Page added on February 8, 2022

The End of Growth. No more cheap energy, no more growth

The energy crunch, of which I have started to write about in September, 2021 doesn’t want to ease its grip on us. The price of natural gas is still near record highs along with coal — both costing three times as much as the last ten years’ average. Oil is also climbing steadily upwards, now surpassing 90 USD — a price not seen since 2014. Here is quick visual reminder on why this is a huge problem:

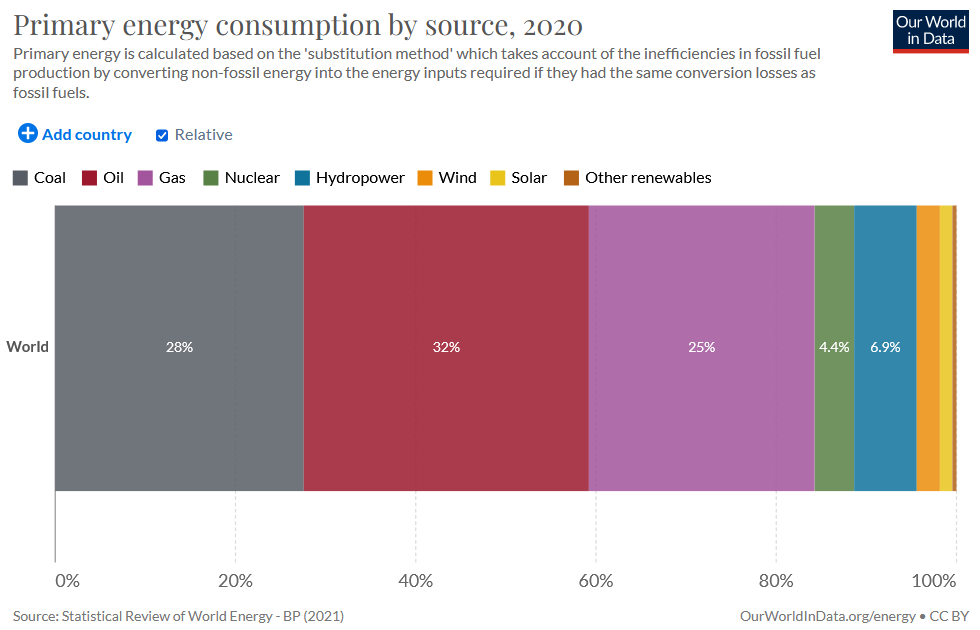

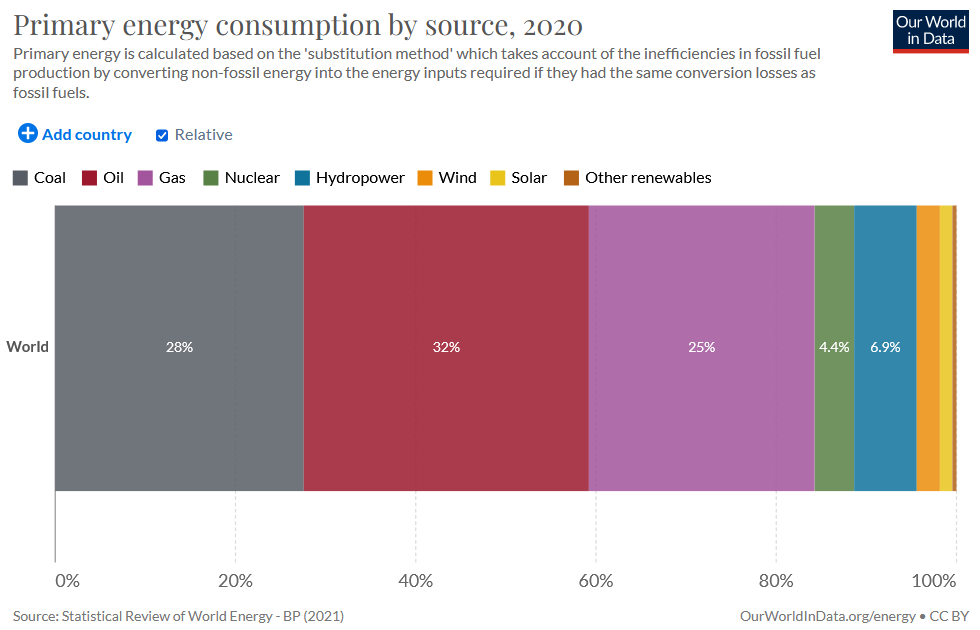

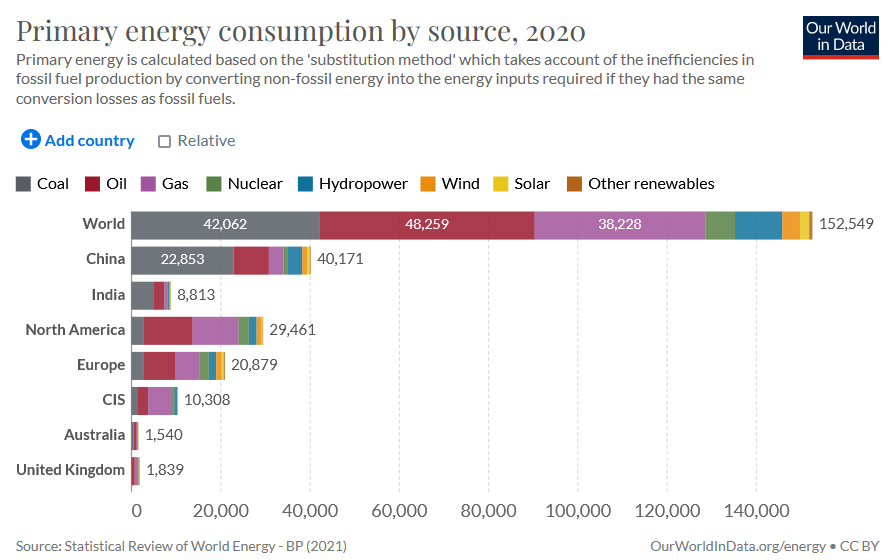

See those yellow/orange lines on the right? Those are “renewables” — made entirely using fossil fuels. The first three bars (coal, oil, nat. gas) take up 85%. Nuclear? 4.4% — also built and maintained using fossil fuels. That is our problem. Even today, the vast majority of our energy hungry processes (including the mining, manufacturing and transporting of solar panels and wind turbines among countless other things) rely entirely on fossil fuels — and need to be fed constantly, with an ever increasing amount to avoid shortages and an eventual collapse in production.

The price of fossil fuels thus affects everything: from metals to plastics, from food to electricity. It’s no wonder the price of commodities are soaring.

The switch to renewables on the other hand, is simply and factually not happening. Solar, wind and hydro is only an extension to an ever increasing overall fossil fuel use:

Contrary to western government propaganda we are not getting an inch closer to Net Zero. Some countries? Maybe, but do not ask where those panels and turbines came from. See those tiny downticks in oil, coal and gas use? That is where most of our current energy woes (leading to inflation and various shortages) are coming from. Let me explain.

Energy must be spent in every single economic activity. Without it the (human) world stops. No mining. No transport. No manufacturing. No food. No nothing. Energy is not a simple cost item on a long list, but one of the most important inputs to civilization (if not the most important). Take it away, and any civilization collapses immediately.

Unfortunately for us, humans, this is what we see unfolding before our eyes in slow motion. Metals, essential to a transition to “renewables” cost more than ever, or are near to their all time highs. This prolonged energy crisis, going on for half-a-year now, has made an already worsening metals crisis even worse. It’s no wonder: mining and smelting ever worse ores is an energy intensive process by nature; you have to haul more and more rocks to get the same amount of metals. Combined with an ever increasing demand, this degradation has lead to an exponential increase in energy needs (electricity, gas, diesel fuels) and thus increased costs. To cite the study linked above:

Analyzing only copper mines, the average ore grade has decreased approximately by 25% in just ten years. In that same period, the total energy consumption has increased at a higher rate than production (46% energy increase over 30% production increase).

This is a prime example of diminishing returns in real life. You increase your efforts more and more to keep up with demand, but your work yields weaker and weaker results… As a result, the productivity (or efficiency) of the mining industry has hit a peak in 2002, and falling relentlessly ever since (Michaux, 2021, Figure 33). As the author made it clear:

What this means, is the cost of mining is being driven up, as each of the higher quality deposits are extracted and processed. In particular, the truck and shovel fleet in open pit mining is required to haul much more ore per unit of metal, resulting in an increase in diesel fuel consumption. To put things in appropriate context, decreasing grade does not mean that the supply of copper in the ground is running out. It does mean that the supply of copper that is economical to extract is declining, forcing the production cost going up. It also makes mining very reliant on the energy (diesel fuel in particular).

Due to this unfortunate, but perfectly natural process of the depletion of once rich reserves and rising costs of energy, the mining of essential metals is now coming dangerously close to a tipping point, from where less and less metal would be produced despite a soaring demand. In case of copper — an irreplaceable commodity in all “renewable” (such an oxymoron) projects — this tipping point could happen well before 2040. Worst case, before 2030… (Michaux, 2021, Figure 11)

We are not there yet, and the “transition to renewables” has just started — one could argue. A copper shortage, resulting from the above trend however, is already sending prices upward and have already started to slow the “transition to renewables” (better put: the addition of solar and wind to the now struggling fossil fuel infrastructure).

Again, it doesn’t matter if few windswept islands in the North Sea, or an energy deprived peninsula of Eurasia switches a part of its electricity production to renewables, when those non-renewable devices are produced by burning coal, oil and natural gas on the other half of the planet, using rapidly depleting reserves of metal ores.

Then surely more mines will be opened and it will drive the cost down! For those hoping that “high prices always give rise to higher production” I have bad news to serve: it takes 10 years to establish a new mine and ramp up mineral extraction. To cite Wood MacKenzie:

delivering the base metals to meet [net zero 2050] pathways strains project delivery beyond breaking point from people and plant to financing and permitting.

As an article on mining.com pointed out even more clearly:

Copper, which Woodmac emphasizes “sits at the nexus of the energy transition” stands out particularly. The 19 million tonnes of additional copper that need to be delivered for net-zero 2050 implies a new La Escondida must be discovered and enter production every year for the next 20 years. Even if you focus on just one of the obstacles bringing new copper supply online – the time it takes to build a new mine – and leave aside all other factors, net-zero 2050 has zero chance.

New mines would offer little in terms of salvation anyway, as they require an increased use of energy (from polluting and now possibly dwindling fossil sources) to get the same amount of metal compared to yesteryear — guaranteeing higher prices for years to come…

As less and less of us will be able to pay these higher and higher costs of — for example copper — “production” and as a result “renewables”, less and less of them will be built. This is how the production of solar and wind could slowly grind to a halt in a tight lockstep with the withering mining industry, in a process called demand destruction. This is how capitalism ends itself: it doesn’t “worth” doing it anymore.

It is very important to note however that this is not a financial problem. Money printing — be it digital currencies or whatever-coins — will not make ore grades better, nor fossil fuels abundant again. In fact it will only use up even more energy and inflate everything else away, as you can already see it happening today.

I know that it’s very hard to accept, but it looks like that we are already approaching planetary limits to growth — before a true transition to renewables could even begin.

This is where we tie back to the energy market. If we have so much oil in the ground as governments tout, why did we haven’t come out of the “pandemic induced” slump of oil production yet? Now, that demand is soaring again — much to the detriment of the future of life on this planet — oil prices are on the rise again. Why there isn’t enough oil (and gas, and coal) on the market?

The answer is dead obvious after one gets the basics of geology (see Michaux, 2021, Figure 56–57). Resource depletion is as true to coal oil and gas as to anything else. These resources are located in finite deposits, created millions of years ago — just like copper, or any other mineral. Following the low hanging fruit principle, the big fat fields with low energy (and monetary) investment needs were emptied first. Then the industry moved on to lower and lower quality, harder and harder to reach plays.

“Harder to reach” means higher energy inputs, and with higher energy prices, this has translated to higher costs of extraction. Now as a result, we are running out of the best spots — in fact there are barely any places left to drill. It looks increasingly unlikely that we will hit 2018’s level of oil extraction again, and face a long slow decline after a few years of struggle. It’s important to note here, that we do not need to completely run out of a resource in order to experience serious issues.

Clearly, economists do not read such studies… As a Morgan Stanley analyst wrote: “The oil market is heading for simultaneously low inventories, low spare capacity and still low investment.” — a good observation, albeit lacking the fundamental understanding of the nature of drilling for a finite resource. Of course there is a lack of investment, if the next well you must drill to compensate the eventual depletion of old (easy to drill) wells costs you more and more, every year.

The same goes for exploration — we are well past diminishing returns on both activities. No wonder, that even the biggest oil companies are now choosing to invest in “renewables”, or decide to pay back their investors instead… Then leave. Not even OPEC can pump more —they are also out of spare capacities for the same reason. This is how the entire system looses its resiliency. Stir in geopolitical instability, threatening to disturb supply in the middle east, or Russia being embargoed… and here you go: the biggest oil crisis ever.

The same story plays out with natural gas. The US, where everything seems to be right (for now), will be running out of natural gas in a mere 12 years from now… if they could pump the remaining gas at full speed. However as fields deplete, they give less and less gas and/or oil ; preventing any attempt made at pumping them at full throttle till the very end (1). The only possible way forward for the US is thus to face an ever falling production rate: first slowly then at an ever increasing pace. The US might have a couple of good years left with stagnating natural gas extraction into 2023, 2024 at best, then production will most probably tip over and start to decline.

Canada, Australia and Europe are all facing the same issue on a similar timeframe — leaving the western world with Russian, Middle Eastern and South American gas (whose rate of production is also set to fall in the coming decades). This could easily lead to a peak in global gas production by 2028 — six years from now. Not the best news for the energy transition, and certainly not for agriculture (2).

Where does this leaves us?

- Higher energy prices (oil, natural gas, electricity, wind & solar) leading to higher extraction and manufacturing costs for everything, including solar panels and wind turbines too.

- This translates to higher investment costs for ALL sorts of energy (from fossil to wind and yes, nuclear too). Not only in monetary, but in energetic terms too: competing with vital needs like food production and infrastructure maintenance, not to mention manufacturing — providing jobs for a lot of people. Expect hot debates around the “renewable transition” as various pressure groups collide over the matter of energy use.

- As investments fall, we will eventually— in the not so distant future — pass a point where replacing depleted wells and mines with new ones, or with renewables will become a loosing battle. Simply put: we will be losing more capacity than what we could add to the global energy system, resulting in a global peak of energy production (peak oil, peak gas, peak electricity) somewhere in the coming ten to twenty years. (Certainly before 2040, possibly before 2030 depending on the availability and use of coal.)

This is a bold prediction to make, I know. Still, based on the information what I have today, this seems to be the most likely scenario. Then who knows? Maybe the financial economy collapses sooner making this entire discussion moot. Maybe oil companies find a way to access reserves under the melting Arctic. Maybe aliens come and save us…

More realistically speaking, it would make much more sense to talk about how we ration whatever is left of the planet’s resources. How do we bring down consumption in the most equitable way possible? How do we get rid of both fossil fuels and mining on the long term? How should country’s, town’s, or individuals handle the upcoming shortages and increasing unaffordability of energy (both from fuels and electricity)? How do we build back resiliency?

That’s a lot to think about, and your answers may vary greatly depending on where you live. As always though, it is better to be prepared than surprised.

Until next time,

8 Comments on "The End of Growth. No more cheap energy, no more growth"

Theedrich on Thu, 10th Feb 2022 2:00 am

The Davos elites aim to control the earth. Their scheme is a self-enrichment strategy to seize power over all capitalist countries in order to milk them dry for their own benefit. In a recent Hillsdale-College Imprimis article entitled The Great Reset, scholar Michael Rectenwald wrote that

and

(Interestingly, there is a Latin word, clades, which means “disaster.”)

This is what Klaus Schwab, Georg Sörös, Bill Gates and other megabillionaires of the World Economic forum (WEF, Weltwirtschaftsforum) have in store for the White world. Their intention is to quasi-sinicize it — make it into a replica of Red China, but with themselves at the top pulling the marionette strings of us peasants below.

Since they now have the entire American federal government (along with its European vassals) and its ministry of propaganda along with Big Tech under their control, it is only a matter of time before the Great Reset turns into the Great Collapse. Then they will be able to use the COVID-19 pandemic and economic devastation to impose their own version of “saving the earth” by returning it to medieval feudalism on a civilizational scale. The ordinary, impoverished White will be happy with his daily dose of government-supplied narcotics and propaganda. The elites, however, will still need their corporate jets to fly to Davos and plan further manipulation, and will have to have their private, billion-dollar yachts to relax and enjoy their orgies on.

A necessary prelude to the completion of their takeover is the submergence of White civilization in the current mudslide of ThirdWorld immigration into formerly White nations. Because, we are told, the primitives are all “stakeholders” in the achievements of Whitey. So they must be allowed to invade the West and overwhelm it in order to complete its transformation into a woke paradise.

How convenient that today we have a Red Chinese virus to help them out.

Cloggie on Tue, 15th Feb 2022 4:46 am

“The End of Growth. No more cheap energy, no more growth”

False conclusion, it all depends on how you define growth.

Yes it is true: the old-skool bulk growth in the production of more oil, gas, coal, steel, concrete, glass, cars, planes, ships, roads, skyscrapers will indeed go in reverse gear.

But it is still possible for large groups of people to simply sit together, if necessary virtually, and create for instance a magnificent piece of software, new technological methods that require less energy. The growth of bulk products may be over, the growth of quality doesn’t need to be halted.

Cloggie on Tue, 15th Feb 2022 5:20 am

Europe will develop reusable rocket:

https://www.n-tv.de/wissen/Europa-plant-wiederverwendbare-Rakete-article23127780.html

The propulsion should be reused 5 times, the rocket parts should be reused too. First tests in April. Fuel: methane rather than hydrogen. First lift-off in 2023 in Sweden. Real production date 2025. If all goes well, the technology will be applied to the ESA flagship Ariane-6 as well.

FamousDrScanlon on Tue, 15th Feb 2022 11:14 am

cunts cunts cunts

Biden's hairplug on Tue, 15th Feb 2022 12:14 pm

“cunts cunts cunts”

TalmudTurk working on his street creds.

#ThugLife

Biden’s hairplug on Tue, 15th Feb 2022 1:58 pm

EU to take on Amazon and SpaceX with internet from space:

https://www.siliconrepublic.com/innovation/eu-space-satellite-system-six-billion-internet

“EU Commission launches plans for a €6bn satellite internet system“

Meh on Thu, 24th Feb 2022 4:35 am

Bs

Meh on Thu, 24th Feb 2022 4:39 am

This site is full on Bs my friends designed to manipulate the uniformed be weary