Page added on January 20, 2017

The Emerging Markets Consumer

By Karl Desmond

Three billion people entering the middle class1 and $30 trillion of annual consumption by 20252 – these are two numbers that summarize the drastic demographic and economic shift currently happening in emerging market countries and what McKinsey & Co. has called, “the biggest growth opportunity in the history of capitalism.” 2 The Dow Jones Emerging Markets Consumer Titans 30 Index is comprised of 30 of the largest and most liquid emerging market consumer companies that are poised to benefit from these changes.

Consistent Outperformance

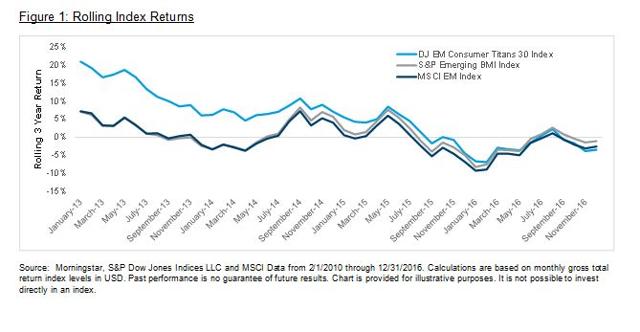

The emerging market consumer is not a new theme and since the inception of the Dow Jones Emerging Markets Consumer Titans 30 Index (1/8/2010), these companies have outperformed broader EM indices. Over 3-year rolling return periods (rolled monthly), the Dow Jones Emerging Markets Consumer Titans 30 Index has consistently outperformed both the MSCI EM Index and the S&P Emerging BMI Index under almost all market conditions. As seen in Figure 1:

- The Dow Jones Emerging Markets Consumer Titans 30 Index has outperformed the MSCI EM Index 94% of the time.

- The Dow Jones Emerging Markets Consumer Titans 30 Index has outperformed the S&P Emerging BMI Index 85% of the time.

Is the best yet to come?

The historical performance of the Dow Jones Emerging Markets Consumer Titans 30 Index has been impressive, but the growth of the emerging market consumer is in its infancy. As seen in Figure 2, the emerging markets middle class is estimated to represent 15% of the world’s population in 2030, up from 4% in the year 2000.

The Takeaway

There is no denying demographics – emerging market populations will continue to grow rapidly and the emerging market consumers will continue to increase their wealth. However, broad emerging market benchmarks do not target this exposure, as the consumer sectors make up less than 20% of those benchmarks.

By specifically targeting consumer-oriented companies in emerging markets, the Dow Jones Emerging Markets Consumer Titans 30 Index has generally been able to outperform broad market indices since its inception. More importantly, however, this index taps into the future growth of the emerging market middle class, which looks brighter than ever.

For more information on this topic, watch the replay of S&P Dow Jones Indices’ webinar, “Painting Emerging Markets with a Narrower Brush.”

1Ernst & Young, “Innovating for the next three billion”, 2011

2 McKinsey, August 2012, “Winning the $30 trillion Decathlon”

The posts on this blog are opinions, not advice. It is not possible to invest directly in an index.

14 Comments on "The Emerging Markets Consumer"

Davy on Fri, 20th Jan 2017 9:15 am

More dreamy hopium unable to connect the dots of decline. The status quo is overwhelmingly caught up in narratives of techno optimism and economic progress. Markets and political machines are rigged and corrupt. Increasingly this facade of illusions will be shattered by a reality of decay and decline. Demand destruction is alive and well and its force multiplier depletion never sleeps. Now we have the systematically destructive force of nationalism set to restrict trade and turn politics inwards. Don’t forget climate change and its sister ecosystem failure. This is not something to be preaching long term optimism over yet, that is constantly what we get from the fake MSM.

penury on Fri, 20th Jan 2017 9:40 am

What Davy said. I would like to add that the dream of a constantly increasing economy for nations is somewhat akin to “oil surplus forever” ain’t going to happen.

Sissyfuss on Fri, 20th Jan 2017 9:58 am

The investor class holding up bright shiny objects to distract you while they reach for your wallet.

onlooker on Fri, 20th Jan 2017 10:14 am

Just another in the parade of wishful fantasies. Article is written as though the authors were oblivious to the Economic and Environmental stresses on the planet by the huge human population. Oh yes, the Chinese and Indians would love to replace the Americans in their lifestyles. The same lifestyles that have contributed to a deteriorated Earth and its ecosystems. Just one problem Mother Earth is no longer going to cooperate.

rockman on Fri, 20th Jan 2017 10:18 am

p – “I would like to add that the dream of a constantly increasing economy for nations”. That dream will materialize for SOME nations to a degree. It’s not a perfect zero sum gain but a certain amount of the growth of those expanding economies will come at the expense of other economies.

Which takes me back to that silly acronym some fool invented: the MADOR concept…Mutually Assured Distribution Of Resources. IOW the more powerful economies can focus on “battling” each other for resources or focus on stripping them from the weak…including historically allied nations.

As an example: is the US going to mount meaningful opposition to China’s efforts to control resources in the S China Sea? Or will we essentially let that be a problem for the other countries in the region?

Davy on Fri, 20th Jan 2017 12:08 pm

Interesting take on the future of alternative energy and storage. IMHO overly optimistic but it is hard not to feel good about some optimism. I am just not ready to jump on the band wagon.

“Kauai Shows Solar + Storage is Starting to Become Cost Competitive With Fossil Fuels, Nuclear”

https://robertscribbler.com/

“And with the price of solar + storage options falling into the 11 cent per kilowatt hour range, it appears likely that these varied mated systems have the potential to largely out-compete fossil fuels and nuclear based on price alone well within the foreseeable future and possibly as soon as the next 3-5 years.”

Rockman on Fri, 20th Jan 2017 2:37 pm

Davy – Yes…closer to being cost competitive. But in what dynamic’? One dynamic: Wind was CC with respect to building NEW alt power sources vs building ff sources. At least since we spent $7 billion upgrading the grid. But wind did not replace our coal/NG fueled plants. Second dynamic: is alt energy replacing existing (and often already paid for) ff fired plants CC? In that case the cost of building a new alt source + operation cost has to be compared to just the ops cost of the existing plants.

That’s a huge hurdle to overcome. Even if the old plants are retained as backup (as they have been in Texas) the economic justification will be based on building new while still having an existing source in place. And I think that’s why you rarely see a functioning ff plant shut down. IOW forget how much new alt energy is coming online: how many existing ff have we seen VOLUNTARIALLY shut down? IOW can’t count those that wore out and had to be replaced.

It matters little with respect to climate change how much new alt energy develops if most of the ff plants remain in operation. Same point I made about GHG emissions from autos. Adding a million or 5 million EV in 2016 while at the same time adding 80 million new ICE’s to the 1.2 BILLION already on the road IS NOT improving the environment. At best it’s only slightly slowing down the INCREASINGLY WORSE conditions.

Anonymous on Fri, 20th Jan 2017 3:52 pm

Just what ‘we’ need, more ‘consumers’. And by ‘we’, of course, I am referring to uS globalist corporations. No doubt ‘they’ are looking forward to this. Corporations main priority after all, is not to produce ‘goods’ as such, but to expand the total pool of ‘consumers’ to the greatest extent possible. At least until they stip-mine the planet down to the bedrock. By then, it will be someone else’s problem.

The current pool of ‘consumers’ is clearly not generating sufficient ‘profits’ for the uS globalist ‘investor class’. Tack a few billion more North American style consumers on and see what happens. What could possibly go wrong?

JN2 on Fri, 20th Jan 2017 3:53 pm

Rockman, wind [after 80% PTC(2017) is 1.4c/kWh] is *way* more CC than fossil steam’s fuel + O&M costs of 3.7c/kWh.

Forget climate change or new build!

joe on Fri, 20th Jan 2017 3:56 pm

These people will find it hard to go back to the ploughshare and homespun white cotton dresses and turbans. Just as in China they will go back to the blue Mao jumpsuits and camels may be making a big comeback. Fact is that 3 billion people all eating meat and burning oil is a dangerous idea. It will be like turning the car on in a locked garage. Already we are smashing up the ground looking for tight oil. How will we supply another 3 billion?

rockman on Fri, 20th Jan 2017 11:13 pm

JN – “Rockman, wind [after 80% PTC(2017) is 1.4c/kWh] is *way* more CC than fossil steam’s fuel + O&M costs of 3.7c/kWh.” Apparentyly you didn’t get the point. Your wind farm doesn’t produce power for 1.4¢/kWh. It costs 1.4¢/kWh + $billions to build the wind farm. Whereas the ff plant costs 3.7¢/kWh + $0.00 since it already exists.

So now answer the f*cking question: how many viable ff fired plants have been scraped and replaced by alt power? IOW you can’t compare the operational cost to run an existing ff fueled plant to any alt energy facility THAT DOES NOT EXIST because it isn’t producing any energy…because it DOES NOT EXIST.

Now in Texas wind farms were built because if the weren’t we would have had to spend $billions to build NEW coal/NG plants to meet our increasing electricity demand.

That’s the correct apples to apples comparison.

Davy on Sat, 21st Jan 2017 6:33 am

There is a real story about alternative energy and one that is hopium. Alternatives are not replacing fossil fuels they are complimenting. To be fair this is more true in the US and China than Europe where real and focus effort are attempting to leave FF. This hopium story continues but the real story is FF capacity remains and new capacity is added with a significant amount of alternatives. This is a great story and one to be hopeful for. It represent diversity and resilience and the more the better. The problem is the narrative of techno optimist greens who are talking about these changes as if this is a transformation. It is a beginning but it is not the story they are preaching. The Scribber article I referenced above was heavy on optimism but lite on reality.

Fossil fuels remain because society is not yet ready to do what it takes to leave them. The economic bar of the whole process is very high. In the beginning the costs are low but as market penetration increases the cost escalate as storage is needed. Since very little storage systems have been constructed FF are that back up. FF’s are not being dismantled. They are being put in cold storage or remain to supply power as needed. These are cost not factored into the cost comparisons. These FF plants are in most cases paid for. A new alternative energy project is fresh costs. Fresh cost to a society already up to its eyeballs in challenges that require investments.

Most techno optimist tend to think price and cost in a constant economy. They don’t want to deal with the messy reality that economies can and do go into recessions and depressions. Today for some reason most of us can’t comprehend this economic reality because we are in a habituated sense of economic stability. Most treat the economy as a constant and this constant will go far into the future. These fresh cost of construction needed for alternatives is facing an economy that is in systematic decline. Systematic decline means this whole status quo process may shift to a new reality. There are many reason we might see economic output drop considerably. If it does this alternative renaissance will too. New alternative construction will drop because funds will dry up and existing FF assets will be cheap by comparison.

Techno optimistic greens live in a progressive narrative of growth and prosperity. This part of their equation ensures a constant economy that allows them to forecast out to 2050 and a fossil fuel free world. It is easy to sell a win-win narrative like today’s techno story. If you remove the constant economic growth variable. This 2050 benchmark falls flat on its face. This is especially true when you factor in all the other costs of storage, grid upgrades, and replacement of existing infrastructure. Techno’s think this will all fall into place because that is what has happened with all other energy transformations. Growth will remain and even grow and that will make this all true.

Techno’s want to save the planet and I want to believe it too. Yet, what is more important than saving the planet is being honest to ourselves. Techno’s are not going to save anything if they do not try to save the truth. Wisdom tells us that we need to reality test our actions. We can’t just make assumptions and goal seek the answers because that is what we want. Techno’s need to first call into question growth itself. Without growth their buildout will not happen. Growth is an existential issue. Any growth is a problem now and the green kind is no different. We should ask ourselves is leaving fossil fuels completely the answer? Should we lower our expectations because we understand we can’t leave them? The economics of techno’s do not add up. We should at minimum address the narrative to adapting to less growth and maintaining what we have with fossil fuels included. All we are doing now is adding alternative capacity and maintaining and adding FF capacity. This is a narrative of “MORE”. It is disguised as more with less because efficiency is always included. It is about more with alternatives that are less dirty but are still dirty. It is still more and this is a finite planet at planetary limits.

This message is flawed on multiple levels. We grownups here should acknowledge this assumption incongruity. Let the kids think there is a future green world with happy endings. We grownup realize the challenges ahead and the reality of what is really unfolding is an alternative but an alternative story. This alternative story is one of the approach of the end of growth with green growth included. We grownups realize climate change is likely a runaway event. The scale and the time needed to arrest climate change is past. That said as a grownup I am all for any and all alternatives that are built out. I don’t care if the story is flawed. Alternatives are better than for example a new airport with no future. I believe in the truth and the truth says there is likely no happy ending for a civilization that only considers growth. A civilization constructed to only survive on growth is one that has an ending. We are near that ending. Maybe it is growth itself we need to be addressing but that is not part of any narrative except us fringe forces of the truth. Unfortunately the truth also includes darkness, doom and decline.

Cloggie on Sat, 21st Jan 2017 7:05 am

Fossil fuels remain because society is not yet ready to do what it takes to leave them.

Some societies are more ready than others.

The economic bar of the whole process is very high.

For some societies the bar is indeed much higher than for others.

Oil = Seven Sisters = Anglo geopolitical power (Middle East).

That’s why “Anglo country” Holland is also lagging behind (in Europe) with renewable energy.

It is a story of vested interests and sunk investments

For Anglosphere oil was a gigantic success story and the single source of its geopolitical pre-eminence in the 20th century.

Countries like Denmark, Germany and Italy have little fossil resources and as such are forced to change their behavior.

A blessing in disguise… because they will be the “renewable energy super powers” of the 21st century.

JN2 on Sat, 21st Jan 2017 12:14 pm

Rock said >> It costs 1.4¢/kWh + $billions to build the wind farm. Whereas the ff plant costs 3.7¢/kWh + $0.00 since it already exists. <<

I understand. Cost per kWh of new build coal is between 6.0 and 14.3c/kWh.

I can produce a kWh by wind for 1.4c/kWh *including* capital costs. Marginal costs for wind are approximately zero.

If wholesale prices are 3.7c/kWh then FF profit is *zero* and wind profit is 2.4c/kWh. Am I wrong?