Page added on February 1, 2016

The Oil Crash Is Kicking Off One of the Largest Wealth Transfers In Human History

Economists are still hotly debating whether the oil crash has been a net positive for advanced economies.

Optimists argue that cheap oil is a good thing for consumers and commodity-sensitive businesses, while pessimists point to the hit to energy-related investment and possible spillover into the financial system.

A new note from Francisco Blanch at Bank of America Merrill Lynch, however, puts the oil move into a much bigger perspective, arguing that a sustained price plunge “will push back $3 trillion a year from oil producers to global consumers, setting the stage for one of the largest transfers of wealth in human history.”

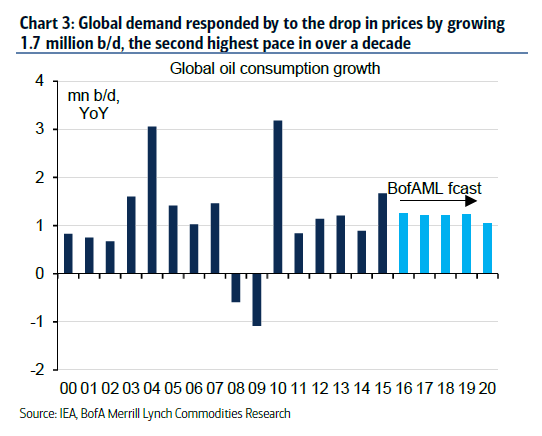

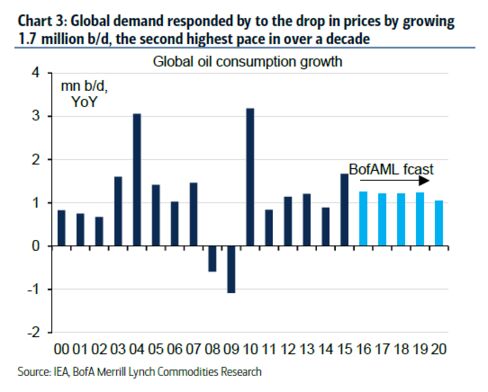

Blanch and his team already see evidence that the fall in the price of crude is having a positive impact on demand, and say that it could accelerate even further if prices don’t pick up.

Says Blanch: “Alternatively in a lower oil price scenario, e.g. if prices were to average just $40 over the next five years which is close to the current forward curve, demand would grow by 1.5 million barrels per day, which is 0.3 above our base case. Finally, at $20 oil demand would grow by an explosive by 1.7 per year on average, 0.5 above the base case, on our estimates.”

Meanwhile, in emerging markets, where much of the story of late has been about disappointing economic growth, Blanch still sees huge upside potential in terms of automobile penetration and consumption.

Take China for example, where the strategist sees the oil plunge helping to fuel a boom in SUV sales: “Moreover, the low oil price is encouraging Chinese consumers to buy increasingly larger cars. Sales of SUVs, the heaviest passenger vehicles category, are up 60 percent year-on-year in the last three months, while overall passenger vehicle sales are growing robustly at 22 percent.”

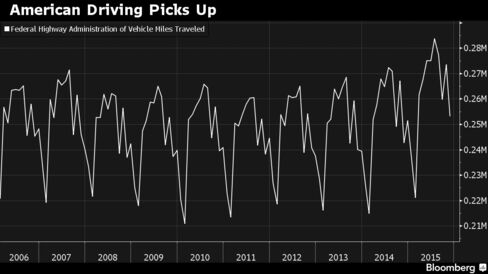

And it’s not just emerging markets where the impact of cheaper gasoline is being seen.

After years of stagnation, vehicle miles traveled in the U.S. clearly ticked higher in 2015.

Combine these trends with the decline in, say, Saudi Arabia’s foreign exchange reserves, or the stock price of any oil company, and you can see the dramatic wealth shifts now taking place in the world.

52 Comments on "The Oil Crash Is Kicking Off One of the Largest Wealth Transfers In Human History"

rockman on Mon, 1st Feb 2016 6:28 am

“…setting the stage for one of the largest transfers of wealth in human history.” A valid point, of course. They just have the timing off: The truly massive wealth transfer began around 2007. At that time the energy companies began transferring huge sums to mineral owners via royalty payments, NOC’s, govts (in the form of production and income taxes), drilling contractors and other service companies and shareholder via dividends: cumulatively in the many $TRILLIONS. And during that same time $TRILLIONS more were transferred from consumers to oil producers at times reaching for than $3 TRILLION PER YEAR.

Compared to then relatively little wealth is being transferred today: much less drilling and mineral leasing thus less wealth transferred from oil companies to the service industry, much less production and income taxes, much lower dividends (none at all from many companies) and a huge decrease in royalty payments to mineral owners including NOC’s. And while consumers are paying less they are still transferring about $1 TRILLION PER YEAR to the oil producers. One can hardly say that the oil companies pulling in that amount of revenue are transferring wealth to consumers. All in all IMHO this is one of the biggest piles of horse sh*t I’ve seen written lately. LOL.

shortonoil on Mon, 1st Feb 2016 7:18 am

It is good thing that these economists are reading PO News. This is exactly what we have been claiming for the last 6 months.

“*****************************************************************************************

01/21/16 PO News

Demand is dying as technology improves

“What bullshit- why was this article even published here?”

We are seeing it because the 1% are getting desperate. The crash in oil prices has started the largest movement of money in history; from the top to the bottom. $trillions are now moving from the 1% to the 99%, and the 1% are stuck. If they stop paying for the oil all of their wealth disappears when the economy collapses; if they don’t all their wealth disappears. They will spend it to produce the oil that is needed to secure their wealth. The energy half way point turned everything around, and as yet – the 1% don’t have a clue.

http://www.thehillsgroup.org/

*********************************************************************************************”

We didn’t get it out of an ECON 101 model either!

Revi on Mon, 1st Feb 2016 7:23 am

I really can’t feel too much sympathy for the 1%. Sorry. I think it’s the big half price sale prior to going out of business.

geopressure on Mon, 1st Feb 2016 7:29 am

http://www.bloomberg.com/news/articles/2016-02-01/china-can-t-resist-30-oil-as-african-north-sea-cargoes-surge

Davy on Mon, 1st Feb 2016 7:50 am

“Take China for example, where the strategist sees the oil plunge helping to fuel a boom in SUV sales.” Analyst or industry cheerleaders I would ask? Anyone looking at what is going on with China and its currencies and markets would know better.

The largest wealth transfer in history is no a transfer it is a wealth bonfire. We are seeing the unwind of a system in decay and random abandonment. We are seeing infrastructure that is vital for future growth cannibalized and destroyed in the process of economic bankruptcy. Widespread bad debt in the form of loans, industry overcapacity, and unneeded development will not only decay and turn to economic dust it will infect and kill other healthy areas.

This is an epic economic event we are in now that will be the end game of globalism. This could play out for a time in a cycle that appears like a business cycle. We may see phantom recoveries and moments of sun but the reality is we overextended ourselves with population and consumption and are facing what comes with those conditions. Those conditions have always been overshoot collapse with the very real possibility of a bottleneck. This may be years down the road but it appears increasingly to be our future reality.

In the here and now we have a system of growth based economics losing momentum and becoming increasingly dysfunctional. Every day we are going to see a new and dangerous situations surface. These are going to overwhelm us eventually. Time frame as always is uncertain because like all peaks and breaks at the macro level you don’t know the play until it has played out. Wealth is not being transferred it is being destroyed.

ghung on Mon, 1st Feb 2016 7:53 am

The article failed to disclose what planet the writers live on. Certainly not Earth. Positing that oil production at @ $40 can continue at current levels, even increase, is either utterly clueless, or pure propaganda; likely both.

Wealth transfer into the POOF! zone.

joe on Mon, 1st Feb 2016 8:14 am

Things have a way of not working out. If Saudi is impoverished, how will the king pay for hundreds of princes? He will have to rule a much harsher regime. Also how to maintain stability in a collapsing middle east, we cant even be sure where the borders will be in 5 years, yet we talk about wealth transfers. Things look smoother frok ivory towers but on the ground, with each and every economic migrant, the world can see what the future of oilistans really are. Regions with access to ready cash, like oil regions, or drug markets relying on weak authorities will seek to undermine regions of strength. Oil markets are the same. 5 years ago the banks never said that oil would collapse, they didnt know that back in 2011 and they cant know that in 2021 what the price will be. Claiming to know something and being right, doesn’t make you a prophet, it only means you were lucky. Go back and read what the banks were saying in 06 about where things would be in 2011. I think they got it WRONG! Banks only do one think, reap rewards based on risk, thats it. They gamble. Oil is not a gamble, its a rigged price mining operation, its murkier than al Baghdadis wifes hijab.

marmico on Mon, 1st Feb 2016 8:28 am

Gasoline spending as a percent of aggregate wages in 2015 at 3.89 pennies per dollar was the 8th lowest in the 69 year history of the data series. A wealth transfer to U.S. household drivers of $110 billion over 2014.

https://research.stlouisfed.org/fred2/graph/?g=3j9E

shortonoil on Mon, 1st Feb 2016 9:52 am

“Wealth transfer into the POOF! zone.”

This is very much part of the cannibalization of the infrastructure that must take place to continue producing oil. We have been mentioning this for some time. We now have central banks around the world reverting to negative interest rates to facilitate this process. That step guarantees that asset values will decline. I doubt if they fully understand why they have taken this route, it was just that they had no other option. What is happening is that the owners of the infrastructure (the 1%) are now passing that wealth to the consumers (the 99%), and like the central banks they have no other option. This will undoubtedly result in a politically very unhappy 1%. What kind of draconian route they will try to take to stem those losses is yet to be seen. But you can be absolutely sure that something very nasty is in the works.

http://www.thehillsgroup.org/

penury on Mon, 1st Feb 2016 11:53 am

I am afraid that I have to agree with Short The 1& never lose money to the 99%. What they lose on the swings hey make up for on the round abouts, *(as the English used to say)

Apneaman on Mon, 1st Feb 2016 12:12 pm

What about the people who don’t drive? 6 1/2 billion? Will the 1% be sending out cheques for their share of the wealth transfer?

twocats on Mon, 1st Feb 2016 12:16 pm

What short is pointing to in a very clear way is the catch-22 of peak oil. Just to look at a couple sides of the rock and hard place. If the economy slows down (oil price falls): 99% buy oil at below production cost (wealth transfer), Debtors don’t make enough to pay their debts and default (hurting 1% who are mostly creditors), consumers stop spending what little money they have (earnings drop). If the economy speeds up: (oil price rises): 99% can’t afford oil because they are not part of these QE money streams, i.e. the economy “speeding up” over the past 8 years has been an asset recovery in the main, and not really a consumer recovery. In fact, with health care, education, and rents having blazed new heights it more than offsets lower interest rates for houses/cars (witness subprime car lending and student loan delinquencies for proof of that). So in order to speed up the economy and have it actually benefit the 1% they would need to first transfer their wealth BACK to the 99% (that cheque Apman was talking about) so that they can spend it on the goods and services they are providing. In energy and resource terms it’s a zero sum game. It’s like when you give a kid an allowance so that when you buy them candy at the store they can buy it “with their own money”. It’s still your money, but it makes the world go round.

As for what the wealthy are going to do? Negative interest rates to try and shake the bushes for money to make a run from one place to another. Sure why not, what could possibly go wrong. And eventually, helicopter money. Or, skip to the fascist high-tech dark ages. Or a combination.

Apneaman on Mon, 1st Feb 2016 12:31 pm

BP to announce 70% collapse in profits

Figures likely to be even worse after energy firm factors in writedowns and one-off charges as slump in oil price takes its toll

http://www.theguardian.com/business/2016/jan/31/bp-to-announce-70-collapse-in-profits

GregT on Mon, 1st Feb 2016 12:47 pm

“A wealth transfer to U.S. household drivers of $110 billion over 2014.”

Wow marmi, $340 per capita/per year, or 93¢ per day. My hydro/electric bill alone, increased by more than that during the same time period. My grocery bill increased by 15%, my automobile insurance by 8%, and my house insurance by 7.5%. Even the new bridge tolls cost me over 5 times that amount daily. Add to that increases in transit levies, income taxes, home owner’s taxes, utilities, and on top of everything else, zero percent interest rates. Hell, even inflation itself wiped out 2/3 of that massive “wealth transfer” for the average American wage earner in 2014.

shortonoil on Mon, 1st Feb 2016 1:13 pm

“What short is pointing to in a very clear way is the catch-22 of peak oil.”

That is a pretty good summation. What we need now is a thread on how the individual can best survive the squeeze that is coming. There are obvious routes to take, like get out of debt (deflation is going to kill anyone with very much it), and reduce ones cost of living to a bear minimum. But in this Topsy Turvy world of an economy that is now running backwards many unexpected, and unforeseeable events are likely to happen. Having many eyes looking for them would likely be a considerable benefit. We may be rushing back to the Dark Ages, but we’re not there yet. Maximizing our survival, and comfort levels should be the primary goal for the near future.

Jerry McManus on Mon, 1st Feb 2016 1:20 pm

All well and good, and we can argue all day about whether $trillions are being “transferred” or whether they are being “evaporated”, but in the end it all boils down to one simple question:

If oil were free, then what?

Keeping in mind Liebig’s law of the minimum, I have to wonder:

If oil were free for the taking, as much as you want, then what will be the next hard, bio-physical, planetary limit that we industrious humans will hit at full speed like a bug going splat on a windshield?

In the big picture, after all, the price of oil is not the only factor playing into the complex dynamic that is our ongoing global ecological overshoot and collapse.

In fact, I would hazard to guess that it’s probably not even a significant factor.

Revi on Mon, 1st Feb 2016 1:40 pm

Oil is on sale now, but they aren’t going to have any incentive to make more, so this is the big markdown prior to it not being available any more.

It’s like those towns that lost all their businesses to make way for a Wal-Mart that was then shut down.

Lots of cheap stuff for a little while, then nothing.

markisha on Mon, 1st Feb 2016 1:46 pm

in my opinion . The 1% should pay workers to clean garbage on the planet for 1oo0$ per day . So that workers can buy stuff again. And 1% should distribute their wealth in that manner to 99%. So we can continue living at list for little bit longer, but I know it wont happen so we are screwed. Something like this hahhahaha

dubya on Mon, 1st Feb 2016 2:59 pm

I don’t quite understand the premise.

Since we were paying $1.40 per liter and now we are paying .80 this is a downwards wealth transfer? 100,000 oil workers lose their jobs and the executives get the same bonuses? Sounds rough.

I suppose if I’m getting raped every day and the Rape Corporation chooses to take off Friday, Saturday and Sunday it’s an improvement.

shortonoil on Mon, 1st Feb 2016 3:02 pm

“If oil were free for the taking,”

If oil was free there won’t be any of it. It is not produced by sweet little elves who try to deliver a better cooky. When oil companies can no longer make money producing oil they will stop; and so also will just about everything else!

Peter kvitovic on Mon, 1st Feb 2016 3:18 pm

Does government/military take over essential production when companies are bankrupted to mAintain civilisation?

bug on Mon, 1st Feb 2016 4:29 pm

Peter, that is the question.

I wonder how it plays out?

Will uncle sam become like ARAMCO?

Peter kvitovic on Mon, 1st Feb 2016 4:45 pm

Yes if major bankruptcies happened in industry from low prices wouldn’t emergency nationalization be logical to keep things functioning.

Outcast_Searcher on Mon, 1st Feb 2016 5:02 pm

shortonoil wrote:

‘If oil was free there won’t be any of it. It is not produced by sweet little elves who try to deliver a better cooky. When oil companies can no longer make money producing oil they will stop; and so also will just about everything else!’

Riiiiiiiiiiiight. Because heaven forbd that the market work, as it has worked for many decades, this time, since that would interfere with the “all doom all the time” thesis.

Marginally high cost oil producers WILL stop producing when they feel it no longer benefits them. (Like when current high cost wells play out and they refuse to drill new high cost wells and instead sit on resources and await higher prices).

And when the oil demand (which continues to rise on a global scale) line crosses the supply line by enough to eat meaningfully into what is being stockpiled during the current glut. *gasp* prices will rise accordingly, since investors astute enough to read will want to profit from oil.

And when prices rise high enough — well, it’s really not that complicated.

But no, let’s pretend that the sweet little elves of doom somehow make everything different THIS time, because?

Is it that this helps sell certain newsletters perhaps?

Outcast_Searcher on Mon, 1st Feb 2016 5:06 pm

Peter k wrote:

“Yes if major bankruptcies happened in industry from low prices wouldn’t emergency nationalization be logical to keep things functioning.”

Yes, because socialist thugs nationalizing things is such a successful strategy in keeping things functioning — like the economies of Brazil and Venezuela currently, for example.

No, wait…

Outcast_Searcher on Mon, 1st Feb 2016 5:10 pm

Ghung wrote:

“The article failed to disclose what planet the writers live on. Certainly not Earth. Positing that oil production at @ $40 can continue at current levels, even increase, is either utterly clueless, or pure propaganda; likely both.

Wealth transfer into the POOF! zone.”

Well, just because wealth is transferred doesn’t mean it goes away — even if it is spent on VERY stupid stuff. The clown buying the gigantic truck and SUV since “gas is cheap” is still really saving about $2.00 a gallon, even if gnats are smarter than such buyers.

And the longer prices stay low, the greater the savings for all the users of energy — which helps the overall economy.

That’s not “poof”, even if it’s not helpful for preparing to bring future oil to market to meet demand, and even if it helps destroy the planet through more FF burning fueling AGW.

Boat on Mon, 1st Feb 2016 5:40 pm

apeman, GregT,

Do you remember when I commented that drop in oil was one of the great transfers of wealth? I see the MSM finally caught up with the dude from Texas.

Fracking tech continues to evolve.

http://www.worldoil.com/news/2016/2/1/first-continuous-duty-frac-pump-enters-canadian-market

Now I could post links like this all the time like the links ya’ll post in the assumption of a world changing crash. It would be a waste of time to close minded people. Tech won’t die soon and neither will oil or nat gas. Get used to the idea of fracking around the world as the price to frack drops. Americans are good at this stuff.

ghung on Mon, 1st Feb 2016 5:57 pm

Yeah, OS, my point is that much of that oil being burned will never be paid for at $40, so someone’s petro-dollars are going POOF! I doubt those doing the burning are deriving much more benefit from oil being marketed at below cost than they did at $100, and I doubt the economy will benefit proportionately. Easy come; easy go.

The main point is this, from the article: “…if prices were to average just $40 over the next five years…”, a lot more of somebody’s money is going POOF!,, so it ain’t happening.

marmico on Mon, 1st Feb 2016 6:04 pm

Wow marmi, $340 per capita/per year, or 93¢ per day

I wouldn’t expect an innumerate to know what ceteris paribus means. 🙂

Apneaman on Mon, 1st Feb 2016 6:25 pm

Das Boat, yes I remember laughing my ass off last week when I read you repeating shit you had read. Trying to pass it off as an original thought, then and now? I’ve read the econ 101 wealth transfer bullshit many times before and also before you said it in regards to oil prices. Like most of your deep thoughts, you are simply parroting the stuff that confirms your hopes. I have yet to see an original thought from the leaky boat. I read the same shit too boaty. I read it all – not like you who has admitted to not needing to click on links others provide. Don’t need to when you “know” the future of oil/economy. Something the econ profession has an abysmal track record at predicting, yet you “know”.

Here’s the wealth transfer claim a week or so before you.

JAN 20, 2016 | 2:00 PM EST

“And as I’ve previously noted, all of this “low-energy price” stuff is simply a wealth transfer — money is staying with oil consumers instead of going to oil producers.”

http://realmoney.thestreet.com/articles/01/20/2016/chill-out-selloff-ridiculous

Boat on Mon, 1st Feb 2016 7:41 pm

Apeman,

I have kept all you doomers up to date on my personal gasoline savings since the beginning of the drop in price. $1.48 per gal today.I got no need to parrot. Transfer of wealth indeed.

GregT on Mon, 1st Feb 2016 7:45 pm

Boat,

How about keeping everyone up to date with your personal gasoline expenditures starting from before the prices began climbing up. As opposed to cherry picking the data.

GregT on Mon, 1st Feb 2016 7:59 pm

This might help to jog your memory Boat.

http://www.eia.gov/todayinenergy/images/2015.02.03/figure1.png

Bloomer on Mon, 1st Feb 2016 8:27 pm

Low oil prices is a green light to consume more.

The restless consumers are already trading their Honda Civics in for Ford F350’s. Real men and women drive big trucks.

More oil consumption, more C02 in the atmosphere. Its a good thing that climate change is just a conspiracy theory from the left wing to bring down capitalism otherwise I be worried.

makati1 on Mon, 1st Feb 2016 8:52 pm

There will soon come a day when a million shares of BP or Amazon or Apple will not buy a plate of beans.

GregT on Mon, 1st Feb 2016 9:53 pm

There will soon come a day when a million will seem like an enormous number again.

Apneaman on Mon, 1st Feb 2016 10:34 pm

das Boat, I own rental property. I get paid when sit on my ass. Get a cheque every month regardless of the price of gas. I consider that wealth. Paying less for gas is not making anyone wealthy. Unless you consider wealth one more weekly trip to Dollarama? Extra cheese on the pizza? Buy a water filter to slow the lead poisoning? No the biggest wealth transfer ever started in 2008 and it’s almost complete. Just 1% more to go. Boat you are a slave who has been assed raped by your master and is thanking him for it. Boat the bitch. Soon you’ll be offering them blow jobs just to get something warm in your belly. Slave.

Oxfam says wealth of richest 1% equal to other 99%

http://www.bbc.com/news/business-35339475

62 people have as much wealth as world’s 3.6B poorest, Oxfam finds ahead of Davos

http://www.cnbc.com/2016/01/17/62-people-have-as-much-wealth-as-worlds-36b-poorest-oxfam-finds-ahead-of-davos.html

Boat on Mon, 1st Feb 2016 11:39 pm

Apeman,

For six years the world payed to much for oil and now it is getting oil to cheap. High oil prices didn’t come from oil producers. Oil demand didn’t come oil producers. You, me and anybody else who ever consumed about anything is to blame . Your views are just immature and not well thought. As most people who blame others for problems.

Doesn’t bother me one bit your financially independent. Better that than needing help.

I came from generations of hard workers and would have it no other way. On paper I could have stopped working years ago but what would I do. Sit around and eat ice cream?

Apneaman on Tue, 2nd Feb 2016 12:31 am

No ones financially independent. People lose jobs in shitty economies and don’t pay rent. Seen it in Atlanta in 2009 – many regular folks who own a rental house or two instead of a 401k lost plenty of income/retirement income and some had to sell and take a hit. Speaking of needing help it wasn’t the working man who got bailed out was it? No it was your 1%er heros. Ever get tired of the boot licking boat? How grateful you are for them letting you exist and telling you your purpose in the one and only life you will ever have. Why don’t you grow up and grow a pair. What could be more immature than blindly following the dictates of your “betters” and spending your free time parroting their think tank memes as gospel? Your the immature one as far as I’m concerned – clinging to your long held beliefs in the face of all evidence to the contrary as your city and nation falls a little farther every day. You should stop working and go help some blind kids or something – maybe meet a nice lady there too. Better than spending the rest of your life mindlessly consuming and cheerleading the cancer. Besides the consuming will end soon enough since the 1% have been so utterly successful in their wealth transfer project that they have almost culled their customer bases out of existence. Also hollowed out the tax base to the point where the infrastructure they depend on as much as anyone is crumbling and is never getting anything more than a few band aids. You must see it every day in Houston.

FHA: Hundreds of area bridges are ‘structurally deficient’

Houston-area bridges in need of major repairs

http://www.click2houston.com/news/fha-hundreds-of-area-bridges-are-structurally-deficient_20151123145325336

SYLVESTER TURNER IS TRYING TO ERADICATE ALL OF HOUSTON’S HORRIFIC POTHOLES

http://www.houstonpress.com/news/sylvester-turner-is-trying-to-eradicate-all-of-houstons-horrific-potholes-8073698

6. Houston (City of Houston Public Works)

Houston is the fourth-largest U.S. city. It gets its water from sources such as the Trinity River, the San Jacinto Rivers and Lake Houston. Texas conducted 22,083 water quality tests between 2004 and 2007 on Houston’s water supply, and found 18 chemicals that exceeded federal and state health guidelines, compared to the national average of four. Three chemicals exceeded EPA legal health standards, against the national average of 0.5 chemicals. A total of 46 pollutants were detected, compared to the national average of eight. The city water has contained illegal levels of alpha particles, a form of radiation. Similarly, haloacetic acids, from various disinfection byproducts, have been detected.

http://www.nbcnews.com/id/41354370/ns/business-going_green/t/us-cities-worst-drinking-water/#.VrBI5tIrKt8

Houston’s air-quality issues: Interlinking problems

http://www.harc.edu/features/Houston%E2%80%99s_air-quality_issues_Interlinking_problems

Clean livable communities with functional infrastructure, like in the past, are the real wealth boat – not cheaper gas and cheaper consumer crap.

Davy on Tue, 2nd Feb 2016 1:23 am

“Caught On Tape: Chinese Investors Find Out They Got Fleeced By A $7 Billion Ponzi Scheme”

http://www.zerohedge.com/news/2016-02-01/caught-tape-chinese-investors-find-out-they-got-fleeced-7-billion-ponzi-scheme

“On Monday we got the latest “big” news out of China when Beijing announced it had arrested 21 people over a $7.6 billion P2P fraud Ezubao. 900,000 people were defrauded, making the fiasco the biggest ponzi scheme in history by number of victims.”

“Ezubao’s model was simple: they pitched the “business” as a P2P lending company through which investors could fund a variety of projects. The problem: 95% of the projects didn’t exist. Ezubao just made them up and used the new money to repay existing investors who were promised annual returns of between 9% and 15%.”

“On thing we’ve discussed at length over the past year is the extent to which China is teetering on the verge of social unrest. Between the stock market meltdown, the cratering economy (which will invariably lead to massive job losses) Chinese policymakers are going to have their hands full explaining what went wrong to the country’s 1.4 billion people”

Davy on Tue, 2nd Feb 2016 1:55 am

“China Will Probably Have to Impose Capital Controls, SocGen Says”

“http://www.bloomberg.com/news/articles/2016-02-02/china-will-probably-have-to-impose-capital-controls-socgen-says”

“$3.3 trillion of reserves not enough to defend yuan: lender”

“French bank forecasts 12% drop in currency if outflows quicken”

“China will probably have to resort to capital controls as even the world’s biggest foreign-exchange stockpile won’t be sufficient to defend the yuan, according to Societe Generale SA.”

“Just because you have the world’s biggest foreign-exchange reserves, the domestic monetary implications of running down your reserves at a rapid pace shouldn’t be underestimated,” Kit Juckes, a global strategist at Societe Generale, said at the same interview. “They have a clear choice: tightening the capital account or allowing the currency to depreciate more quickly.”

“Chinese policy makers are trying to counter record outflows and prop up the yuan, while opening up the capital account and keeping borrowing costs low to revive economic growth. The balancing act challenges Nobel-winning economist Robert Mundell’s “impossible trinity” principle, which stipulates a country can’t maintain independent monetary policy, a fixed exchange rate and free capital borders all at the same time.”

GregT on Tue, 2nd Feb 2016 2:24 am

All of these articles, and not one of them mentions the main reason for the slowdown in growth in China, or the reason for the insane growth in China to begin with.

I smell an agenda, and a distraction. I have always considered Bloomberg to be one of the biggest sources of the western internationalist’s propaganda. It appears that ZeroHedge has now been infiltrated as well. Sad that, Zerohedge used to be

much less biased. Even RT seems to have been corrupted now. Looks like Hillary’s vision for a global western dominated media is working out. God help the world if she gains control in 2016.

Apneaman on Tue, 2nd Feb 2016 3:00 am

Wealth transfer from the taxpayer to the oil companies via bailouts. Subsidies are no longer enough. Talk about your tit sucking welfare recipients. Whatever it takes to keep the cancer growing for a few more years eh?

The Big-Oil Bailouts Begin

“On Wednesday, it was leaked that the IMF and World Bank would dispatch a team to oil and gas-dependent Azerbaijan to negotiate a possible $4 billion emergency loan package in what threatens to become the first of a series of global bailouts stemming from the tumbling oil price.

In Latin America’s largest economy, Brazil, the government has refused to rule out bailing out Petrobras, once the jewel of the nation’s crown but now a scandal-mired shadow of its former self, weighed down by $127 billion in debt, most of it denominated in dollars and euros.

If it is unable to sell the $15 billion in assets it has targeted by the end of this year – a big IF given how the prices of oil and gas assets have deteriorated – Petrobras might need some serious help from Brazil’s Treasury. According to Citi, that help could reach $21 billion – just enough to plug the company’s cash hole and fix the capital structure on a sustainable basis. That’s a big payment for a government that has on its hands a widening budget gap, a 4% economic contraction, and double-digit inflation.

Brazil is not the only Latin American economy entertaining a bailout of its national oil company. The government of Mexico just announced that it quietly injected 50 billion pesos ($2.7 billion) of public funds into the coffers of state-owned oil company Pemex.”

http://wolfstreet.com/2016/01/30/the-big-oil-bailouts-begin/

karle on Tue, 2nd Feb 2016 3:42 am

Low oil prices will make it impossible for several middle eastern countries to feed the people, including Saudi Arabia.

That will make people walk those 3,000 miles to Germany.

We had about 1.5 million migrants arriving here in 2015. Lots of problems here …

We expect an estimated 3 – 4 million migrants in 2016. That might make our infrastructure collapse. Already now you can drink and drive since police is busy with migrant violence.

Now imagine those many millions in the oil countries going on the march to Germany.

Davy on Tue, 2nd Feb 2016 7:40 am

“All of these articles, and not one of them mentions the main reason for the slowdown in growth in China” and those would be……..? I think someone lacks financial insight along with an unsupported statement. What is happening to China is relevant news to the systematic implications of global economic decay from the moral hazards of corruption, financial repression, and a malinvested Ponzi credit creation. All my links are pointing to this and supporting a very relevant theme that is also inconvenient to the Bricophiles.

This is agenda on one level and that is to show the Bric narrative is dead. The crowing is over for the death of the dollar and the rise of China and the yuan. The bricophils are remarkably quiet lately. The US was supposed to be the epicenter of this global implosion but instead it has started with the Brics. The dollar was dead and the Yuan the new global reserve currency. The dollar is dead also just not like the anti-American narrative said it would be.

Don’t worry the US is setting up for a huge fall. The US is right in the middle of a global recession. The US financial markets are set for a 30’s style crash. Whether that will happen dramatically or in slow motion is a big question.

This Chinese news is the most relevant short term news and more so than oil. It is the Chinese slowdown that is one of the main variables in initiated this global oil crash. China’s demand drop and its currency and market carnage is being manifested in the oil complex. China is where the most extreme excesses have occurred that are part of the global Ponzi. The US is partly responsible for China’s issues and also a part of the excesses of the global Ponzi.

“I have always considered Bloomberg to be one of the biggest sources of the western internationalist’s propaganda”. Of all the mainstream media Bloomberg is the most objective. Bloomberg is targeting the global investor who could care less about propaganda and more about their greed. They have investments they want to see succeed. They are invested everywhere not just the US. Propaganda is rife everywhere so it is our job to digest and navigate these distortions. Pretty much if you ignore Bloomberg you are ignoring financial reality. Bloomberg data is referenced by everyone from the Brics to the west. It takes a gold pan that sifts through all the worlds’ news for the best information.

Zerohedge is one of the most anti-American news amalgamators I visit. They are extremely pro-Russian and even pro Chinese on the military end of their news. They used to be pro-Chinese on the economic side until the truth of the Chinese rot became apparent. The best pro-Putin propaganda is on Zerohedge. When I say propaganda I also mean relevant and factual news. I call it propaganda because they do what they typical anti-Americans do and that is discredit the US and talk up their bright horses. The reason Zerohedge is all over China is because it is the most relevant news to “the unravel” of the global markets currently. China is full of lies and distortions. Zerohedge is front and center in the exposing of these issues.

“Even RT seems to have been corrupted now.” I think someone is getting paranoid and upset that their whole global world view is collapsing. Someone had a narrative that it turns out is a turd. It was not supposed to happen this way. Reality was supposed to be different. Someone is mad that their agenda is lame.

GregT on Tue, 2nd Feb 2016 9:13 am

“Someone is mad that their agenda is lame.”

I can’t take you seriously anymore Davy. You’ve lost all credibility with me.

Davy on Tue, 2nd Feb 2016 9:29 am

I was going to give you a shovel gregger but you are really good a digging your own hole.

GregT on Tue, 2nd Feb 2016 9:41 am

The red white and blue is shoved so far up your ass that you can’t see three feet in front of your own face Davy.

You’ve fallen for the propaganda hook line and sinker. Either that, or you are complicit.

joe on Tue, 2nd Feb 2016 10:14 am

Apeman got it right. In modern crapitalism, ‘wealth’ is a term used to describe the potential utility in the economy for the consumer. So saving for a rainy day is the same as a recession. Oil price drops mean the 1% is happy because you can buy that ipad you always wanted next christmas. Since most people seem to be still in recession there is the idea that this ‘stimulus’ money is vanishing into the blackhole called ‘federal government debt’.

Davy on Tue, 2nd Feb 2016 10:15 am

You know Greg has been bitch slapped good when the labels and personal attacks start. Lol