can afford to buy the house. The price of the house may be bid up to a new higher level–perhaps to a price level where the monthly payment is $550 per month–higher than previously, but still below the old payment amount.

Furthermore, if interest rates fall, owners of homes that have risen in value can refinance their mortgages and obtain the new lower interest rate. Often, they can withdraw the “excess equity” and spend it on something else, such as a new car or home improvements. This extra spending tends to stimulate the economy, and thus tends to raise commodity prices. Suddenly, investments in oil fields that previously looked too expensive to extract, and mines with ores of very low grade, start looking profitable. Businesses hire workers to staff the investments that are now profitable, stimulating the economy.

Businesses receive other benefits, as well, when interest rates fall. Their borrowing cost on new loans falls, making new investment more affordable. Demand for their products tends to rise. The additional demand that results from lower interest rates allows economies of scale to work their magic, and thus allows profits to rise.

Companies that have large portfolios of investments, such as insurance companies and pension funds, find that the values of their assets (stocks, bonds, and other investments) rise when interest rates fall. Thus, their balance sheets look better. (Of course, the low interest payments when interest rates are low provide a different problem for these companies. Here, we are talking about the impact of falling interest rates.)

Of course, the reverse of all of these things is also true. It is truly bad news when interest rates rise!

Wages Depend on Interest Rates and Debt Growth

When interest rates fall, debt levels tend to rise. This happens because expensive goods such as homes, cars, and factories become more affordable, so customers can buy more of them. Thus, falling interest rates are very closely associated with rising debt levels.

We find that when we look at debt levels, rising debt levels seem to be highly correlated with rising US per capita wages, (especially up until China joined the World Trade Organization in 2001, and globalization took off). “Per capita wages” are calculated by dividing total wages and salaries by total population. Per capita wages thus reflect the impact of both (a) changes in the wages of individual workers and (b) changes in workforce participation. Using this measure “makes sense,” if we think of the total population as being supported by the wages of the working population, either directly or indirectly (such as through taxes).

Figure 3. Growth in US Wages vs. Growth in Non-Financial Debt. Wages from US Bureau of Economics “Wages and Salaries.” Non-Financial Debt is discontinued series from St. Louis Federal Reserve. (Note chart does not show a value for 2016.) Both sets of numbers have been adjusted for growth in US population and for growth in CPI Urban.

What does oil price depend upon?

Oil price depends upon the amount customers can afford to pay for oil and the finished products it produces. The amount customers can afford, in turn, depends very much on interest rates, since these influence both wages and monthly payments on loans. If the price that a significant share of consumers can afford is below the selling price of oil, we get an oil glut, as we have today.

It is important to note that oil and other energy products are important in determining the cost of finished products, such as cars, homes, and factories. Thus, high prices on energy products tend to ripple through the economy in many different ways. Many people consider only the change in the cost of filling a car’s gasoline tank; this approach gives a misleading impression of the impact of oil prices.

Affordability is also affected by growing wage disparity. Growing wage disparity tends to occur because of growing complexity and specialization. Globalization also contributes to wage disparity. These are other problems we encounter as we approach energy limits. Demand for commodities is to a significant extent determined by the wages of non-elite workers because there are so many of them. High wage workers tend to influence commodity prices less because their purchases are skewed toward a greater share of services, and toward the purchase of financial assets.

Because interest rates, debt, wages, and oil prices (and, in fact, commodity prices of all kinds) are linked, the system is much more complex than what most early modelers assumed was the case.

Hubbert’s Theory Underlies Many Mainstream Energy Beliefs

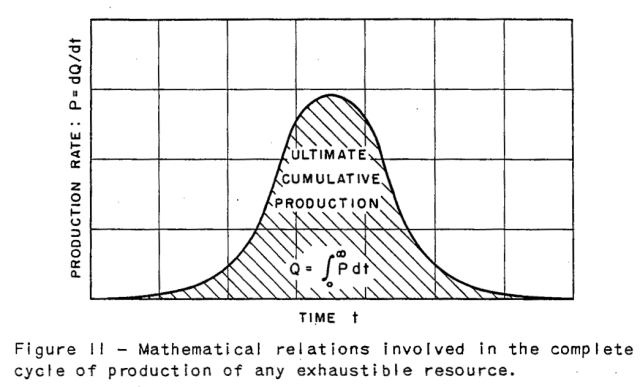

Today’s mainstream beliefs about our energy problems seem to be strongly influenced by Peak Oil theory. Peak Oil theory, in turn, is based on an analysis by geophysicist M. King Hubbert. This view does not consider interest rates, debt, or prices.

Figure 4. M. King Hubbert’s symmetric curve explaining the way he saw resources depleting from Nuclear Energy and the Fossil Fuels, published in 1956.

In this view, the amount of any exhaustible resource that we can extract depends on the resources in the ground, plus the technology we have to extract these resources. In general, Hubbert expected an approximately symmetric curve of extraction, as illustrated in Figure 4. The peak is expected when about 50% of the resource is extracted. Hubbert believed that improved technology might allow more exhaustible resources to be extracted after peak, making the actual extraction pattern somewhat asymmetric, with a larger share of a resource, such as oil, being extracted after peak.

With this theory, we can expect to extract a considerable amount of resources in the future, even if the energy supply of a particular type starts to fall, because it is “past peak.” With the relatively slow decline rate shown in Figure 4, it should be possible to “stretch” supplies for some years, especially if technology continues to improve.

At some point, the standard view is that we will “run out” of energy supplies if we don’t make substitutions or conserve the use of these nonrenewable resources. Thus, an increase in efficiency is viewed as one part of the solution. Another part of the solution is viewed as substitution, such as with wind and solar energy.

In the mainstream view, the major influence on commodity prices is scarcity, not affordability. The expectation is that scarcity will cause oil prices will rise; as a result, expensive substitutes will become cost competitive. The higher prices will also encourage more conservation and more high-cost technologies. In theory, these can keep the economy operating for a very long time. The very inadequate models that economists have developed have encouraged these views.

The Usual Energy Model Is Overly Simple

Hubbert assumed that the amount of oil extracted would depend only upon the amount of resources available and available technologies. In fact, the amount of oil extracted depends on price, in part because price determines which technologies can be used. It also governs whether oil can be extracted in areas that are inherently expensive–for example, deep under the sea, or heavily polluted with some other material that must be removed at significant cost. Because of this, if oil prices are high, new technologies can be brought into play, and resources that are expensive to reach can be pursued.

If oil prices are lower than really needed, for example in the $40 to $80 per barrel range, the situation is more complex. The problem is that taxes on oil are important, especially for oil exporters. In this range, many producers can continue to produce, but their governments collect inadequate taxes. Their governments find it necessary to borrow money to maintain programs upon which the populations of the countries depend. Governments with inadequate tax revenue tend to get into more conflicts with other countries, such as is happening today with other Middle Eastern countries fighting with Qatar.

The situation of inadequate tax revenue is inherently unstable. It can eventually be expected to lead to the collapse of oil exporting countries.

Factors Underlying the Rise and Fall of Historical Oil Prices

The fundamental problem regarding the cost of resource extraction is that we tend to extract the cheapest-to-extract resources first. Thus, the cost of extracting many types of resources, including oil, tends to rise over time. Wages grow much more slowly.

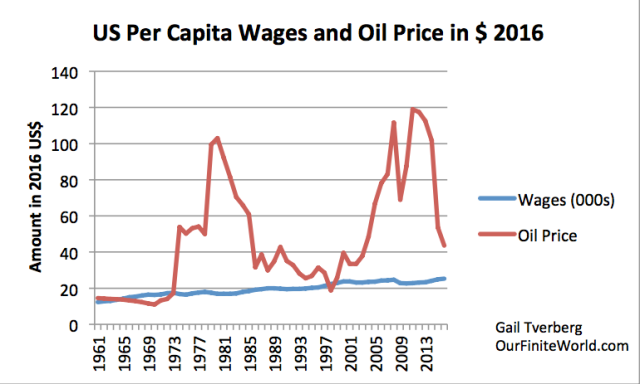

Figure 5. Average per capita wages computed by dividing total “Wages and Salaries” as reported by US BEA by total US population, and adjusting to 2016 price level using CPI-Urban. Average inflation adjusted oil price is based primarily on Brent oil historical oil price as reported by BP, also adjusted by CPI-urban to 2016 price level.

This mismatch between wages and oil price tends to cause increasing affordability problems over time, even as we switch to cheaper fuels and increased efficiency. Part of the reason why affordability problems get worse has to do with our inability to keep reducing interest rates; at some point, they reach an irreducible minimum. Also, as I mentioned previously, there is a growing wage disparity problem caused by growing complexity and globalization. Those with low wages find themselves increasingly unable to afford goods such as homes and cars that require oil products in their construction and use.

Looking at Figure 5, we see two major price “humps.” The first of these is in the 1970-1998 period, and the second is in the 1999 to present period. In the first of these two periods, we often hear that the run up in oil prices was the result of an oil supply problem. This occurred because the US oil supply peaked in 1970, and the Arabs made the situation worse with an oil embargo.

In fact, I think that at least half of the problem in the 1970-1981 period may have been that wages were growing rapidly during this period. The rapid run up in wages allowed oil prices to increase in response to a fairly small oil shortage. Thus, the run up in prices was caused to a significant extent by greater demand, made possible by greater affordability. Note that timing of wage increases is slightly ahead of the timing of increases in CPI Urban. This suggests that wage growth tends to cause price inflation. It seems likely that globalization reduces the influence of US wages on oil prices, and thus on price inflation, in recent years.

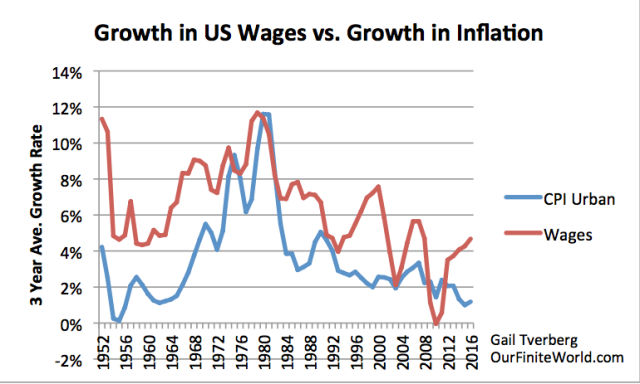

Figure 6. Growth in US wages versus increase in CPI Urban. Wages are total “Wages and Salaries” from US Bureau of Economic Analysis. CPI-Urban is from US Bureau of Labor Statistics.

The large increases in wage payments shown in Figure 6 were made possible by growing total population, by rapidly growing productivity, and by an increasing share of women being added to the workforce. Figure 6 shows that the big increases in wages stopped after interest rates were raised to a very high level in 1981.

Economists hope that rising oil prices will bring about new supply, substitution, and greater efficiency. In the 1970s and 1980s, oil prices did seem to come back down for precisely these reasons. I explain the situation in more detail in the Appendix. Rising inflation rates and interest rates were a problem during this period for insurance companies. One insurance company I worked for went bankrupt; another almost did.

We have not been able to achieve the same new supply–substitution–efficiency result in the 1999 to 2016 period, partly because whatever easy efficiency and substitution changes could inexpensively be made were made earlier, and partly because we are reaching diminishing returns with respect to extracting energy products, especially oil. Also, the wage disparity of workers is growing. Growing wage disparity makes debt growth increasingly ineffective in raising wages. Instead of debt growth funding more wages and more affordable goods for the working poor, the additional debt seems to go to the already rich.

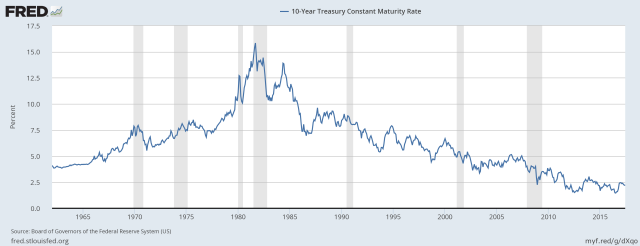

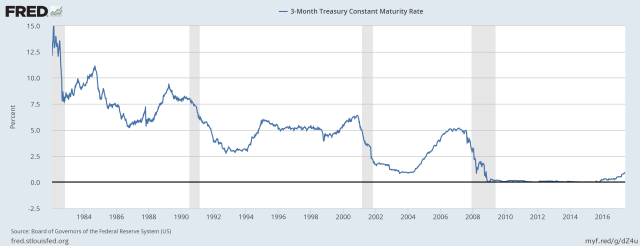

The decreases in interest rates since 1981 have given the economy an almost continuous upward lift. This long-term decrease tends to get overlooked because it has gone on for such a long time. The major exception to the long-term decrease in interest rates since 1981 was the big increase by the Federal Reserve in target interest rates in the 2004-2006 period (shown indirectly in Figure 7).

The problem started when Alan Greenspan dropped target interest rates very low in the 2001-2004 period to stimulate the economy, and then raised them in the 2004-2006 period to cut back growth (Figure 7). This seems to have been one of the major causes of the Great Recession. The other major cause of the Great Recession was fact that oil prices rose far more rapidly than wages during the 2003-2008 period. More information is provided in the Appendix.

Where We Are Now

We have many leaders who do not seem to understand what our real problems are, and how successful programs have been to date in keeping the system from crashing. Way too much of their understanding has come from traditional models regarding “land, labor and capital,” “supply and demand,” and “higher prices bring substitution.” These models are not suitable for understanding how the economy, as a self-organized networked system, really works.

These leaders seem to believe that QE worldwide is no longer working well enough, so it should be removed. In addition, securities currently held by central banks should be sold. Also, the growth in debt should be slowed, because it is getting too high. Whether or not debt is too high, this strategy will lead to “Peak Economy.” As I explained in an earlier post, debt is what pulls an economy forward. It is the promise (which may or may not actually be kept) of future goods and services. These goods will be made with energy resources and other resources that we may or may not actually have in the future. Once we pare back our expectations, the system is likely to spiral downward.

It is not entirely clear the extent to which interest rates have already started to influence the economy. Long term interest rates, such as 10 year Treasuries, have not yet changed in yield (Exhibit 1). But short-term interest rates clearly have increased (Figure 7). An increase from 0% to 1% is a huge increase, if someone is using very short-term interest rates to fund highly levered investments.

Worldwide, the International Institute of Finance reported an increase in debt of $70 trillion, to $215 trillion between 2006 and 2016. This sounds like a huge increase, but it only amounts to a 4.0% increase per year during that period. It is doubtful this is enough to support the GDP growth the world needs, plus the increase in commodity prices demanded by diminishing returns.

There is evidence the economy is already headed downward. A recent report indicates that in the US, the smallest increase in consumer credit in 6 years took place in April 2017.

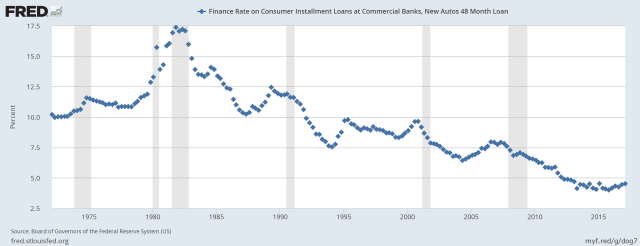

Another worrying area is auto loans. This is an area where interest rates have already begun to increase a bit, making monthly payments on cars higher.

The average finance rate in February 2017 was 4.52%, compared to an average finance rate of 4.00% in November 2015 (the low point). We don’t yet have information on what the increase would be to May 2017. A person would expect that if finance rates are following the interest rates on short to medium term US government securities, the finance rate would continue to rise. This interest rate rise would be one of the things that discounts provided by auto dealers would act to offset.

Because of the higher cost to the buyer of rising auto financing rates, a person would expect such a rise to adversely affect new auto sales. Higher interest rates would also affect lease prices and auto resale prices. We don’t yet know the extent to which higher interest rates are currently affecting auto sales, but the kinds of changes we are seeing are precisely the kinds of changes we would expect to see from higher interest rates. We have had a long history of falling interest rates (plus longer maturities) helping to prop up auto sales. Simply getting to the end of this cycle could be part of the problem.

Peak Economy is likely not very far away. We do not need to encourage it, by raising interest rates and selling securities held by the Federal Reserve. We badly need more people to understand the connection between interest rates and oil prices, and how important it is that interest rates not rise–in fact, more QE would be better.

Appendix – More Detail on Changes Affecting Oil Prices

(a) Between 1973 and 1981. Our oil problems started when US oil production began to decline in 1970, and Arab countries took advantage of our problems with an oil embargo. We immediately started work on extracting oil from other locations that we knew had oil available (Alaska, North Sea, and Mexico). Also, Japan was already making smaller cars. We started building smaller, more fuel-efficient cars in the US, too. We also began to substitute other fuels for oil in home heating and in the making of electricity.

(b) Between 1981 and 1998. In 1981, Paul Volker decided to force oil prices down by raising target interest rates to a very high level. He knew that such a high interest rate would lead to recession, which would reduce demand and thus prices. Also, earlier efforts at new oil supply and demand reduction approaches began to be effective. The new oil supply was somewhat higher priced than the pre-1970 oil. Falling interest rates made it possible for consumers to tolerate the somewhat higher oil prices required by the new higher priced oil.

(c) Between 1999 and 2008. Oil prices rose rapidly during this period, in large part because of rising demand. Globalization added huge demand for oil. Also, Alan Greenspan reduced target interest rates at about the time of the 2001 recession. (Target interest rates affect 3-month interest rates, shown in Figure 7.) At the same time, banks were encouraged to be more lenient in lending standards, and to offer loans based on the very favorable short-term interest rates available at that time. This combination of factors led to rapidly rising housing debt and much refinancing activity. All of this activity also added to oil demand.

Fortunately, these demand increases coincided with an increase in the cost of oil extraction. The world’s supply of “conventional oil” was becoming limited in supply, and began to decline in 2005. The higher demand raised prices, thus encouraging producers to pursue more expensive unconventional oil production.

(d) The 2008 Crash occurred after the Federal Reserve raised target interest rates in the 2004-2006 period, in an attempt to damp down rising food and energy prices. This interest rate rise made home buying more expensive. Oil prices were also increasing in the 2002-2008 period. The combination of rising interest rates and rising oil prices reduced demand for new homes and cars. Home prices fell, debt levels fell, and oil prices fell. Many people blamed the problems on loose mortgage underwriting standards, but the basic issue was falling affordability of oil, as oil prices rose and as higher interest rates took away the huge boost the economy previously had received. See my article, Oil Supply Limits and the Continuing Financial Crisis.

(e) 2009-2011 ramp up in prices was enabled by QE. This QE brought a broad range of interest rates to very low levels.

(f) 2011-2014. Oil prices gradually slid downward, because there was no longer enough upward “push” created by QE, since interest rates were no longer falling very much.

(g) Mid to late 2014 to Present. The US removed its QE, leading to a sharp reduction in carry trade in US dollars. Many currencies fell relative to the US dollar, making oil products less affordable in these currencies. As a result, oil prices fell to a level far below that needed by oil producers, especially oil exporters.

55 Comments on "World GDP in current US dollars seems to have peaked; this is a problem"

Hello on Tue, 15th Aug 2017 6:03 am

>>>>> With high interest rates, practically nothing that is bought using credit is affordable. This is frightening.

Not at all frightening. It’s about time interest goes up. 20% is probably a good number.

Antius on Tue, 15th Aug 2017 6:39 am

The world has passed peak energy, when the energy needed to produce energy is accounted for.

Since energy is the capacity to do work, it is unsurprising that global economic growth has halted. In fact, it was inevitable.

Not good news for those of us working to pay off mortgages. In fact, not good news for anyone that isn’t due to die from natural causes in the next year.

Hello on Tue, 15th Aug 2017 6:52 am

>>> Not good news for those of us working to pay off mortgages

Actually very good news. Once growth halts, money printing starts and inflation follows.

You will be able to repay your whole mortgage on a 1-day salary.

Davy on Tue, 15th Aug 2017 7:12 am

“The world has passed peak energy, when the energy needed to produce energy is accounted for. Since energy is the capacity to do work, it is unsurprising that global economic growth has halted. In fact, it was inevitable. Not good news for those of us working to pay off mortgages. In fact, not good news for anyone that isn’t due to die from natural causes in the next year.”

Well put Antius! What we have to include is the other dimensions to this decline. These are planetary and systematic late term civilizational issues. Combining energy, planetary decline, and civilizational decline makes this an open and close case.

The important caveat is scale, time frame, and location. For us individual humans and our local living arrangements this is where all this takes on a different dimension. It is the trees and forest thing. What I try to do is follow both. They both require different viewpoints. They involve different scale relationships.

We individual humans have short lives compared to macro events yet, we confuse them. Civilizations collapse and all of them have but that is history not the here and now. We humans tend to be binary or overly general. Often we mix the two into an emotional exercise in fantasy. Many of us here may never see a really bad world. Some of us are going to see it soon. Isn’t this the story of our lives and personal triumphs and failures?

Our physical and mental health are illusionary. Our homes can be gone in one bad event. I had a tornadic event glide right over me back in May. We lost trees but some people nearby lost their roof. I will admit I am worried for the young and this is why I am talking about doom and prep. They need meaning and education for what in every sense of the word looks like descent. Techno optimist will dismiss what I just said or they offer their techno solutions. I am happy for them and hope for the best but that should not be a reason to dismiss decline.

dave thompson on Tue, 15th Aug 2017 7:13 am

Many here will concur with Gail. The MSM will never pick up this story however.

Makati1 on Tue, 15th Aug 2017 7:14 am

Hello, not if you need those inflated dollars to buy food, which will also go up in price to match inflation. When $1,000,000 will not buy a loaf of bread, what use is paying off a mortgage? The banks will never take your home because there will be many tens of millions of mortgages defaulting. Car loans, Credit cards, etc. The reset is going to be horrendous for Americans.

Makati1 on Tue, 15th Aug 2017 7:26 am

bTW: It is modtly the WEstern countries and their wannabees that gave declining GDPs. Most of Central ans South America and many Asian and African countries have increasing GDPs. The Ps will increase by about 6.7% this year.

http://data.worldbank.org/indicator/NY.GDP.MKTP.CD

paultard on Tue, 15th Aug 2017 7:46 am

A reduction in interest rates tends to make asset prices rise. The reason this happens is because if someone already owns an asset (examples: a home, factory, a business, shares of stock) and interest rates fall, that asset suddenly becomes more affordable to other people, so the price of that asset rises because of increased demand.

When interest rates fall, debt levels tend to rise. This happens because expensive goods such as homes, cars, and factories become more affordable, so customers can buy more of them. Thus, falling interest rates are very closely associated with rising debt levels.

I see conflicting analyses here. On one hand, homes become more expensive but on the other, more affordable to consumers.

Davy on Tue, 15th Aug 2017 7:48 am

“The Ps will increase by about 6.7% this year.”

So what makat, that is like we telling the world that Missouri (similar gdp) is going to grow by 6%. Who the frig cares? You are so parochial.

_____________________ on Tue, 15th Aug 2017 7:49 am

Fiat is becoming worthless. Once you use up the wealth and energy stored in old machines and infrastructure there will be a critical mass when you can’t afford to replace it. Similar to a old starving cheetah that doesn’t have the energy for one more chase

Hello on Tue, 15th Aug 2017 7:57 am

>>>>> MAK: Hello, not if you need those inflated dollars to buy food, which will also go up in price to match inflation

Yes. It doesn’t matter if you make $1/day and a bread costs 1 cents, or if you make $1M and a bread costs $10k.

But your fixed $1M mortgage sure becomes a lot cheaper.

Antius on Tue, 15th Aug 2017 8:47 am

Erm…This news item appears to have linked the wrong article!

Antius on Tue, 15th Aug 2017 9:00 am

Makati, this post references the wrong article. Here is the real one:

https://ourfiniteworld.com/2017/08/14/world-gdp-in-current-us-dollars-seems-to-have-peaked-this-is-a-problem/

The China and Vietnam growth trajectories look like one half of a Gaussian bell-curve. There is clear indication of a levelling, prior to a peak and fall. The EU and Japan look like flattened versions, with the first part of the decline visible. For oil exporters, the decline appears to be steeper than the up phase. India and Philippines show no imminent peak, but their energy intensity is still low. This is bad news for everyone. The great fall has clearly begun.

Antius on Tue, 15th Aug 2017 9:33 am

“Well put Antius! What we have to include is the other dimensions to this decline. These are planetary and systematic late term civilizational issues. Combining energy, planetary decline, and civilizational decline makes this an open and close case.

The important caveat is scale, time frame, and location. For us individual humans and our local living arrangements this is where all this takes on a different dimension. It is the trees and forest thing. What I try to do is follow both. They both require different viewpoints. They involve different scale relationships.

We individual humans have short lives compared to macro events yet, we confuse them. Civilizations collapse and all of them have but that is history not the here and now. We humans tend to be binary or overly general. Often we mix the two into an emotional exercise in fantasy. Many of us here may never see a really bad world. Some of us are going to see it soon. Isn’t this the story of our lives and personal triumphs and failures?

Our physical and mental health are illusionary. Our homes can be gone in one bad event. I had a tornadic event glide right over me back in May. We lost trees but some people nearby lost their roof. I will admit I am worried for the young and this is why I am talking about doom and prep. They need meaning and education for what in every sense of the word looks like descent. Techno optimist will dismiss what I just said or they offer their techno solutions. I am happy for them and hope for the best but that should not be a reason to dismiss decline.”

Thanks Davy. As human beings we do tend to see the world in small pieces and fail to look at the entirety of the situation. Tech optimists tend to look for new energy solutions (usually renewable) and assume that if only these solutions can be brought to fruition, the problem is solved. This type of thinking results when a world view is fixated on a small part of the overall problem. As human beings we are hard wired to solve technical problems with technical solutions. The problem is that we live in a finite environment. Under those circumstances, there are no technical solutions that will allow growth of anything to continue for very long. Even our greatest achievements begin to look like failures.

I never really understood how any intelligent person could expect continuous economic growth when we live on a finite ball of rock 8000 miles wide. How can economists and politicians not see the inherent contradiction with this situation?

I always held out for some technical innovation that might actually take us out of our finite world and allow us to expand into the wider solar system. Despite some promising developments (Musk, etc) this is not looking promising. The alternative looks grim indeed. We are stuck on a planet with growing population and shrinking resources of every kind. It is difficult to look forward to a third world existence.

Cloggie on Tue, 15th Aug 2017 9:39 am

Since energy is the capacity to do work, it is unsurprising that global economic growth has halted. In fact, it was inevitable.

http://www.worldeconomics.com/Images/CMS/LoadedContent/Papers/WE/7c66ffca-ff86-4e4c-979d-7c5d7a22ef21_201603_C01.jpg

I’m sure I’m missing something and that Antius is going to tell me what that is.

Kenz300 on Tue, 15th Aug 2017 9:42 am

Zero and negative interest rates were helpful during the recent depression / recession.

Interest rates are still very low and are accommodative. They are just moving from very, very accommodative to very accommodative.

It is time to slowly normalize rates.

GregT on Tue, 15th Aug 2017 10:01 am

“I’m sure I’m missing something and that Antius is going to tell me what that is.”

Here Cloggie, this might help:

https://www.tullettprebon.com/Documents/strategyinsights/TPSI_009_Perfect_Storm_009.pdf

Specifically chapter 4, Loaded Dice

Cloggie on Tue, 15th Aug 2017 10:04 am

I’m sorry, but I am not going to read 84 pages in a desperate attempt to understand why somebody else apparently does get his facts straight regarding global economic growth.

Not that desperate.

bobinget on Tue, 15th Aug 2017 10:10 am

Falling Interest Rates Have Postponed “Peak Oil”

Posted on June 12, 2017 by Gail Tverberg

Don’y think the author should take blame or credit?

Unless we grow enough to feed a growing population we will collapse.

Pay attention. Forward looking nations are taking giant steps for its citizens.

Germany, Denmark, Norway, Sweden. and Canada come to mind. All of the above are securing a future for it’s children. By adopting refugees and low carbon energy resources they go long on everyone’s future.

Cloggie on Tue, 15th Aug 2017 10:14 am

All of the above are securing a future for it’s children. By adopting refugees and low carbon energy resources they go long on everyone’s future.

You mean to say: by letting all these invaders in from hostile countries, they are setting their own children up for a civil war, the very one developing in the US now.

http://www.bbc.com/news/uk-england-south-yorkshire-28939089

Pure ethnic warfare and only the tip of the iceberg.

GregT on Tue, 15th Aug 2017 10:23 am

If we lowered interest rates to say -10%, that would help to make even more of the dregs profitable for producers. Which in turn would make alt energy appear to be even more ‘affordable’. Of course there would be the difficult to ignore problem of even faster growing mountains of unrepayable debt.

When one considers the fact that the economy runs on energy, and not on money, the real underlying problem becomes far more obvious.

GregT on Tue, 15th Aug 2017 10:31 am

“I’m sorry, but I am not going to read”

Willful ignorance Cloggie. The paper is written in terms that even an engineer, or an economist, should be able to understand.

Try reading pages 43 through 57. 14 pages shouldn’t be too tough to read for someone of your technical background.

GregT on Tue, 15th Aug 2017 10:33 am

And Cloggie, ignoring the pictures, it’ would probably be closer to about 4 or 5 pages. I read the entire article in less than an hour. Well worth the time.

GregT on Tue, 15th Aug 2017 10:37 am

And to give credit, where credit is due;

Thanks MASTERMIND, for providing the link.

Antius on Tue, 15th Aug 2017 10:45 am

Cloggie,

Number 1: read Gail’s post:

https://ourfiniteworld.com/2017/08/14/world-gdp-in-current-us-dollars-seems-to-have-peaked-this-is-a-problem/

Number 2: Take a look at the global GDP figures from the World Bank:

http://data.worldbank.org/indicator/NY.GDP.MKTP.CD?end=2016&start=1960&view=chart

Number 3: Come back and comment.

Cloggie on Tue, 15th Aug 2017 11:02 am

#2 – Aha, I see, that last little hockeystick end was missing in my GDP graph. The devil is in the details.

And now what? We’re all f*? Sorry to hear that. Well, at any rate it has been nice knowing you all. See you in a next universe and/or eon.

Regarding Gail… since the Heinberg debacle I have stopped reading thunderous opinions expressed by what are essentially laymen. Waste of time.

GregT on Tue, 15th Aug 2017 11:16 am

We are not all f* Cloggie, but the economy is. Find a way to live outside of the economy, and you should be OK. Unless, of course, runaway CC has already kicked in, or is going to. Then, we are all truly f*.

Cloggie on Tue, 15th Aug 2017 11:28 am

I thought that we would get heatwaves and stuff, now with this climate change thingy breathing in our necks, but all we got is a…

koele zomer

(“cool Summer”)

http://www.agf.nl/artikel/144626/Koele-zomer-is-prima-voor-aardappelconsumptie

On a positive note, that’s good for the potatoes.

GregT on Tue, 15th Aug 2017 11:32 am

Exactly what is to be expected from CC Cloggie. But I’m sure that someone of your intellectual prowess already understands that.

bobinget on Tue, 15th Aug 2017 11:53 am

Instilling fear of refugees may be popular stick

for nationalists since Roman conquests.

Time always proves those fears unfounded.

Watch insular Japan age with too few workers on line to support it’s retired. Japan treats life long Koreans, for instance, as foreigners.

Russia is losing population

(in support of YouTube accident videos)

Have you heard of great numbers of refugees looking to settle in Russia?

No. Most want either Democratic, welcoming nations.

Canada is second only to Russia in size. Where would YOU go if need be?

GregT on Tue, 15th Aug 2017 12:00 pm

“The AMOC transports a large amount of heat into the North Atlantic where it is given up to the atmosphere and helps regulate the climate in Europe and North America. The major effect of a slowing AMOC is expected to be cooler winters and summers around the North Atlantic, and small regional increases in sea level on the North American coast,” explained Chambers.”

“The AMOC and Gulf Stream are part of a complex global ocean circulation system that is still not completely understood,” said Dixon. “If human activities are starting to impact this system, it is a worrying sign that the scale of human impacts on the climate system may be reaching a critical point”

https://phys.org/news/2016-01-greenland-ice-sheet-affect-global.html

Cloggie on Tue, 15th Aug 2017 12:07 pm

Time always proves those fears unfounded.

You apparently missed the wars in Yugoslavia, Iraq, Syria, Donbass, etc. All wars between different ethnicities with hundreds of thousands of casualties.

Watch insular Japan age with too few workers on line to support it’s retired. Japan treats life long Koreans, for instance, as foreigners.

So what, there are too many people in Japan any way.

Russia is losing population

No they are not. You have no idea what Wladimir the Great can achieve, even with his pants on:

http://russia-insider.com/en/russia-demographics-are-now-reasonably-healthy-birth-rate-highest-europe/ri2354

Have you heard of great numbers of refugees looking to settle in Russia?

No. Most want either Democratic, welcoming nations.

They couldn’t care less about demockressie. All they care about is handouts. That’s why they come to the West and not to Russia.

Canada is second only to Russia in size. Where would YOU go if need be?

That would indeed be a very hard choice. I deeply admire Putin and despise that airhead Trudeau. Fortunately I do not have to make that choice and stubbornly will stay behind the dikes, thank you very much.

Outcast_Searcher on Tue, 15th Aug 2017 1:53 pm

That’s why credible organizations measure US and global GDP in constant currency terms or PPP (purchasing power parity) terms, NOT in “current dollar” terms.

Currencies are volatile. So if you measure in short term currency values, all you’re measuring is mostly that currency’s short term trend.

If the doomer narrative fails (i.e., credible organizations like the IMF report that real global GDP has risen every year except 2009 for the last 35+ years), then cherry pick and skew statistics until you find one that “works”.

Thanks for playing, but it’s not credible.

http://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD

MASTERMIND on Tue, 15th Aug 2017 2:03 pm

Conventional Oil Peaked in 2006 –IEA

http://imgur.com/a/hccu9

New Oil discoveries by scientists have been declining since 1965 and last year was the lowest in history -IEA

http://imgur.com/a/W60yn

International Energy Agency Chief warns of world oil shortages by 2020 as discoveries fall to record lows

https://www.wsj.com/articles/iea-says-global-oil-discoveries-at-record-low-in-2016-1493244000

Saudi Aramco CEO believes world oil shortage coming despite U.S. shale boom

http://www.foxbusiness.com/markets/2017/07/10/saudi-aramco-ceo-believes-oil-shortage-coming-despite-u-s-shale-boom.html

UAE warns of world oil shortages ahead by 2020 due to industry spending cuts

http://www.arabianindustry.com/oil-gas/news/2016/nov/6/more-spending-cuts-as-uae-predicts-oil-shortages-5531344/

HSBC Global Bank warns 80% of the worlds conventional fields are declining and world oil shortages by 2020

https://www.research.hsbc.com/R/24/vzchQwb

UBS Global Bank warns of industry slowdown and world Oil Shortages by 2020

http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/12136886/Oil-slowdown-to-trigger-supply-crisis-by-2020-warns-bank.html

German Government (leaked) Peak Oil study concludes world oil shortages would collapse the world economy & world governments/democracies

http://www.spiegel.de/international/germany/peak-oil-and-the-german-government-military-study-warns-of-a-potentially-drastic-oil-crisis-a-715138.html

The 1973 so-called “oil embargo” which reduced oil supply to the USA by somewhere around 3% or 4%. It slammed the US economy, caused the largest stock market crash since the great depression, doubled gasoline prices, severely damaged US industry and caused a 55 MPH national speed limit which remained in effect for ten years. The government also put restrictions on how much gasoline you could purchase. There were fist fights and even a couple murders between the public at gas stations. Just wait until we experience a 10% or 20% drop in oil supplies. In a few years or sooner we certainly will. When it hits the economic and social damage will be catastrophic. The end of Western Civilization, from China to Europe, to the US, will not occur when oil runs out. The economic and social chaos will occur when supplies are merely reduced sufficiently.

Antius on Tue, 15th Aug 2017 2:07 pm

Here is the GNP chart for Cloggie’s country:

http://data.worldbank.org/indicator/NY.GNP.PCAP.CD?locations=NL&view=chart

My country:

http://data.worldbank.org/indicator/NY.GNP.PCAP.CD?locations=GB&view=chart

For Germany, the powerhouse of Europe.

http://data.worldbank.org/indicator/NY.GNP.PCAP.CD?locations=DE&view=chart

They all show sharp downward trends. Europe is on the brink of a depression that will make the 1930s look like practice for a real depression. Then again, so is everywhere else. Maybe there is a silver lining. Maybe a depression will bring some real political change. The sort of change where the invading, murdering, raping middle-eastern invaders get what they deserve.

Fred on Tue, 15th Aug 2017 2:11 pm

“More QE would be better”. Really? More money for nothing for the banks to loan out at interest? An even harder time for our children?

If something is unsustaiinable, then it must come down. The sooner we start thinking along the lines of staying within the Earth’s limited resources the better. We need to stop using the atmosphere, seas and land as a sewer for our short lived “pleasures”. We don’t need no stinking more cars paid for with more car loans, we need LESS.

rockman on Tue, 15th Aug 2017 3:13 pm

“Oil price depends upon the amount customers can afford to pay for oil and the finished products it produces.” Finally someone who understands that the refineries set the price they pay for oil…not the producers. And the refineries set that price based on what they estimate the consumers will pay for their products.

And then he blows it by defining “glut” based on the price of oil: “If the price that a significant share of consumers can afford is below the selling price of oil, we get an oil glut, as we have today.” And since he doesn’t define “significant share” neither am I obligated to do so. Thus for the last 50+ years a “significant share” of the potential consumers have not been able to afford the “selling price of oil”. So we’ve had a “glut” since the end of WWII? So we must have had a severe “glut” when oil hit $147/bbl in 2008 given how so many fewer consumers could afford that price. Likewise there must have been a “glut” in the late 90’s when oil hit $17/bbl since if there wasn’t enough competition amongst the consumers to push prices higher.

At least today there are enough consumers who can afford a “significant share” of the available oil to push the price up to $45-$50 per bbl. At the current oil price there are obviously a “significant” number of buyers for oil since that volume has reached an all time high not too long ago. IOW an “insignificant” number of buyers are unable to afford oil today. So by his own definition of an oil “glut” there is none now, right?

In the Rockman’s world an oil “glut” occurs when he can’t find a buyer for his oil and has to shut his wells in. That has not happened even once in the last 41 years. Didn’t happen when oil was $17/bbl or when it was $147/bbl. The Rockman has always had someone to buy every bbl he wanted to sell.

Apneaman on Tue, 15th Aug 2017 3:32 pm

“credible organizations like the IMF”……..

Bahahahahahahahahahahahahahahahahahahahahahahahahhahahahahhahahahahahahahahahahahahahahhah

Apneaman on Tue, 15th Aug 2017 3:47 pm

An ever greater portion of money-energy is going to rescue folks, repair, rebuild and relocate after the ever worsening AGW jacked weather disasters and wildfires. In addition there are economic losses from the interruption and slowing of BAU in the unfortunate local and more resources being thrown at adaption like Miami beach and their $500 million tax dollars on pumps and raised roads which might buy them a decade.

Here in BC they are quickly approaching a record (old record 2015) number of dollars spent on fighting the new abnormal (3 months longer than 1990 & prior) wildfire season with many forced evacuations and property loss/damage and a big hit on the $7 billion plus per year tourism industry.

Refugees of a different kind are being displaced by rising seas — and governments aren’t ready

Sea levels are on the rise, displacing entire populations and stirring fears for ‘climate refugees’ that must relocate.

A ‘tipping point’ is nearing as costs mount, and governments appear unprepared.

The impact is being felt as far away as Panama, and as close as Louisiana.

“Relocating those populations costs vast sums of money, raising the question of who will cover those costs as sea levels continue their uptrend.”

“We all thought this is something that was going to happen in 100 years or something. But it’s happening right now.”

https://www.cnbc.com/2017/08/11/climate-change-refugees-grapple-with-effects-of-rising-seas.html

Boat on Tue, 15th Aug 2017 6:10 pm

mm,

“Just wait until we experience a 10% or 20% drop in oil supplies. In a few years or sooner we certainly will. When it hits the economic and social damage will be catastrophic. The end of Western Civilization, from China to Europe, to the US, will not occur when oil runs out”.

The US has pretty much equaled world oil demand by raising oil production over 100,000 6 months in a row. Imports to the US are around 5 mbpd vrs. 12 mbpd a few years ago.

Tar sands from Canada mixed with fracked oil refined with US nat gas produces finished petroleum products from state of the art refineries cheaper than most of the world.

What do US refiners import by choice from around the world to maximize their profits? Heavy cheap low api grades. There is less money to be made on so called higher grade “conventional” oil.

Antius on Tue, 15th Aug 2017 6:17 pm

World energy consumption actually declined last year.

https://yearbook.enerdata.net/total-energy/world-energy-production.html

Electricity consumption in countries outside of Asia, has not grown since 2005.

https://yearbook.enerdata.net/electricity/electricity-domestic-consumption-data.html

Coal production has peaked in China. That means electricity production has also peaked.

https://yearbook.enerdata.net/coal-lignite/coal-world-consumption-data.html

Numbersman on Tue, 15th Aug 2017 7:43 pm

Serious question: Why wont negative rates solve a few significant problems we discuss on this board? It slowly drains wealth from the hoarders, and it creates a mechanism to absorb printed money. It wont make oil, but it can fund the pursuit of smaller and smaller supplies, fund the development of more renewable sources, and fund jibs, a critical source of meaning for people. Hard to imagine the dynamics, though. Lots of counter-intuition it seems.

Numbersman on Tue, 15th Aug 2017 7:46 pm

Fund jobs

Makati1 on Tue, 15th Aug 2017 7:48 pm

Numbersman, negative rates are just a tax by the banks. It will only make things worse, as has been seen over the last few years. It is another leveling effect on he serfs.

paultard on Tue, 15th Aug 2017 8:04 pm

numbers is there such a problem with money supply? when i walk around i see big vacuum cleaners (walmart, amazon, home depot, kmart, bill gates, warren buffet). why take money from everybody? they have none because the vacuumn cleaners suck up all money

paultard on Tue, 15th Aug 2017 8:09 pm

when i see cities near the coasts flush sewage to teh ocean i wanted a way to recover essential nutrients/minerals. ultimately they’re taken out of mines or elsewhere on land.

i thought of gathering seashells and turn them into fertilizer but these shells only contain a limited number of minerals. same thing go with sea weeds but it’s a consumable vegetable.

it just occurs to me that robotic farming of salty produce using sea water is the way. this way we recover the minerals without mining them. finally, i see a very productive use for seawater.

i’m still researching cold fusion. gotta keep an open mind

Numbersman on Tue, 15th Aug 2017 8:26 pm

I see the problem with growing salty produce

I see the problem with trying to boil water with earth bound star power.

I see the problem with climate change and environmental degradation.

But as ive been reading Kunstler a bit much, Im having trouble with unpayable debt collapse… it just seems that making loans at negative rates will keep that jig going until we fry on a denuded planet, Which is a relatively slow change compared to economic implosion.

But alas, negative rates assume an orderly and empowered government…. so there you have it- when chaos reigns there can be no administration of negative rates. Same reason Louis the 14th didnt use them I suppose.

JuanP on Tue, 15th Aug 2017 8:55 pm

Bob “Russia is losing population

Have you heard of great numbers of refugees looking to settle in Russia?

No. Most want either Democratic, welcoming nations.”

Bob, Russia is not losing population. Russia’s population has been growing for several years and only contracted for a few years after the collapse of the Soviet Union. Google it. Also, Russia is the second country in the world by number of foreign immigrants; only the USA receives more foreign immigrants than Russia according to the UN and even the CIA’s own factbook. Google it.

GregT on Tue, 15th Aug 2017 11:50 pm

“Have you heard of great numbers of refugees looking to settle in Russia?”

Obama’s Ukrainian Coup Triggered the Influx of 2.5 Million Ukrainian Refugees into Russia

I know bob, 2.5 million isn’t exactly a ‘great number’ anymore, but it certainly used to be. Times have changed.

http://www.globalresearch.ca/obamas-ukrainian-coup-triggered-the-influx-of-2-5-million-ukrainian-refugees-into-russia/5579719

Cloggie on Wed, 16th Aug 2017 3:54 am

I know bob, 2.5 million isn’t exactly a ‘great number’ anymore, but it certainly used to be. Times have changed.

But leftist “kumbaja bob” (and 80+ year old “Meathead” from “All in the family”) will never learn anything from the Ukrainian drama. Ukranians and Russians are pretty similar people (Slavic, Orthodox, Cyrillic alphabet, mutual history for centuries, Kiev Rus, etc), but the rule was: Russians dominate. During the nationalist Maidan revolution of 2013/2014 (prepared for and sponsored by State, the CIA and Adenauer Stiftung), the Ukrainians smelled the chance to “join Europe” and get a better life. The Russian majority in the East was not interested to become a minority in a nationalist Ukraine, identity thingy, certainly not when Kiev began to demand that the Ukraine was officially to become monolingual. And Donbass decided to secede, which succeeded thanks to that mighty neighbor.

Regarding America, the “ethno-cultural distance” between Europeans on the one hand and Africans and Mexicans on the other is far greater than between Russians and Ukrainians. The civil rights movement of the 1960s always was about “minority rights” and the white majority grudgingly (“Archie Bunker”) went along with this development.

But now in 2017, a completely demoralized European America that doesn’t see any future for itself, knows that the story of European America is over, intentionally ruined as it is by the deep state.

The death of white America is illustrated by the removal of Confederate statues everywhere now, even “under Trump”:

https://www.theguardian.com/us-news/gallery/2017/aug/15/confederate-statues-removed-across-southern-us-states-in-pictures

The darkies have won and when Trump will leave office, the Deep State will attempt to ensure that this accident of an uncertified Aryan candidate becoming president will never happen again by opening the flood gates for the third world and make a Republican victory impossible, other than with certified “conservative Bolsheviks” candidates like Rubio.

The new realization will be for European America that there is only one way out to create a new perspective for itself: secession and start all over again. Manifest Destination in the reverse gear and let go of large territories.

https://unitedstateshistorylsa.wikispaces.com/file/view/blog-1pghgqk.jpg/460892790/blog-1pghgqk.jpg

And everybody in Eurasia: Europe, Russia and China, will have an interest to see the uprising succeed, so each of them can advance in the global geopolitical pecking order at the cost of America.

And that is why the coming uprising will succeed, for the same reason that the uprising of 1776 succeeded, thanks to decisive continental European support. This time it won’t be the British that need to be removed from power in America. This time it is that mysterious Deep State, nobody wants to talk about, other than the courageous African-American congressman Earl Hilliard:

https://www.youtube.com/watch?v=yw_v3hqtCl0

(14:50-15:37)